Consumer Electronics

What Samsung Must Do to Threaten Apple's Grip on the Tablet Market

Published:

Last Updated:

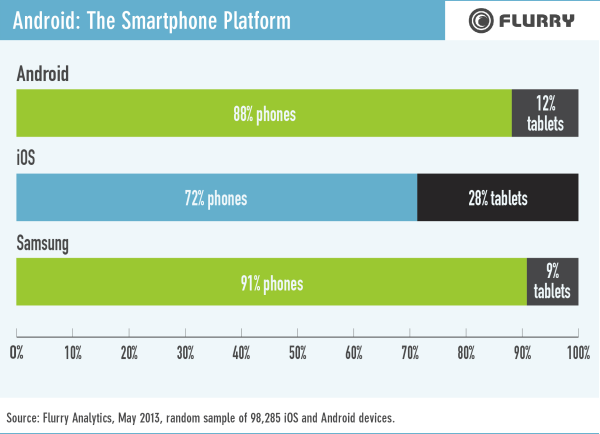

Tablets take an even smaller share of mobile devices made by Samsung Electronics. Just 9% of all Samsung Android devices are tablets while 91% are smartphones.

Now smartphones still dominate in global markets and Android-based smartphones made by Samsung own a 59% share of the market according to research firm Flurry. Samsung tablets hold a 42% share of global tablet in Flurry’s sample of more than 45,000 Android devices.

Flurry notes that the behavior of owners of Samsung’s smartphones and tablets more closely mirrors that of Apple device owners than it does that of other Android device users. Why then hasn’t Samsung penetrated the tablet market to a greater degree?

The short response is that the Korean company has been focused on getting to an equal footing in its hardware development and has let the ecosystem surrounding its tablets drift. It’s not an uncommon error. Everyone looks at Apple’s snazzy hardware and first-time buyers leap after it. But they stay because the ecosystem surrounding the hardware offers them everything they need.

Samsung has the software ecosystem attached to Android available, but the company’s undifferentiated apps offerings don’t give it a positive marketing message in the tablet space. It is forced to compete on hardware innovation and that’s why we see smaller tablets and phablets and watches, among other hardware.

Samsung is stuck with a difficult choice. Either go after smartphone sales in developing markets where price is very likely to drive sales or throw more resources at selling tablets and other higher end devices in developed markets like the U.S. Or attack both markets at once.

The stakes are high and going after both markets will be costly. But, as Flurry notes, if Samsung could succeed at both markets, the Korean company becomes a bigger threat to Apple than does Google.

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.