Central banks and finance ministries currently hold more than 33,000 tons of gold worth about $1.4 trillion, at today’s prices. These authorities are among the world’s largest holders of gold.

While the United States, like in many economic and financial measures, leads the pack with the most gold of any nation, at more than 8,100 tons of the precious metal, other countries with the most gold may be less obvious.

In addition to holding its own gold, nations such as the United States and the United Kingdom have been repositories for other nations’ gold. That is not surprising given America’s position as a secure bastion after World War II and the Bank of England’s reputation for security.

[in-text-ad]

In recent years, however, nations such as the Netherlands, Germany, Austria, and Belgium have begun repatriating their sovereign gold. Part of the reason is the changing monetary policy of central banks such as the U.S. Federal Reserve.

Of the top 20 gold-holding nations, five have added to their stores of the precious metal over the last 10 years — Turkey, Kazakhstan, India, China, and Russia. They are doing so as a way to diversify their reserves away from dollar-denominated securities. Germany and France have reduced their gold inventory, while the remaining countries on the top 20 list have left their reserve total virtually unchanged.

24/7 Wall St. has compiled a list of the countries that control the world’s gold. Many nations on this list rank among the wealthiest countries in the world. We reviewed data from the World Gold Council, as well as mining and engineering websites, national mint sources, and media reports about stories pertaining to gold. 24/7 Wall St. also considered information from the International Financial Reporting Standards Foundation, a nonprofit that seeks accountability, transparency and efficiency in financial markets around the world.

20. Turkey

> Gold reserves in USD as of Q4 2018: $10.4 billion

> Gold reserves in metric tonnes as of Q4 2018: 254

> Gold as % of total reserves: 12.7%

> GDP: $2.0 trillion ($25,135 per capita)

> Population: 80.7 million

Given its geographical importance, gold has played a key role in Turkey’s history. Merchants traded gold coins in ancient Lydia, and Turks have historically used gold as a hedge against inflation and weak currency. Turkey has been buying gold from Venezuela at a rapid pace recently. The struggling South American country is seeking cash because revenue from its petroleum reserves has declined. The United States is concerned that some of the gold may go to Iran through Turkey, a violation of American sanctions against Iran. Turkey has boosted its metric tonnage of gold by more than 118% to 254 tons over the last 10 years.

19. Austria

> Gold reserves in USD as of Q4 2018: $11.5 billion

> Gold reserves in metric tonnes as of Q4 2018: 280

> Gold as % of total reserves: 49.7%

> GDP: $400.3 billion ($45,437 per capita)

> Population: 8.8 million

Gold was first mined in Austria 2,000 years ago, primarily in the Rauris and Gastein Valleys. Gold extraction has fallen since, but mining activity continues in the country. Austria is home to the Austrian Mint, which dates from medieval times and is one of Europe’s oldest mints. It is renowned for its minting expertise and coin production.

18. Spain

> Gold reserves in USD as of Q4 2018: $11.6 billion

> Gold reserves in metric tonnes as of Q4 2018: 282

> Gold as % of total reserves: 16.4%

> GDP: $1.6 trillion ($34,272 per capita)

> Population: 46.6 million

Spain gained gold wealth from extracting the precious metal from mines in areas where the Incas lived in South America in the 16th century. The Spanish used gold to pay off debts and bankroll the religious wars in subsequent centuries. An interesting economic theory suggests that the influx of gold led to Spain’s decline as a great power because the Spanish had so much gold they could buy goods instead of investing in means of production to produce those goods.

17. Lebanon

> Gold reserves in USD as of Q4 2018: $11.8 billion

> Gold reserves in metric tonnes as of Q4 2018: 287

> Gold as % of total reserves: 22.5%

> GDP: $80.2 billion ($13,191 per capita)

> Population: 6.1 million

Lebanon, the least populous nation on the list with just over 6 million people, has the world’s second largest reserves of gold per capita of any nation. Gold has been a big part of Lebanon’s history because of its maritime tradition. Lebanon controls 287 metric tons of gold, unchanged over the last 10 years.

16. United Kingdom

> Gold reserves in USD as of Q4 2018: $12.8 billion

> Gold reserves in metric tonnes as of Q4 2018: 310

> Gold as % of total reserves: 7.4%

> GDP: $2.6 trillion ($39,753 per capita)

> Population: 66.0 million

Given its colonial history, the United Kingdom has accumulated gold over hundreds of years from the countries where it held sway. The U.K. currently has no operating gold mines. The Bank of England has a well-earned reputation for safety and security, and many nations store their gold reserves there. It has the second largest vault in the world after the New York Federal Reserve.

