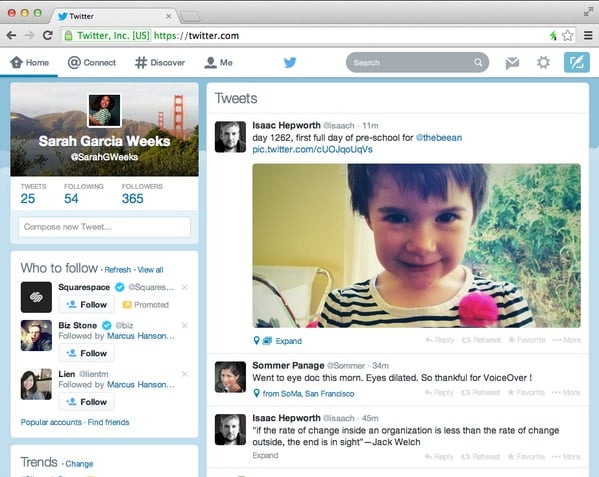

Twitter Inc. (NYSE: TWTR) has seen a wild ride since its initial public offering (IPO). It has likely made investors some small fortunes, and has likely cost some short sellers a fortune (or two) as well. Twitter got off to a rough start in 2014 because the gains were so high in December. But now some key analysts are telling investors that Twitter is a stock to Buy. Source: courtesy of Twitter

Source: courtesy of Twitter

The microblogging stock saw a second very positive research call ahead of Friday’s trading. On Thursday evening came word that Stifel Nicolaus was starting coverage of Twitter with a Buy rating. Stifel has said that the rising metrics at the company should not be discounted just because of its high valuations.

The firm even issued a $75 price target on the stock, which is less than 1% higher than the highest share price that has been seen since Twitter’s IPO. This appears to be the street high price target of all analysts as well. Stifel believes that the earnings momentum and strategic value will trump Twitter’s financial valuation concerns.

24/7 Wall St. would point out that these values are close to 100 times revenue, and the $25 billion market cap implies a valuation of about 31 times expected 2014 revenue. Another issue is that Twitter is expected to have operating losses in 2014.

Earlier in the week we saw that Goldman Sachs had raised its price target to $65 from $46 in its call. A gain of more than 5% in mid-Friday trading has Twitter’s stock price up to $63.70, close to the Goldman target. Twitter shares were indicated up 4% around $63 in early trading.

One cautious research note was issued in the past week. Nomura Securities had assigned only a Neutral rating. Other key downgrades have been seen since the start of 2014:

- Morgan Stanley cut it to Underweight (1/6)

- Cantor Fitzgerald cut it to Sell (1/8)

- Cowen and Co. started it as Underperform (1/9)

Twitter shares closed out 2013 at $63.65, and the stock traded above $70 only one day so far this year. By January 9, Twitter shares were back down around $55. After a 5% gain to $63.75, it seems as if the bulls are back in charge of Twitter.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.