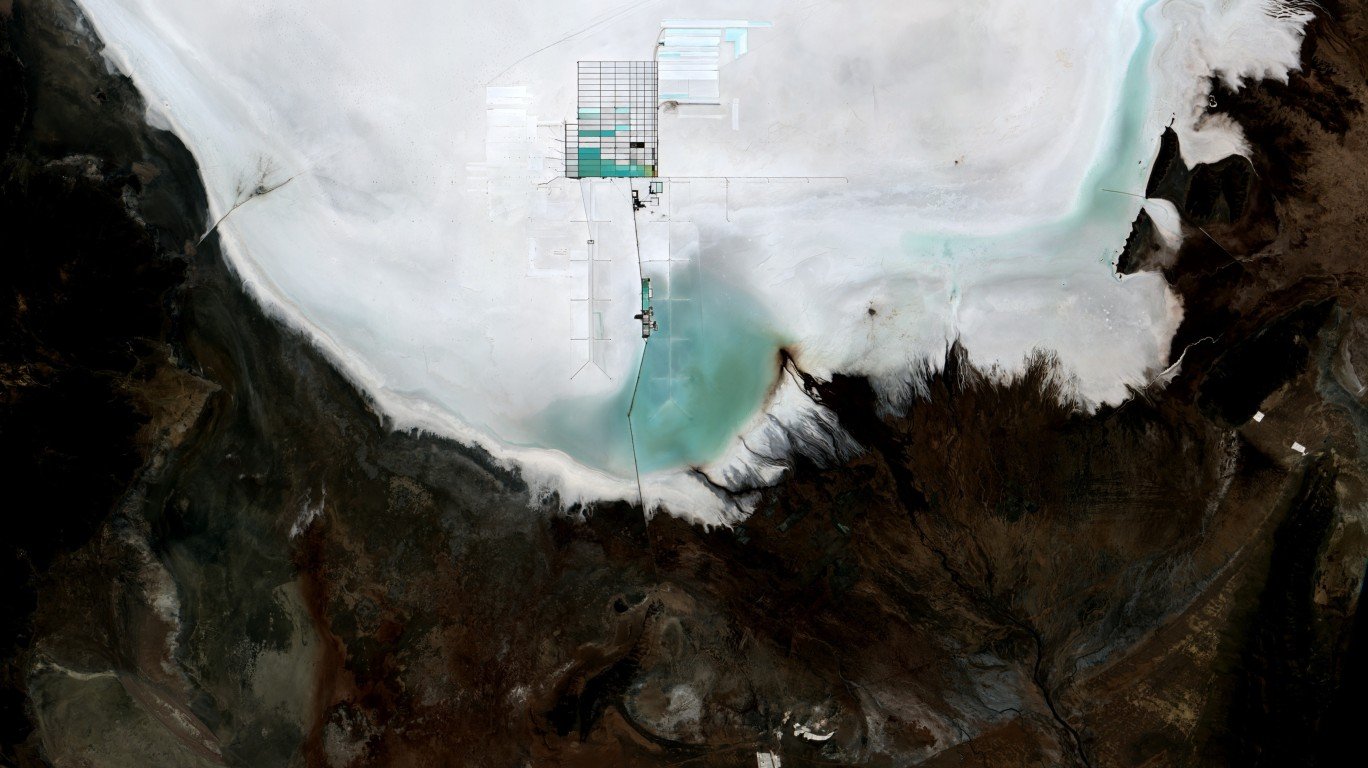

Albemarle Corp

NYSE: ALB

$114.98

Closing price April 25, 2024

Has NewMarket CEO Thomas Gottwald been increasing or decreasing his share count over the past year? Does he know something we don’t?

Published:

Here are the top analyst upgrades and downgrades for Thursday. Including one resumption, there are five hot stocks this morning.

Published:

Thursday's top analyst upgrades and downgrades included Albemarle, Arm, CrowdStrike, Dow, Fortinet, Hudson Pacific Properties, Lithium Americas, LyondellBasell Industries, Match, Palo Alto Networks,...

Published:

Wednesday's downgrade of U.S. credit took a heavy toll on some stocks. The selling continued early in Thursday's regular trading session.

Published:

After U.S. markets close on Wednesday, these five companies will report quarterly results.

Published:

Thursday's top analyst upgrades and downgrades included Albemarle, Catalent, Chipotle Mexican Grill, Cinemark, CrowdStrike, DoorDash, Estee Lauder, Icahn Enterprises, McDonald's, ServiceNow and...

Published:

Ford's investor day proved to be a good day for investors--in Tesla stock.

Published:

Friday's top analyst upgrades and downgrades included Albemarle, Amazon.com, Array Technologies, BlackBerry, Dynatrace, Futu, Gap, Mosaic, Procter & Gamble, Regions Financial, Take-Two Interactive...

Published:

Last Updated:

UBS upgraded lithium miner Albemarle and boosted the stock's price target. The analysts are seriously bullish.

Published:

Tuesday's top analyst upgrades and downgrades included Albemarle, Alphabet, BorgWarner, Catalent, Charles Schwab, DuPont de Nemours, Goodyear Tire & Rubber, LXP Industrial Trust, Meta Platforms, SoFi...

Published:

Friday's top analyst upgrades and downgrades included Albemarle, Alcoa, Alphabet, Block, CF Industries, Kraft Heinz, Livent, Mosaic, Norfolk Southern, Pfizer, RingCentral, Roblox, StoneCo, Trade...

Published:

Wednesday's Top Analyst Upgrades and Downgrades: Boeing, Palantir, PayPal, Shopify, Walmart and More

Wednesday's top analyst upgrades and downgrades included Albemarle, Boeing, Ingersoll-Rand, Novo Nordisk, Nutrien, Palantir Technologies, PayPal, Shoals Technologies, Shopify, Skyworks Solutions,...

Published:

Tuesday's top analyst upgrades and downgrades included Albemarle, Alcoa, American Airlines, Coinbase Global, Draftkings, Dropbox, Fortinet, Monster Beverage, Monster Beverage, Snowflake, Southwest...

Published:

The leading U.S.-based lithium mining company and a major smartphone chipmaker are set to report results after U.S. markets close on Wednesday.

Published:

Bed Bath & Beyond has finally answered the question of when it would file for bankruptcy, and Chile is sticking its nose into the lithium business.

Published: