Health and Healthcare

Q3 Worst for Biotech in 7 Years: Which Large Cap Leaders to Buy Now

Published:

Last Updated:

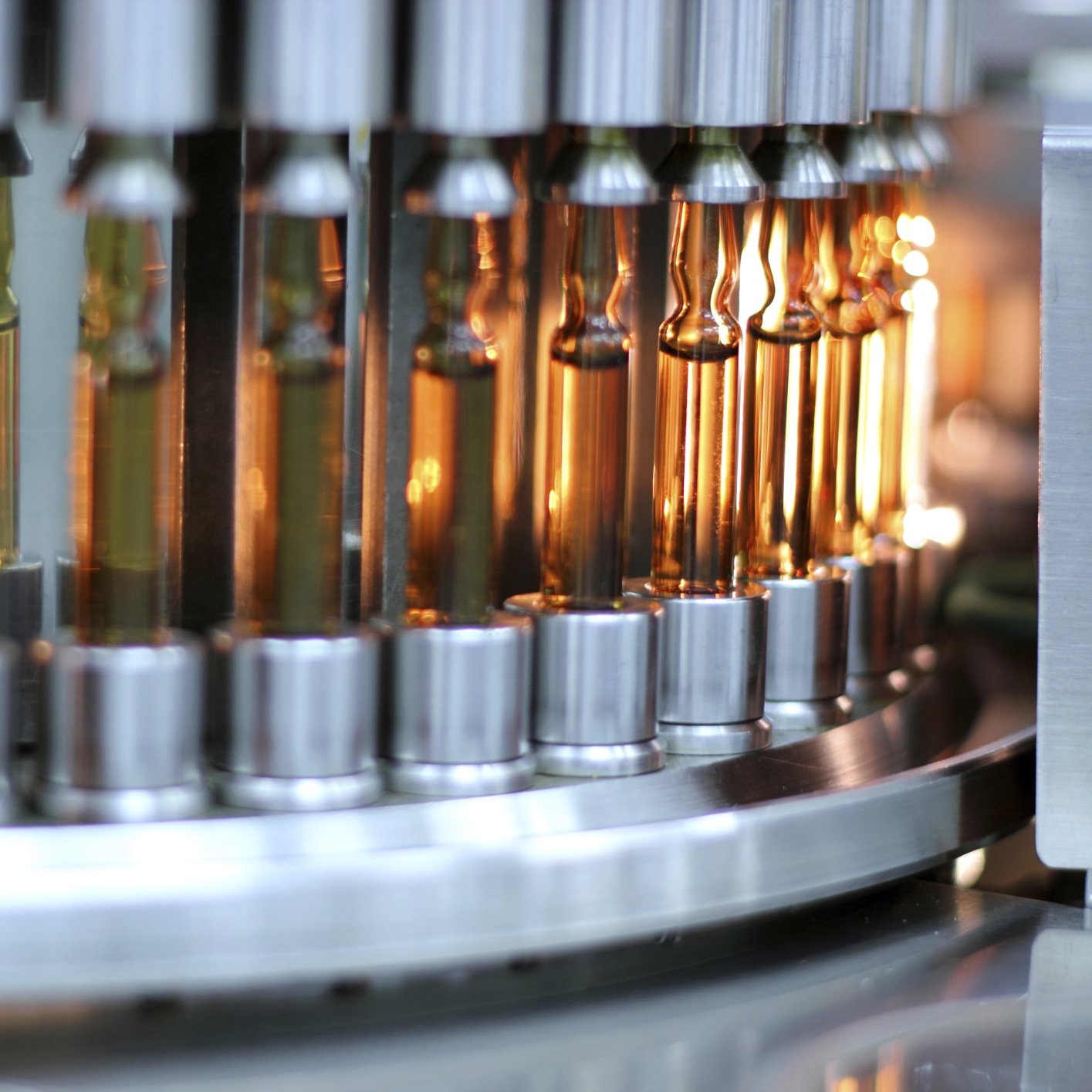

After racing to all-time highs in late July, the Nasdaq Biotechnology Index (NBI) and the NYSE Arca Biotechnology Index (BTK) then proceeded to decline 18.0% and 18.2% respectively. What really put the hammer down at the end of the quarter was the Turing Pharmaceutical pricing scandal, and then comments from presidential candidate Hillary Clinton on drug pricing and needed reforms. It was the exact kind of populist political rhetoric that can melt a sector. Source: Thinkstock

Source: Thinkstock

A new report from Cowen notes that while the sell-off was very large and painful, and the inevitable “bear market” chatter on the sector heated up, the biotech indexes are tracking right about flat for the year, in line with the other major indexes. The firm says the way to play it is with large cap sector leaders that can beat earnings estimates. Cowen also thinks third-quarter earnings beats could highlight the risk of not owning biotech now.

We scanned the Cowen coverage universe for four top stocks that they think can beat earnings estimates for the third quarter. All are rated Outperform.

Amgen

After posting outstanding second-quarter earnings, the biotech giant remains a top stock for investors to buy. Amgen Inc. (NASDAQ: AMGN) focuses on areas of high unmet medical need and leverages its biologics manufacturing expertise to strive for solutions that improve health outcomes and dramatically improve people’s lives. A biotechnology pioneer since 1980, Amgen has grown to be one of the world’s leading independent biotechnology companies, has reached millions of patients around the world and is developing a pipeline of medicines with breakaway potential.

