By David Callaway, Callaway Climate Insights

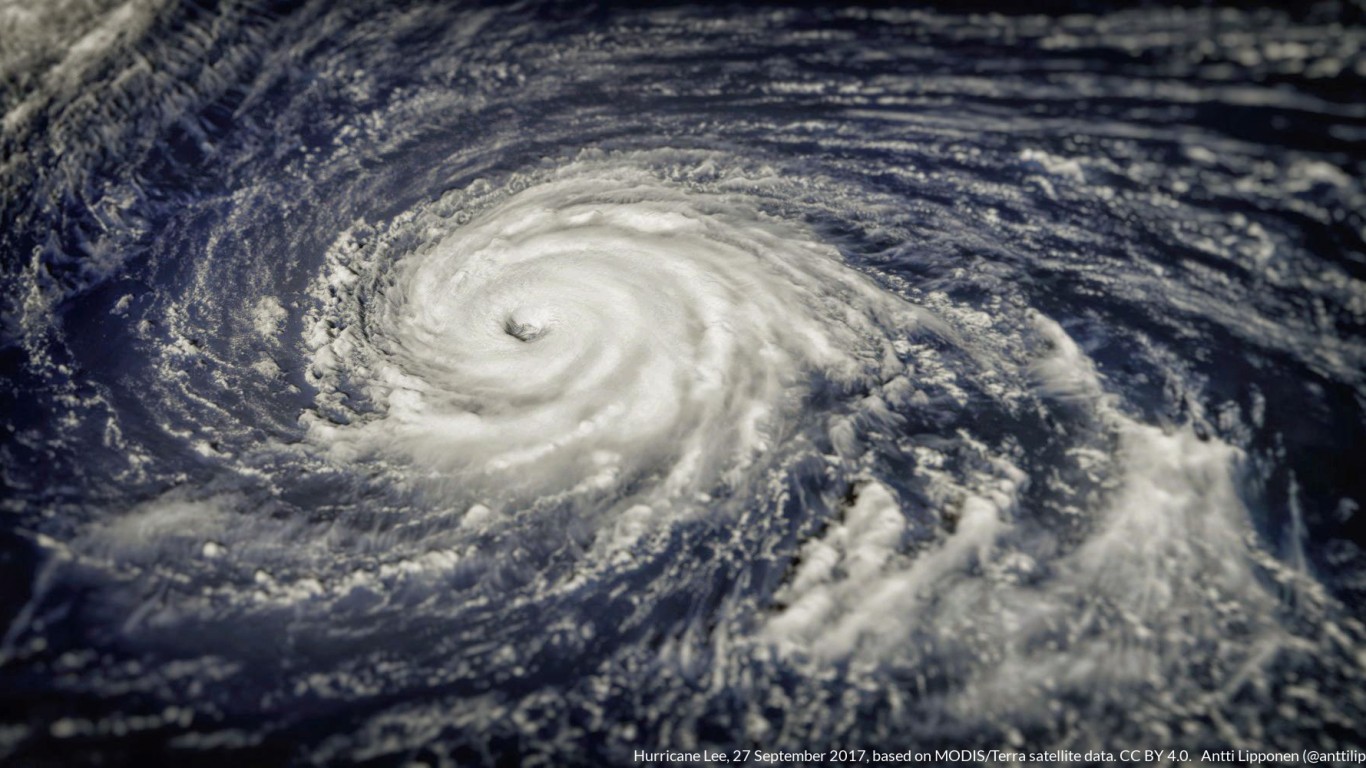

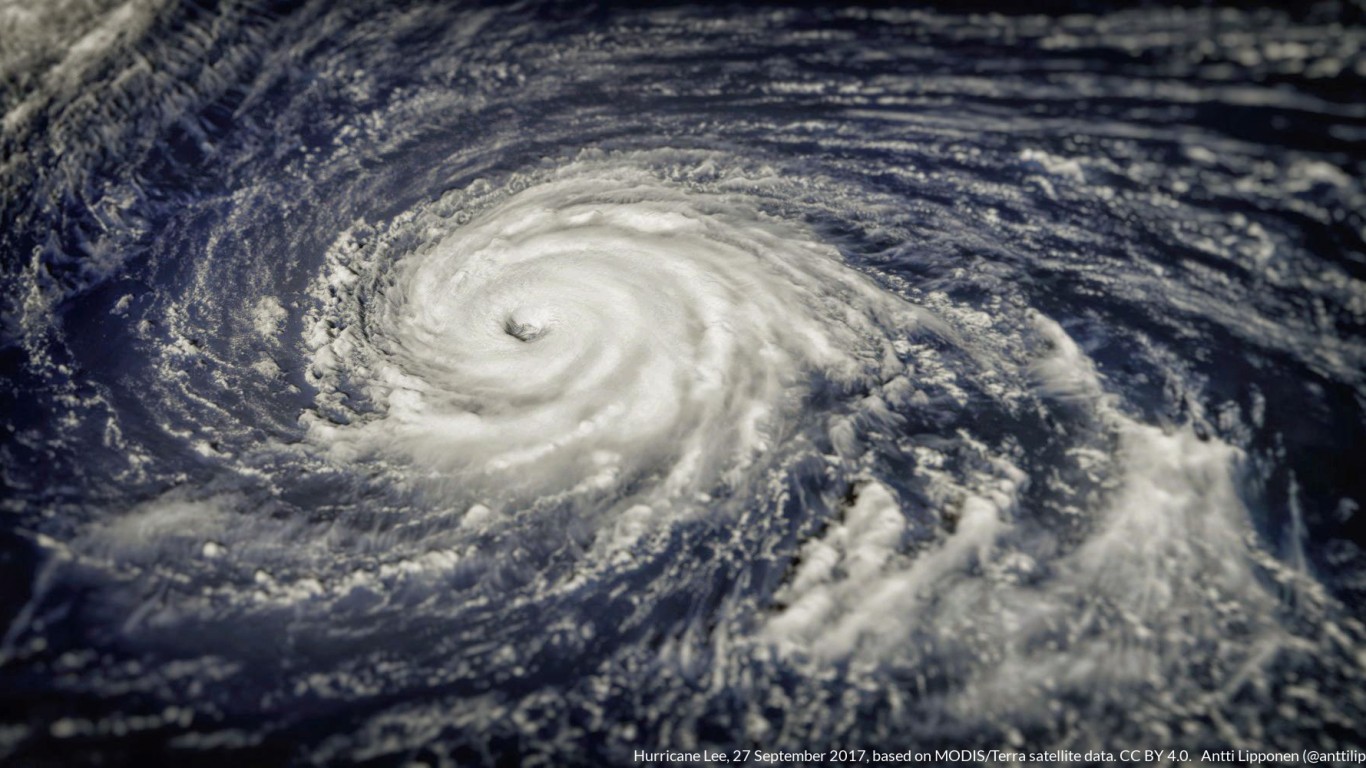

As the twin concepts of a “climate arsonist” and “more explosive trees” competed for attention in the U.S. election campaign’s climate change detour this week on the West Coast, a rare parade of baby hurricanes in the Atlantic reminded those out East that this is their climate change, too.

But while Joe Biden and California Democrats ratcheted up the pressure on President Donald Trump, who assured everyone that “it’ll start getting cooler, you just watch,” actual progress is being made this week on many fronts. As I wrote in my ZEUS column a few weeks ago, climate change as an election issue is well down the priority list, in part because most people already agree it’s important. In fact, Darrell Delamaide’s piece below highlights a couple dozen Republican candidates for the U.S. House and Senate this election season with climate chops, bucking the traditional party line.

So despite the theatrics of the campaigns and, well, the smoke and fire and wind and suffering, climate change is not contentious enough to top, say, law and order, taxes, or Covid-19 response as a political dividing line.

Instead, asset managers, tech companies, and sustainability executives prepared to honor “climate week” in New York City next week with a host of announcements and agreements that begin to show how the business community is taking matters into its own hands. Not the least of which was that Google (GOOGL) has bought enough carbon offsets to account for all of the carbonized energy it’s ever produced.

Now if it can just start producing it cleaner, as it and Apple (AAPL), have promised by 2030, we’ll see real progress. Until then, remember your mask helps keep the smoke out, too.

The Google story and other insights, below. . . .

