Source: Thinkstock

The GDPNow model aggregates the same 13 subcomponents used by BEA to construct its estimate, but when a data point is not available, the model uses “bridge equations” to fill the gap. Other forecasters use similar “nowcast” techniques, but the Atlanta Fed notes that other forecasts are not updated more than once a month or once a quarter. Also, they are not publicly available and do not include forecasts of the subcomponents that add color to the top-line number. The GDPNow model fills those voids.

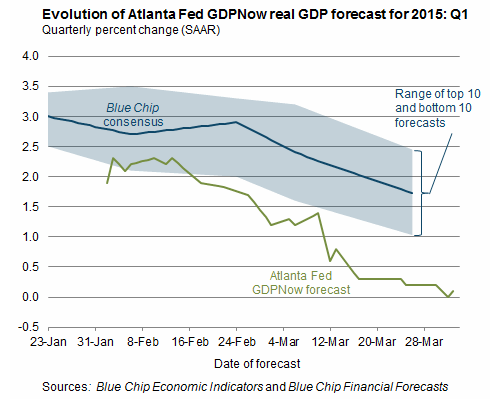

On February 2, the GDPNow model forecast GDP growth of 1.9%. At that time the change in net exports was forecast to be down $15 billion. By March 12, that total had dropped to a $40 billion negative change. Nonresidential construction spending was initially forecast to drop by 1.5% and is now forecast to be down 22.5%.

The following chart shows the relationship between the Atlanta Fed’s GDPNow forecast and the Blue Chip consensus.

Source: Federal Reserve Bank of Atlanta

GDP growth may not actually reach zero in the first quarter of 2015, but there does not appear to be much question that it will end up well below where initial forecasts put it.

ALSO READ: America’s Fastest Growing Cities

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.