Energy

Natural Gas Demand to Rise 65% Over Next 25 Years: Exxon

Published:

Last Updated:

The losing energy source, of course, is coal, according to Exxon’s “The Outlook for Energy: A View to 2040” for 2014 released Thursday morning. Exxon says demand for coal will rise until around 2025, but coal’s share of the global energy mix will fall from 25% today to below 20%.

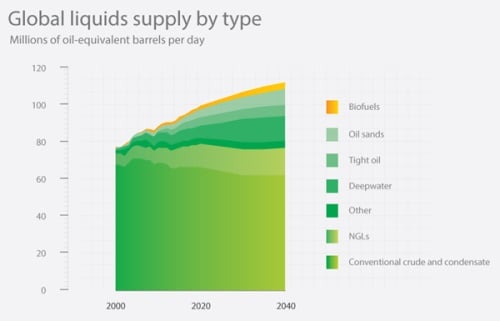

Oil is projected to remain the top global energy source for the next 25 years or so. Exxon expects demand for oil to rise by 25% through 2040. Much of that increase will come from sources such as deepwater, oil sands and tight (shale) oil. The following chart illustrates the degree of change.

Source: courtesy of Exxon Mobil Corp.

Source: courtesy of Exxon Mobil Corp.

At current production rates, the global supply of natural gas will last for about 200 years. About 40% of that supply will come from unconventional sources like shale gas, tight gas and coalbed methane, and by 2040 about one-third of global production will come from these unconventional sources. The primary source for that production will be North America, where horizontal drilling and fracking were first developed and where the technology is being improved and extended.

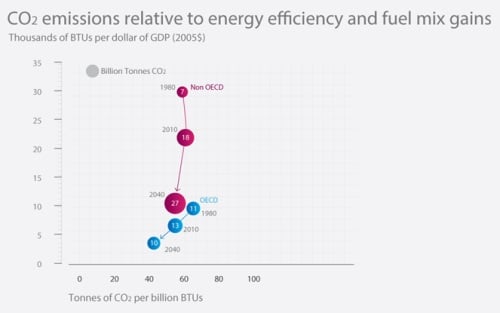

The overall rise in demand for energy is driven by a growing world population. The current 7 billion residents of the planet will grow to nearly 9 billion by 2040 and, according to Exxon, and the global economy will double and demand for energy will rise by 35%. Economic growth will be much higher in non-OECD countries, more than double the rate in the developed world.

Exxon also expects carbon emissions to peak before 2030 and decline gradually through 2040. The developed countries of the OECD are expected to contribute most to the decline, which will be driven by government policy and lower dependence on coal.

Source: courtesy of Exxon Mobil Corp.

Source: courtesy of Exxon Mobil Corp.

A related report from CDP (formerly known as the Carbon Disclosure Project) lists 29 major U.S. firms that currently use an internal price on carbon in making plans for future spending. The businesses range from Exxon to Walt Disney Co. (NYSE: DIS), Google Inc. (NASDAQ: GOOG) and Microsoft Corp. (NASDAQ: MSFT). As more countries adopt pricing for carbon, whether as a direct tax or some kind of cap-and-trade scheme, demand for cleaner fuels like natural gas inevitably will rise while demand for dirtier fuel like coal will decline.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.