15. Saudi Arabia

> Gold reserves in USD as of Q4 2018: $13.3 billion

> Gold reserves in metric tonnes as of Q4 2018: 323

> Gold as % of total reserves: N/A

> GDP: $1.6 trillion ($48,986 per capita)

> Population: 32.9 million

Gold was first mined in Saudi Arabia around 3000 B.C. and it is an important part of Saudi Arabian culture. The Mahd Ad Dahab mine produces most of the gold in Saudi Arabia. When Saudi men propose marriage to their fiancées, they give them jewelry. Gold is also given to Saudi women at birthdays and wedding anniversaries. Saudi gold reserves, now at 323 metric tons, have changed very little over the last 10 years.

[in-text-ad]

14. Kazakhstan

> Gold reserves in USD as of Q4 2018: $14.4 billion

> Gold reserves in metric tonnes as of Q4 2018: 350

> Gold as % of total reserves: 46.6%

> GDP: $434.3 billion ($24,079 per capita)

> Population: 18.0 million

Gold reserves in Kazakhstan, a former republic of the Soviet Union, have soared almost fivefold over the last 10 years to 350 metric tons. The nation intends to boost gold production enough to vault Kazakhstan into the ranks of the largest gold-mining countries in the world by the middle of the next decade and has sought foreign investors to invest in mining ventures. That might be a challenge because Kazakhstan ranks 124th out of 180 countries on Transparency International’s Corruption Perceptions Index.

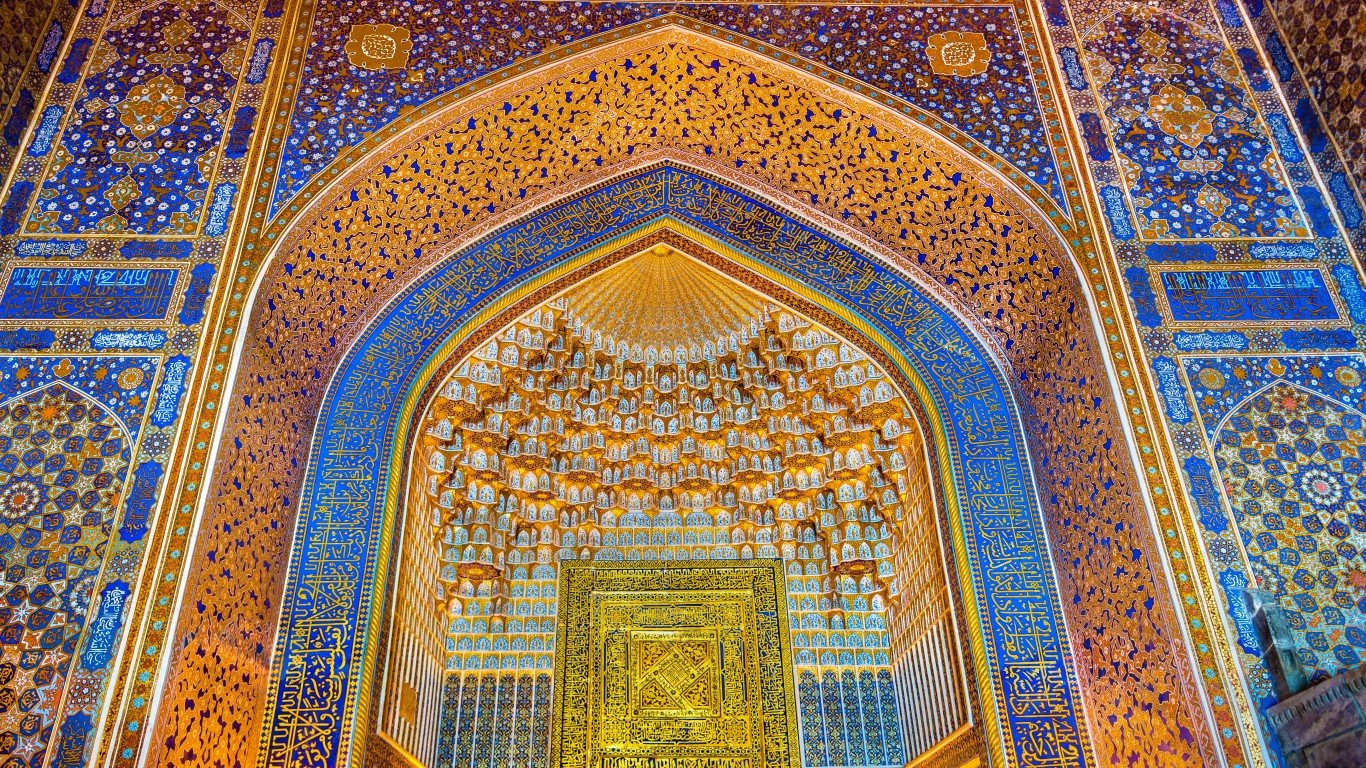

13. Uzbekistan

> Gold reserves in USD as of Q4 2018: $14.6 billion

> Gold reserves in metric tonnes as of Q4 2018: 355

> Gold as % of total reserves: 53.8%

> GDP: $202.5 billion ($6,253 per capita)

