December 11, 2017: Markets opened mixed Monday with the DJIA lagging a bit. By mid-afternoon all three major indexes were trading in the green, even if barely. Tech, telecom, and energy sectors were among the day’s leading sectors while industrials and financials lagged. WTI crude oil for January delivery settled at $57.99 a barrel, up 1.1% for the day. February gold dropped 0.1% on the day to settle at $1,246.90. Equities were headed for a higher close shortly before the bell as the DJIA traded up 0.11% for the day, the S&P 500 traded up 0.19%, and the Nasdaq Composite traded up 0.41%.

Bitcoin futures for January closed at $18,450 on the CBOE after opening Sunday afternoon at $15,000 per bitcoin. Fewer than 4,000 contracts were traded.

The DJIA stock posting the largest daily percentage gain ahead of the close Monday was The Walt Disney Co. (NYSE: DIS) which traded up 1.97% at $106.28. The stock’s 52-week range is $96.20 to $116.10. Volume was about 50% lower than the daily average of around 7.8 million shares. The company is expected to announce a deal with Fox this week.

Apple Inc. (NASDAQ: AAPL) traded up 1.80% at $172.42. The stock’s 52-week range is $112.49 to $176.24. Volume was about 15% below the daily average of around 28.8 million shares. The company announced the acquisition of music-recognition company Shazam.

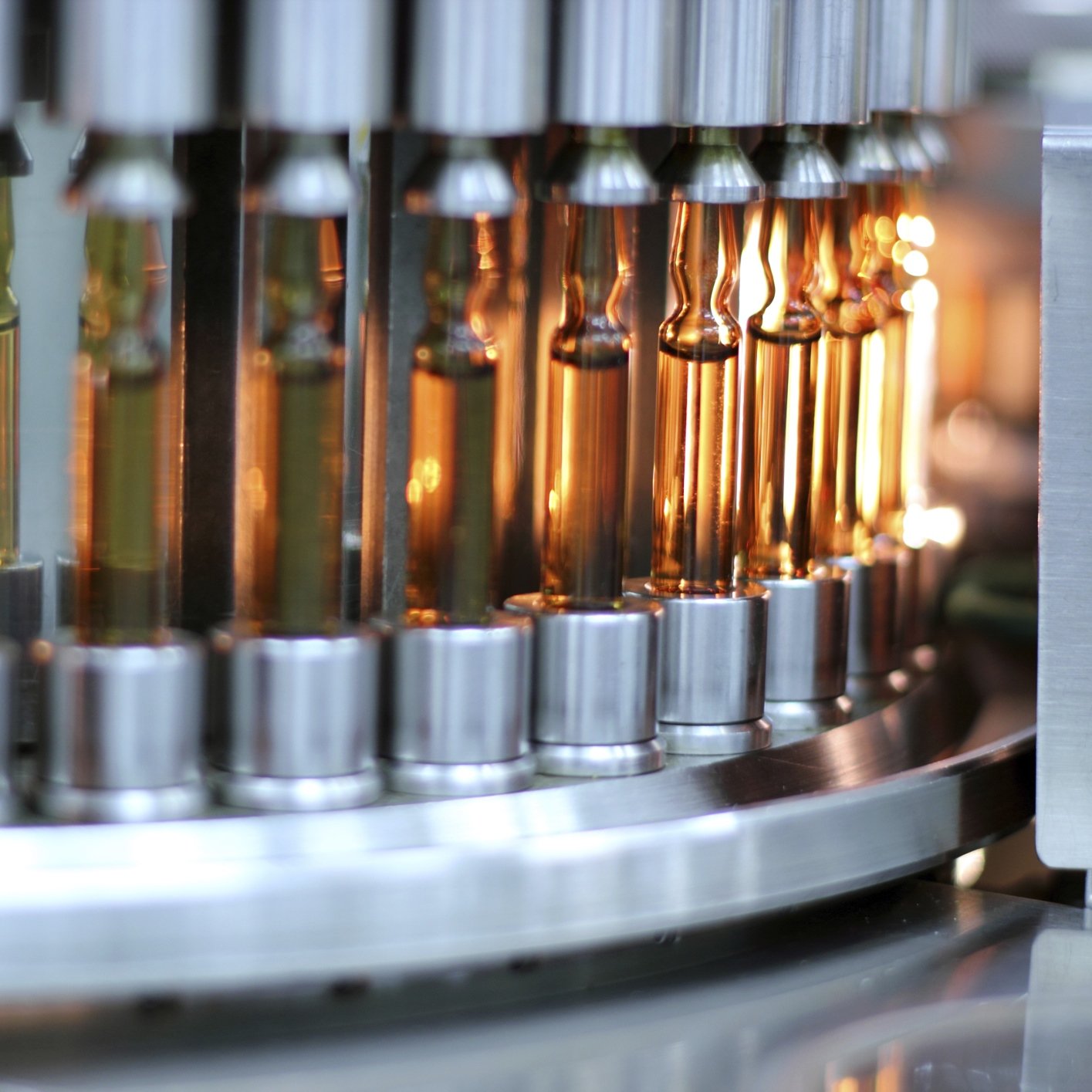

Merck & Co. Inc. (NYSE: MRK) traded up 1.40% at $56.35. The stock’s 52-week range is $53.63 to $66.80. Volume was about about 35% below the daily average of around 11.1 million shares. The drug giant had no specific news.

Pfizer Inc. (NYSE: PFE) traded up 1.29% at $36.20. The stock’s 52-week range is $30.90 to $36.78. Volume was about half the daily average of around 16.3 million. The company, along with other pharmaceutical firms, is expected to benefit from the proposed tax bill.

Of the Dow stocks, 17 are on track to close higher Monday and 13 are set to close lower.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.