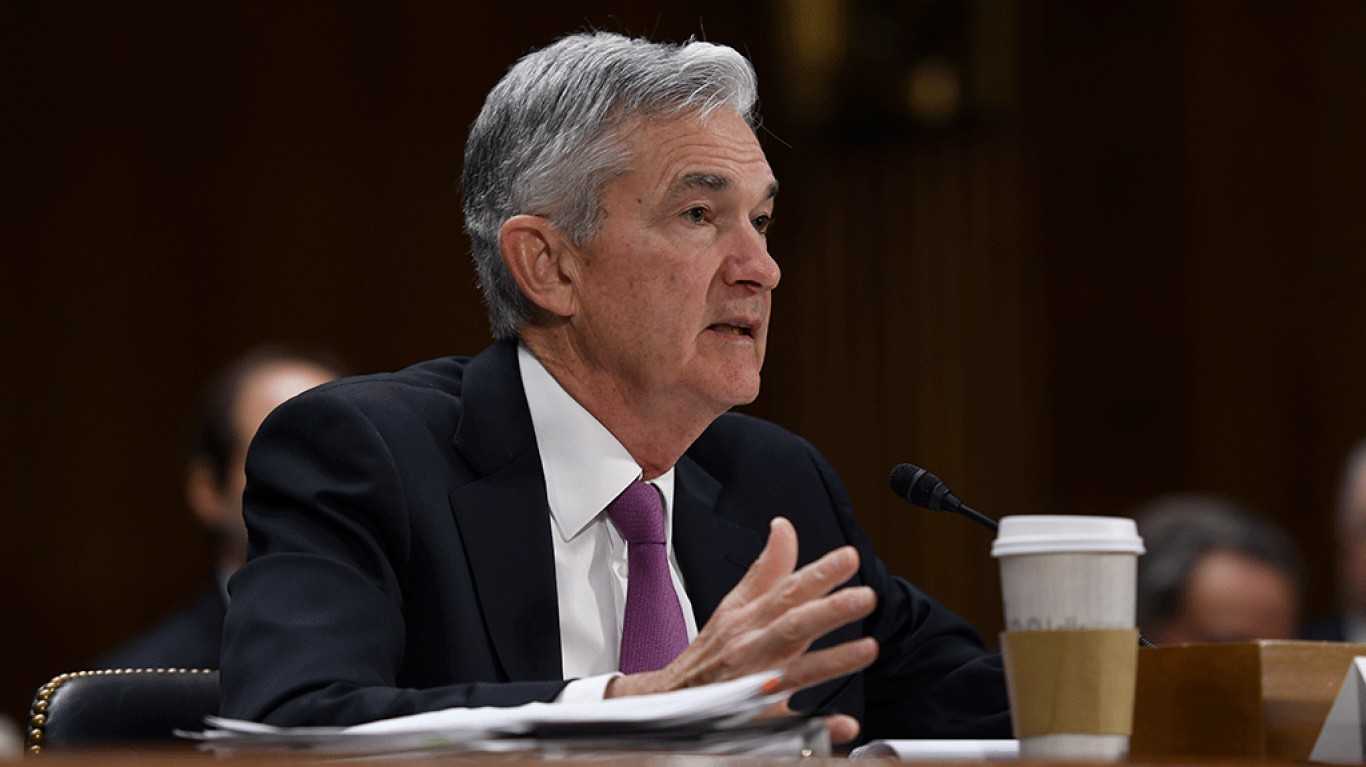

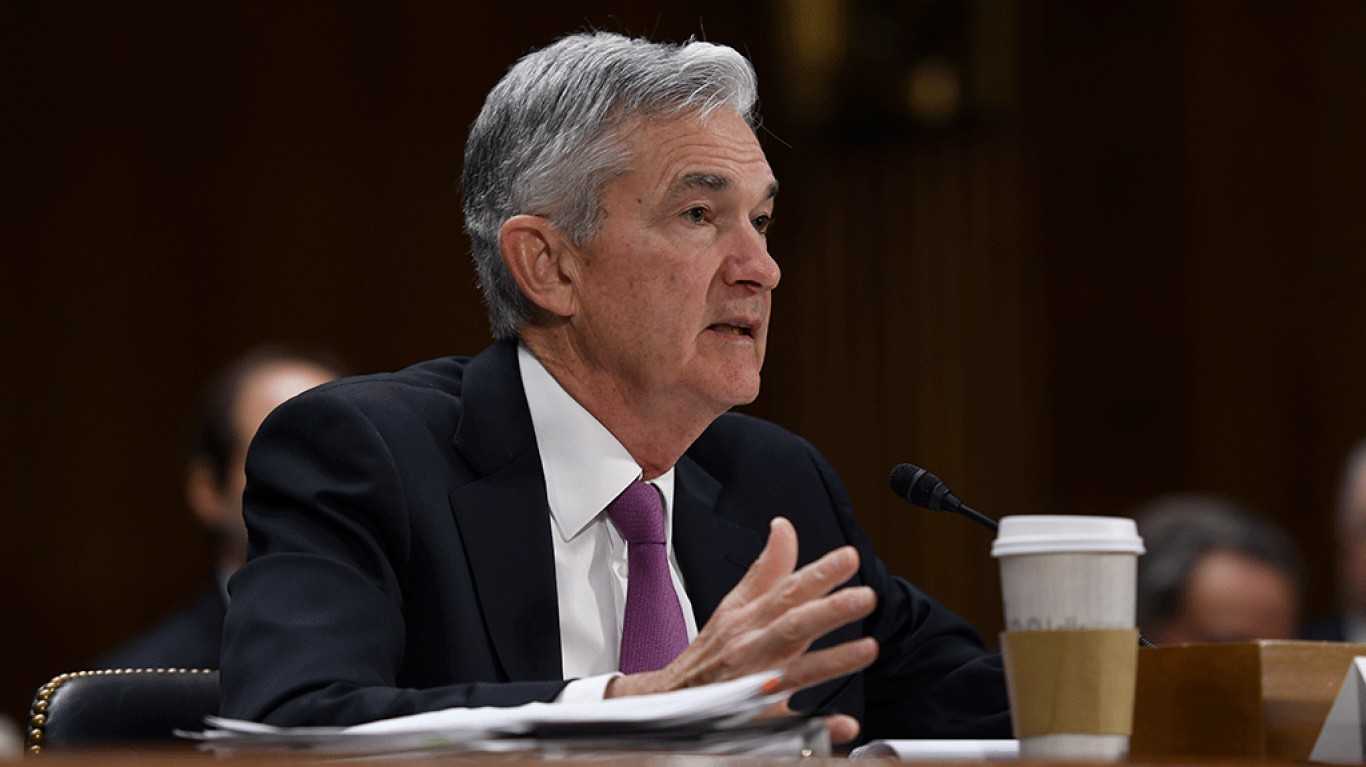

Sometimes the news has an exaggerated impact on the financial markets. Federal Reserve Chairman Jerome Powell provided the exaggeration on Wednesday. Powell spoke via webcast at the Peterson Institute for International Economics in Washington, D.C., updating the scope of the deepest economic recession since World War II. While he outlined some of the known events, it was his look forward that has taken some enthusiasm away from stocks.

Investors were first pinning Wednesday’s sell-off on Powell and on another market maven’s comments, but these may be excuses rather than being the real cause. The markets already had rolled over on Tuesday, and Wednesday’s midday trading had the Dow Jones industrials and S&P 500 down another 2%.

Foremost on the economic impact is the crushing blow that was dealt to the workforce in the COVID-19 shutdown. Almost 40% of those people who were working and earning $40,000 or less in February lost their job in March.

Equally important has been the government’s “swift and forceful” response, as Powell referenced. So far, Congress has added roughly $2.9 trillion in economic stimulus and support. Those funds have gone to individuals and to businesses, as well as to state and local governments. All in all, it’s roughly 14% of gross domestic product. It is no exaggeration to say that the coronavirus recession was the largest and fastest on record, and the response also has been the fastest and largest to fight any downturn since World War II.

As many questions about forecasts remain unknowable, Jerome also indicated that policies already need to have been effectively considered for a range of possible outcomes.

One additional point that Powell addressed was that the loss of thousands of small and medium-sized businesses will create a disaster ahead. Destruction of a lifetime of work and family legacies would predicate that the job recovery would be weaker and may bring an extended period of low productivity growth as well as stagnant incomes.

