Investing

Climate moonshot, a $2 trillion estimate, and the CEO driving profit by cutting carbon

Published:

Last Updated:

By David Callaway, Callaway Climate Insights

Do we need a new Manhattan Project for climate change? That’s the claim banging around Washington D.C. the past few years, most recently voiced by Sen. Lamar Alexander (R.-Tenn.), as he disparaged the Green New Deal last spring. Not sure at this stage a secretive, government-funded project that could end the world if placed in the wrong hands is the answer.

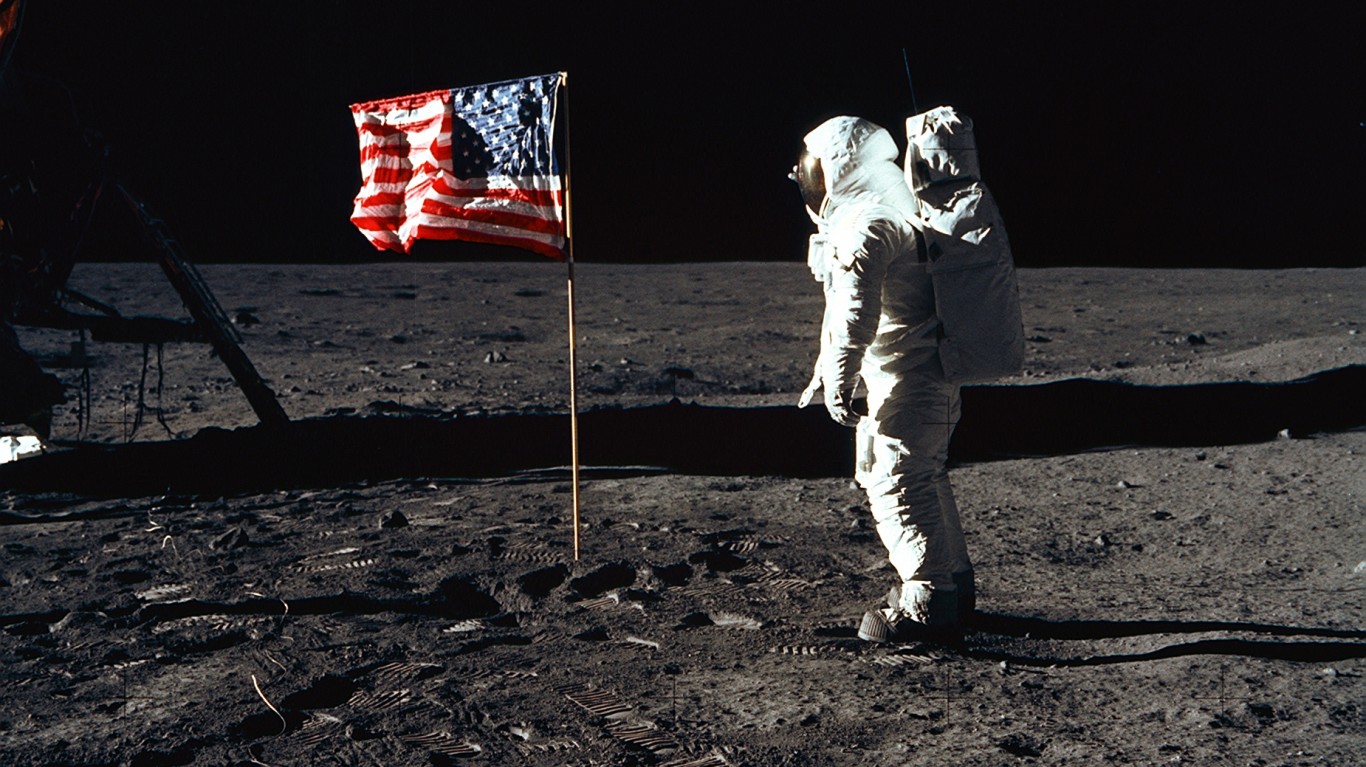

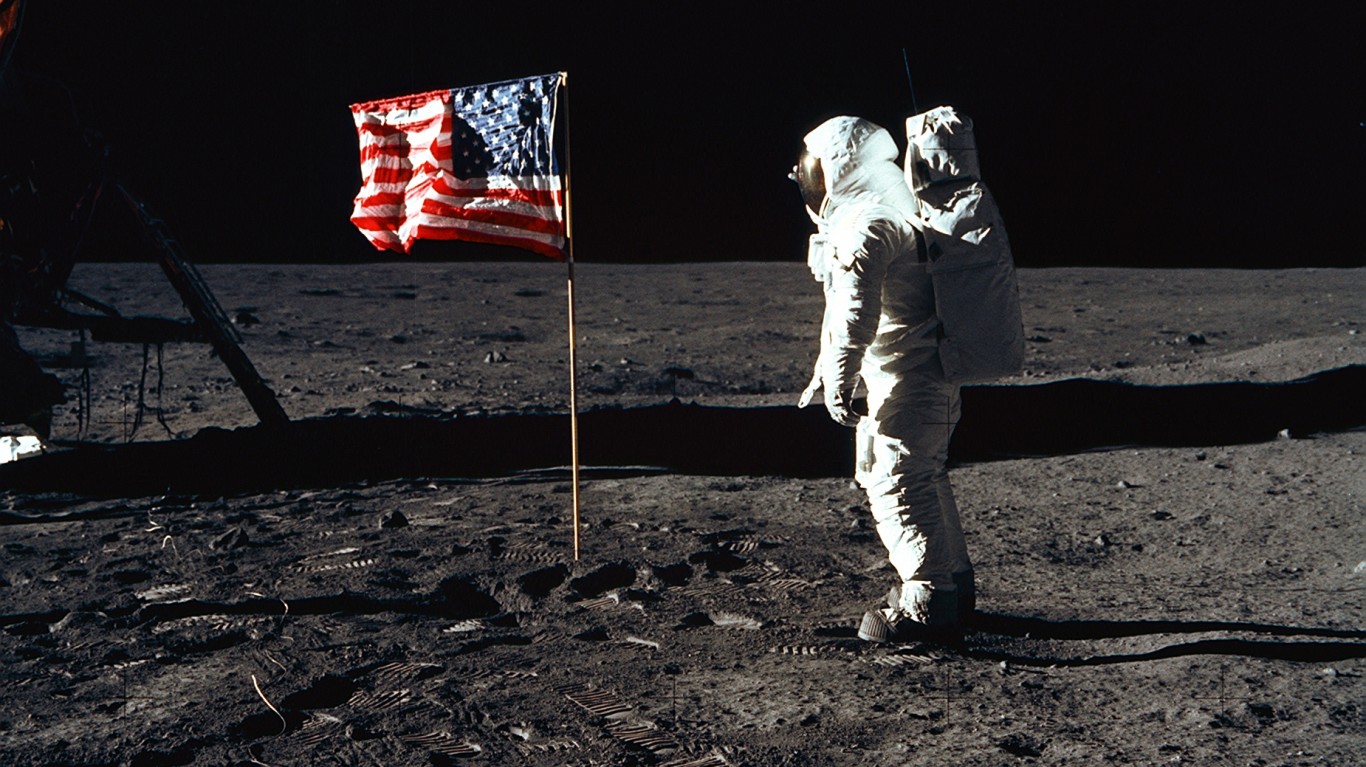

But a new piece in the MIT Technology Review by three international energy policy experts revised the idea this week in a more palatable format, calling for a National Energy Innovation Mission. Kind of along the lines of the Apollo 11 moonshot, the World War II financing effort, or today’s race for a Covid-19 vaccine.

The report lays bare the challenge below, even with the massive amount of capital coming into the environmental, social and governance space this year:

Today’s technologies aren’t up to the task of deep decarbonization. The International Energy Agency warns that of 46 technologies needed to address the climate crisis, only six are advancing on track for mass deployment to enable net-zero emissions by 2070 and restrain global warming below 2°C.; the remaining 40 won’t fall in cost or achieve commercial scale without additional innovation.

A global challenge requires a global response, and something like this could radically alter the leadership structure of the international climate effort. For now, in the absence of policy, at least in the U.S., it’s up to investors to help innovators bootstrap solutions. Don’t be surprised to see Europe or even China take the lead on this if Washington sits on its hands. The awakening of big business this year to the challenge could not come too soon.

More insights below. . . .

. . . . Carbon counter: Hannon Armstrong, the public investment trust run by Jeff Eckel, is focused on investing in carbon reduction, and making money. Shares of Hannon (HASI) are up by a third this year and sport an annual average return of 25% in the past five years. We spoke with the CEO, who has been with the company most of his career and led a successful IPO seven years ago, about why climate investing makes sense. It comes down to cold, hard numbers. Eckel sees assets that are invested in carbon reduction gaining in value if a price is put on carbon emissions, and that more efficient technologies will yield higher returns.

