Health and Healthcare

What Expect From Gilead Earnings

Published:

Last Updated:

Gilead Sciences Inc. (NASDAQ: GILD) is set to release its fourth-quarter earnings report after the markets close on Tuesday. Thomson Reuters consensus estimates call for $3.00 in EPS on $8.13 billion in revenue. The same period from the previous year had $2.43 in EPS on $7.31 billion in revenue.

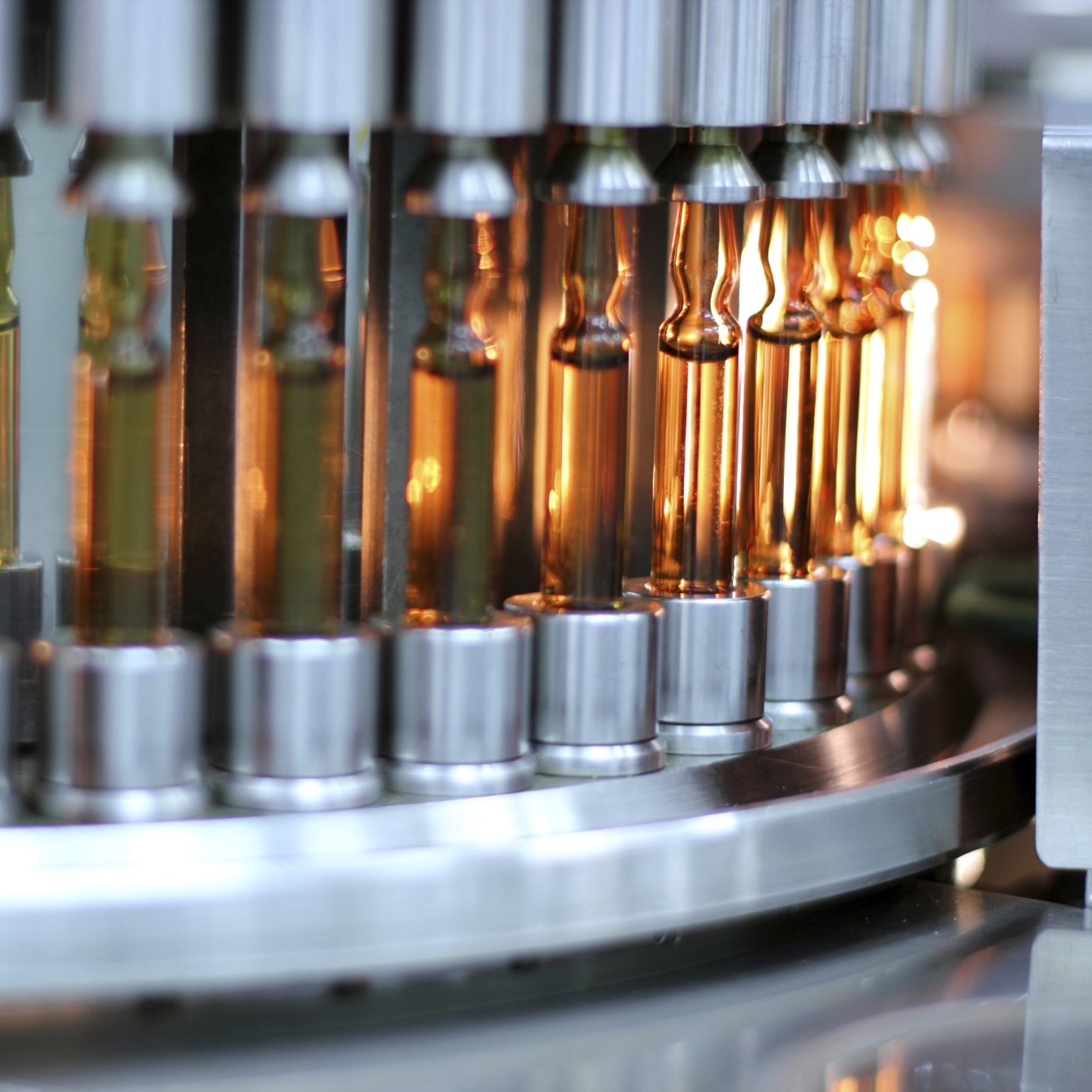

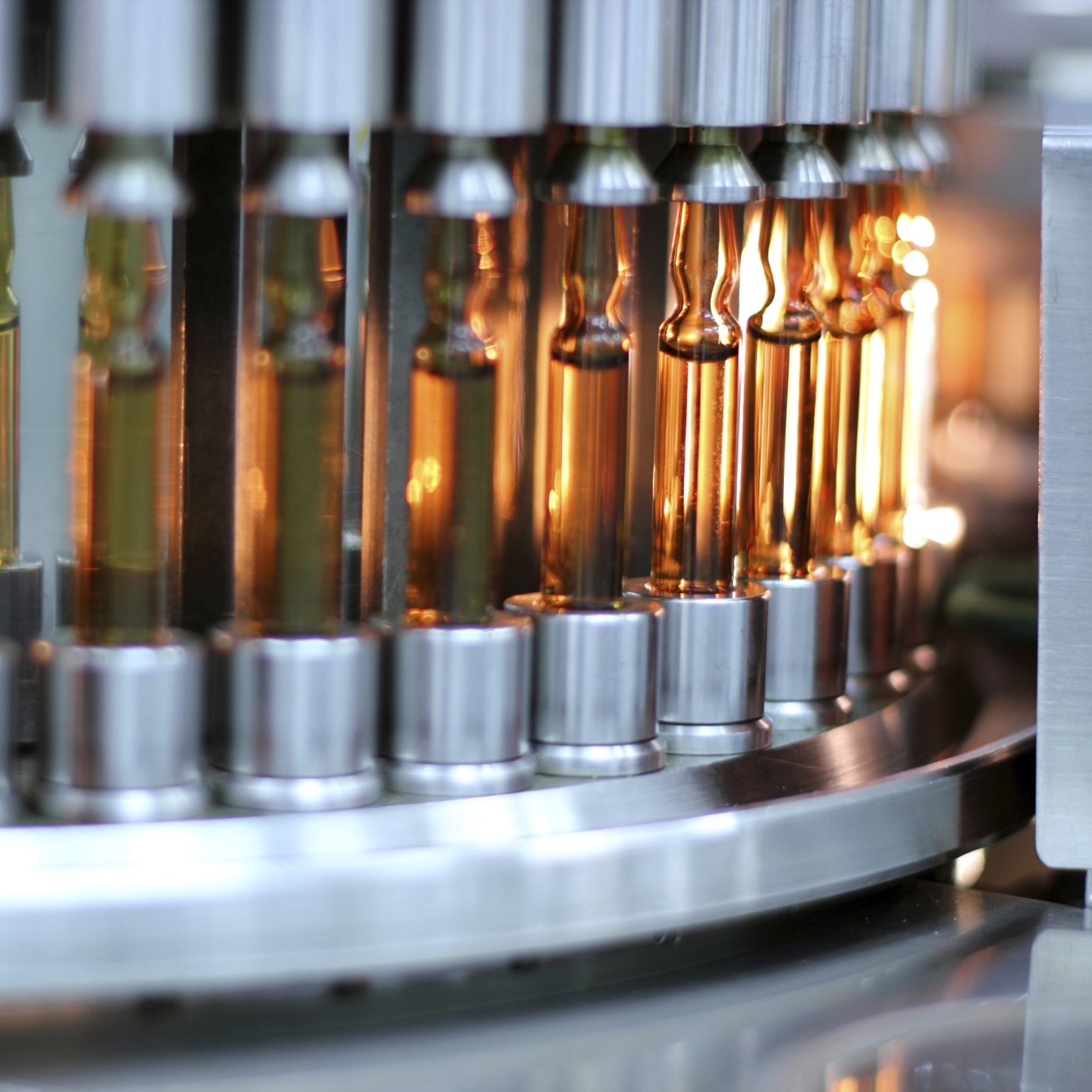

This company discovers, develops and commercializes medicines in areas of unmet medical need in North America, South America, Europe and the Asia-Pacific. Its products include Stribild, Complera/Eviplera, Atripla, Truvada, Viread, Emtriva, Tybost and Vitekta for the treatment of human immunodeficiency virus (HIV) infection in adults; and Harvoni, Sovaldi, Viread and Hepsera products for the treatment of liver disease.

Gilead was mauled last week when long-time CEO John Martin stepped down, to be replaced by John Milligan, the company’s chief operating officer. Martin will become executive chairman. Add in some worries over competition for the company’s hepatitis C drug, and it added up to a very bad week.

For the most recent settlement date, Gilead saw its short interest fall slightly to 23.16 million shares from 23.73 million in the previous period.

A few analysts weighed in on this stock prior to the release of the earnings report:

So far in 2016, Gilead has underperformed the broad markets, with the stock down 17% year to date. Over the past 52 weeks, the stock fell about 19%.

Shares of Gilead were recently trading down 2% at $82.26 on Tuesday, with a consensus analyst price target of $123.24 and a 52-week trading range of $82.28 to $123.37. What is impressive is that Gilead shares are trading at an astounding multiple of less than seven times estimated 2016 estimated profits.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.