Energy

How MLP Funds and ETFs Will Treat Kinder Morgan Holdings Post-Merger

Published:

Last Updated:

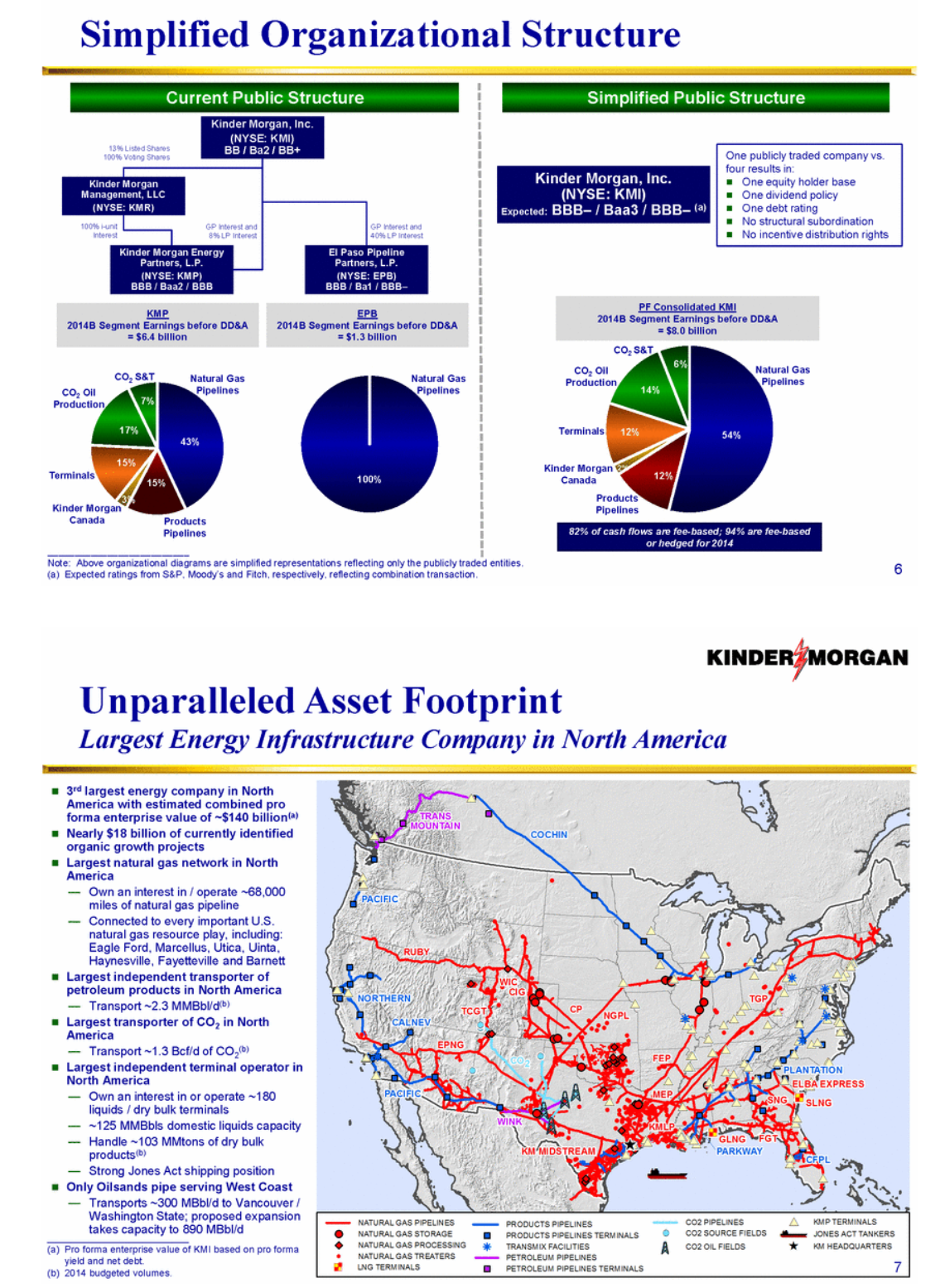

Kinder Morgan Inc. (NYSE: KMI) is just about to hold its special meeting to vote on a monumental merger. The Kinder Morgan operating company is about to roll up its three master limited partnership (MLP) entities of Kinder Morgan Management LLC (NYSE: KMR), Kinder Morgan Energy Partners L.P. (NYSE: KMP) and El Paso Pipeline Partners L.P. (NYSE: EPB). While the deals are expected to go through, the big question is whether the endless number of exchange traded funds (ETFs) and closed-end mutual funds that track MLPs will — or will be able to — hold shares of Kinder Morgan Inc. after the transaction. Source: Kinder Morgan Inc.

Source: Kinder Morgan Inc.

This question may seem odd on the surface, considering that Kinder Morgan will now reincorporate three very large MLP structures, but these transactions are expected to close on Wednesday, November 26, 2014, after a November 20 vote. At issue is that Kinder Morgan’s entities will be part of the “Inc.” rather than the alternative structures that make up the MLPs.

24/7 Wall St. has noted on multiple occasions that there are literally billions of dollars in closed-end funds and in ETFs that track MLPs. If the MLP-tracking sector does decide to keep Kinder Morgan Inc. shares in the portfolio, it is a big deal. If not, it is still a big deal.

ALSO READ: Analyst Sees Higher MLP Distributions

Here is proof that the deal matters for MLP funds and ETFs. Alerian announced on Wednesday that Martin Midstream Partners L.P. (NASDAQ: MMLP) and Valero Energy Partners L.P. (NYSE: VLP) are expected to be added to the Alerian MLP Index and the Alerian MLP Equal Weight Index, replacing El Paso Pipeline Partners and Kinder Morgan Energy Partners in a special rebalancing. Martin Midstream Partners was up almost 2% on the news, and Valero Energy Partners was up over 2.5% — indexing is a big deal.