> Population: 32.4 million

According to Engineering & Mining Journal, Uzbekistan claims to have 41 gold deposits and plans to invest $4.5 billion in gold production over a seven-year period ending in 2020. Many of the gold deposits lie in depths of up to 330 feet, accessible to miners without the need of heavy earth-moving equipment. This has led to private gold mining, which is illegal in Uzbekistan but not enforced. The Muruntau mine in Uzbekistan, one of the former republics of the Soviet Union, is one of the world’s largest open-pit gold mines.

12. Portugal

> Gold reserves in USD as of Q4 2018: $15.7 billion

> Gold reserves in metric tonnes as of Q4 2018: 383

> Gold as % of total reserves: 63.2%

> GDP: $287.6 billion ($27,937 per capita)

> Population: 10.3 million

Gold reserves in Portugal stand at about 383 metric tons and have been unchanged over the last 10 years. Much of Portugal’s gold was accumulated from the western part of Africa during the Age of Discovery. The discovery of the yellow metal in Brazil, a Portuguese colony in the late 17th century, prompted a gold rush in that part of South America.

[in-text-ad-2]

11. Taiwan

> Gold reserves in USD as of Q4 2018: $17.4 billion

> Gold reserves in metric tonnes as of Q4 2018: 424

> Gold as % of total reserves: 3.6%

> GDP: N/A

> Population: N/A

The island nation off the coast of China was the site of a gold rush in the late 19th century, with extensive mining activity around the area of present-day New Taipei City. In the late 1980s and early 1990s, Taiwan was a major importer of gold, and for a brief period it was the world’s biggest gold importer. Taiwan holds 424 metric tons of gold in its central bank and keeps all of the precious metal on the island.

10. India

> Gold reserves in USD as of Q4 2018: $24.7 billion

> Gold reserves in metric tonnes as of Q4 2018: 600

> Gold as % of total reserves: 6.2%

> GDP: $8.6 trillion ($6,430 per capita)

> Population: 1.3 billion

India’s stores of gold have grown almost 68% over the last 10 years. The world’s second most populous nation with more than 1.3 billion people is one of the planet’s biggest consumers of the metal and helps drive global demand for gold. Gold is embedded in the country’s culture and given as gifts for weddings, birthdays, anniversaries, and religious occasions. BMG Group Inc. estimates that as many as 15 million weddings are performed in India every year.

[in-text-ad]

9. Netherlands

> Gold reserves in USD as of Q4 2018: $25.2 billion

> Gold reserves in metric tonnes as of Q4 2018: 612

> Gold as % of total reserves: 65.6%

> GDP: $830.5 billion ($48,473 per capita)

> Population: 17.3 million

Nations started repatriating gold in 2011, beginning with Venezuela. The Netherlands announced in November 2014 that it had repatriated 122 tons of gold reserves to Amsterdam from New York, over concerns about the safety of its gold following the eurozone debt crisis. The Netherlands keeps about 31% of its reserves in Amsterdam. The rest are in New York, Ottawa, and London. The Netherlands has allocated almost 66% of foreign reserves in gold, the fourth highest on the list.

8. Japan

> Gold reserves in USD as of Q4 2018: $31.5 billion

> Gold reserves in metric tonnes as of Q4 2018: 765

> Gold as % of total reserves: 2.5%

> GDP: $4.9 trillion ($39,002 per capita)

> Population: 126.8 million

Late last year, concerns were raised in Japan, the world’s third largest economy, over a proposal to boost a consumption tax for the first time since 2014. When the island nation boosted that tax to 8% from 5% about five years ago, gold smuggling activity jumped as well. Japan has become a center of gold smuggling. Criminals clandestinely bring in the metal into the country and evade the tax, then try and sell gold to shops, and the buyer pays for the gold and the tax. The consumption tax is set to rise to 10% in October. Japan has just a 2.5% allocation of gold in foreign reserves, the second lowest share on the list behind China.

