With an over 3,000-year written history, China is one of the world’s oldest civilizations. China was a global economic superpower as early as the period between 1100 and and the early 1800s. Following its conquest by European colonizers and subsequent economic decline in the 19th century, the People’s Republic of China was established in 1949. Since then, China has fully re-emerged as a dominant economic power.

China’s gross domestic product in current or nominal dollars is $14.22 trillion, second only to the United States’s GDP of $21.34 trillion, according to the latest figures published by the International Monetary Fund. On a per capita basis, China is behind more than 100 countries. Here are the 25 richest countries in the world.

China’s gross domestic product measured in purchasing power parity is $27.33 trillion, by far the largest in the world. The United States, India, and Japan follow, with a GDP (ppp) of $21.34 trillion, $11.47 trillion, and $5.75 trillion.

Nominal GDP uses market exchange rates to set the nation’s GDP — the value of all goods and services produced in a country. GDP on a PPP basis takes into account cost of living differences, and is favored by many economists for more accurately capturing quality of life. For developed countries, the differences between the two measures tend to be smaller. For developing economies, the differences tend to be larger, and most often, PPP is higher than nominal GDP, as is the case with China. Because everything is measured in U.S. dollars, the U.S. GDP in both measures is the same.

How did China become the global economic force it is today? In light of the 70th anniversary this week of the founding of The People’s Republic of China, 24/7 Wall St. reviewed events in China’s history, including each of its 13 five-year plans. We also considered several features of China’s economy, including having for decades by far the world’s largest labor force.

Click here to see how China’s economy became the largest in the world.