Richard Kinder is effectively paying some $40 billion in stock and $4 billion in cash for the three entities. Still, the latest pre-merger document shows the total purchase price as $75.6 billion, if you include the $27 billion in assumed debt. Pre-merger market caps as of Wednesday were: Kinder Morgan Energy Partners at $45 billion, Kinder Morgan Management at $13.5 billion and El Paso Pipeline Partners at $10 billion.

So, back to the MLP holdings of a post-merger Kinder Morgan by ETFs and mutual funds.

The Alerian MLP ETF (NYSEMKT: AMLP) had assets worth over $9.5 billion as of November 18. It turns out that Kinder Morgan Energy Partners had a 10.12% weighting, implying a holding value of more than $950 million in just the one entity. El Paso Pipeline Partners had a weighting of 2.96%, which implies a total holding of almost $285 million.

JPMorgan Alerian MLP ETN (NYSEMKT: AMJ) is an exchange traded note rather than a classic ETF, which means that holdings could in theory be derivatives or other instruments that track the Alerian MLP Index. Its market cap as of November 18 was just over $6.5 billion, and it also tracks the Alerian MLP Index. It listed Kinder Morgan Energy Partners with a 9.59% index weighting aa the second largest constituent.

24/7 Wall St. spoke with a representative of Kayne Anderson, and the firm would not comment on details of the holdings. They referred us to the latest prospectus, which said, “Our investment objective is to obtain high after-tax total return by investing at least 85% of our total assets in public and private investments in MLPs and other Midstream Energy Companies.” Then there are further details of the investment policy that allows for a wider discretion that even includes private issuers and other securities.

ALSO READ: The 10 Safest High-Yield Dividends

Kayne Anderson MLP Investment Co. (NYSE: KYN) has some $7.6 billion in total investments, including Kinder Morgan Management at 5.159 million units, worth $490.8 million, with a 6.5% weighting in its long-term investments. Kayne Anderson’s October 31 holdings also stated:

At October 31, 2014, in addition to the KMR shares (in 000) owned by the Company, it owned 1,036 shares of KMI ($40.1 million), 1,944 common units of KMP ($182.3 million) and 5,305 common units of EPB ($215.7 million).

