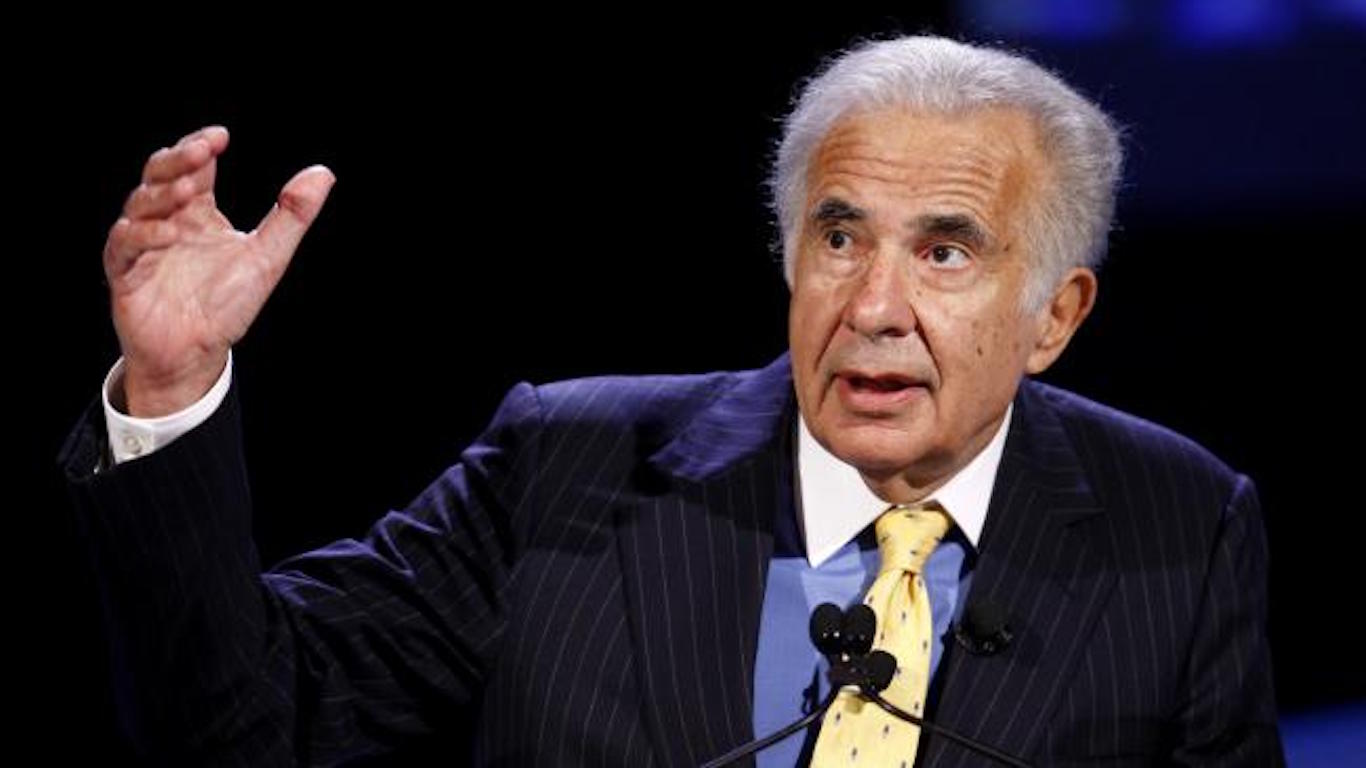

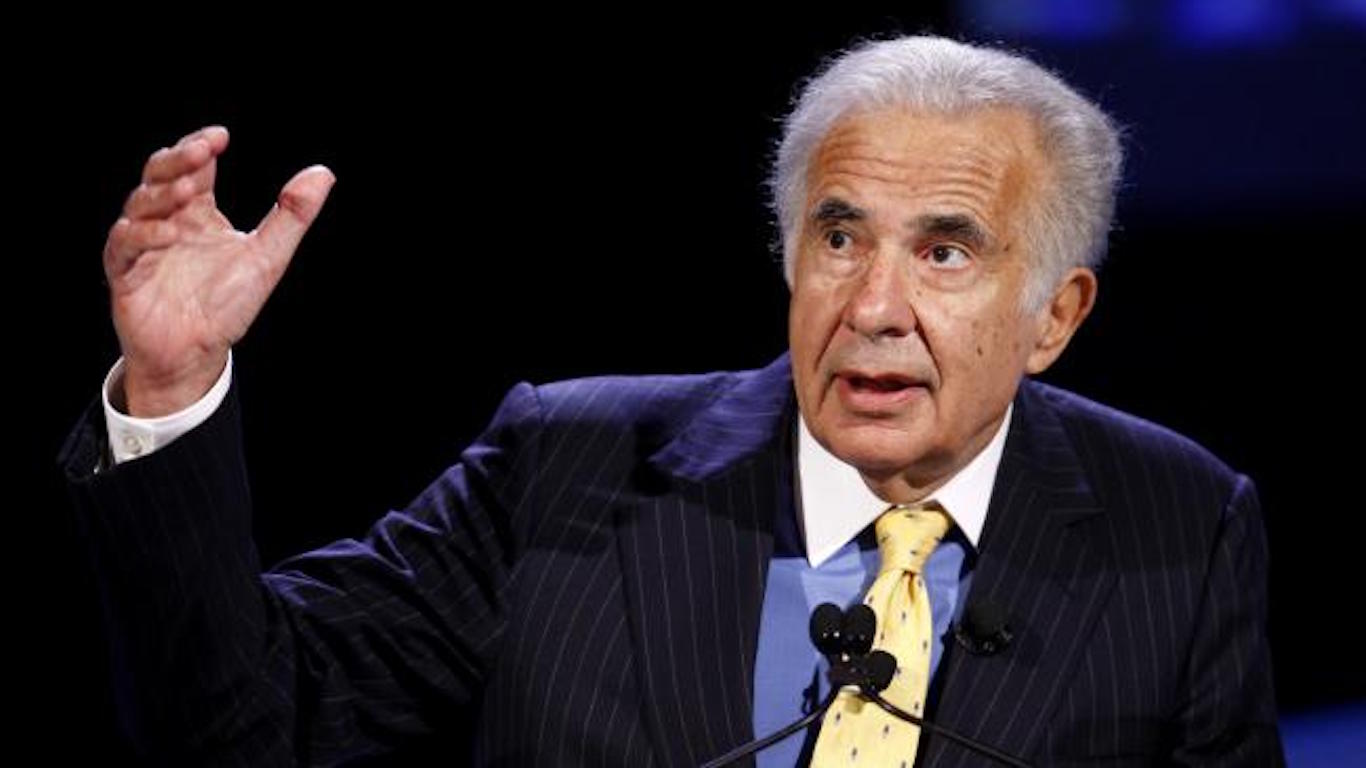

Getting activist investor Carl Icahn in your corner can be a double-edged sword. When it comes out that he is investing in a stock, those shares usually trade up. But what happens when Icahn starts dialing down his holdings?

Hertz Global Holdings Inc. (NYSE: HTZ) was among the big losers on Tuesday after it was disclosed in an SEC filing that Icahn had sold some 5 million common shares of the rental car giant. What is amazing about the drop is that Icahn’s stake of about 24.3 million shares is still roughly 29% of the company. His prior stake had been about 35%.

Hertz had been facing pressure from Icahn, and he has been the largest of the shareholders for several years. Icahn’s team has board seats, and there have been two CEO changes at the rental car giant.

The news of the Icahn stake sale came just days after Barclays had raised its rating to Equal Weight from Underweight with an $18 price target.

Shares of Hertz were last seen trading down 14% at $17.18 on Tuesday, with trading volume of more than 12 million shares in the early afternoon, which was already more than four times a normal day’s worth of trading volume. Hertz has a consensus analyst target price of $22.88 and a 52-week trading range of $13.01 to $22.70.

Hertz originally had traded up as high as $21.95 after earnings, but the stock sold off in recent days. The Form 4 filed with the SEC showed that the 5 million shares sold by entities under Icahn went at $19.45 apiece.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.