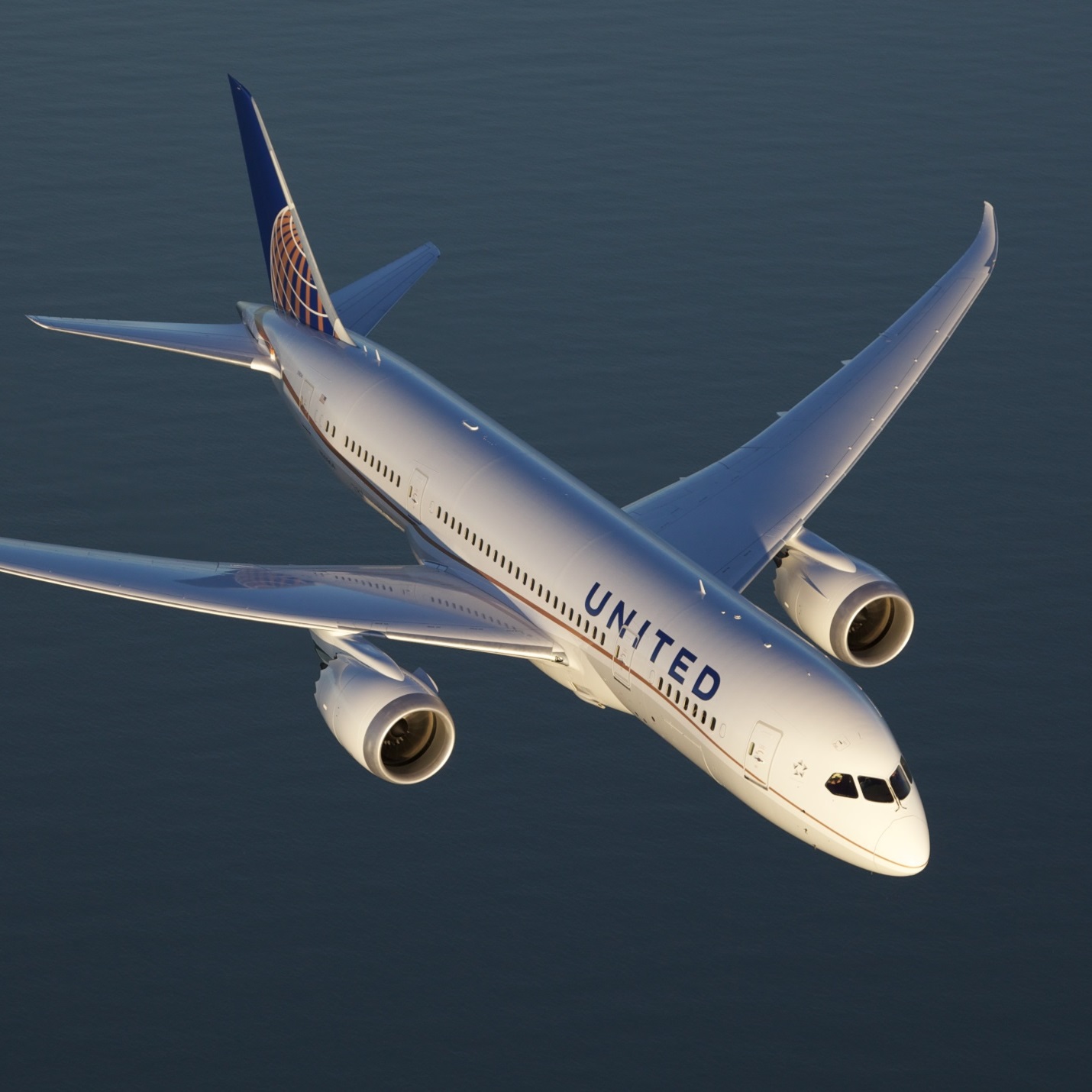

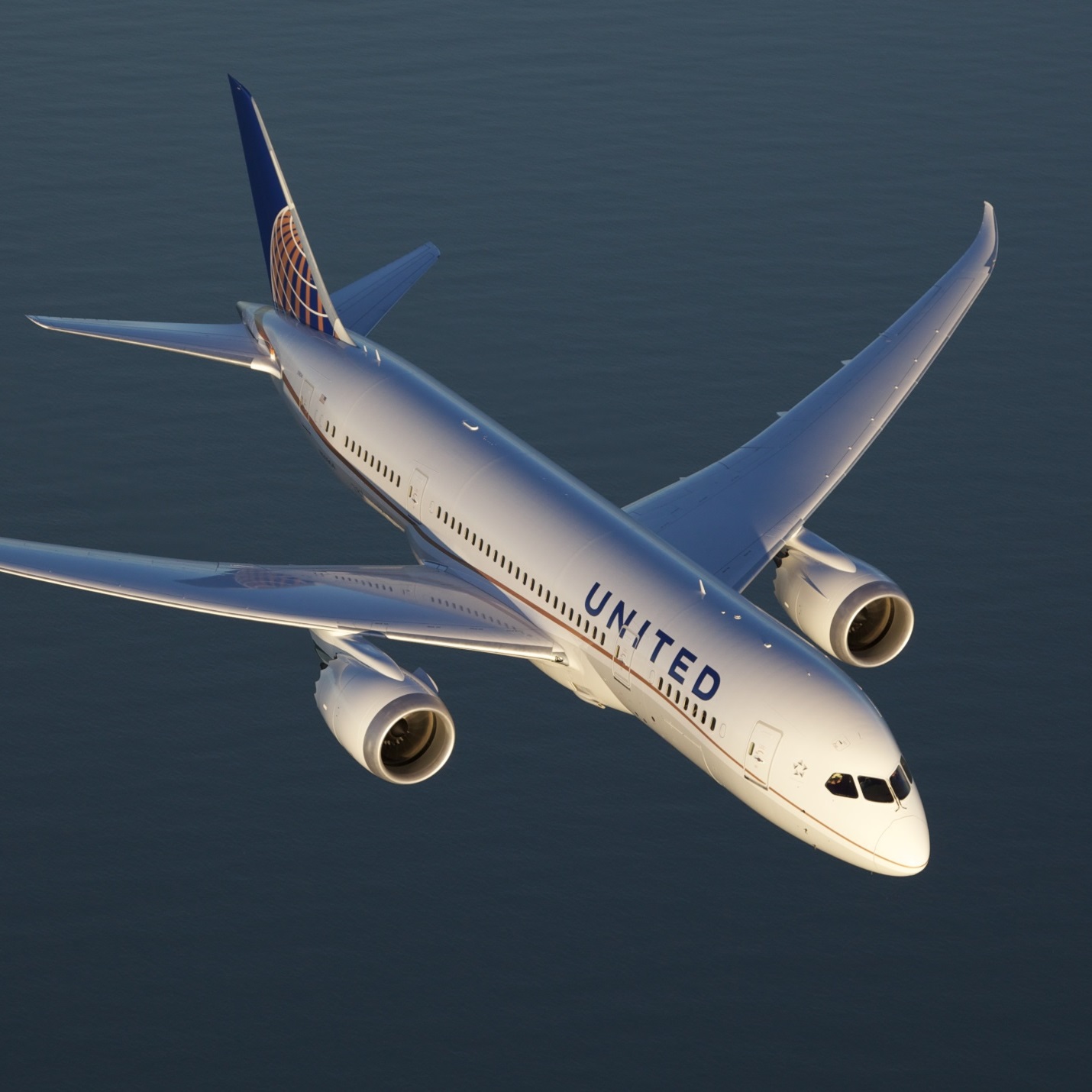

United Continental Holdings Inc. (NYSE: UAL) announced Tuesday morning a plan to boost the airline’s profitability by $3.1 billion by 2018. The plan outlined by United calls for a combination of higher prices, reduced costs, and better performance.

Most important in the near term is United’s new forecast for a smaller decline in unit revenue. The company lowered the top end of its expected decline from 8.5% to 7.5%. The low end of the forecast year-over-year decline is unchanged at 6.5%.

While the outline is pretty much boilerplate, some of the specifics are interesting. The company said it expects to drive approximately $1.5 billion in “incremental value” through increased customer segmentation, an upgrade to its rewards program and changes to its revenue management system.

The airline said it would improve its cost structure by upgauging (putting bigger planes on popular routes) and installing slimline seats. Those are the thinly padded seats that can be set closer together while still maintaining the seat pitch (distance between seat backs). Adding more seats and other “sensible cost management” will contribute approximately $1.3 billion to enhanced profitability.

Another $300 million in value is expected to come from “running a more reliable airline,” which the company said will increase United’s share of premium customers, cut costs related to delays and cancellations, and reduce the number of passengers sent to other airlines, among other things.

United’s CEO, Oscar Munoz, said:

We continue to accelerate our business performance while making strides in earning back the trust of our employees and customers. With the renewed engagement of our 86,000 aviation professionals, a great global network, a highly flexible fleet plan and a healthy balance sheet – all of the building blocks are in place for United to unlock its full potential.

United’s stock traded up about 3% at $44.62 Tuesday morning, in a 52-week range of $41.46 to $62.21. The consensus price target on the stock is $64.00.

Legacy airline stocks (Delta and American) are down between 11% and 30% for past 12 months and between 21% and 30% for the year to date.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.