The CEO of Texas Instruments Inc. (NYSE: TXN) has resigned because of personal conduct issues. According to Reuters:

Texas Instruments Inc said on Tuesday that Brian Crutcher had resigned as the company’s chief executive officer just six weeks into the role, after finding following a report that he had violated the chipmaker’s code on personal behavior.

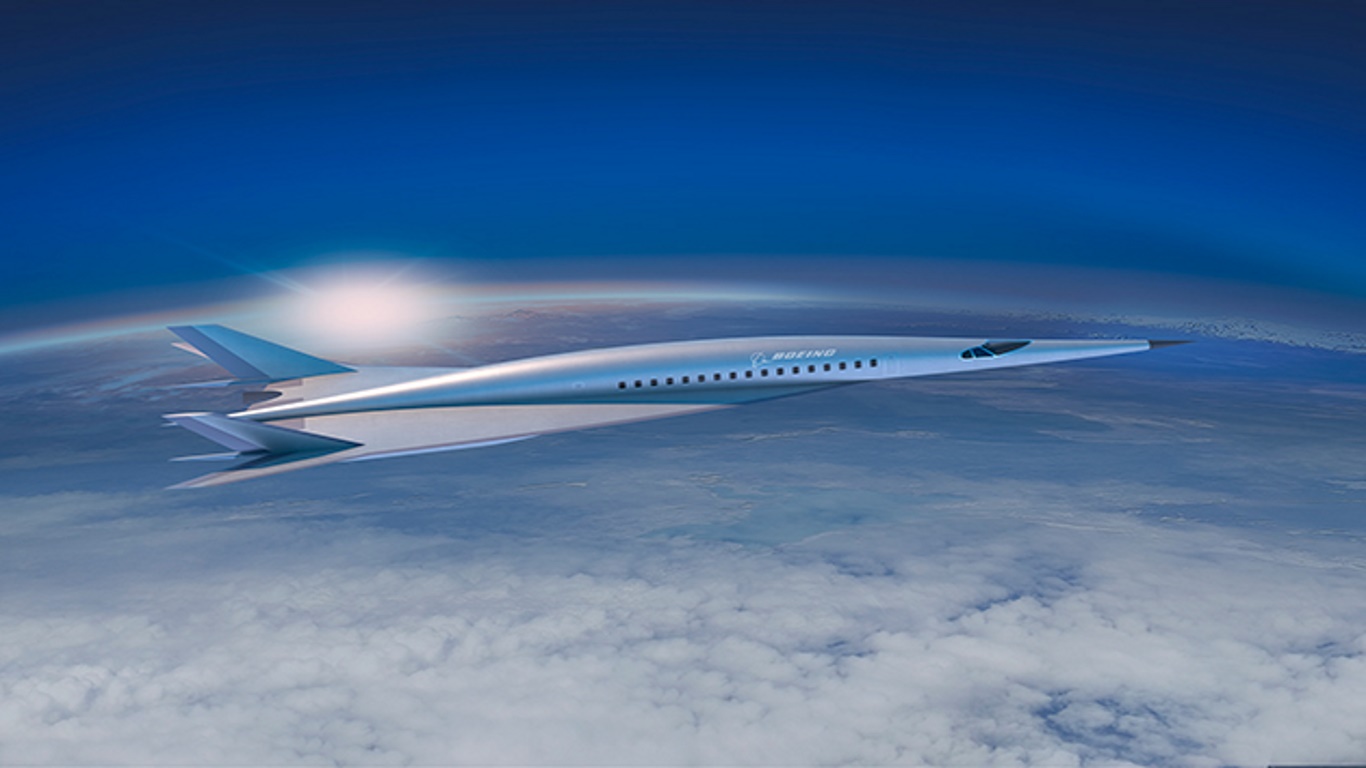

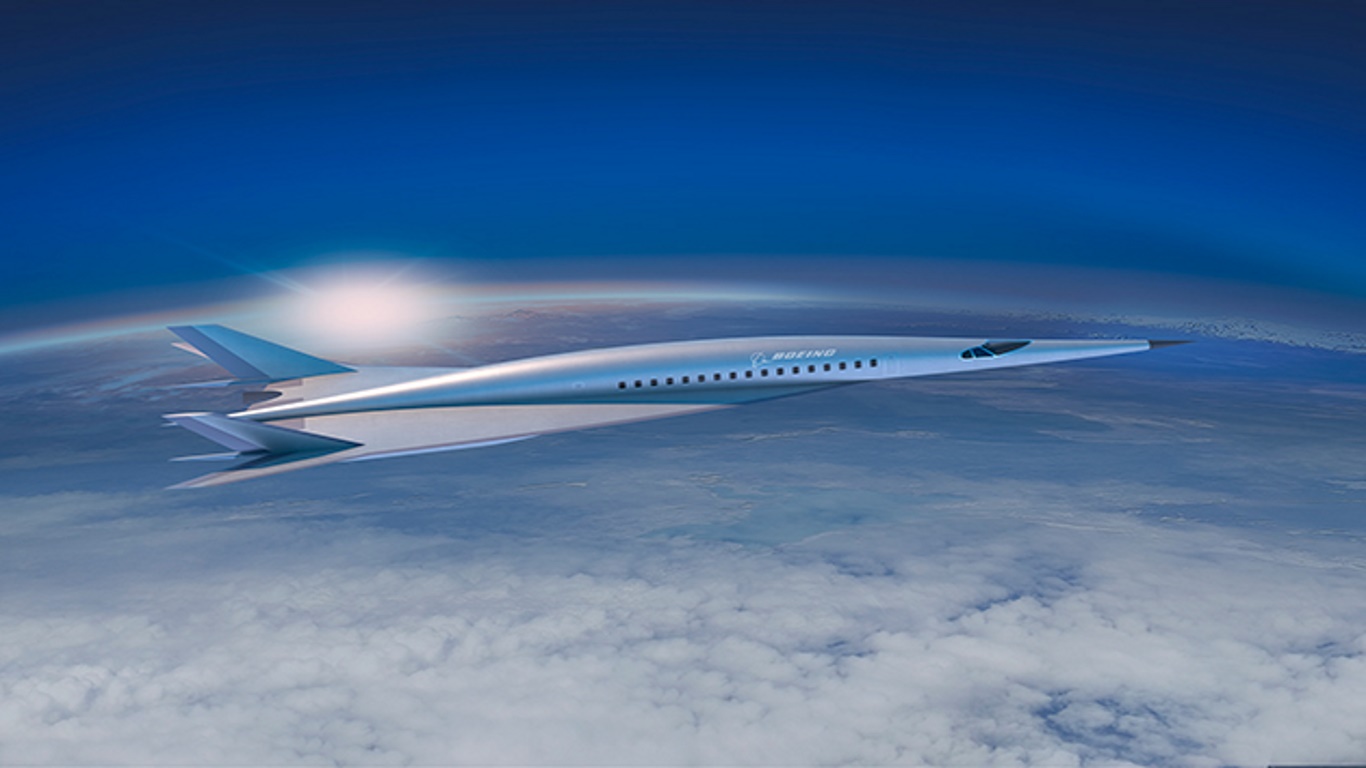

Boeing Co. (NYSE: BA) has set a major deal to build Air Force One. According to The Wall Street Journal:

Boeing Co. on Tuesday secured a $3.9 billion deal to build the new jets that will fly as Air Force One, with only one wrinkle yet to be resolved: their color.

The award follows 18 months of an at times tortuous to-and-fro between the aerospace giant and President Donald Trump, who had threatened to cancel the planned sale over concerns about the cost of replacing the aging 747 jumbo jets.

The cost of a car sold in the United States will soar if tariff proposals stick. According to The Wall Street Journal:

The Alliance of Automobile Manufacturers, the auto industry’s chief lobbying group in Washington, estimates a 25% tariff would increase the average price of an imported vehicle by $5,800.

Google faces a massive fine from the European Union. According to Bloomberg:

Google will be fined around 4.3 billion euros ($5 billion) by the European Union over Android apps on Wednesday, setting a new record for antitrust penalties, according to a person familiar with the EU decision.