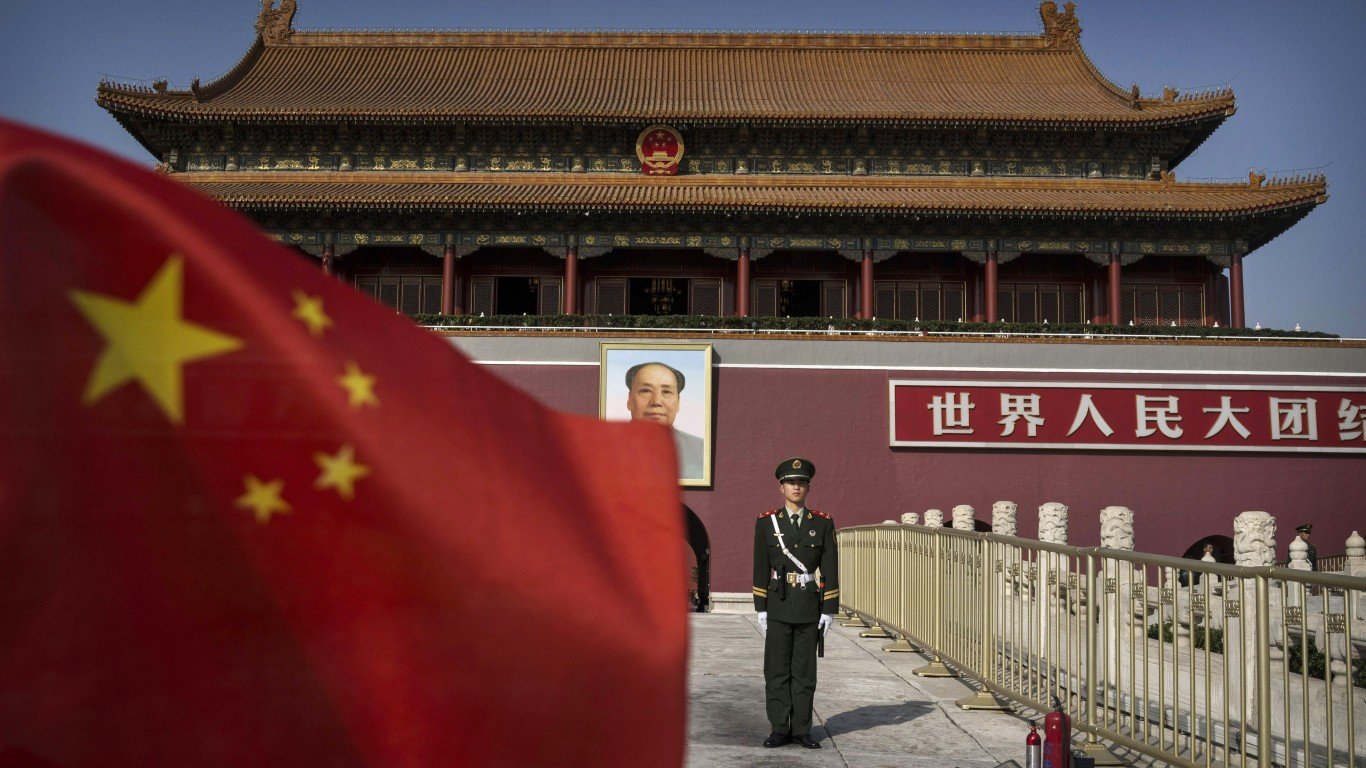

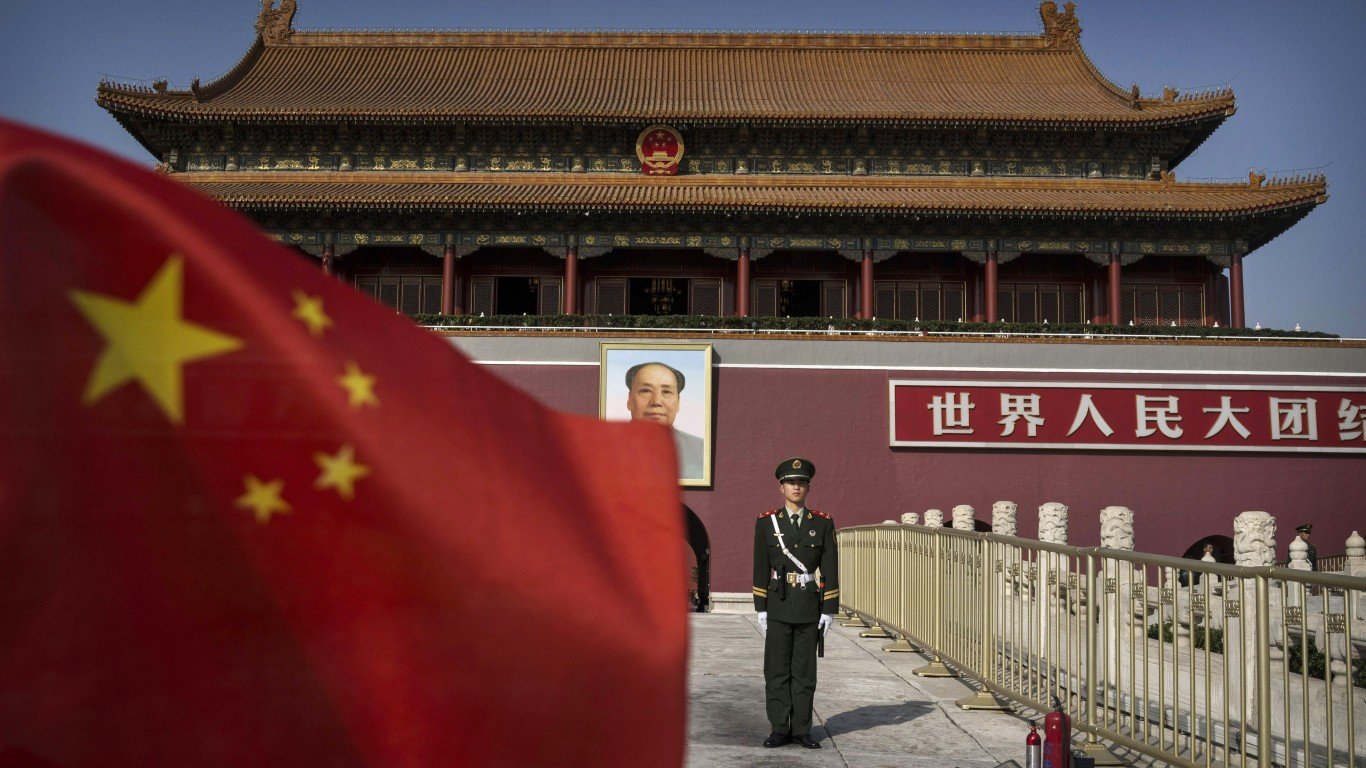

The People’s Republic of China is established, 1949

Under the leadership of Communist Party Chairman Mao Zedong, the People’s Republic of China was established in 1949, following a drawn-out civil war with the Nationalist Chinese government of Chiang Kai-shek. Under Mao, the economy of China was centrally planned and directed by the state, which set production goals, determined prices, and controlled resources.

[in-text-ad]

First Plan (1953-1957)

The Chinese government’s strategy for growth centered around five-year plans. The first of these initiatives began in 1953 and was modeled after the Soviet Union’s centralized economy model of intense investment in heavy industry and collectivized farms. The Soviet model did not at first promote the rapid economic growth that China would become known for later, because it was not industrialized. Eventually, in the course of the first five-year plan, it seems the emphasis on heavy industry kicked in. Workers wages rose 9% annually during this period. While farm collectivization efforts kept grain prices relatively low, especially for urban dwellers, this model did not increase grain production.

Second Plan (1958-1962)

China’s second five-year plan is called the “Great Leap Forward Period.” This aimed to build upon the achievements of the first plan. However, political ideological conflict between Mao and Soviet leader Nikita Khruschev led to the withdrawal of Soviet engineers and managers from China, hampering economic expansion. Mao also failed to learn the lesson of the failed farm collectivization efforts by the Soviet Union in the 1920s that led to famine. A similar outcome in China during the second five-year plan led to the deaths of as many as 45 million people.

Third Plan (1966-1970)

The famine in the late 1950s and early 1960s was devastating for China, which did not enact its next five-year plan until 1966. The focus of the third five-year plan was to develop agriculture and address the basic needs of the world’s most populous nation. China also made building up its national defense a priority. The nation had detonated its first atomic weapon in 1964. In addition, China planned to improve its infrastructure and boost scientific research.

