While Monday saw a massive snapback rally in the equity markets, one area where the rally never seems to stop is the U.S. Treasury market. The yield on the 10-year Treasury bond dropped to a historic low of 1.08%, which means buyers seeking a safe haven continue to pile into the bonds.

The coronavirus concerns are one main reason for the recent massive drop in yields. Yet, the prospects of a Federal Reserve rate cut later this month, as well as long-term factors like slowing economic growth, tepid inflation expectations and not enough safe assets to go around, have all contributed to the yield decline this year.

Yields will rise at some point, but the reality is that low single-digit yields look to be around for a long time, and while negative-yielding foreign sovereign debt has declined, there is still a very large amount out there.

We screened our 24/7 Wall St. research database and found four companies that are leaders in their respective industries and yield at least 6%. They are rated Buy at major Wall Street firms as well.

Altria

This maker of tobacco products is offering value investors a great entry point after the huge market sell-off. Altria Group Inc. (NYSE: MO) is the parent company of Philip Morris USA (cigarettes), UST (smokeless), John Middleton (cigars), Ste. Michelle Wine Estates and Philip Morris Capital. PMUSA enjoys a 51% share of the U.S. cigarette market, led by its top cigarette brand Marlboro, one of the most valuable brands in the world.

Altria also owns over 10% of Anheuser-Busch InBev, the world’s largest brewer. In March 2008, it spun off its international cigarette business to shareholders. In December 2018, the company acquired 35% of Juul Labs, and while there have been some negative headlines on vaping recently, the trend is probably here to stay. Altria also has purchased a 45% stake in cannabis company Cronus for $1.8 billion.

The negative press on vaping has been a big headwind, and the crash in marijuana stock prices have weighed on this worldwide leader. In addition, the legal age to buy tobacco products recently was raised to 21. Despite all the headwinds, investors are still able to buy the stock at a very reasonable price.

Investors will pocket a massive 8% dividend. Merrill Lynch has a $58 price objective on the shares, while the Wall Street consensus target is $54.89. Altria stock was last seen Monday trading at $42.07 per share.

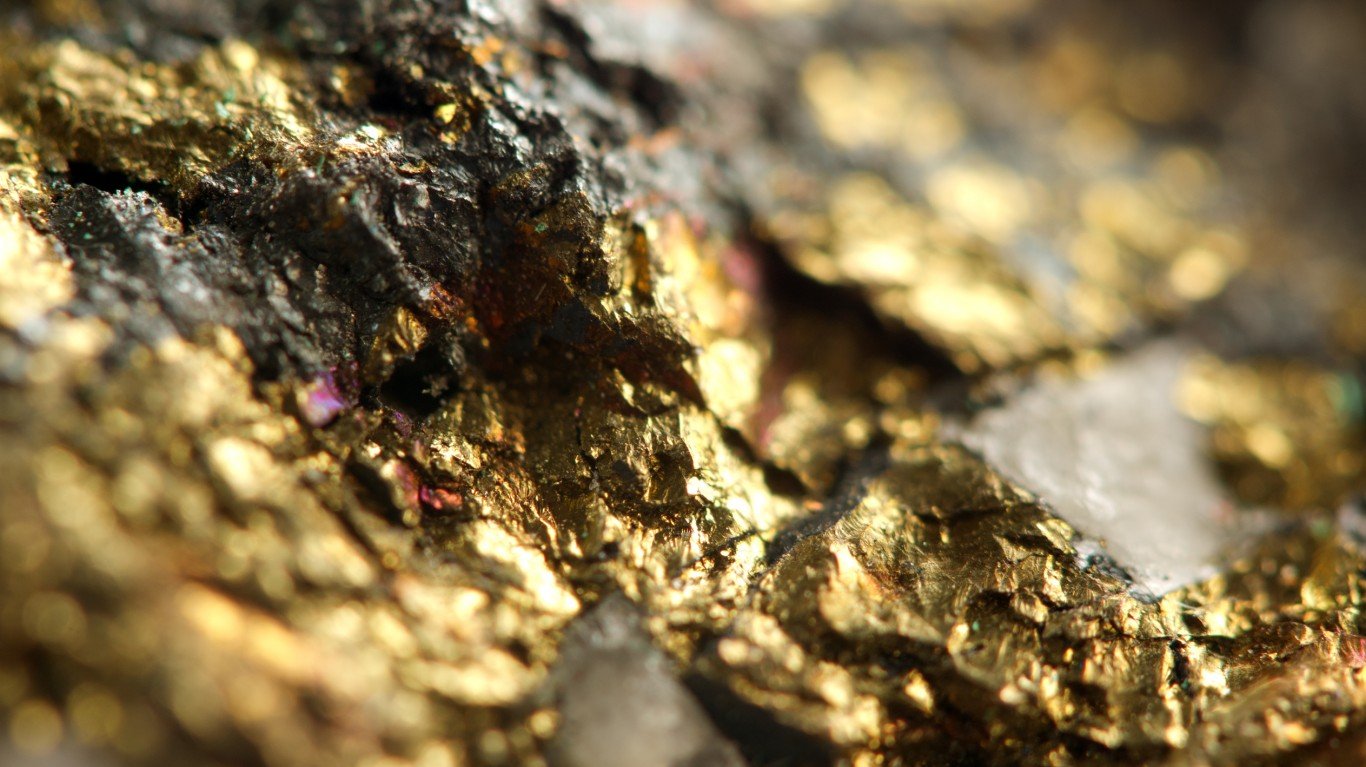

Occidental Petroleum

This energy company may be offering investors the best total return potential. Occidental Petroleum Corp. (NYSE: OXY) is an oil-levered multinational organization with principal business segments in oil and gas and in chemicals.

The oil and gas segment explores for, develops, produces and markets crude oil and natural gas, primarily in the U.S. Permian Basin, Colombia, Bolivia, Libya, Oman, Qatar and Yemen. Meanwhile, the chemicals segment manufactures and markets basic chemicals, vinyls and performance chemicals.

The shares have underperformed since the Anadarko acquisition was announced, but the investment case anchored by yield has not changed. The analysts note that the company has 50% of 2020 production hedged, and they pointed to the integration of Anadarko, where planned synergies, noncore asset sales and conglomerate cash flows provide downside protection through current commodity weakness.

Shareholders receive a massive 9.59% dividend. The Merrill Lynch price target is a huge $75, well above the posted consensus target of $50.05. Occidental Petroleum stock closed on Monday at $32.95.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.