7. Switzerland

> Gold reserves in USD as of Q4 2018: $42.8 billion

> Gold reserves in metric tonnes as of Q4 2018: 1,040

> Gold as % of total reserves: 5.4%

> GDP: $486.0 billion ($57,410 per capita)

> Population: 8.5 million

Switzerland, one of the smallest countries on the list in terms of population, has the world’s largest reserves of gold per capita of any nation, about 4 ounces per person. The country has not increased its reserves over the last 10 years. The landlocked, mountainous nation that was neutral during World War II was the nexus of the gold trade in Europe during the war, dealing with the Allies and Axis nations. Now, Switzerland trades gold with China.

[in-text-ad-2]

6. China

> Gold reserves in USD as of Q4 2018: $76.2 billion

> Gold reserves in metric tonnes as of Q4 2018: 1,853

> Gold as % of total reserves: 2.4%

> GDP: $21.2 trillion ($15,309 per capita)

> Population: 1.4 billion

China’s economic sparring with the United States is reflected in its gold holdings. The world’s most populous nation has just 2.4% of its allocation of foreign reserves in gold. China added more of the precious metal to its foreign reserves in December, the first time it has done so in two years. China has boosted its gold reserves by more than 200% over the last 10 years. The country is trying to diversify its holdings and lower its dependence on dollar-denominated securities.

5. Russia

> Gold reserves in USD as of Q4 2018: $86.9 billion

> Gold reserves in metric tonnes as of Q4 2018: 2,113

> Gold as % of total reserves: 18.5%

> GDP: $3.6 trillion ($24,766 per capita)

> Population: 144.5 million

While the gold reserves of most countries on this list tend to remain relatively flat, Russia’s gold stores have grown immensely in recent years. Over the last one-, five-, and 10-year periods, the country’s stores of the precious metal grew by 11.8%, 74.9%, and 306.7%, respectively. Two years ago, Russia bought 224 tons of gold bullion as it tried to diversify away from the U.S. dollar. Relations between the United States and Russia have deteriorated since Russia annexed Crimea in 2014. Russian Prime Minister Vladimir Putin said in 2011 that the dollar as a world reserve currency threatens the world financial system.

[in-text-ad]

4. France

> Gold reserves in USD as of Q4 2018: $100.2 billion

> Gold reserves in metric tonnes as of Q4 2018: 2,436

> Gold as % of total reserves: 60.2%

> GDP: $2.6 trillion ($38,606 per capita)

> Population: 67.1 million

France’s gold reserves have declined by 2.3% over the last 10 years. In recent years, Marine Le Pen, leader of the right-leaning Front National party, has urged the French national bank to repatriate its gold reserves, discontinue plans to sell the metal, and take advantage of the decrease in the spot price of gold to buy additional amounts of the precious metal.

3. Italy

> Gold reserves in USD as of Q4 2018: $100.8 billion

> Gold reserves in metric tonnes as of Q4 2018: 2,452

> Gold as % of total reserves: 66.3%

> GDP: $2.1 trillion ($35,220 per capita)

> Population: 60.6 million

A lawmaker and a member of the country’s ruling League party told Reuters in February that the nation has no plans to sell the Bank of Italy’s gold reserves to fill in budget gaps. The League has drafted a proposed law that would eventually permit the government to sell Italy’s gold reserves if the constitution were amended, which would be a long and involved undertaking.

2. Germany

> Gold reserves in USD as of Q4 2018: $138.6 billion

> Gold reserves in metric tonnes as of Q4 2018: 3,370

> Gold as % of total reserves: 70.1%

> GDP: $3.7 trillion ($45,229 per capita)

> Population: 82.7 million

Nazi Germany’s Reichsbank accumulated more than 3,700 kilograms of gold from its plundering of Europe during World War II. By 1948, after the Allies recovered most of the stolen gold, Germany’s coffers were empty. Since then, prospering under multiple periods of economic growth, Germany’s gold stores have grown to 3,370 metric tonnes worth approximately $138.57 billion — second only to the United States.

[in-text-ad-2]

1. United States

> Gold reserves in USD as of Q4 2018: $334.5 billion

> Gold reserves in metric tonnes as of Q4 2018: 8,133

> Gold as % of total reserves: 74.5%

> GDP: $17.7 trillion ($54,225 per capita)

> Population: 325.7 million

The United States has the most gold in the world and about the same amount as the next three countries combined. At about 75%, the United States holds the highest percentage of its total foreign reserves in gold of any country on this list. Much of the precious metal is held in Fort Knox in Kentucky, the Philadelphia and Denver mints, the San Francisco Assay Office, and West Point Bullion Depository.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.