Investing

Ten Reasons the Market Will (or Will Not) Crash

Published:

Last Updated:

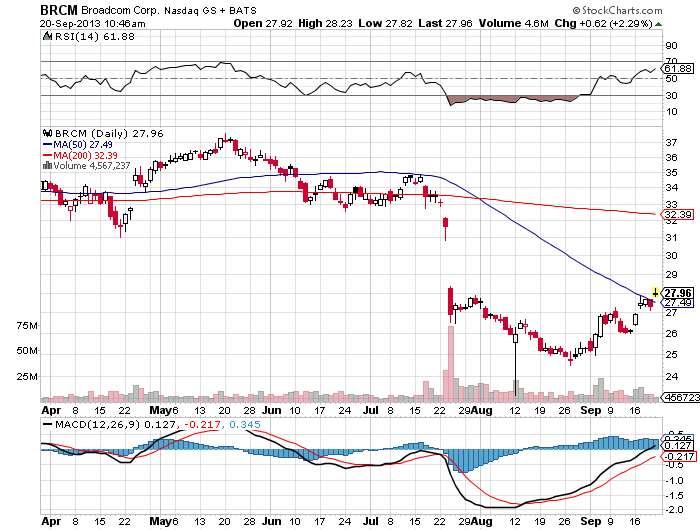

Like clockwork, every time the American stock market makes new highs, some people insist it cannot go higher. A subset of those believe the market will crash. Others even believe it will reset like it did when the S&P 500 dropped from more than 1,500 in October 2007 to just above 600 in March 2009. A review of the most widely held beliefs about why a new crash is coming shows that some are bogus, while others almost certainly are likely to be right. Source: StockCharts.com

Source: StockCharts.com

Here are the top ten:

1. The S&P 500 price-to-earnings (PE) ratio is too high. Right now, it stands at almost 20. Market expert Mark Hulbert recently made the point that:

… according to data compiled by Yale University finance professor Robert Shiller. The average P/E for the S&P 500 since 1871 is 15.5 and the median P/E is 14.5.

Much analysis based on ancient history has the disadvantage of being old. Earnings have been measured differently over time, and accounting for earnings has evolved. The “S&P is too high” argument can be thrown out. Earnings definitions change too rapidly, as do the ways that public companies report them.

ALSO READ: The World’s Largest Automakers

2. The economic recovery has slowed. Well, the recovery has been slow since the recession. If a weak gross domestic product (GDP), a poor housing market and historically high unemployment undermine the market, the S&P should not have moved from its recent low of just over 600 to its current level just shy of 1,700. This is another poorly reasoned argument, if only based on a short period of activity.

3. Forward earnings forecasts are weak. This is a strong argument. Many of America’s biggest companies anticipate poor fourth-quarter numbers, which could extend into 2014. Among the causes are a recession-plagued European economy, which is essential to the revenue of many multinationals. American consumers may have lost the bit of optimism they have had as the recovery barely bounces along the floor without a powerful recovery. Corporations dependent on consumer sales may have trouble posting improved numbers.

4. The federal government could be shut down for weeks or even months. This is another powerful position. Federal spending is a significant part of GDP. The United States employs too many people for a drop in their purchasing power to be shrugged off. If Washington is shuttered, many federal workers will drop off the payroll. So, the average citizen has reason to be anxious. If America cannot keep its own government operating, well, America cannot keep its own government operating.

5. There will be a new recession. That is not really likely, even if the government shuts down for a time. Unemployment, even if it is high by historic standards, continues to shrink toward less than 7%. Housing has recovered enough so the market in home sales is brisk. The number of underwater mortgages continues to disappear quickly, which leaves more and more people with positive home equity. That equity, in turn, in the past at least, has helped consumer spending.

6. Oil prices could spike. Another very unlikely option. Even if the unrest in the Middle East continues, it would take a regionwide catastrophe to stop the flow of crude from Saudi Arabia, Kuwait, Qatar and the United Arab Emirates. Oil production in other countries with large reserves — Canada, Russia, Venezuela, the United States and China — would not be curtailed. Oil prices might rise temporarily, but they are unlikely to stay high for long.

ALSO READ: Seven States Slashing School Spending

7. The Chinese economy will collapse. Another unlikely scenario. Although it slowed briefly this year, Chinese GDP improvement should be well above 7% in 2013. Most expert forecasts call for the number to improve to 8% or better in 2014. The anxiety about high residential property values and regional bank loan levels may be well founded, but it is hard to make a case that the central government of the People’s Republic does not have adequate reserves to deal with these problems. China, the world’s second largest economy by GDP, will remain open for business, and business will be brisk.

8. Apple’s sales will continue to suffer, and along with that its earnings. Apple Inc. (NASDAQ: AAPL) is supposed to be a proxy for the consumer’s enthusiasm. It is the largest company in the world, based on market cap. However, it is not an overall proxy for the economy or stock market. The “Apple is the economy” argument is all but stupid, and certainly no more than an invention of Apple fanboys.

9. Dark pools will move against the rally. These nearly invisible and massive oceans of unseen traders have watched the market soar and see the only real profit in shorting it. Dark pool trades are made away from the exchanges, which makes their activity hard to track. However, these pools do trade a huge number of the shares in U.S. companies. A conspiracy among them to take the market down has some chance of success, although it would cause mass prosecutions. However, conspiracy theories usually are wrong, and dark pool participants have goals that are different enough that it is improbable they will act in concert.

ALSO READ: America’s Fastest Growing Retailers

10. The market will collapse because it always does. This is the most powerful argument for a huge correction. No matter how powerful a rally, the market will not go up forever. That observation is obvious, but that does not prevent it from being true.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.