By David Callaway, Callaway Climate Insights

Lordstown Motors ranks among the worst-performing electric vehicle stocks so far this year, as shares fell sharply following allegations against it by short-seller Hindenburg Research and disclosure of an SEC probe. Read more, here, about Lordstown’s quarterly report this week and the Callaway Climate Insights EV index.

The inevitable collision of high-flying electric vehicle stocks and the Securities and Exchange Commission’s newfound eagerness to patrol environmental, social and governance (ESG) investing broadsided Lordstown Motors (RIDE) shares Thursday after the Ohio EV company disclosed the regulator had reached out.

Lordstown shares were down almost 25% year-to-date after the disclosure during the company’s first earnings call late Wednesday, and fell another 12% as of this writing Thursday, putting them down a third in the past three months. For investors who had been promised a robust response to allegations by short-seller Hindenburg Research last week that demand for the company’s Endurance pickup was exaggerated, the acknowledgement of an SEC probe was deflating.

Like investors in Nikola Corp., (NKLA) attacked by Hindenburg last summer, Lordstown investors can now expect a lengthy purgatory before either the company or the regulator uncover what happened. Against a backdrop of widening losses at the company, the outlook for the shares, is for the most part, unplugged.

EV shares have proven rich pickings for short-sellers after they spiked last year, and while that likely won’t reduce the auto industry’s drive toward electric vehicles, it will certainly lead to a healthy re-evaluation of the sector by analysts. No surprise that Tesla (TSLA) is also down year-to-date, though so far it has been immune to the impact of any major short-selling. Perhaps because its cars actually exist.

More insights below. . . .

EU notebook: Eastern Europe aims at ‘energy poverty’ of Soviet-era buildings

. . . . The Khrushchyovka panel buildings of the former Soviet Union, named after Nikita Khrushchev, are home to some of the more creative energy efficiency projects in Eastern Europe these days, writes Vish Gain from Dublin. Countries such as the Czech Republic, Slovakia and Romania have all launched renovation programs that they hope to improve efficiency, cut emissions, and roll up into investable securities. Challenges, aside from, well, Russia, abound. . . .

Good vs. evil? The thin gray line between green and ‘dirty’ energy companies

. . . . When it comes to green energy, it’s not just black and white. A report by Callaway Climate Insights columnist Mark Hulbert last year that said traditional fossil fuel companies held a surprising number of green patents sparked controversy among readers about the companies’ motives. So Hulbert asked his sources to do some more research. Their new findings will add a fresh dimension to the debate about whether investors should divest fossil fuel stocks from their portfolios, or double-down on their renewable innovation. . . .

Allison Herren Lee, from Trump appointee to new face of regulatory ESG push in Washington

. . . . Allison Herren Lee, acting SEC chief, became unavoidable for comment this week in a blitz of speeches in Washington that highlighted the regulator’s intent of being a major player in forcing corporate climate disclosures going forward, writes Marsha Vande Berg. The securities attorney, appointed two years ago by the Trump Administration, publicly moved away from its policies to tell fund managers that the SEC under incoming chief Gary Gensler will be a different animal, starting with shareholder proxy resolutions. . . .

Thursday’s insights: How climate’s threat to sovereign credit ratings will shake up government bond markets; plus the renewables edge

Greek alphabet will not be used for future #hurricane names because it created a distraction from storm warnings and caused confusion in 2020.

IF regular list of names is exhausted, a new supplementary list will be used

(And we hope not in 2021)https://t.co/tJGn1dxT1o

🌀🌀 pic.twitter.com/Fxrds5u56I— World Meteorological Organization (@WMO) March 18, 2021

. . . . The rise of green bonds has shaken up credit markets, particularly in Europe, but a new report out of Cambridge University this week will hit government bond markets where it hurts — credit ratings. More than 60 major issuers in the $66 trillion (yes, trillion) government debt market face downgrades by the end of the decade, including the U.S., UK and Germany, if they don’t rein in greenhouse gas emissions. And that’s just the tip of the systemic risk iceberg. Read more here. . . .

. . . . With respect to Warren Buffett’s bet on Chevron (CVX), a new report out this week shows that renewable energy stocks outperformed fossil fuel companies by more than seven times in the past decade, highlighting an opportunity that’s only just beginning to play out as more renewable companies go public. Read more here. . . .

