President Joe Biden will announce Wednesday another sale of crude oil from the U.S. Strategic Petroleum Reserve (SPR). The sale is the last of the 180-million-barrel withdrawal authorized by the president earlier this year and is intended to ease further the soaring price of oil following the Russian invasion of Ukraine. But that is not the big news from the announcement.

The president has authorized the U.S. Department of Energy (DOE) to repurchase oil for the SPR at a fixed price for future delivery. This is a big deal.

The SPR has a capacity of more than 700 million barrels and had more than 400 million barrels in storage as of last week. The 15 million barrels Biden has authorized the DOE to sell will be available to buyers in December.

The DOE will now be able to enter contracts to buy U.S. crude at a floor price of $67 to $72 a barrel, ostensibly to replenish the SPR:

This repurchase approach will protect taxpayers and help create certainty around future demand for crude oil. That will encourage firms to invest in production right now, helping to improve U.S. energy security and bring down energy prices that have been driven up by Putin’s war in Ukraine.

In essence, the DOE is guaranteeing a price floor in exchange for certainty or, at least, less volatility. The White House fact sheet noted that U.S. crude oil production has reached nearly 12 million barrels a day, and that total will rise next year. But there is a catch:

However, a number of industry participants have suggested that, even with today’s high prices, they are concerned about investing in production when prices could fall in the future. … DOE has finalized a first-of-its-kind rule that enables it to enter into fixed-price contracts with suppliers, through a competitive bid process, to repurchase oil for future delivery windows. This new authority will shore up demand for oil when supply is less uncertain and prices are anticipated to be lower.

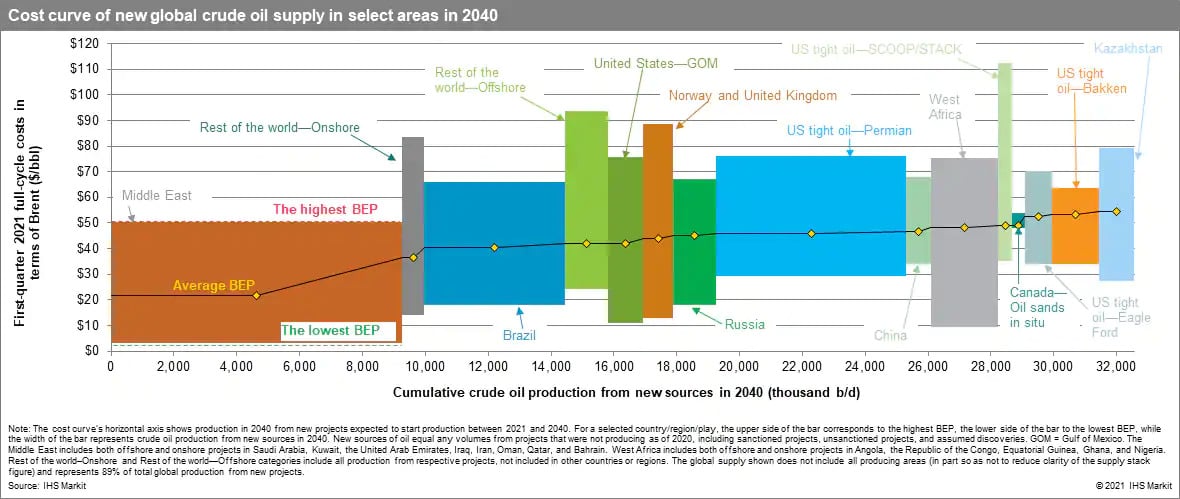

While not exactly a gift to oil producers, it is unlikely that any will object to the offer. According to an IHS Markit review in September of 2021, the average break-even price for a barrel of Permian Basin crude was about $46 per barrel of Brent crude (Brent typically has a higher market price than the West Texas Intermediate price of Permian crude). The global average break-even price was between $40 and $50 a barrel. According to an IHS Markit study, “most sources of global crude oil supply projected until 2040 can break even below $50/barrel Brent crude in constant 2020 dollar terms.”

Brent crude on Wednesday was trading at around $91 a barrel. At that price, a barrel of West Texas Intermediate (WTI) produced at a Brent cost of $46 yields a profit of nearly 100% to the producer. Even at the proposed floor price of $67 to $72, oil producers are looking at a minimum profit of around 33%.

The December 2024 option price on a barrel of WTI is just under $70, about $12 below the option price for a barrel delivered in December 2022. If the DOE contracts for 2024 oil at that price, it can resell it at a higher price, if that is how the market turns two years from now, or it can buy it for a lower price.

The White House calls this approach a “win for taxpayers” and a “win for energy security.” Taxpayers win because the DOE will refill the SPR at a lower price than the price at which it sold the 180 million barrels released this year. Oil producers win because there is “more certainty of continued oil demand to inform investment decisions today, thereby spurring needed increases in production.”

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.