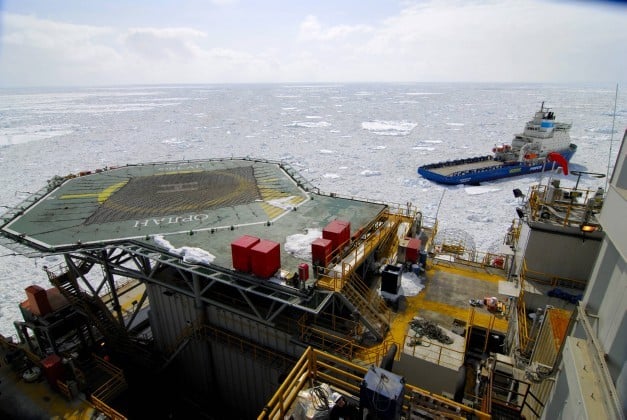

Large-cap oil service stocks are trading at valuations that are very close to multiyear cycle troughs. Is there a reason why investors are loath to own these top names when they are at their cheapest levels? While oil prices have been a big driver of return on capital and stock price performance over the past 15 years, the industry has matured, with business models positioned very differently than in prior cycles. The J.P. Morgan analysts do not see the large caps chasing the cycle anymore. They maintain that the global build-out of equipment and infrastructure has passed and the top companies are well positioned for slow but steady market growth over the next several years. Source: Courtesy Rosneft

Source: Courtesy Rosneft

In a new report, the J.P. Morgan team revisits the items that have been on Wall Street’s mind for some time concerning the oil service names: Lower capital expenditures, which are expected to remain flat over the next several years. Working capital is shrinking and trending lower. Internal corporate efficiencies are driving costs lower and expanding operating margins. The bottom line: large-cap services providers are generating free cash flow for the first time in the history of the industry, with stronger cash flow likely if the cycle accelerates. The time to buy may be now.

J.P. Morgan raised targets on two major names, and we also spotlight other top oil service names to buy.

Halliburton Co. (NYSE: HAL) is one of the top names J.P. Morgan is very positive about. The company stands to benefit from continued robust levels of domestic drilling activity and a pickup in international markets. Management believes the company can deliver earnings per share of $6 by 2016, double the level from 2012. Investors receive a 1.1% dividend. The J.P. Morgan price target goes from $66.60 to $77.00. The Thomson/First Call estimate is much lower at $64.09. Halliburton closed Wednesday at $55.16.

Schlumberger Ltd. (NYSE: SLB) is another mega-cap oil field services stock to buy at J.P. Morgan. Strong offshore drilling activity combined with a seasonal rebound in Western Canadian activity have driven Schlumberger’s recent growth. The company said it expects double-digit earnings growth for the rest of the year when it reported earnings recently. For 2014 and beyond, Schlumberger sees five markets providing strong growth: Russia, Sub-Saharan Africa, the Middle East, China and Australia. Shareholders are paid a 1.6% dividend. The J.P. Morgan price target is increased to $122 from $109. The consensus is right in line at $110.38. Schlumberger closed Wednesday at $92.35.

Ensco PLC (NYSE: ESV) is a top energy name that fits the bill. The company recently took delivery of ENSCO 121, the second of four ultra-premium harsh environment jackup rigs in its ENSCO 120 Series. ENSCO 121 is an enhanced version of Keppel’s proprietary KFELS Super A Class design. The rig has been contracted in the North Sea at a day rate of approximately $230,000. Shareholders are paid an outstanding 5.7% dividend. The J.P. Morgan price target stands at $66, and the consensus target is lower at $56.73. Ensco closed Wednesday at $52.81.

FMC Technologies Inc. (NYSE: FTI) remains on the list of top stocks to buy at J.P. Morgan. The analysts believe that subsea equipment is one of the few services area that will see secular growth in 2014 and beyond. The company’s Subsea Technologies segment designs and manufactures subsea systems used in the offshore production of crude oil and natural gas; and multiphase meters used in production and surface well testing, reservoir monitoring, remote operation, fiscal allocation, process monitoring and control, and artificial lift optimization, as well as provides installation and workover tools, installation assistance and field support for commissioning, intervention and maintenance of subsea systems. The J.P. Morgan price objective is $59.50. The consensus is at $60.06. FMC closed Wednesday at $50.20.

National Oilwell Varco Inc. (NYSE: NOV) is a top name across Wall Street and at J.P. Morgan. The company is a leading provider of equipment and services to the oil and gas industry through its three segments: Rig Technology, Petroleum Services & Supplies, and Distribution & Transmission. Warren Buffett is a big fan of the stock and recently increased his stake to 7.5 million shares. Investors are paid a 1.4% dividend. The J.P. Morgan price target is a whopping $97, while the consensus target is lower at $91.41. The stock closed Wednesday at $74.34.

Weatherford International Ltd. (NYSE: WFT) has been a frustrating stock for many investors over the years. While the company offers a wide range of global capabilities, including a proprietary system for pressure management in the mushrooming arena of subsea production. To improve financial performance, the company has planned to cut around 7,000 jobs, which is around 10% of the total workforce. The workforce reduction will be done in parts and is expected to be completed by the first half of this year. The J.P. Morgan price target is $20.50, and the consensus target is $17.85. Weatherford closed Wednesday at $16.06.

Wall Street and many investors are genuinely negative on oil and oil service stocks. As J.P. Morgan points out, the game is changing and only the best and, in some cases, the biggest firms are going to grow. One thing is for sure, being out-of-favor and cheap is usually a top contrarian way to trade. It may make good sense to scale some money into this sector.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.