Energy

20 Billion Barrels Added to US Estimated Oil Resources

Published:

Last Updated:

The Permian Basin of west Texas and southeastern New Mexico is one of the oldest and easily most productive oil regions in the country. The first oil was produced in 1931, and the Permian has produced more than 28 billion barrels of oil and 75 trillion cubic feet of natural gas since then.

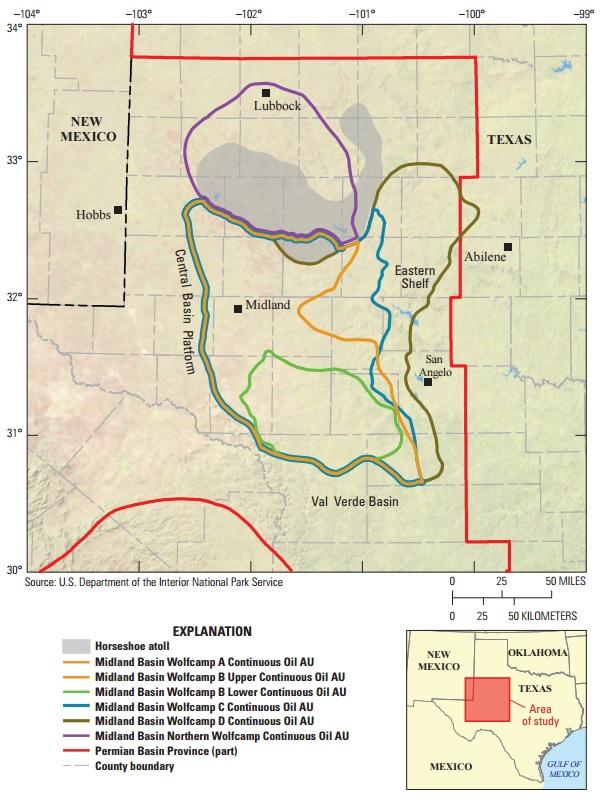

The United States Geological Survey (USGS) announced Tuesday that its latest estimate of the Wolfcamp shale portion of the Permian Basin contains an estimated 20 billion barrels of oil, 16 trillion cubic feet of natural gas and 1.6 billion barrels of natural gas liquids (NGLs). The estimate includes continuous, unconventional (typically horizontally drilled and fracked) oil and is made up of undiscovered, technically recoverable barrels.

These barrels may or may not ever be produced, and that’s the tricky bit about the USGS estimate. The USGS defines “undiscovered” this way: “Resources postulated, on the basis of geologic knowledge and theory, to exist outside of known fields or accumulations. Included also are resources from undiscovered pools within known fields to the extent that they occur within separate plays.” In other words, a very educated guess, but a guess nevertheless.

Another definition also should be kept in mind. “Technically recoverable” means “producible using currently available technology and industry practices. USGS is the only provider of publicly available estimates of undiscovered technically recoverable oil and gas resources.”

In other words, these barrels may not be as numerous as the USGS estimates, nor may they be economically recoverable with a certainty of about 90%, the definition of a “proved reserve.” Still, 20 billion barrels is lot of oil.

A USGS official said:

The fact that this is the largest assessment of continuous oil we have ever done just goes to show that, even in areas that have produced billions of barrels of oil, there is still the potential to find billions more. Changes in technology and industry practices can have significant effects on what resources are technically recoverable, and that’s why we continue to perform resource assessments throughout the United States and the world.

Lease prices in the Permian Basin have skyrocketed in recent months as the basin’s oil remains among the cheapest to produce and get to market of any field in the country. RSP Permian last month paid $2.5 billion for leases on 41,000 net acres in another portion of the Permian called the Delaware Basin. That works out to about $61,000 an acre for current production of about 15,000 barrels of oil equivalent per day of net production from 58 producing and another 3,200 gross and 1,950 net total undeveloped drilling locations.

The USGS assessment of the Wolfcamp shale is the agency’s first assessment of continuous resources in the Midland Basin portion of the Permian.

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.