International Business Machines Corp. (NYSE: IBM) reported fourth-quarter financial results after markets closed Tuesday. Big Blue said that it had $4.87 in earnings per share (EPS) and $21.8 billion in revenue, compared with consensus estimates that called for $4.84 in EPS and $21.75 billion in revenue. The same period of last year reportedly had EPS of $5.14 in EPS and revenue of $22.54 billion.

In terms of its segments, IBM reported:

- Cognitive Solutions (includes solutions software and transaction processing software) — revenues of $5.5 billion, flat year to year (up 2% adjusting for currency), led by growth in solutions software, including analytics and AI.

- Global Business Services (includes consulting, application management and global process services) — revenues of $4.3 billion, up 4% (up 6% adjusting for currency), with growth across consulting, application management and global process services. Gross profit margin increased 300 basis points.

- Technology Services & Cloud Platforms (includes infrastructure services, technical support services and integration software) — revenues of $8.9 billion, down 3% (flat year to year adjusting for currency), with growth in hybrid cloud revenue. Gross profit margin increased more than 140 basis points.

- Systems (includes systems hardware and operating systems software) — revenues of $2.6 billion, down 21% (down 20% adjusting for currency), with growth in Power, offset by the impact of the IBM Z product cycle dynamics.

- Global Financing (includes financing and used equipment sales) — revenues of $402 million, down 11% (down 9% adjusting for currency).

Looking ahead to the 2019 fiscal year, the company expects to see EPS of $13.90 and free cash flow of roughly $12 billion. The consensus estimates call for $13.84 in EPS and $79.06 billion in revenue.

