Banking, finance, and taxes

Global Bank Account Owners Rise 700 Million

Published:

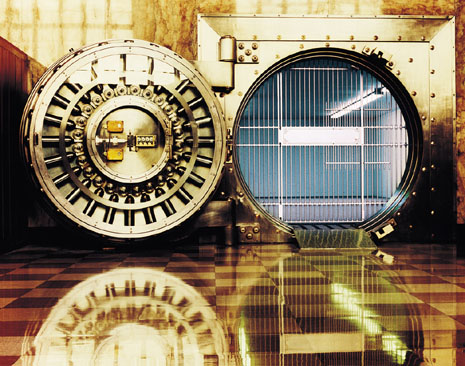

The number of global bank account holders increased by 700 million recently, which is good news for banks and bad news for consumers who pay fees for maintaining these accounts. Source: Thinkstock

Source: Thinkstock

Access to financial services and products has expanded rapidly across the globe in the past few years. The number of adults worldwide who report having an account at a formal financial institution or through a mobile device grew by an estimated 700 million between 2011 and 2014. Now, 62% of the world’s adult population has an account, which is up from 51% in 2011.

The trend drove the number of account owners overall to about 3.2 billion worldwide. Gallup’s experts say this leaves 2 billion people unbanked, or “excluded from the financial system.” One primary reason for the large number of people who do not participate is poverty, and likely some people live in parts of the world that do not have financial services at all. Gallup data break down the reasons in more detail:

South Asia and East Asia and the Pacific are home to about half of the world’s 2 billion “unbanked” adults. In South Asia, about 625 million adults lack account access, and the same is true for about 490 million adults in East Asia and the Pacific. India, China and Indonesia alone account for 38% of unbanked adults globally. Sub-Saharan Africa has the next-largest population of unbanked adults, at about 350 million — or 17% of the global total.

ALSO READ: What Is the Right Age to Get a Credit Card?

Furthermore:

As in 2011, the most common reason cited for why adults remain unbanked is the lack of money. Fifty-nine percent list poverty as one of the reasons for being unbanked, but only 16% cite it as the sole reason. In all developing regions except Europe and Central Asia, lack of enough money is the most commonly cited reason. It is important to add that just 4% say lack of need is the only reason they do not have an account, underscoring the unmet demand for financial services among the unbanked. Beyond this, the reasons residents are most likely to report vary according to local conditions. In sub-Saharan Africa, distance to financial institutions is the second most commonly reported barrier, cited by 27%. In the Middle East, 41% of adults without an account say they cannot get one. This likely reflects prohibitive costs and documentation requirements for opening an account.

Beyond that, 30% of the people asked say that do not want an account at all.

The data imply that as long as banks do not move into underserved areas, the populations in these areas will continue to be part of the unbanked pool of people. However, even the presence of banks cannot draw people who do not want to be part of the system and get an account.

Methodology: Results are based on telephone and face-to-face interviews with approximately 1,000 adults per country, aged 15 and older, conducted in 2014 in more than 140 economies. For results based on the total sample of national adults, the margin of sampling error ranged from ± 2.5 percentage points to ± 5.2 percentage points at the 95% confidence level.

ALSO READ: The Best (and Worst) Paying Cities for Women

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.