The third five-year plan coincided with the Cultural Revolution, in which Mao sought to reassert control over the nation and purge those from power whom he claimed were diverting the country from the goals of the revolution.

[in-text-ad]

Massive labor force

China, the world’s most populous country, has by far the largest labor force of any nation in the world. Nearly a billion people are available for work in the country. The not just large but also cheap labor force helped encourage international investment and drive China’s remarkable economic growth for decades. Thousands of American and other foreign companies — AT&T, Adidas, Coca-Cola Foods, Caterpillar, Ford Motors, Family Dollar Stores, FedEx, Kraft Foods, Mattel, Nikon, Trader Joe’s, Victoria’s Secret, Xerox, and many, many others — own or contract factories in China, benefiting from the lower cost of manufacturing their products.

This international competitive advantage is changing, however. Economic growth has led to higher wages in China. And due to a rapidly aging population and the long-term effects of its one-child policy implemented nationally in 1980, the growth and economic edge of China’s famously large and affordable labor force will likely continue to wane.

Fourth Plan (1971-1975)

China’s fourth five-year plan set a goal of doubling the production of steel. Initially, the target for steel output was between 35 million and 40 million tons. That was revised lower to between 32 million and 35 million tons in 1973, and revised still lower to 30 million tons. The goal of the plan was for annual growth rate of gross output of industry and agriculture to climb to 12.5%. China’s economy reportedly improved starting in 1972.

Fifth Plan (1976-1980)

Following the death of Mao Zedong in 1976, China’s economy began a major transformation. Under Chinese leader Deng Xiaoping, the nation decentralized its economic management and allowed industrial supervisors greater autonomy in terms of determining production goals. Farmers were also permitted greater control over their enterprises. Deng’s reforms extended into China’s political and social spheres as well and included China’ controversial one-child policy intended to control the nation’s population.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.