International Business Machines Corp. (NYSE: IBM) is set to report its second-quarter financial results after the closing bell on Wednesday. The consensus forecast calls for $3.07 in earnings per share (EPS) and $19.16 billion in revenue. In the same period of last year, IBM said it EPS of $3.08 and $20.0 billion in revenue.

Back in October of 2018, Big Blue announced a $34 billion agreement to acquire cloud software maker Red Hat. Now that the deal for Red Hat is officially closed, IBM’s stock has gained about 12% since the deal was announced.

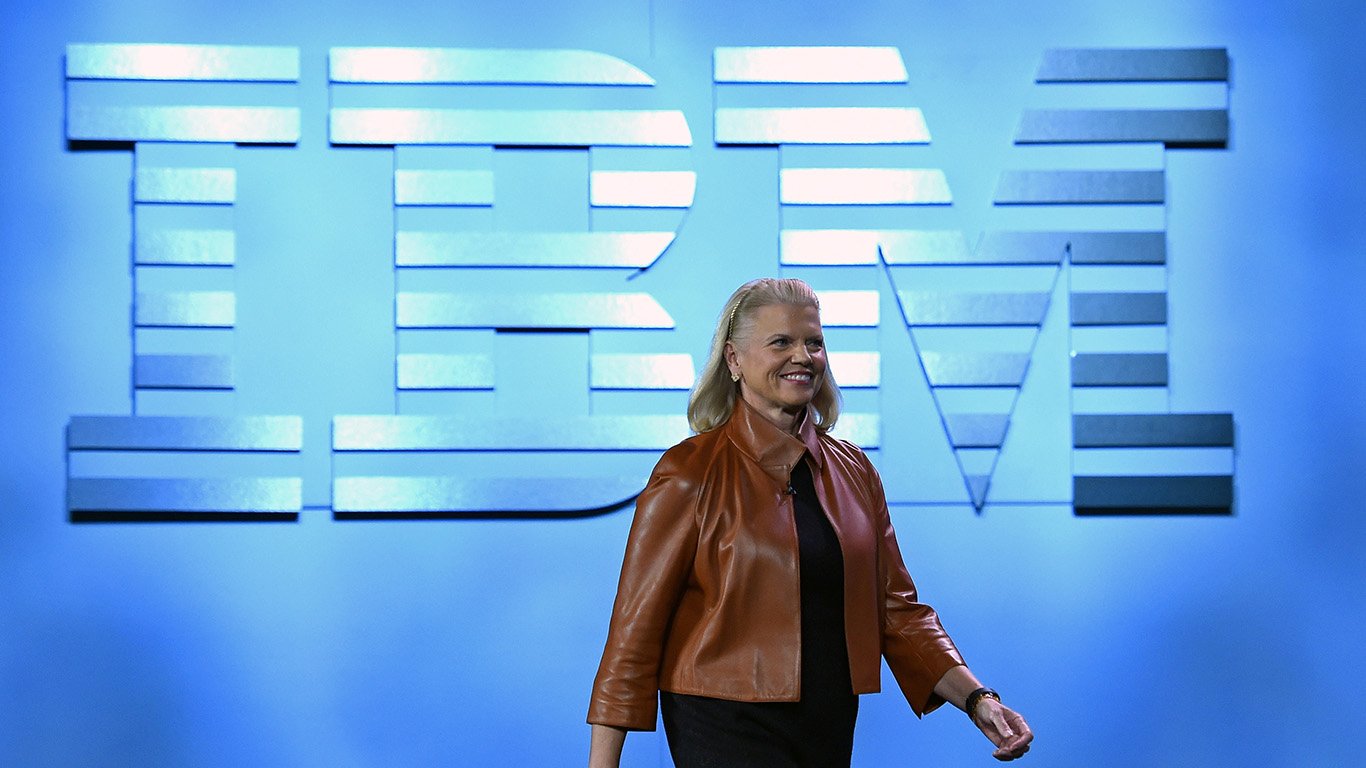

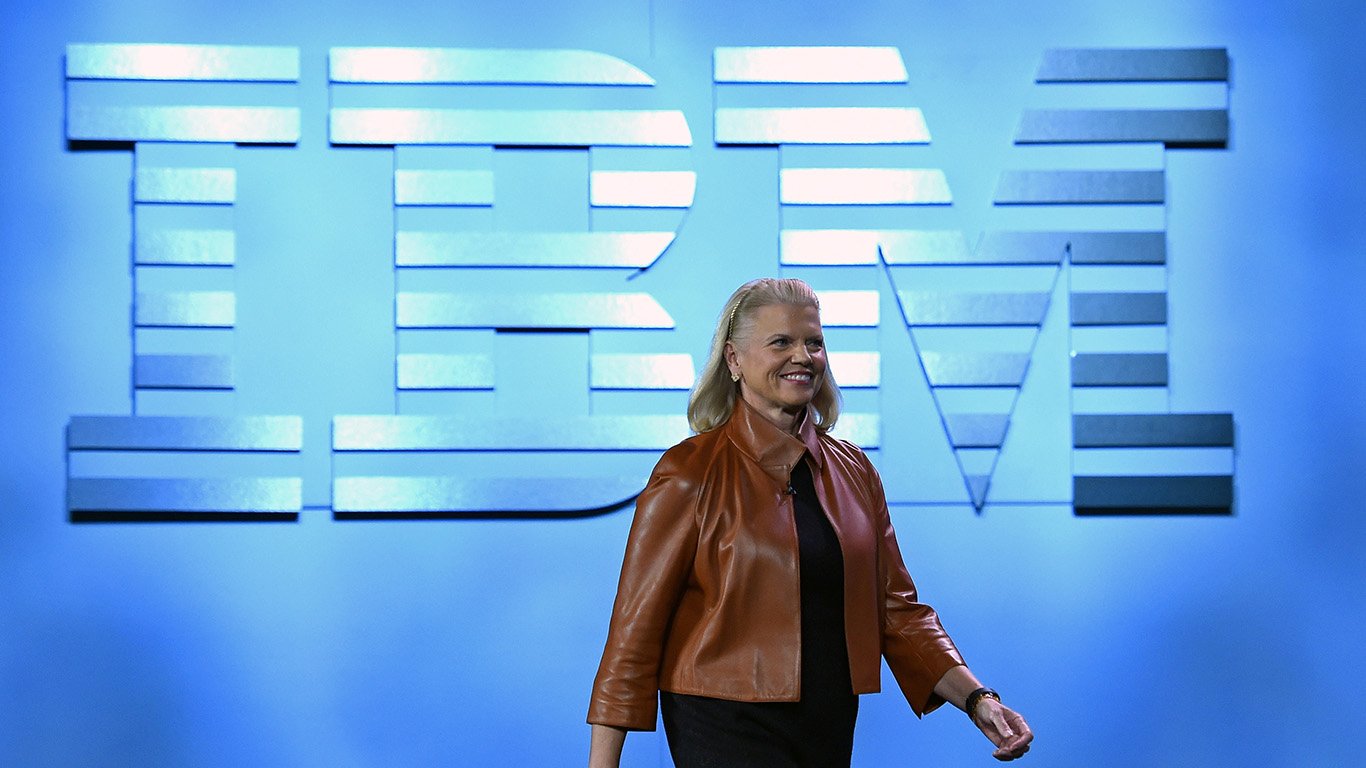

When she announced the deal, IBM CEO Ginni Rometty said this:

The acquisition of Red Hat is a game-changer. It changes everything about the cloud market. IBM will become the world’s #1 hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses.

By “hybrid cloud,” Rometty means an open-source platform that has to run on competing systems from leading vendors like Amazon’s AWS, Microsoft Azure and Google Cloud. IBM’s hybrid, multi-cloud platform is a first, Rometty claims.

Since 2013, IBM’s cloud services revenue has grown from 4% of total company revenues to 24%, and the company expects Red Hat to add about two points of compound annual growth to that over a five-year period. The big idea is that the IBM/Red Hat platform will permit companies to behave completely agnostically to data stored on-site and on private or public clouds.

A few analysts weighed in on IBM ahead of the report:

- Evercore ISI has an Outperform rating and a $150 price target.

- UBS Group has a Buy rating with a $160 target price.

- BMO Capital Markets rates it as Market Perform with a $155 target.

- Citigroup has a Neutral rating with a $140 target price.

- Credit Suisse has an Outperform rating and a $173 price target.

Shares of IBM traded down fractionally on Wednesday at $142.70, in a 52-week range of $105.94 to $154.36. The consensus price target is $147.21.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.