Kayne Anderson Energy Total Return Fund Inc. (NYSE: KYE) had over $1.627 billion in investments as of October 31, with many large MLP holdings. Kinder Morgan Management was listed as 2.438 million units, worth $232 million, with a 14.3% weighting of the long-term investments. Kayne Anderson’s October 31 holdings also stated:

At October 31, 2014, in addition to the KMR shares owned by the Fund, it owned 450 shares of KMI ($17.4 million) and it did not hold KMP or EPB.

Kayne Anderson Midstream/Energy Fund Inc. (NYSE: KMF) listed some $1.315 billion in total investments as of October 31. Its holdings included Kinder Morgan Management at 1,317 units, worth $125.3 million, with a 9.5% weighting of long-term investments, and also Kinder Morgan Inc. at 1,336 shares, worth $51.7 million, with a 3.9% weighting of long-term investments. The fund said that it did not hold Kinder Morgan Energy Partners or El Paso Pipeline Partners.

The ClearBridge Energy MLP Fund Inc. (NYSE: CEM) closed-end fund had over $3.2 billion in total investments at the end of October. Kinder Morgan Management units were listed as the third largest holding in the fund, being worth $227.5 million, or 7.0% of the total weighting.

ALSO READ: Atlas and Targa Make Complicated MLP Merger

The ClearBridge Energy MLP Total Return Fund Inc. (NYSE: CTR) closed-end fund counts some $1.4 billion in total investments. Kinder Morgan Management was listed as the third largest holding of the fund, worth some $79.3 million at the end of October, with an investment weighting of 5.6%.

The ClearBridge Energy MLP Opportunity Fund Inc. (NYSE: EMO) closed-end fund had $1.275 billion in total investments as of October 31. Kinder Morgan Management units were the second largest holding, worth $73.9 million, or about 5.7% of the total fund weighting.

The ClearBridge American Energy MLP Fund Inc. (NYSE: CBA) closed-end fund had over $1.51 billion in total investments, and Kinder Morgan Management was the sixth largest position, worth some $86.4 million and with a 5.5% total weighting.

It would seem as though the closed-end fund universe has a more flexible structure than the ETF and ETN universe. Here are some, but not all, of the additional closed-end funds with soon-to-be or existing Kinder Morgan exposure to consider, with assets listed, as follows:

ALSO READ: Did Halliburton Steal Baker Hughes?

Kinder Morgan will be one of the largest oil and gas players in the nation after this merger. At the time of the merger announcement (i.e., before the price of oil tanked), Richard Kinder said that its dividend payment would rise to a projected level of $2.00 a share in 2015 (versus about $1.72 in 2014), and he forecast that the combined structure will grow that dividend payout by about 10% a year from 2015 to 2020.

How closed-end funds and ETFs that track MLPs will treat the new Kinder Morgan ahead does matter. The ETFs generally track an index, and the rules are more strict on their holdings, although most MLPs say that they will hold up to 90% of their total assets in securities of the underlying tracking index. Closed-end funds in general have a more flexible structure. They generally measure performance against the same indexes that exchange traded funds and notes use, but their investment policies generally allow for a larger degree of portfolio manager decisions.

That being said, the ETFs and ETNs will have a harder time justifying holding a C-corporation structure than will closed-end funds. The path of least resistance from the closed-end funds will be to hold the shares of Kinder Morgan after the merger — at least while they get used to dealing with such a large entity within the portfolio that isn’t an MLP.

We have included an infographic showing what the newco post-merger Kinder Morgan will look like.

Source: Kinder Morgan SEC Filing

Source: Kinder Morgan SEC Filing

ALSO READ: 10 Companies That Will Not Be Saved by the Bull Market Alone

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.