. . . . Hurricane Zoe? Sounds oddly modern. But that’s the plan from the folks who name hurricanes, who will drop Greek names this coming season because the hoopla around them was taking attention from, well, the storms. Read some of the other names you can expect to hit the Florida coast here. . . .

. . . . And finally, a shout out to the LA Times for this scoop, about how just ahead of of the 10th anniversary last week of the tsunami that killed 18,000 people in Japan, the system that detects tsunamis at the National Oceanic Atmospheric Association in Maryland was knocked out by a broken water pipe. The outage left a critical early warning system inoperative for almost a week. File under “surf’s up.”

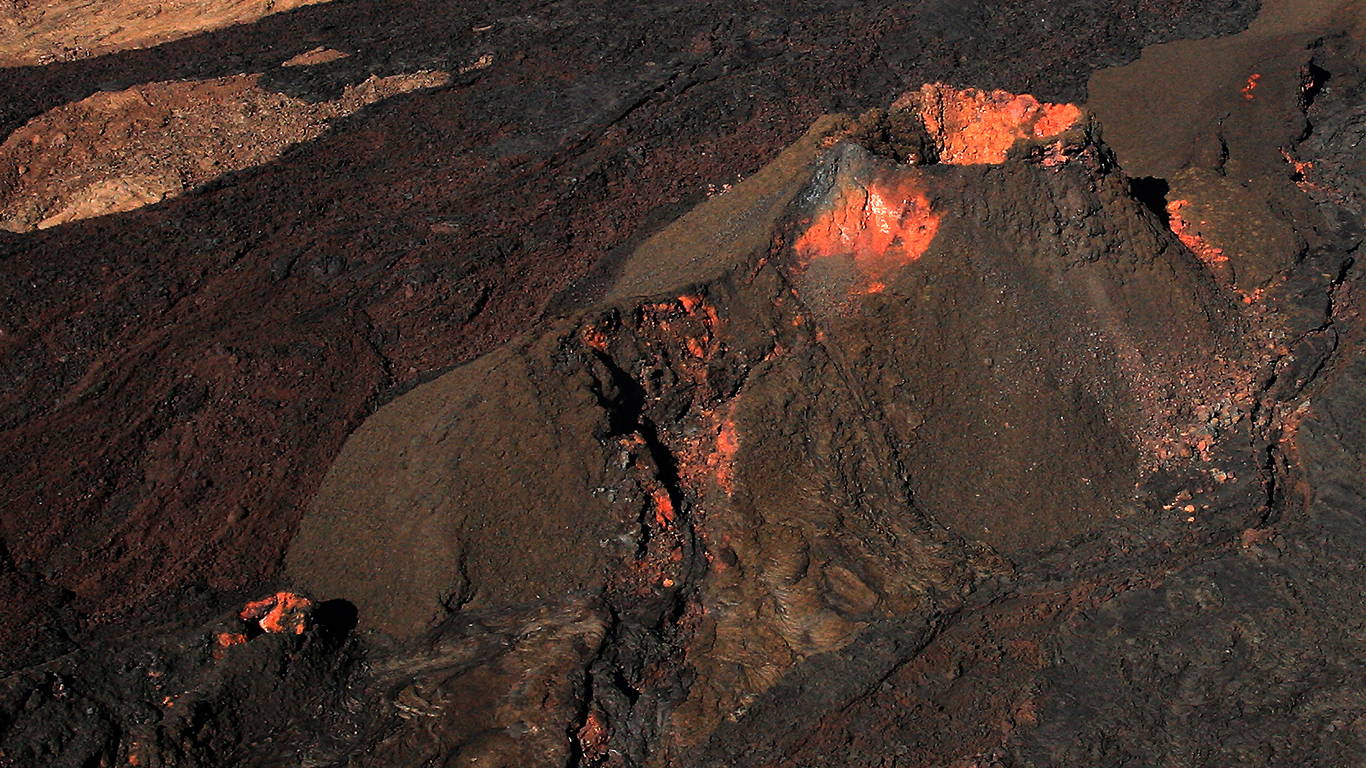

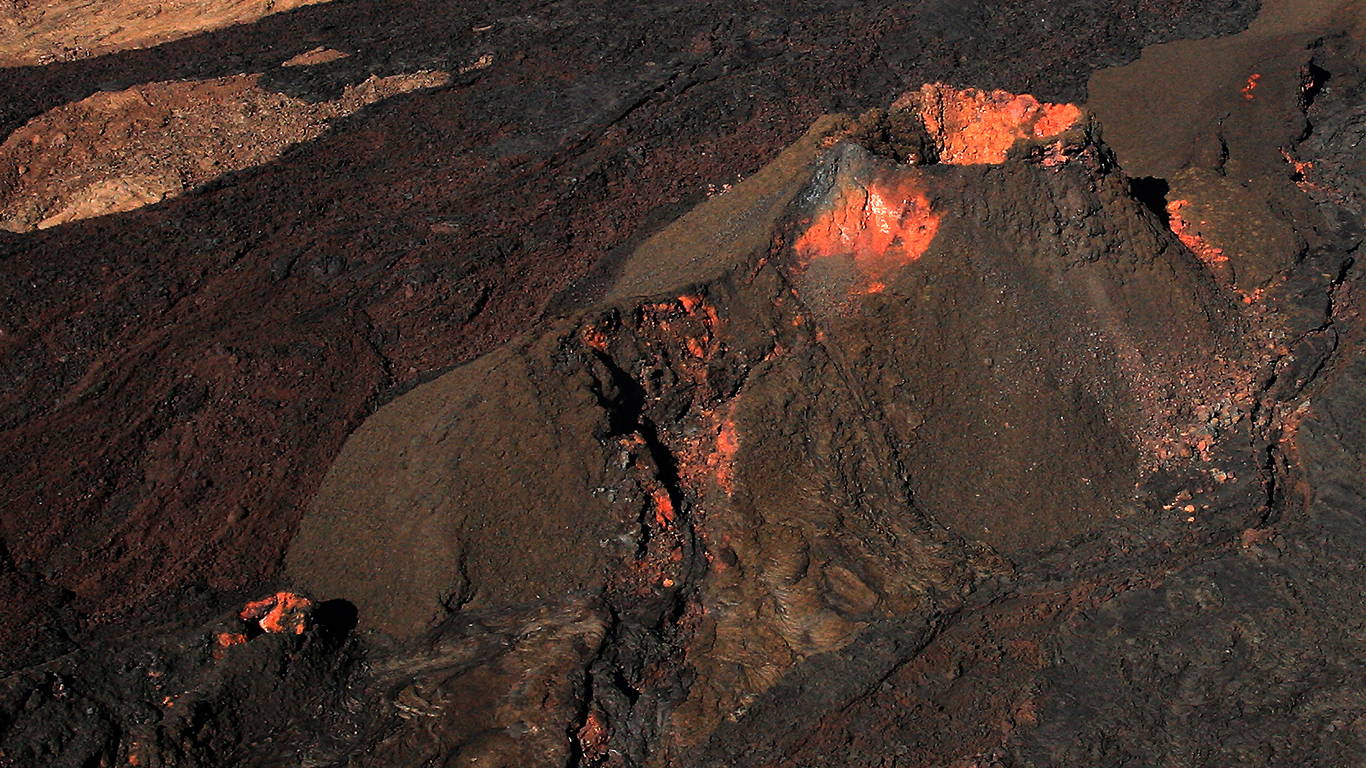

Data driven: Mauna Loa is waking up, USGS says

. . . . The Hawaiian name “Mauna Loa” means “Long Mountain.” The USGS says the name is apt, as the subaerial part of Mauna Loa extends about 74 miles from the southern tip of the island of Hawaii to the summit caldera and then east-northeast to the coastline near Hilo. Mauna Loa is among Earth’s most active volcanoes, having erupted 33 times since its first well-documented historical eruption in 1843. It has produced large, voluminous flows of basalt that have reached the ocean eight times since 1868, according to the USGS. It last erupted in 1984, when a lava flow came within 4.5 miles of Hilo, the largest population center on the island. It’s been in the news lately, as the volcano continues to awaken from its slumber. The USGS says that while an eruption of Mauna Loa is not imminent, it’s urging residents to update their “personal eruption plans,” similar to preparing for hurricane season. . . .

Free Callaway Climate Insights Newsletter

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.