As the Bureau of Labor Statistics released the Consumer Prices Index for September, all news headlines read about the same. Inflation has not tapered off, as some economists said it would as the U.S. adjusted to the post-pandemic world. There are still enough jobs open, some argued that a loose labor market would not drive up wages. A booming economy would increase production of the items most Americans need for day to day life. Supply of these would be abundant, and Inflation would last a quarter or so, but not more.

There were prominent economists who argued otherwise. Former Treasury Secretary Lawrence Summers, who is a well regarded economist, said the assumption inflation could be tamed was false. Government spending to help build jobs after the 2020 recession and more proposed by the Biden Administration would fund a surge in consumer spending. Troubled supply chains would mean many goods would be in low supply. The formula for sharp inflation is already in place, Summers argued.

The September CPI supported the alarms of people who believe in Summers’ view. What consumers pay for goods and services rose 5.4% on an unadjusted basis compared to September 2020. And, for some Americans, the numbers were worse.

Take the basics that most people pay money for each month. In September, the price of beef steak rose 22% from the same month last year. The prices of several other types of meat rose by 12% to 19%. Apples rose over 7% as did chicken. Other notable increases were juices and non-alcoholic drinks up 3.9%

What are the negative effects of this inflation? In two words, “consumer spending” While wages for most Americans have risen in the last year, they have rarely risen by 8% or 9%. Consumer spending could be undermined as the prices of things people use regularly run higher than what they make. The worry is this will trigger a much slower economy.

Click here to see the household items with prices that are soaring

[in-text-ad]

24. Crackers, bread, and cracker products

> Price increase, Sept. 2020-Sept. 2021: +7.1%

22. Fresh whole chicken

> Price increase, Sept. 2020-Sept. 2021: +7.2%

[in-text-ad-2]

21. Salad dressing

> Price increase, Sept. 2020-Sept. 2021: +7.2%

20. Chicken

> Price increase, Sept. 2020-Sept. 2021: +7.6%

[in-text-ad]

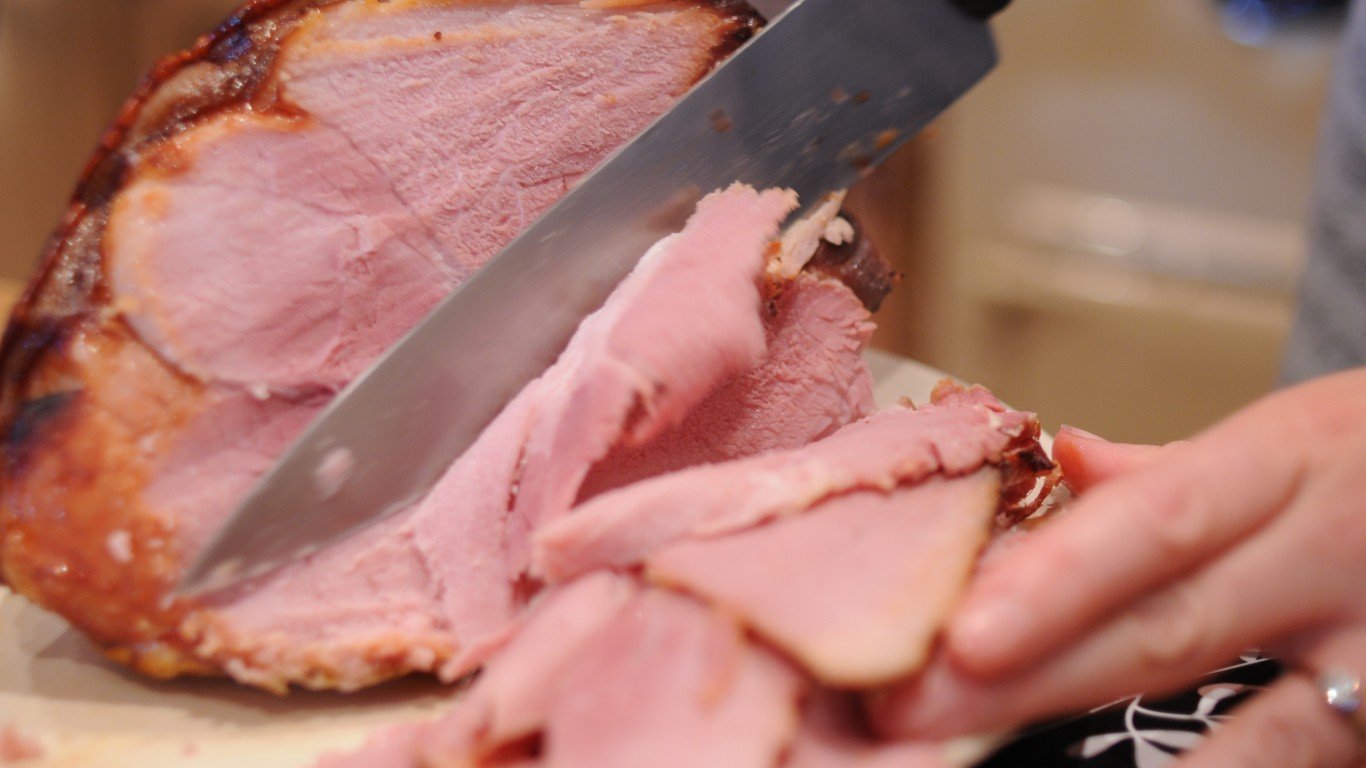

19. Ham, excluding canned

> Price increase, Sept. 2020-Sept. 2021: +7.7%

18. Apples

> Price increase, Sept. 2020-Sept. 2021: +7.8%

17. Breakfast sausage and related products

> Price increase, Sept. 2020-Sept. 2021: +7.9%

[in-text-ad-2]

16. Fresh and frozen chicken parts

> Price increase, Sept. 2020-Sept. 2021: +8.1%

15. Meats, poultry, and fish

> Price increase, Sept. 2020-Sept. 2021: +10.4%

[in-text-ad]

14. Meats, poultry, fish, and eggs

> Price increase, Sept. 2020-Sept. 2021: +10.5%

13. Other fats and oils including peanut butter

> Price increase, Sept. 2020-Sept. 2021: +10.7%

12. Fresh fish and seafood

> Price increase, Sept. 2020-Sept. 2021: +10.7%

[in-text-ad-2]

11. Uncooked ground beef

> Price increase, Sept. 2020-Sept. 2021: +10.8%

10. Eggs

> Price increase, Sept. 2020-Sept. 2021: +12.6%

[in-text-ad]

9. Meats

> Price increase, Sept. 2020-Sept. 2021: +12.6%

8. Pork

> Price increase, Sept. 2020-Sept. 2021: +12.7%

7. Bacon, breakfast sausage, and related products

> Price increase, Sept. 2020-Sept. 2021: +14.6%

[in-text-ad-2]

6. Beef and veal

> Price increase, Sept. 2020-Sept. 2021: +17.6%

5. Other pork including roasts, steaks, and ribs

> Price increase, Sept. 2020-Sept. 2021: +19.2%

[in-text-ad]

4. Bacon and related products

> Price increase, Sept. 2020-Sept. 2021: +19.3%

3. Uncooked other beef and veal

> Price increase, Sept. 2020-Sept. 2021: +20.6%

2. Uncooked beef roasts

> Price increase, Sept. 2020-Sept. 2021: +20.8%

[in-text-ad-2]

1. Uncooked beef steaks

> Price increase, Sept. 2020-Sept. 2021: +22.1%

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.