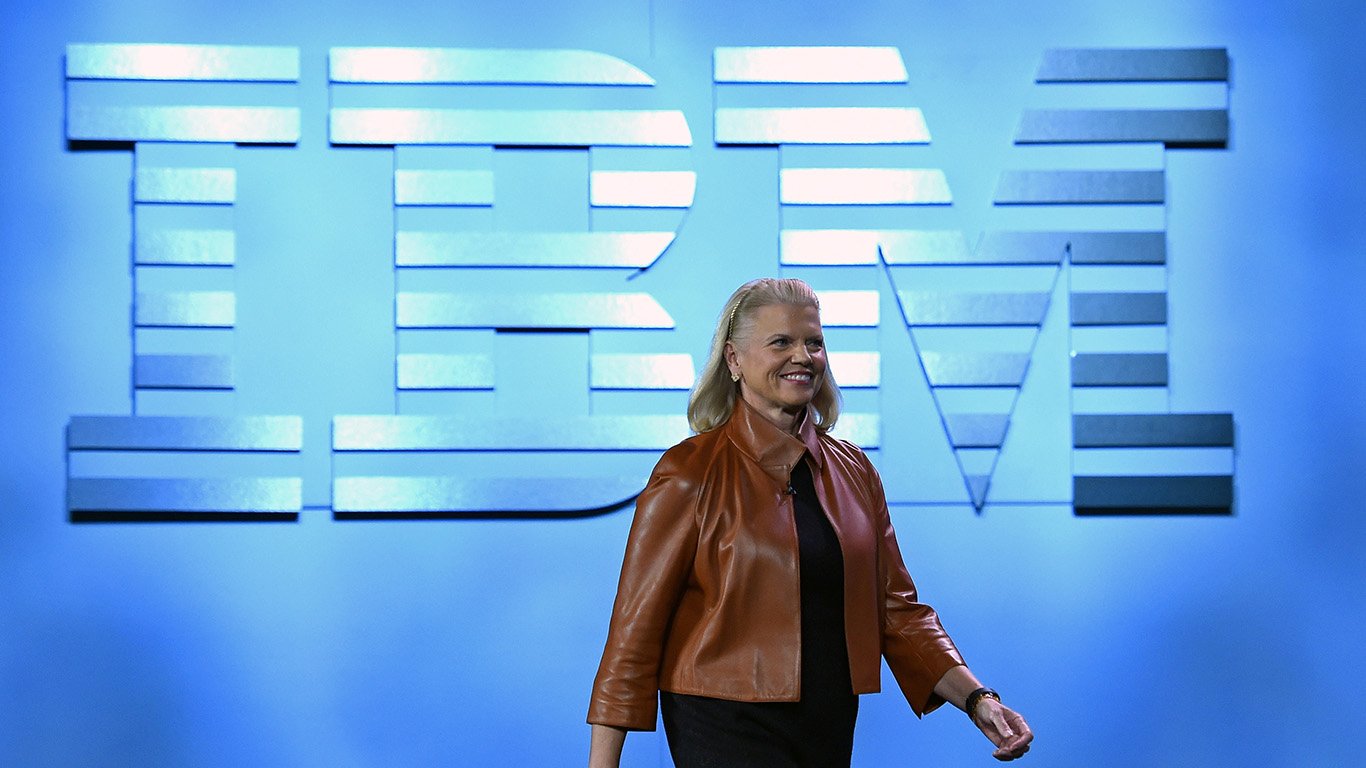

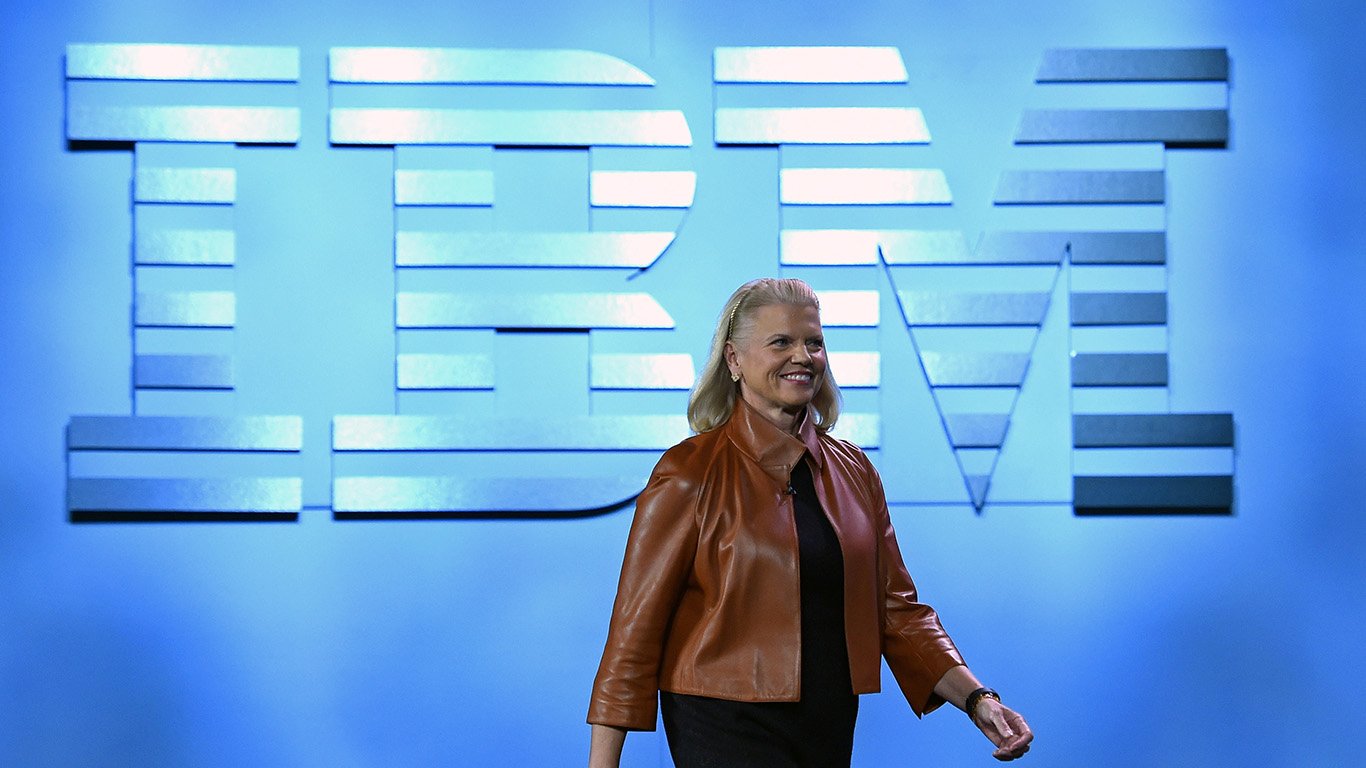

Ginni Rometty, IBM’s board chair, president and CEO, commented:

In 2018 we returned to full-year revenue growth, reflecting growing demand for our services and leadership solutions in hybrid cloud, AI, analytics and security. Major clients worldwide, such as BNP Paribas, are turning to the IBM Cloud and our unmatched industry expertise to transform their businesses and drive innovation.

Shares of IBM closed Tuesday at $122.49, with a consensus analyst price target of $143.84 and a 52-week trading range of $105.94 to $168.72. Following the announcement, the stock was up 4.6% at $128.10 in the after-hours trading session.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.