Eckel is a champion of the movement to put a price on carbon. It gained a big endorsement this week when the Business Roundtable, one of the most important U.S. corporate bodies, supported a price — representing a shift in just a few years for American business from a position of apathy or even of obstruction on climate, to one of action.

Eckel wants the price to come with a dividend as well, so that money raised is not squandered in government coffers, but spent on ways to support communities hard- hit by climate change. “You dividend it to the citizens,” he said. “It will absolutely change the way the private sector deploys resources.”. . .

. . . . We’re gonna need a bigger boat: Investors have been underestimating the potential needs for capital to meet the goals of the Paris Accord, according to speakers at this week’s Morningstar Investment Conference. Following a report by financial regulators last week that said the current ESG universe is not large enough in terms of capital to face the challenge of climate transition, fund managers said sustainability is at an inflection point, and estimated that the transition could wipe out more than 15% of global earnings (mostly fossil fuel-related) in the next few decades.

As dire as things are for legacy industries, the opportunity for new processes and technologies is enormous. Simon Webber, a fund manager at Schroders, said his company’s models indicate “there will need to be $2 trillion a year of additional investment going into these newer technologies creating a low-carbon economy.”. . .

After drubbing by funds, what’s next for Labor Dept.’s ESG proposal?

. . . . Try, try again: After the Dept. of Labor’s proposed rule to restrict the use of ESG strategies in retirement funds was savaged by more than 95% of the fund companies who responded, Tony Davidow looks at how the DOL might instead work to better educate the public (and itself?) to the benefits of more choices for investors.

Rather than depriving investors of these unique strategies, regulators should focus on better education regarding the various types of strategies and the inherent biases. We would all benefit from a better informed investing public and more viable options for retirees. Investors want and deserve to have choices for their retirement plans. . . .

Free Callaway Climate Insights Newsletter

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.