General Electric Co. (NYSE: GE) announced Tuesday morning that it plans to acquire two European 3D printing companies for a total price of $1.4 billion. Both companies will be put under the umbrella of GE’s aviation division.

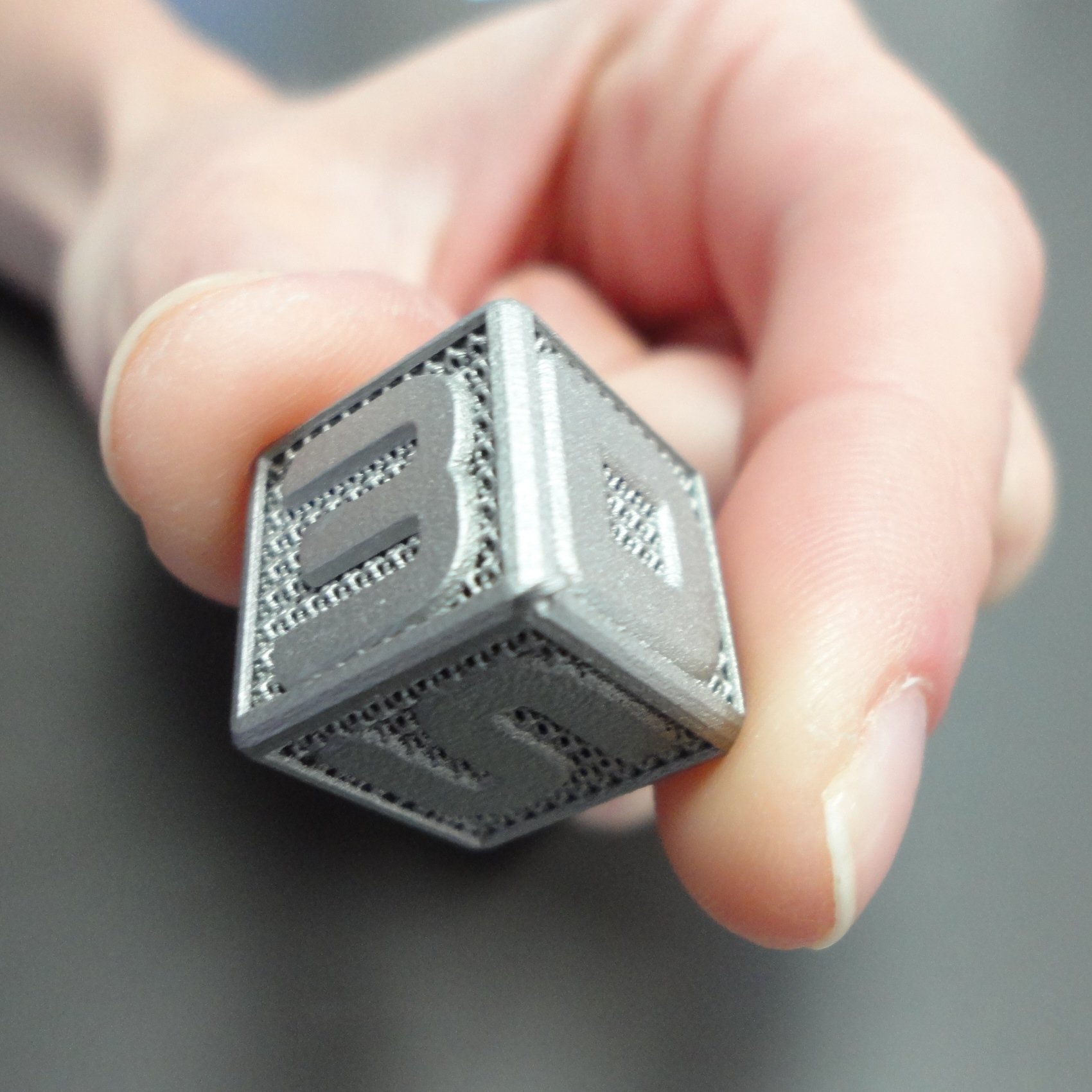

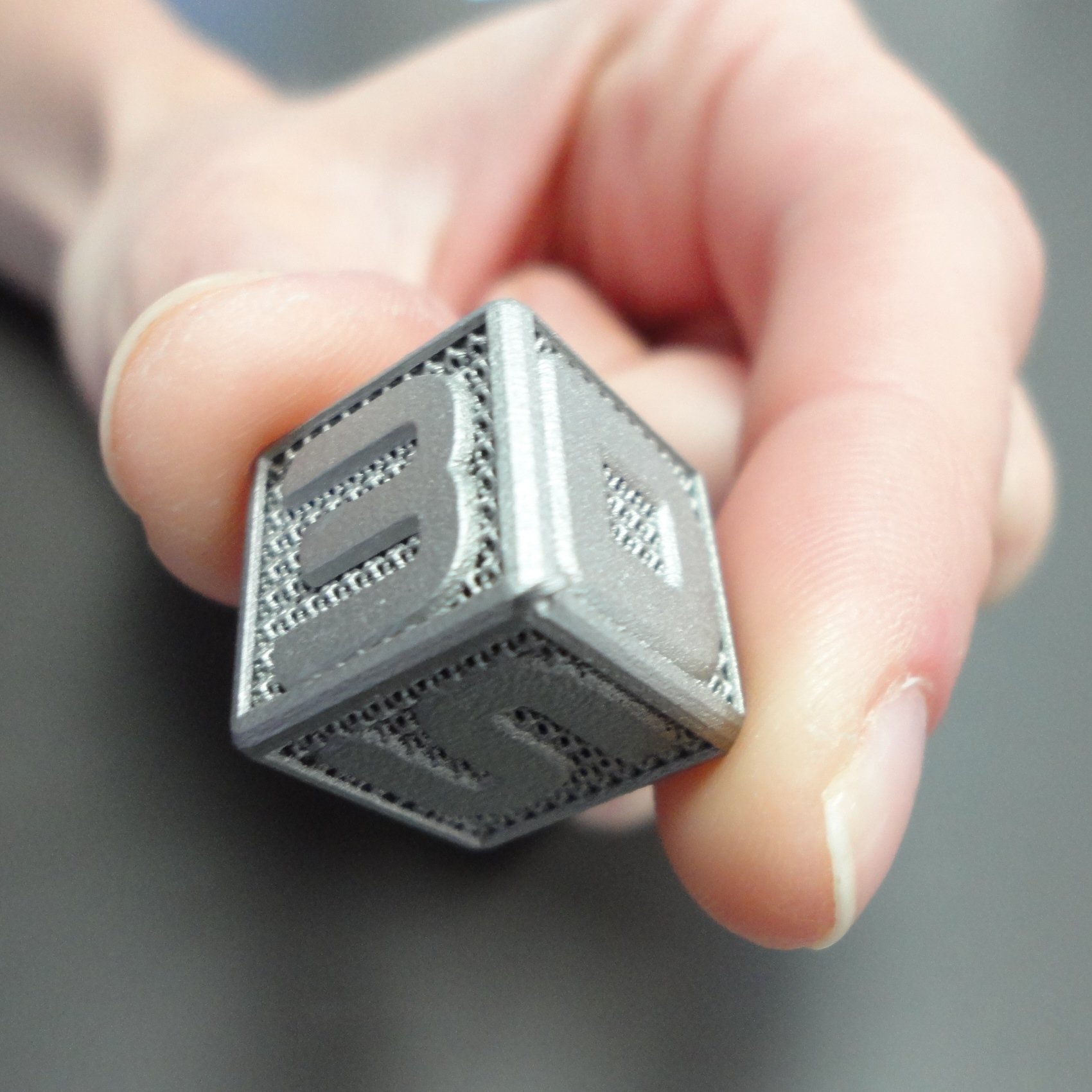

Sweden-based Arcam serves customers in both the aerospace and health care industries with its metal-based additive manufacturing (the technical name for some 3D printing applications) products. Germany-based SLM Solutions supplies laser machines for metal-based additive manufacturing in the aerospace sector.

Shares of 3D Systems Corp. (NYSE: DDD) traded up about 5% in Tuesday’s premarket, as did shares of Stratasys Ltd. (NASDAQ: SSYS). At Friday’s closing prices, both traded down about 80% from their peak share prices of December 2013. Also as of Friday, 3D Systems’s market cap was $1.67 billion and Stratasys’s was $1.15 billion.

Shareholders in both companies must be hoping for a dose of acquisition fever now that GE has pulled the trigger on an acquisition in the 3D printing space. While the size of the deal is relatively modest, it validates the application of 3D printing technology in one of the largest industrial sectors of the market. Another major player in 3D printing is HP Inc. (NYSE: HPQ). Both 3D Systems and Stratasys offer printing services that includes metals as well as polymers and some ceramics; HP’s 3D printing capabilities remain polymer-based.

From an investor’s point of view, GE’s acquisition also signals that 3D printing, at least for giant industrial firms, may best be incorporated by owning the technology rather than buying the equipment and services. That’s better news for 3D Systems and Stratasys than it is for HP.

GE talked up its introduction of additive manufacturing in the announcement:

In July, GE Aviation introduced into airline service its first additive jet engine component – complex fuel nozzle interiors – with the LEAP jet engine. The LEAP engine is the new, best-selling engine from CFM International, a 50/50 joint company of GE and Safran Aircraft Engines of France. More than 11,000 LEAP engines are on order with up to 20 fuel nozzles in every engine, thus setting the stage for sustainably high and long-term additive production at GE Aviation’s Auburn, Alabama, manufacturing plant. Production will ramp up to more than 40,000 fuel nozzles using additive by 2020.

The CFM LEAP engine is available in three variations, one for Boeing Co.’s (NYSE: BA) 737 MAX, another for the Airbus A320neo family and a third for Chinese aircraft maker Comac’s C919.

GE’s share price was up about 0.3% in Tuesday’s premarket, at $31.37 in a 52-week range of $24.26 to $33.00. The consensus 12-month price target is $33.71.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.