Investing

Technician Picks Oversold Biotechs for Large Potential Trading Bounces

Published:

Last Updated:

Now that there has been a biotech bloodbath seen of late, many fundamental and technical analysts have been looking for stocks that either are grossly oversold or are now greatly undervalued. A report on Wednesday from Janney Capital Markets has targeted several companies it believes are now grossly oversold. Source: Thinkstock

Source: Thinkstock

24/7 Wall St. would warn readers that this is a shorter term trading idea from Janney’s team and not a long-term investing idea based on fundamental research. That means these are very short-term views, and they will have absolutely no meaning whatsoever after a few days or a month — or less if the selling pressure resumes and takes out stop-loss areas. Janney Capital Markets even made many such warnings here, and that was if the S&P 500 rolls back over and takes the biotech exchange traded funds (ETFs) with it.

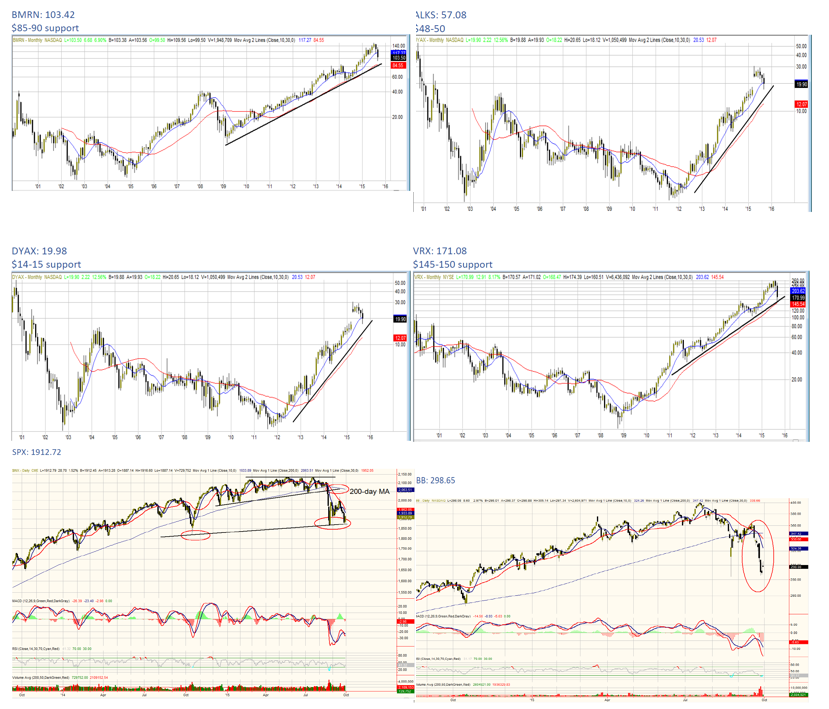

The focus here was on companies with very oversold near-term charts, but where the long-term charts were supportive of trading bounces as well. Janney listed seven seven such stocks, and 24/7 Wall St. decided to focus on the four larger market capitalization names to avoid small cap stocks. These stocks all traded handily higher on Wednesday along with the broader market bounce.

Alkermes PLC (NASDAQ: ALKS) was trading at $58.33 on Wednesday. The stock has a consensus analyst price target of $73.00 and a 52-week trading range of $38.49 to $75.17. Alkermes has a market cap of nearly $8.7 billion.

BioMarin Pharmaceuticals Inc. (NASDAQ: BMRN) shares were trading at $105.00, within its 52-week trading range of $65.91 to $151.75. The consensus analyst price target is $159.65, and the market cap is nearly $17 billion.

Dyax Corp. (NASDAQ: DYAX) was at trading near $20.00, below its consensus analyst price target of $29.63. The stock has 52-week trading range of $9.19 to $30.55, and the market cap is almost $3 billion.

Valeant Pharmaceuticals International Inc. (NYSE: VRX) shares were at $173.46, in its 52-week trading range of $111.41 to $263.81. The consensus price target is $52.38. Valeant has a market cap of about $59 billion.

ALSO READ: Argus Sees 3 Top Health and Biotech Stocks as Oversold

The iShares Nasdaq Biotechnology (NASDAQ: IBB) was specifically mentioned here in the reference against the S&P 500. It was up 4% at $301.50 on Wednesday’s afternoon trading session. It has a 52-week range of $247.86 to $400.79.

Janney’s Dan Wantrobski said that the “IBB” trade would be to buy the IBB using support and stops near $285 (roughly -4% risk from today’s level) for a potential trade toward the $320 to $325 zone, so long as the S&P 500 trades the 1870 trend line as support. The reminder is made about stops and exits:

Remember, if broader market selling commences and the SPX violates this trend line, we would expect stronger corrective action to commence across the board, which would likely (negatively) impact the IBB on a nominal basis (even though it might still outperform on a relative one).

Wantrobski’s call is for the biotechs to produce some explosive oversold trading rallies just ahead. Charts have been listed below by ticker, and with a comparison to the S&P 500 Index.

Wantrobski’s final warning about how this is viewed as a mere trade is that it is from Janney’s “Trading Corner,” rather than based on the investment research area. He said:

From a longer-term perspective, the shot across the bow that we recently experienced via a breakdown on the relative strength charts implies this group may not regain its leadership position when the broader markets resume their primary uptrend. Furthermore – as noted above- we would be especially careful with this sector if the broader markets instead resume their corrective phase …

Source: Janney Capital Markets

Source: Janney Capital Markets

ALSO READ: 3 Top Jefferies Biotech Picks to Buy on Recent Sector Weakness

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.