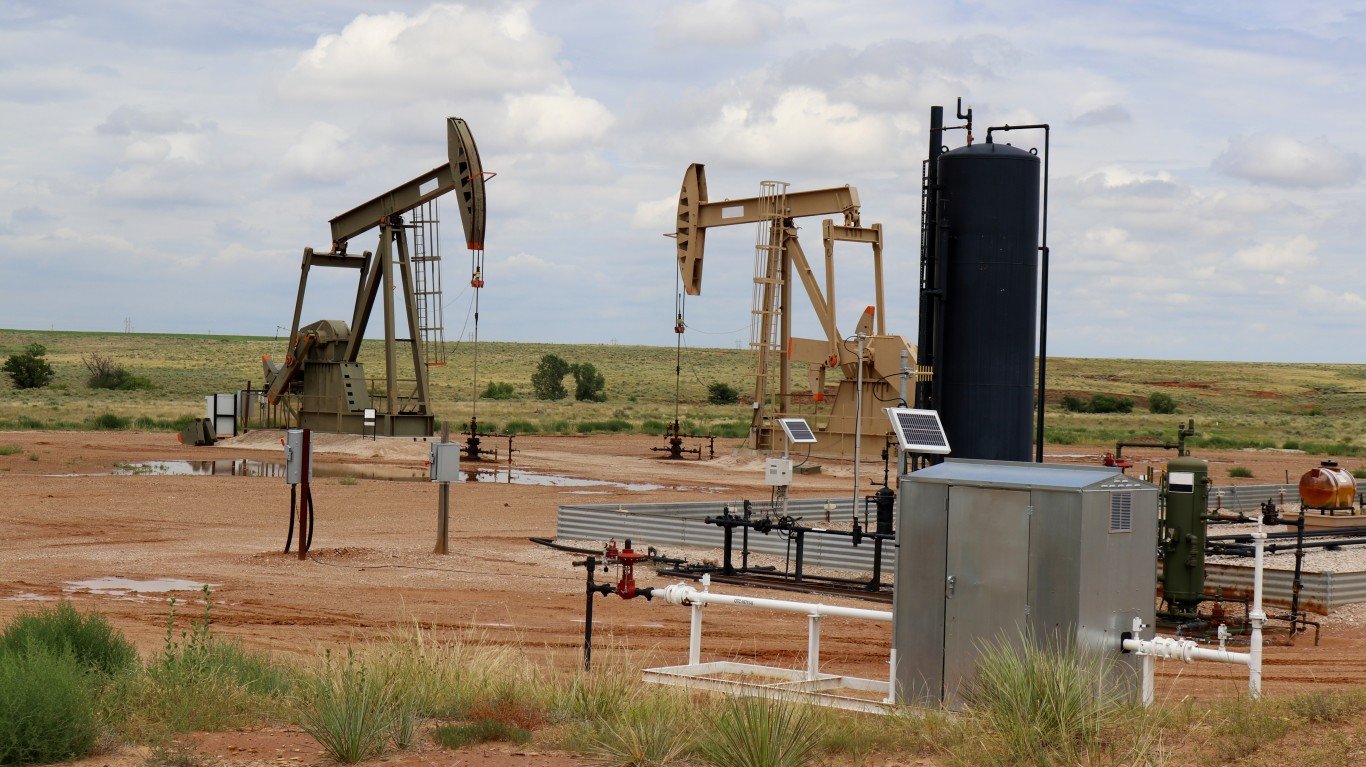

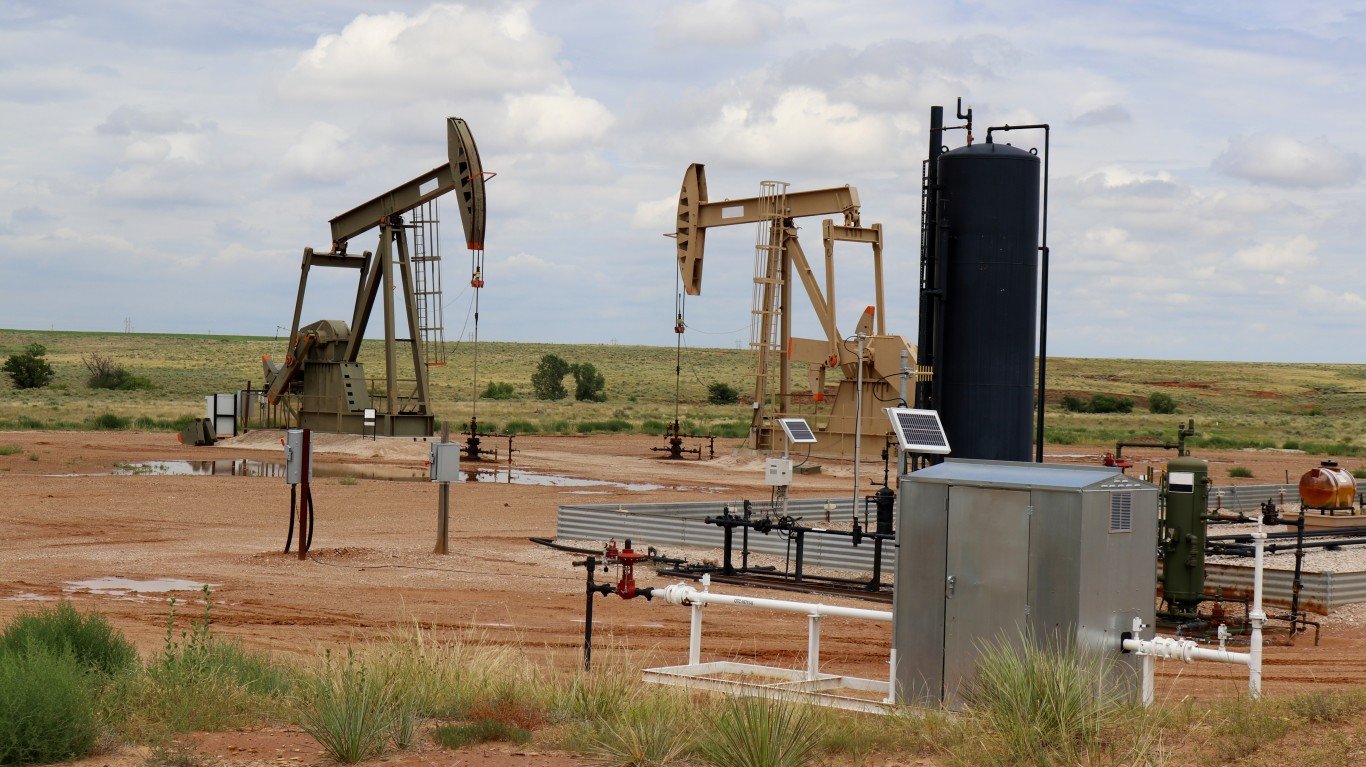

In its second-quarter report on the oil and gas industry, the Federal Reserve Bank of Dallas said Wednesday that energy sector growth slowed significantly in that quarter of 2019. The bank’s business activity index dropped from 10.8 in the first quarter to a −0.6 in the second quarter.

Index scores around zero indicate that activity was essentially unchanged compared to the prior quarter. Exploration and production (E&P) firms, along with oilfield services firms, drove the drop in the index score.

For the first time since the first quarter of 2016, the company outlook index posted a negative reading, dropping 57 index points to −10.2. Oilfield services led the way, dropping 64 points to a reading of −17.2. More than half of the firms surveyed reported greater uncertainty going forward.

Oil and gas production increased for the 11th consecutive quarter, according to executives at E&P firms who responded to the Fed survey. However, the growth rate slowed somewhat, dipping from 21.4 in the first quarter to 17.4 in the second. The capital spending index dropped from 5.0 in the first quarter to −6.1 in the second, while the natural gas production index also fell from 16.7 to 13.4.

The index for utilization of equipment by oilfield services firms dropped 13 points, from 16.4 in the first quarter to 3.4 in the second. The Dallas Fed explains:

Input costs continued rising, with the index inching higher, from 25.0 to 27.1. At the same time, the prices received for services index dipped further into negative territory, from -1.7 to -12.1, suggesting a steepening decline in oilfield services prices. The operating margins index fell sharply, from -6.6 to -32.8, indicating notably lower margins for oilfield services firms during the second quarter.