Many on Wall Street point to Amgen’s tremendous pipeline and outstanding forward earnings and revenue capabilities. Its double-digit earnings and revenue growth rate is expected to continue for the foreseeable future because of the company’s very deep clinical pipeline, which includes potential blockbusters Repatha for high cholesterol and Kyprolis for relapsed multiple myeloma. Amgen also has one of the sector’s deepest biosimilar pipelines, which is expected to generate upward of $3 billion in annual sales in the years ahead.

ALSO READ: Big Biotech Is Cheap With Strong Cash Flows: 3 to Buy Before Earnings

Amgen continues to trim its gigantic workforce as it bows to activist hedge fund shareholders such as Dan Loeb, who has pushed the biotech giant to split into two separate companies to boost shareholder value.

This is a Wall Street and Cowen favorite, and the analyst expects an earnings beat and a guidance raise. It also expects top and bottom line upside driven by Enbrel (with additional price hikes thrown in for good measure), as well as most other products and solid cost control.

Amgen shareholders are paid a 2.05% dividend. The Cowen price target is $165, and the Thomson/First Call consensus target is higher at $184.75. Shares closed Monday at $154.47.

Alexion Pharmaceuticals

Rumors have flown for some time that this stock is considered as a potential acquisition target, and in the spring it was the big buyer. Alexion Pharmaceuticals Inc. (NASDAQ: ALXN) bought Synageva Biopharma for a whopping $8.4 billion in cash and stock. That move added products and pipeline to compliment Soliris, the company’s only marketed product. Soliris is prescribed for the treatment of patients with myasthenia gravis, a rare neurological disorder, which reportedly affects an estimated 13,600 people in the United States.

While Soliris sales beat consensus estimates when the company last reported earnings, and 2015 revenue guidance was increased, it was below what some on Wall Street expected. Many top analysts feel it may be conservative, and they think the company could post better sales than expected and are higher on guidance for 2015. The analysts also point out that Alexion is no longer in what they term a “clinical data vacuum,” with plenty of late and intermediate stage clinical pipeline readouts in the next 12 to 18 months.

The Cowen price target is $216, but the consensus target is even higher at $225.35. Shares closed Monday at $162.11.

ALSO READ: 4 Top Jefferies Aggressive Growth Stock Picks to Buy Now

Celgene

Cowen feels this large cap stock has solid upside potential for 2015 and next year, especially after the beating the biotechs have taken recently. Celgene Corp. (NASDAQ: CELG) has an outstanding partnered pipeline that Cowen thinks is low risk and has the potential to yield several blockbuster drugs. Some Wall Street analysts think that the company can grow earnings 15% on a compounded annual growth rate basis.

The company provided strong guidance earlier this year for its Otezla launch and encouraging feedback from doctors on the potential of new triplet regimens in myeloma. Analysts across Wall Street raised their estimates for the drug as, after a little more than a year on the market, Otezla, which treats psoriasis and psoriatic arthritis, has achieved considerable prescriptions among physicians.

Celgene’s blockbuster blood cancer drug Revlimid continues to dominate. Pomalyst sales grew nearly 46% year over year last quarter. Cancer drug Abraxane is also growing at a respectable rate, so the company continues to have a strong lineup of top-selling drugs. While second-quarter numbers were solid, third quarter and the rest of the year could prove to be better.

The Cowen price target is $150. The consensus target is set at $148.69. Shares closed on Friday at $119.41.

ALSO READ: 4 Top Merrill Lynch Energy Picks That Pay Good Dividends

Gilead Sciences

This stock is trading at an astounding multiple of less than nine times estimated 2016 estimated profits. Gilead Sciences Inc. (NASDAQ: GILD) discovers, develops and commercializes medicines in areas of unmet medical need in North America, South America, Europe and the Asia-Pacific. Its products include Stribild, Complera/Eviplera, Atripla, Truvada, Viread, Emtriva, Tybost and Vitekta for the treatment of human immunodeficiency virus (HIV) infection in adults, and Harvoni, Sovaldi, Viread and Hepsera products for the treatment of liver disease.

Gilead recently announced that the FDA has approved Letairis in combination with Eli Lilly’s Adcirca (tadalafil) for reducing the risk of disease progression and hospitalization and improving exercise ability in patients suffering from pulmonary arterial hypertension. Both Letairis and Adcirca are approved in the United States, European Union and other countries as once-daily treatments for patients with pulmonary arterial hypertension.

Some analysts are curious as to what the non-retail business will look like this quarter. That refers to the government-type plans like Medicaid. Many think there is the possibility for significant spending that has not been modeled into current estimates.

The Cowen price objective is $125, and the consensus target is $123.93. Shares closed most recently at $103.61.

ALSO READ: 3 Tech Stocks That Could Have Big Earnings and a Bigger 2016

While the political rhetoric most likely will hang around through much of the election cycle, one thing that can help calm the headline risk is solid earnings beats and raising estimates.

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.