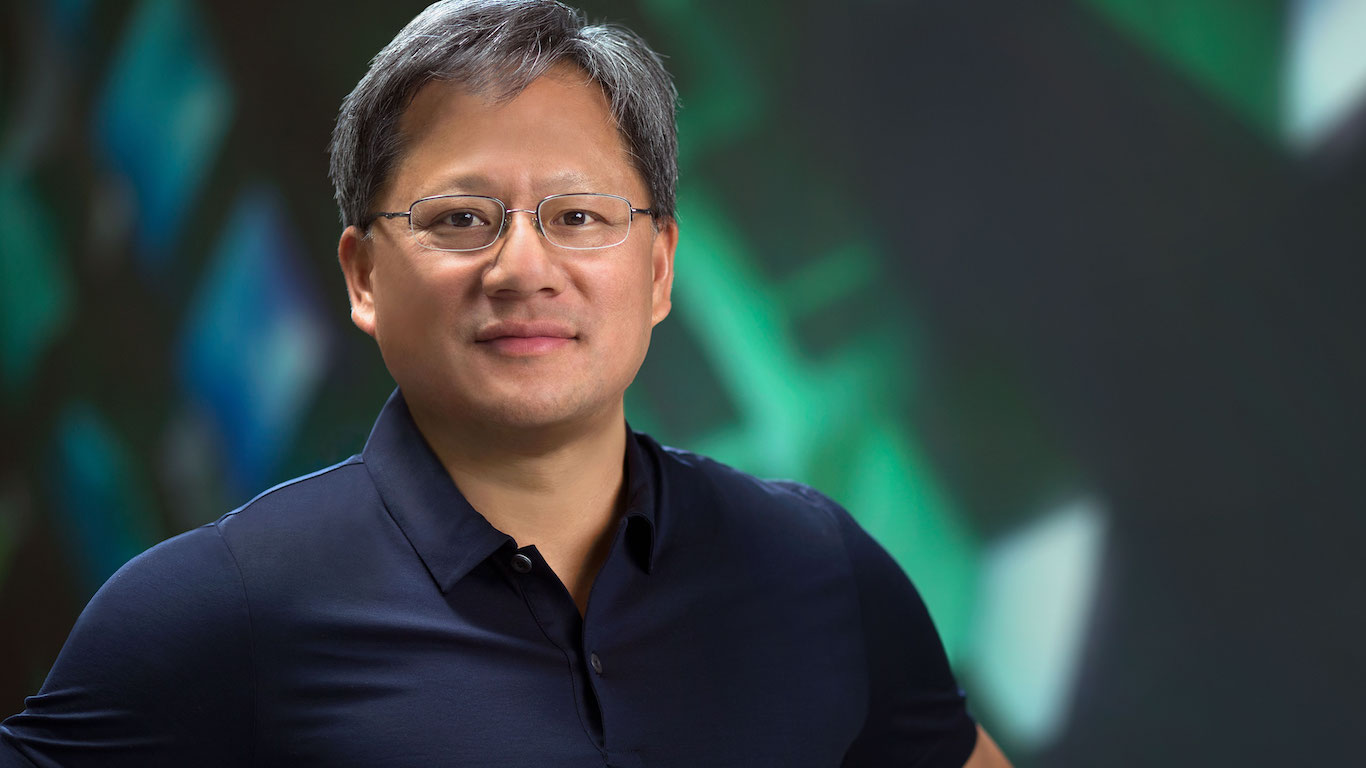

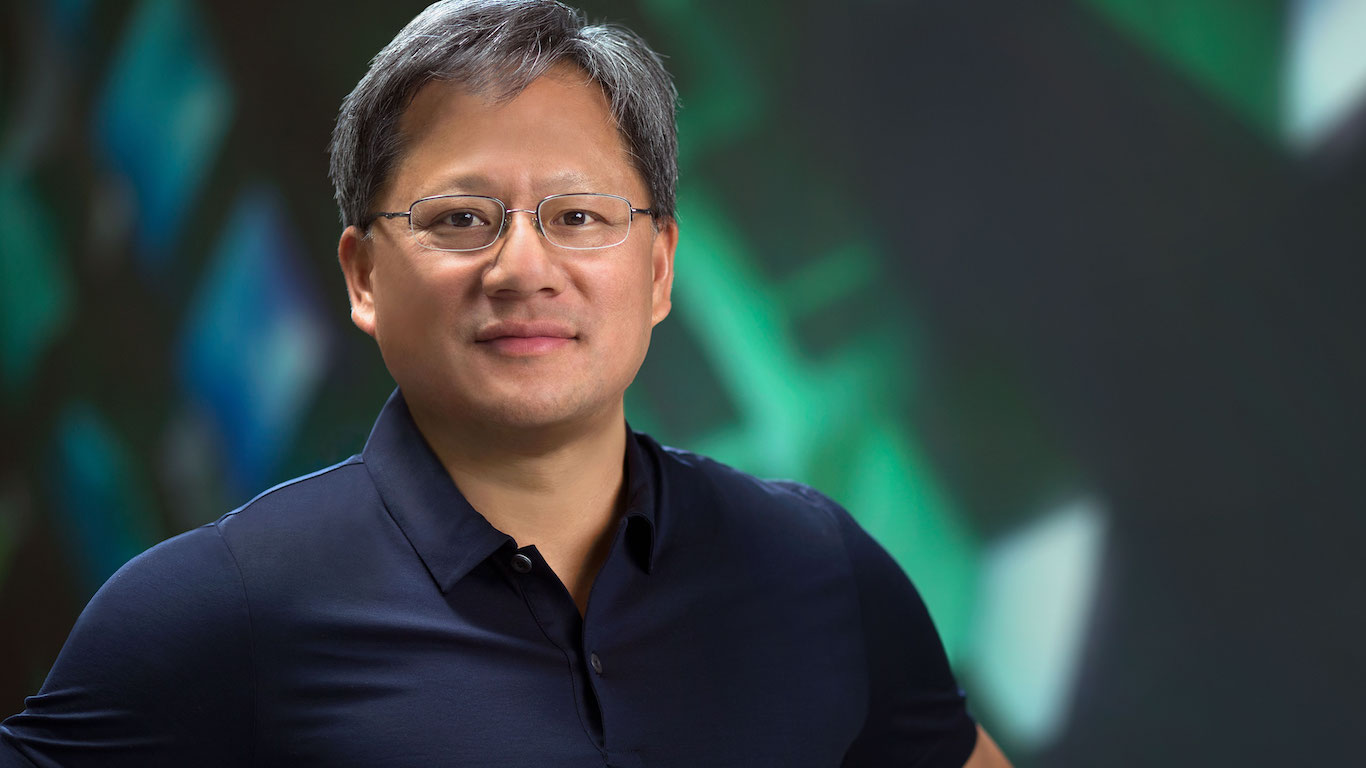

Is there anyone on the planet who would not like to be Nvidia Corp. (NASDAQ: NVDA) CEO Jensen Huang going into next week’s annual shareholders meeting? Like every other firm, Nvidia has had to adopt an online format, so Huang won’t get to hear the applause when he’s introduced.

And applause there should be. Over the past 12 months, Nvidia’s share price has gained more than 160%, the second-biggest gain of any S&P 500 stock for the period, trailing only a company with just one-sixth Nvidia’s market cap.

If analysts are right, the stock is still a buy, even though shares are trading nearly 17% above the consensus price target.

So what do Nvidia shareholders have to talk about on June 9?

No Shareholder Proposals on the Agenda

Just four proposals are on the agenda of the Nvidia annual meeting. First is the election of the company’s board of directors. One retirement will leave 11 members (10 independent plus CEO Huang), all seeking reelection for another term. Since 2015, only three board members have been newly elected.

Another proposal seeks approval for the selection of PriceWaterhouseCoopers as Nvidia’s accounting firm, a position that PwC has held since 2004. Two other proposals would amend and restate the company’s equity incentive plan and its employee stock purchase plan.

The most interesting, of course, is the proposal regarding executive compensation.

Nvidia Executives Don’t Appear to Be Overpaid

For a Wall Street darling that has done more than its share to keep the stock market from a prolonged downturn, the board is recommending essentially the same total compensation for 2020 as the five named executives received in 2019.

In fact, Huang stands to earn somewhat less this year: $11.5 million compared to $12.6 million a year ago.

Chief Financial Officer Colette M. Kress will earn $4.4 million compared to $5.0 million last year. Executive vice president of worldwide field operations, Ajay K. Puri, is to be paid $4.9 million, compared to $5.5 million in 2019, while executive vice president of operations, Debora Shoquist, will be paid $3.5 million, compared to $3.9 million last year. And Timothy S. Teter, executive vice president, general counsel and board secretary, will be paid $3.0 million.

In every case, Nvidia stock comprises well over half of these compensation packages. Nearly $9 million of the CEO’s compensation for this year comes from annual and multiyear stock awards.

