Dell Inc. (NASDAQ: DELL) is not getting a great reception so far on Monday as word of its buyout continues to point to a deal getting closer and closer. Late last week, we were braced for a deal to come as early as this morning. Monday morning came and passed but now reports are fighting over the timing and terms. CNBC’s David Faber reported on this today, as did Dow Jones. Source: courtesy of Dell

Source: courtesy of Dell

24/7 Wall St. has a slightly different possibility to consider. What if this is all just another ploy?

What we do know so far is that Silver Lake is still the lead buyer, with Michael Dell being involved in the hundreds of millions of dollars. Microsoft Corporation (NASDAQ: MSFT) is still expected to contribute up to $2 billion in some form of equity or preferred capital. We are also now expecting that Dell will repatriate its cash from overseas, which ultimately get taxed unless there is some creative collateralization set up outside of the United States.

The buyout price is one which we originally put at about $15.00 per share, but that was back on January 15 and was meant to illustrate a top-dollar that a buyer would pay which would also go off without “breach of duty suits” being filed on behalf of too many shareholders. That $15 is still a top we would expect a buyer to pay to get shareholders to go away, but we also still expect that many stockholders will file lawsuits in as many jurisdictions that they can saying that this is not in their best interests.

So, after looking through the rumored news today, $15 is still probably too high for what a private equity group. Now the talk is a top of $14 or so if you listened to CNBC, and Dow Jones said that the deal is being finalized around $13.50 or $13.75.

Michael Dell owns close to a 16% stake. That being said, what if the ultimate goal here by Michael Dell is to try to not buy the company but to get a core investor like Silver Lake and a strategic partner like Microsoft in the door and to try to just establish a floor for investors?

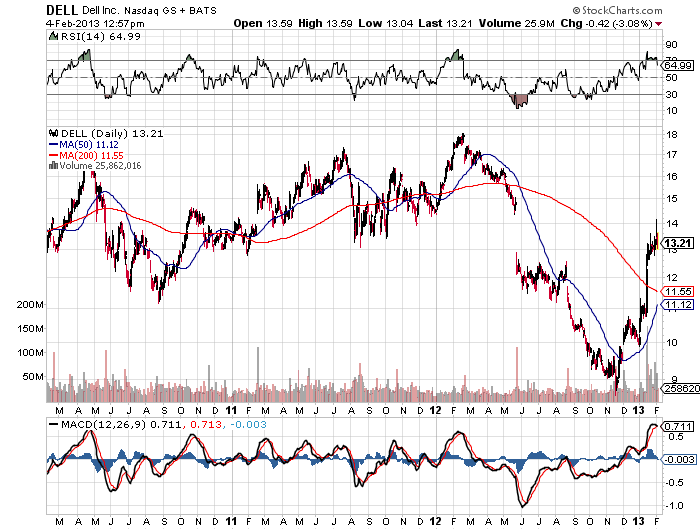

The Dell buyout remains one which might not be the best exit for Dell shareholders. Some holders have been in there for years and years, and some are what we would call “very long and very wrong.” To prove that there is at least some cause for the concern, Dell shares are down 3.1% at $13.21 on the day against a 52-week trading range of $8.69 to $18.36. Its market cap is listed as being almost $23 billion all-in.

There is an old saying, “An offer is as good as a take.” That may be true in some cases. That just might not be the case in this ongoing buyout of Dell. This may be more like a “takeunder” for many long-term shareholders. Below is a long-term 3-year chart from stockcharts.com for your review.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.