The employment index for services firms slipped from 6.0 to −2.5, while the hours-worked index remained barely positive, dropping from 9.7 to 3.1.

More than a third of respondents (34%) said that they have either “slightly” (21%) or “significantly” (13%) reduced their capital spending plans since the beginning of the year, even though borrowing costs remain very low.

Here are several comments from E&P survey respondents:

Nobody’s generating free cash flow.

Futures prices continue to decrease as expenses increase. We are experiencing very tough, and unpredictable, business conditions.

The securities of oil and gas companies now sell at a fraction of what they once commanded. Huge losses in these shares hamper new exploration. It looks like another round of bankruptcies and mergers.

Here are some comments from oilfield services companies:

The impact of low pipeline takeaway capacity impacted Permian Basin activity in first quarter 2019, and in the second quarter, we saw a further decline in activity as a result of a worsening outlook in the financial markets, plus the drop in oil and natural gas prices. The result is a very poor second quarter and a dismal outlook for the third quarter. If oil prices improve, we might see some improvement in the second half of 2019, but today our second-half forecast is between flat and down.

Clear signs of a slowing economy, lessening demand for hydrocarbons, and increasing investor sentiment away from hydrocarbons and U.S. shale continue to equate to a softening market. There are fears of a trade war without boundaries. There are many darkening clouds on the horizon at the moment.

The Dallas Fed conducts this survey quarterly among oil and gas firms located in the 11th Federal Reserve District.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.