The stock market is supposed to be in a bear market now that the COVID-19 pandemic created the quickest and deepest recession of modern history. After having trillions of dollars thrown into the economy at consumers, business owners and taxpayers, and with zero-percent interest rates, the stock market already has recovered the lion’s share of its losses. To add more insult to the bears, the Dow Jones industrials hit 25,000 and the S&P 500 hit 3,000 again.

Even with the Nasdaq now positive year to date, some investors have to be wondering if some of the great rally stocks have gone too far up. There is still a recession and the business climate likely will not immediately bounce back to pre-recession levels. After all, 20%-plus unemployment and over −20% GDP expectations have to mean something.

24/7 Wall St. has identified 10 stocks that have screamed higher since the panic selling levels in March. These should not be considered recommendations to create “short sale” positions by any means. The importance of looking at these at this time is that Wall Street analysts are great at telling customers to buy stocks. They often are not so great at telling their customers that the stock has risen massively or that it may have risen too much.

The basis for this review is to identify some of the stocks that have seen massive gains and where the valuations are now considerably higher than what most of Wall Street’s analysts have said the shares are worth.

At the peak of the selling in March, the Dow was down 39% from its high, and the S&P 500 was down almost 35% from its high. There may still be a sharp recession in the economic reports and in in the annualized corporate earnings trends for the S&P 500 as a whole, but it looks like it is getting more difficult by the day for market pundits to keep calling this a bear market.

On last look, the S&P 500 was now only down 11% from its all-time high and was only down 7% year to date. The Nasdaq was only down 4% from its all-time high, but on last look it was up by 5% so far in 2020. The Dow may still be down 15% from its highs seen in February, but it’s now down only 12% year to date.

Here are 10 stocks that most investors and traders will know that are trading handily above their consensus analyst target prices and have all rallied greatly from the recession-induced (or pre-recession) lows.

We have shown consensus analyst target prices and other consensus data from Refinitiv. While many of these stocks have no recaptured every cent of their pre-recession level, most have, and to be on this list a company’s stock price had to be handily above its consensus price target. We have also shown the so-called street high targets to show that there may be some additional analysts who still see even more upside ahead.

Apple Inc. (NASDAQ: AAPL) seems to catch Wall Street off guard all the time. The analyst community kept lowering expectations during the selling panic, and Apple’s earnings refuted much of the concerns, despite the woes in China and globally. Apple closed down as low as $223.76 on March 23, then rallied to a close of $293.01 by the end of April, and its shares were up marginally on Tuesday near $320. Even as Apple’s analysts have been chasing their consensus target price up, it is still under $310, and its all-time high before the February peak was $327.85.

Chipotle Mexican Grill Inc. (NYSE: CMG) traded as high as $1,087.00 on Tuesday morning, another all-time high. The consensus price target is still not even up at $900 yet, and its lowest closing bell price during the panic selling was $465.21 on March 18. Analysts have been aggressively raising target prices on Chipotle, but most of them have still not kept up with the stock performance. Piper Sandler recently raised its target price to $1,100 from $850, and KeyBanc recently raised its target price to $1,125 from $955.

Clorox Co. (NYSE: CLX) was the absolute dominant winner in consumer products during the COVID-19 scare and as hoarding supplies was common. Clorox specializes in cleaning, and its namesake products with bleach will kill just about anything. Shares peaked at close to $210 in mid-May, and they already have pulled back to about $198. That said, the consensus price target is just under $175. Clorox was close to $170 heading into March, but it was closer to $155 at the start of 2020. The street high target price is $215.

Fortinet Inc. (NASDAQ: FTNT) is winning from the work-from-home trend in data security, but its shares peaked at just over $149 last week. On Tuesday, they were down to about $139 after a 2.5% loss, and that’s still more than $20 higher than its consensus target price of $118.16. Fortinet was down close to $75 at the lowest closing prices during the March panic selling. The street high analyst target for Fortinet is $150.00.

Lennar Corp. (NYSE: LEN) was among the other housing stocks that was pleased to see a positive report in new home sales in April. “March was March, and improvements toward the end of April” must be the case here. After close to a 3% gain to $61.70 on Tuesday, the high for the day was actually up at $63.50. Lennar’s consensus target price is just $51.87, and its panic selling low close was $29.26 on March 23. According to Finviz, Lennar was even the S&P 500’s best performing stock over the past month. The street-high analyst target price is $72.

Nvidia Corp. (NASDAQ: NVDA) keeps getting higher and higher analyst price targets as its stock keeps rising, but they can’t keep with its wins from crypto, artificial intelligence, graphics, processors, driverless car systems and so on. The stock keeps punishing its short sellers, and after hitting a high of $367.27 on Tuesday, the shares were back down to $355 on Tuesday afternoon. Even with analysts raising their target prices, the consensus was still down closer to $300. There have at least been two analysts issuing $400 target prices, and another issuing a $420 target, price after last week’s earnings.

Palo Alto Networks Inc. (NYSE: PANW) is a data security leader and its shares reached as much as $251.11 back in February before falling to under $135 during the dog days of March. Now the stock is near $235, and despite a 1% drop on the day, it has a $212.17 consensus price target. Analysts were raising targets recently, and the street high is $288.00.