Given Huang’s $11.5 million compensation package and the median employee compensation of $178,944 for this year, the CEO to median employee pay ratio this year is 64 to 1.

Nvidia’s main competitor, Advanced Micro Devices Inc. (NYSE: AMD), paid CEO Dr. Lisa Su $58.5 million in 2019, including a base salary of just over $1 million and stock awards totaling $53.2 million. In 2018, Dr. Su was paid $13.4 million.

AMD’s CEO earned $96,874 in 2019, yielding a CEO to median employee pay ratio of 604 to 1. AMD’s board made clear that an August 2019 “special Value Creation Equity Award” to Su distorted the comparison and calculated the required pay ratio as 172 to 1, excluding the special award.

What’s Ahead for Nvidia

Now that Nvidia’s $7 billion acquisition of Mellanox is completed, the company will get to work wringing revenue out of the deal. The Mellanox acquisition and contribution to second-quarter results should push Nvidia’s data center segment revenues above gaming segment revenues. In the first quarter, gaming revenues were $1.34 billion, compared to data center revenues of $1.14 billion. Data center revenues rose 18% sequentially and 80% year over year.

Rising demand for artificial intelligence (AI) and machine learning also are expected to drive Nvidia’s stock price, with the global AI market set to grow to more than $200 billion by 2026. That growth will come from multiple sectors, including manufacturing, where China, Japan and South Korea have deployed tens of thousands of sophisticated manufacturing robots in the past few years.

Natural language processing, voice recognition and machine learning are other big areas for AI innovation. Many companies are using this technology to improve customer service with more automated telephone assistants and online “help” bots.

Chip makers also benefit from the phenomenal growth of gaming, which was exacerbated by the coronavirus pandemic. Popular multiplayer games, such as “Fortnite Battle Royale” and “Call of Duty: Warzone,” require powerful central processing units (CPUs) and graphics processing units (GPUs). While the competition to sell graphics chips is stiff, Nvidia has a more-than-capable performer.

However, this year is all about the Nvidia data center business. The money has been spent, and now it’s time to reap the rewards. If the company can pull it off, don’t be surprised to see Huang’s compensation get a nice boost next year.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.