What the market seemed to key in on for the negative reaction was that additional policy measures may be needed to avoid the perpetual weak outcome ahead. Powell also restated that the Federal Reserve has lending powers but it does not have spending powers. Despite the loans being made and the massive stimulus that has been added, Powell did warn that the recovery may take some time to gather momentum. He also warned that the passage of time can turn liquidity problems into solvency problems. As for additional stimulus, he concluded:

Additional fiscal support could be costly, but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery. This tradeoff is one for our elected representatives, who wield powers of taxation and spending.

There may be a different interpretation of the sell-off. This is actually a slow part of the news cycle, and any words or proclamation can have a greater impact compared to key economic and key earnings reports, along with other developing macro news. The biggest issue to keep in mind is that the indexes had recovered signficantly from the March 23 lows, and we have entered the “sell in May and go away” zone in which any negative news may overpower the positives or a lack of other news.

To help Powell’s speech have an even more exaggerated effect, Appaloosa Management’s David Tepper told CNBC this morning that this was perhaps the second-most overvalued stock market now that the S&P 500 forward price-to-earnings (P/E) ratio has risen above 20.

Shortly before 1:00 p.m. the Dow was down about 500 points (−2%) at 23,275 and the S&P 500 was down 48 points (−1.7%) at roughly 2,822. The yield on the 10-year Treasury note was down about four basis points at 0.64%.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.