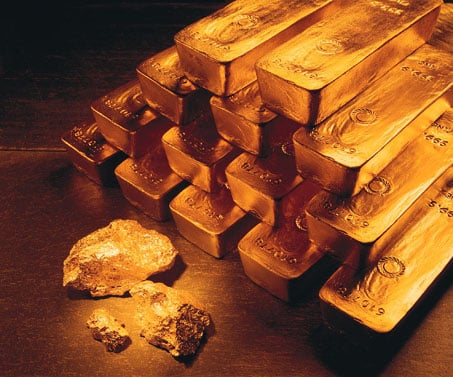

Commodities & Metals

Goldcorp Earnings Break Pattern of Recent Misses

Published:

Last Updated:

On GAAP basis, the company posted earnings of $5 million, compared with $495 million in the year-ago quarter. Adjusted earnings excludes the impacts of foreign currency translations and amendments to the company’s service level agreement at its Pueblo Viejo operations. However adjusted EPS does include a negative impact of $0.03 per share for non-cash stock-based compensation.

The company’s CEO, said:

[W]e remain on track to achieve our annual production and cost guidance. Most importantly, our focus on operational discipline and cost containment delivered positive results. Most of our mines saw meaningful reductions in costs compared to the previous quarter …

The company sold 652,100 ounces of gold on production of 637,000 ounces in the third quarter. Silver production fell from 8.5 million ounces in the third quarter of 2012 to 7.7 million ounces. On an all-in sustaining basis, gold production costs rose from $801 a year ago to $992 an ounce. The average realized gold price for the quarter was $1,339 an ounce, down from $1,685 an ounce in 2012.

The company said that gold production for the fiscal year would be in the range of 2.6 million to 2.7 million ounces at an all-in cash sustaining cost of $1,050 to $1,100 an ounce. The consensus estimates for the fourth quarter call for EPS of $0.23 on revenues of $1.29 billion. For the full year, the consensus estimate for EPS is $0.95 on revenues of $4.25 billion.

Higher production costs and lower selling prices remain the big issues for precious metals miners.

Goldcorp shares were up 2.7% in premarket trading this morning, at $26.29 in a 52-week range of $22.22 to $45.53. Thomson Reuters had a consensus analyst price target of around $33.30 before this report.

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.