The auto industry’s salad days may be over. After five years of selling more than 17 million new cars annually to American drivers, the industry is on track to sell around 16.8 million in 2019, about half a million fewer than were sold in 2018.

Automakers have come up with a workaround, however: higher prices.

In 2019’s Automobile Report, the American Customer Satisfaction Index (ACSI) shows that overall satisfaction with light vehicles (passenger cars, pickups, SUVs and crossovers) has fallen to its lowest point since 2015, with a score of 79 (of a possible 100), down 3.7% from last year’s score of 82. New-car prices have risen 4% to a record average of about $37,000.

According to the report, “[B]oth quality and value have deteriorated, along with key aspects of the driver experience [in 2019].” More than three-quarters of the nameplates included in the study posted lower customer satisfaction scores than in 2018.

Of the six nameplates at the top of the rankings, three are Japanese and three are European luxury brands. The top-ranked vehicle this year is Toyota’s Lexus brand with a score of 84. Lexus was also the top brand last year, but the 2019 satisfaction score dipped a point. Mercedes-Benz ranked second with a score of 83, up a point year over year, and Volkswagen’s Audi brand finished third with a score of 82, also down a point this year.

U.S. automakers placed two brands in the top 10: Ford’s Lincoln nameplate and GM’s Cadillac. Lincoln’s score of 82 was a point lower than in 2018, and Cadillac’s score of 81 was two points lower.

The vehicles with the lowest satisfaction scores came from Fiat Chrysler. The Chrysler nameplate scored a 71, down from 74 a year ago, and the Dodge brand scored a 74, down from 77. The company’s best-selling Jeep brand was the sixth worst with a score of 76, down 5% from 2018’s score of 80.

When ACSI sorts out the mass-market brands, U.S. automakers fare better, taking six of the top 10 slots. Honda, Subaru and Toyota are the top three, while Chevrolet is fourth, Fiat Chrysler’s Ram pickups rank fifth and GM’s Buick ranks sixth. GM’s GMC pickups and SUVs rank eighth, behind Hyundai in seventh and ahead of the Fiat and Ford nameplates that finished ninth and 10th.

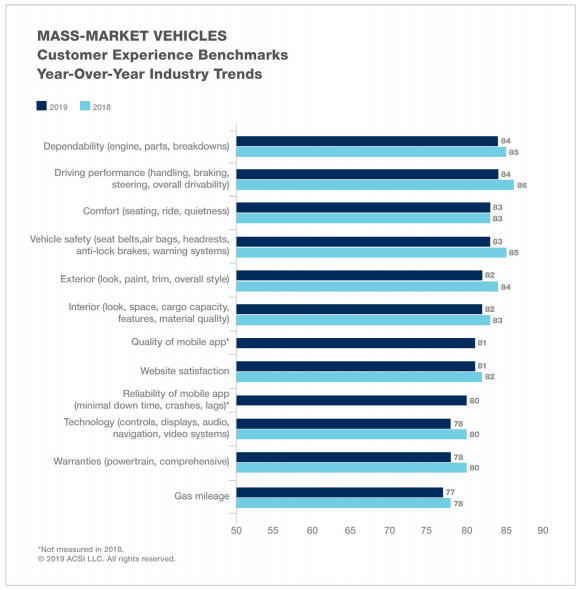

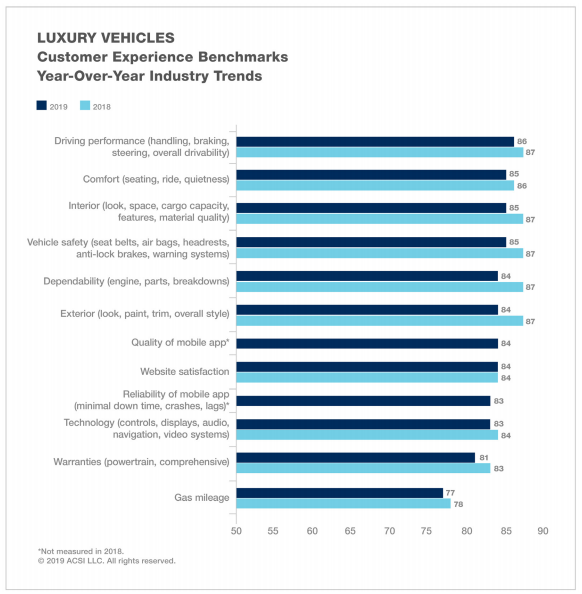

The lowest satisfaction scores in both mass-market and luxury segments are given to gas mileage. No benchmark score in either segment was higher in 2019 than in 2018. On the dependability benchmark, both segments scored 84 this year, but that’s a drop of only one point for mass-market vehicles and a drop of three points in the luxury segment.

Selling fewer vehicles at higher transaction prices works for vehicles in high demand, like pickups, sport utility vehicles and crossovers. For passenger cars, not so much. These trends are reflected in car sales by vehicle type. These are the top-selling cars of 2018 — and these are the cars Americans don’t want to buy.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.