PayPal Holdings Inc. (NASDAQ: PYPL) sold off with the major indexes into March, but its shares rose from under $90 during the March lows to as much as $154.55 on Tuesday morning. On last look, PayPal’s stock was down 2% at $148 on Tuesday afternoon, but that was a gain of almost 40% year to date. PayPal’s consensus price target was $125.65, on last look, but the street high target was still just $152.

Shopify Inc. (NYSE: SHOP) has been bringing in new business galore as every company now knows that have prioritize digitization above all else. No one seemed to care it traded at 20 times next year’s revenues, but after a 30-times valuation maybe it was too much. After hitting a high of $843.99 on Tuesday, the stock was back under $800 in the afternoon, but the consensus target price was still closer to $500. Shopify’s low close around the peak selling panic was $322.29 on March 16. The highest target price we have found is $860.

Zoom Video Communications Inc. (NASDAQ: ZM) has been a hard valuation to justify, even it was the de facto stay-at-home and work-from-home video communications winner. Its shares have had trouble staying very much above $175, and on Tuesday afternoon the stock was down 2% close to $167. That’s a valuation of 275 times expected 2022 earnings. Zoom’s stock already was rising as the panic set in, but its 2019 closing bell price was $68.04. Zoom’s consensus price target is down around $121.50, but the street-high is a $200 price target.

Again, stocks rising and rising further, and then going above the consensus price targets, should not be considered as the end of the rally nor should this be considered a recommendation to sell short. Some stocks can remain irrationally positive for far longer than most short sellers can remain rational.

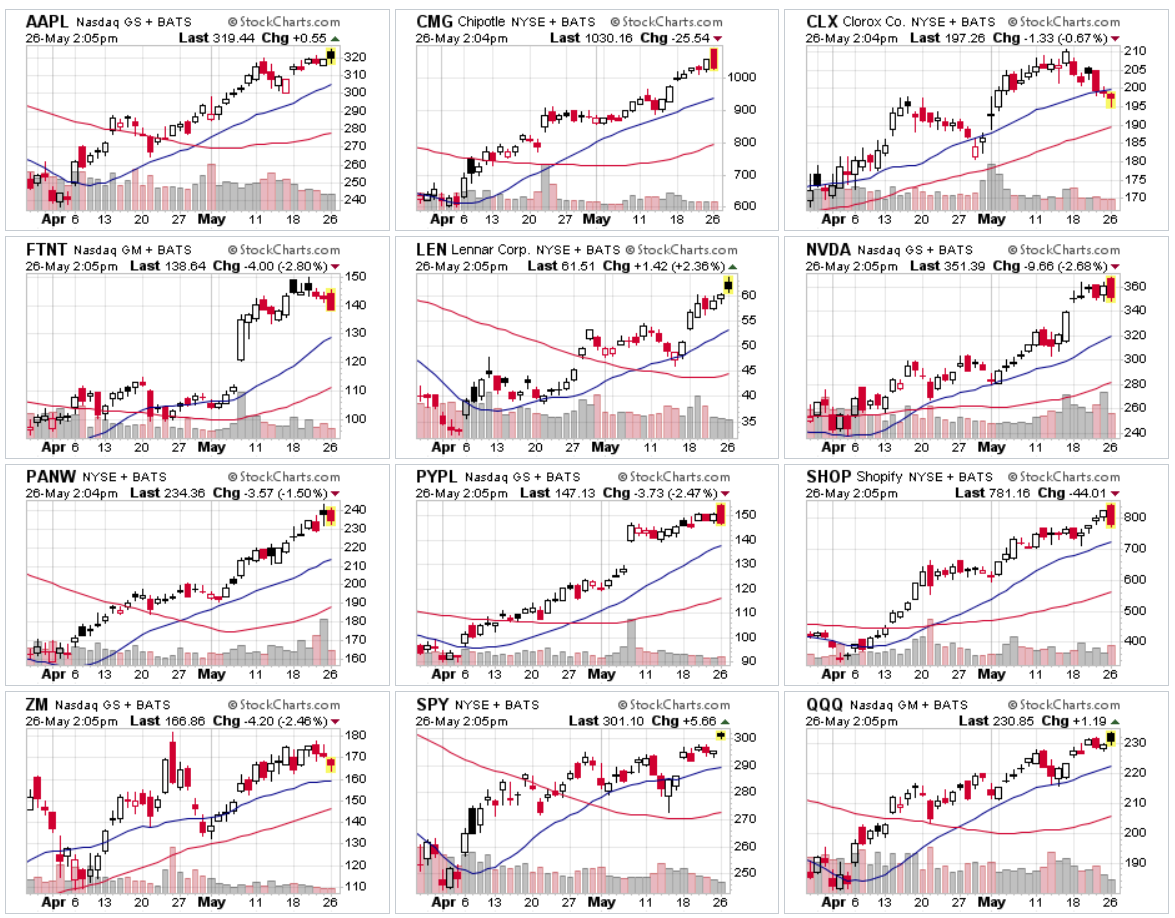

We have provided a candle glance chart montage from StockCharts.com that shows all of these stocks over the last two months and shows the relative performance of the S&P 500 (SPY) and NASDAQ 100 (QQQ) for relevance.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.