Republicans for climate solutions, coming to your ballot box this election

. . . . Almost two dozen Republican candidates for House and Senate seats this election have won the endorsement of the American Conservation Coalition for their climate solutions strategies. Darrell Delamaide looks at who they are and what they’re standing for as the movement by young Republicans begins to shift the dynamics of what had long been a simple party play.

The trench warfare that characterizes our politics prescribes that Democrats believe in the science of man-made climate change and Republicans do not, preferring to side with their supporters in fossil-fuel industries.

It’s not that simple. A new generation of Republican politicians is breaking the mold. Their approach to fighting climate change tends to be less dogmatic on how rapidly to phase out fossil fuels and is more like the all-of-the-above energy strategy favored by former President Barack Obama.

. . . . Round trip: Shares of Nikola Corp. (NKLA) were in the headlines for the fourth time in the seven trading days on Tuesday after the SEC waded into the fray between the electric truck company, the short seller and General Motors (GM). The outcome of this blowup is important because of its potential impact on investors in this growing space for electric vehicle companies, and indeed for many companies in the ESG universe.

As I wrote a few months ago in a column about the spate of deals involving these EV companies, it is wise to remember that many of them — such as Nikola — don’t have any products yet. That Nikola admitted a promotional video of a truck driving was simply a shot of it coasting downhill will not help its case if and when it begins to build its Nikola Badger line (above).

Nikola shares got some relief after General Motors CEO Mary Barra came out in defense of its due diligence tied to taking an investment stake in Nikola last week, before short seller Hindenburg Research accused the company of fraud. But it lost those gains Tuesday on reports of SEC interest.

The fate of Nikola founder Trevor Milton will ride on how this comes out. For investors looking for the next Tesla (TSLA) to ESG managers trying to avoid accusations of “greenwashing” and otherwise over-promotional tactics, this is an early test of the resilience of the bet on green technologies. . . .

. . . . Caving in: The ousting of Australian mining giant Rio Tinto’s chief executive and two other senior executives last week for the company’s blowing up of two indigenous artifact cave sites to get to iron ore was a game changer in the nascent field of shareholder climate activism. Time was, indeed, still is, when big fossil fuel companies could run roughshod over important sites without having to worry about their shareholders.

But the growing wad of ESG money — some $50 trillion worldwide — in the hands of some of the world’s most powerful institutions means those days are coming to an end. Indeed, the combination of the climate movement with the movement for racial justice this summer gives shareholders a powerful new weapon in the fight to rein in global fossil fuel expansion, as Jean-Sebastien Jacques found out.

The world’s biggest polluters should especially take heed of demands this week by more than 500 institutional investors that 161 companies, accounting for 80% of greenhouse gas omissions and including Rio Tinto, be held accountable if they don’t back net-zero emissions strategies. With many of these institutions in places — like Australia and Silicon Valley — directly impacted by climate change right now, it’s hard to see this one fading anytime soon. . . .

. . . . Climate SPAC: Pimco, the institutional asset manager that has been an early leader in sustainability issues, and a group of investors announced late last week plans to set up their own special purpose acquisition company, or SPAC, to invest in climate change solutions. Climate Change Crisis Real Impact/Acquisition will raise $200 million in an initial public offering and will be listed on the New York Stock Exchange, according to regulatory filings. SPACS have been a favorite Wall Street tool this year to help emerging companies become listed, with several tied to electric vehicle companies such as Nikola. This is the first one tied exclusively to climate solutions investing and will be closely watched — by Callaway Climate Insights — for its early positions once it begins trading. . . .

. . . . New Post: Swiss wealth manager Lombard Odier and Oxford University announced what they claim is the first endowed senior academic post in sustainable finance, with a commitment by the bank to a multi-year collaboration that will involve using some of the academic research in its own investment products. Dr. Ben Caldecott of Oxford will be the first holder of the post. Both Oxford and Cambridge Universities have developed large sustainable research programs and lead a lot of Europe’s groundbreaking work on sustainable finance.

Meanwhile, fellow Swiss banking giant UBS announced it will put sustainable investments at the core of its wealth management strategy for its private clients group. UBS, which said it manages some $488 billion in sustainable assets, said the global shift to this type of investing is just beginning. . . .

Free Callaway Climate Insights Newsletter

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.