The Organization for Economic Cooperation and Development (OECD) has issued its global forecast gross domestic product (GDP) for the balance of the year and for 2021. Most nations have forecasts better than those of the most recent OECD prediction in June. Some economies, particularly South Korea and China should almost sail through the pandemic-induced downturn unscathed. At the other end of the scale, three of Europe’s old-world economies will be crushed. They are Spain, France and Italy.

[in-text-ad]

What the OECD calls the Interim Economic Outlook predicts global GDP will fall 4.5% this year. Next year, it rises by 5.0% the OECD experts say. (Note that another explosion of COVID-19 spread would make that forecast useless.) The OECD always has at least one fudge for its predictions. Other than COVID-19, the other is the actions of “policymakers.” Generally, the list adds politicians to central bankers. OECD Chief Economist Laurence Boone said:

Policymakers have the opportunity of a lifetime to implement truly sustainable recovery plans that reboot the economy, generate investment in the digital upgrades much needed by small and medium-sized companies and in green infrastructure, transport and housing to build back a better and greener economy.

Based on the gravity of the problems, many might rather skip the lifetime opportunity.

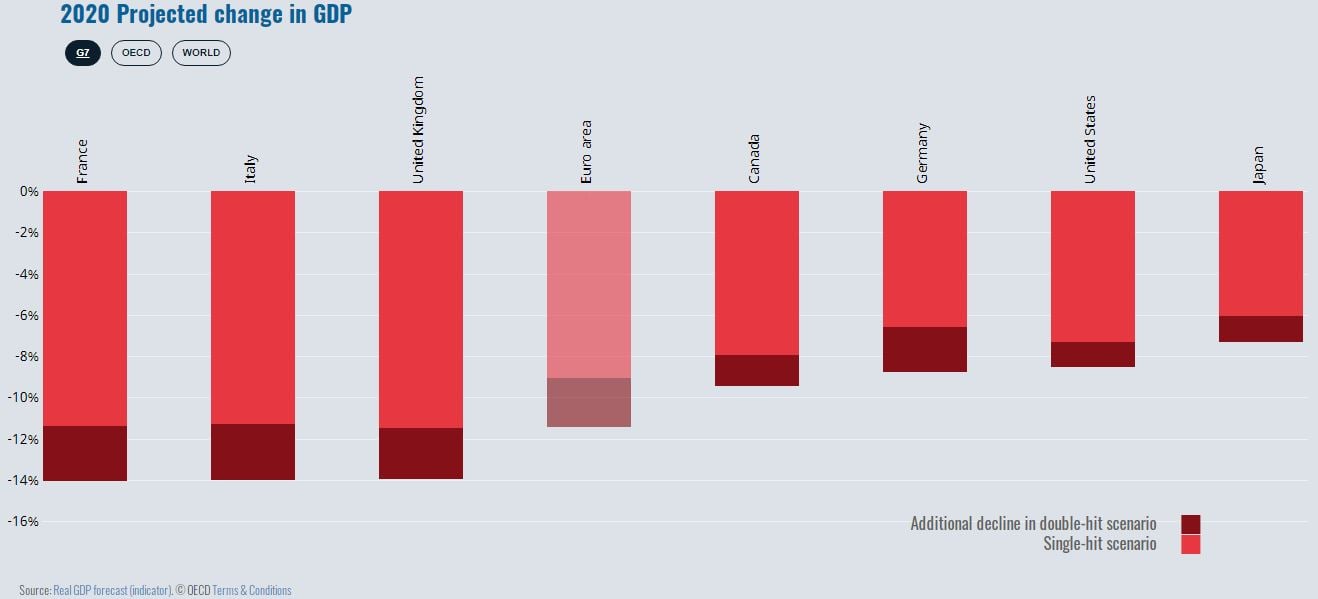

To oversimplify, manufacturing nations do the best in the forecast. South Korea (−1.2% GDP in 2020) and China (−2.6%) continue to be the dominant nations in this category. Although they increasingly argue that they have become cradles of intellectual property and innovation, the United States (−7.3%), Japan (−6.0%) and Germany (−6.6%) have not let go of their hold on that part of GDP creation. These three countries are all forecast to do better than the OECD average for this year.

Italy (−11.3%), France (−11.4%) and Spain (−11.1%) rely so much on tourism and the exports of discretionary purchase items that their economies will be ruined as much as in the Great Recession.

In every case, the national GDPs fall further if the global economy takes a second hit, due mostly to the spread of COVID-19. It would add another point or two downward from the currently forecast figures.

The best news is that the worst of the global GDP downturn is over. Many nations will have GDP increases for the rest of the year. That is, except, for problems with COVID-19 and policymakers.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.