The fine, to be announced about midday on Wednesday, ends an EU probe into Google’s contracts with smartphone manufacturers and telecoms operators. Google Chief Executive Officer Sundar Pichai had a call with EU Competition Commissioner Margrethe Vestager late Tuesday for a so-called state of play meeting, a usual step to alert companies of an impending penalty, according to one of the people, who asked not to be named because the discussion is private.

The Nasdaq has hit an all-time high. According to CNBC:

The Nasdaq Composite hit a record high on Tuesday as strong gains in Amazon and a rebound in Netflix shares led to a big comeback in tech stocks.

The tech-heavy Nasdaq rose 0.6 percent to 7,855.12, after falling as much as 0.7 percent, as Amazon reached an all-time high. Meanwhile, Netflix closed just 5.2 percent lower after falling as much as 14.1 percent earlier in the session.

Texas moved up the list of largest oil producers. According to CNNMoney:

The shale oil boom has brought a gold rush mentality to the Lone Star State, which is home to not one but two massive oilfields.

Plunging drilling costs have sparked an explosion of production out of the Permian Basin of West Texas. In fact, Texas is pumping so much oil that it will surpass OPEC members Iran and Iraq next year, HSBC predicted in a recent report.

If it were a country, Texas would be the world’s No. 3 oil producer, behind only Russia and Saudi Arabia, the investment bank said.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.