Banking, finance, and taxes

Which Central Banks Are Still Buying Up Gold?

Published:

Last Updated:

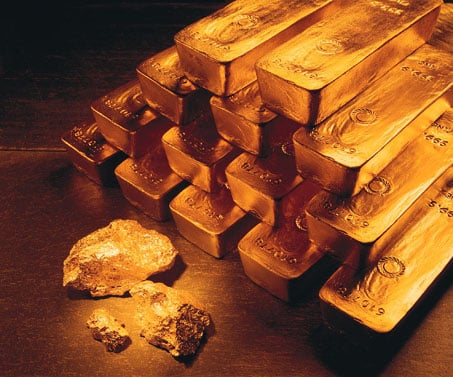

The year-to-date figure for central bank buying is up 9% so far for 2012. As currencies are weakened, it seems that central banks still are adding the shiny yellow metal as real assets in their national treasury holdings.

What 24/7 Wall St. wanted to know was which central banks were the net buyers of gold. The World Gold Council sent us data that goes all the way back to 2002. This was updated in November for the third quarter. We also matched up data from The Economist’s Intelligence Unit to see which of these nations are expected to grow in 2012 and 2013, and it was easy to recognize that the nations adding gold are still growing.

But first a group of nations that added only the smallest amounts of gold. The Kyrgyz Republic added 0.1 tonnes in July and another 0.1 tonnes in August. As most people in the world do not know this nation, we’ll just leave it at that. Mongolia, another nation ignored by much of the world, added 0.1 tonnes in August, and it was listed as trading activity. The Philippines was said to buy locally produced gold, which it may sell or retain in reserves, but it was also listed as a 0.1-tonne gainer, with its purchases coming in August. Serbia added 0.1 tonnes in July and again in August, for a total of 0.2 tonnes in the third quarter.

Taiwan barely made the list this quarter as it purchased 0.9 tonnes in August. But that is more aggressive than the 0.3 tonnes added during the first half of 2012. The Economist data projects 1.3% gross domestic product growth in 2012 and 2.7% in 2013.

Brazil was shown to be a buyer of gold, and it added 1.7 tonnes to its holdings during September. We think that this is important because when we looked at the great nations holding the lion’s share of all the world’s gold, Brazil was way down the list. The country was such a small holder of gold that we even said that the Brazilians better use their success to grab more gold so that it does not have to worry about the woes of the past. This gives the Brazilian Real some actual support. Brazil sits at number 50 on the list of nations and quasi-government entities, with some 35.3 tonnes of gold. That is still only 0.5% of its reserves, and our take is that Brazil really needs to increase this effort. The Economist shows that Brazil’s GDP is expected to grow by 1.5% in 2012 and then by 4.2% in 2013.

Kazakhstan was listed as purchases and swaps, but the nation is deemed to be a net buyer of gold, so that it can bolster its influence. It added 1.4 tonnes in July and again in August, with a 0.4-tonne drop in September. If this is simple straight-line math and really is ending up in the treasury’s war chest, then the nation added some 2.4 tonnes of gold during the third quarter. Kazakhstan was ranked at 33 on the list of nations and quasi-governments, with 104 tonnes coming in at 19.7% of its total reserves. No Economist data was available.

Ukraine continued to buy up gold in each month of the third quarter, adding to the four prior months of gold gains. After adding 4.9 tonnes so far in 2012, Ukraine added some 2.4 tonnes in the third quarter, before any rounding errors. Ukraine came in at number 51 on the list of nations in total gold holdings, with some 35.1 tonnes, or 6.9% of reserves. The Economist projects Ukraine’s GDP to grow by 0.8% in 2012 and by 2.2% in 2013.

Read Also: The Nations That Control the World’s Gold

Paraguay added 7.5 tonnes in July and the lack of notation would imply that its central bank was adding more hard assets into its treasury. This is a substantial gain for Paraguay as its ranking was shown to be all the way down at number 70 among nations and quasi-government entities. Its total was 8.2 tonnes, or 9.7% of its total reserves. An Economist project of GDP growth was not available.

South Korea was the surprise buyer, with central bank purchases adding 16 tonnes of gold in the month of July. No additions or subtractions were seen in August and September, but that is a large enough purchase to stand out for third-quarter activity. The WGC just lists this as Korea, but it is ranked as number 40 at 70.4 tonnes, but that is still only 1.3% of its total reserves. The Economist sees South Korea’s GDP growing by 2.6% in 2012 and by 3.7% in 2013.

Russia was an impressive buyer in the third quarter, with a combined 18.7 tonnes purchased in July and August. We have said previously and continue to believe that Russia will keep on buying gold so that the nation’s Ruble can become more of a trusted global currency. One caveat is that Russia sold 2.2 tonnes in September, so this is worth following in the current quarter to see if the nation will continue to buy gold. Russia’s quarterly net purchases would be tallied up as 16.5 tonnes, without considering any rounding errors. Russia is now number 8 on the list of nations holding the most gold. The Russian central bank appears to be closing on the 1,000 tonnes hurdle as its holdings are listed as 934.5 tonnes of gold, and that comes to 10.1% of its total reserves. The Economist is projecting Russia’s GDP to grow by 3.7% in 2012 and the same 3.7% in 2013.

Turkey was the international leader when it came to central bank buying in the third quarter. We noted before that Turkey was adding gold to its balance sheet as a result of new policy accepting gold in its reserve requirements from commercial banks. The gains were massive at 44.7 tonnes in July, 6.6 tonnes in August and 6.9 tonnes in September. Turkey was also a large buyer of gold earlier in the year, with four of the six months as a net buyer. This bank demand is massive and came in at 58.2 tonnes before any rounding errors. Turkey ranks as number 18 on the list of nations, with its 302.4 tonnes coming to 15.4% of its total reserves. The Economist projects GDP growth in Turkey of 3.2% in 2012 followed by 3.8% growth in 2013.

The WGC did note that changes of less than one tonne are not included unless they form part of a longer-term program. It also said that central banks differ in whether gold out on swap is or is not included in reported reserves. Under the IMF Standard Data Dissemination Standards, such gold is included in reserves, so swap activity does not result in any reported change. However not all central banks yet adhere to this, and for others swap activity can result in a change in reported reserves.

Gold investors can thank ETF buyers and Indian consumers for keeping gold demand up, but they better not forget about the central banks that are adding hard assets to keep their currencies and economies safe against future problems.

JON C. OGG

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.