After markets closed on Monday, Devon Energy reported quarterly results that beat on both the top and bottom lines. The oil and gas producer did not indicate that it planned to increase production or capital spending. Shares traded up 3.2% in Tuesday’s premarket session. Diamondback Energy also beat top-line and bottom-line consensus estimates. Shares were up about 3.9% Tuesday.

Fertilizer maker Mosaic missed both profit and revenue estimates. The company said it expects second-quarter pricing for its phosphate products to be $140 to $160 per metric ton higher than in the first quarter and potash prices to be $40 to $60. Share traded down about 0.4% Tuesday morning.

Pipeline operator Williams beat estimates on both the top and bottom lines. The company said it expects to increase its dividend this year from $1.64 per share (yield of 4.9%) to $1.70. Shares traded up 0.8%.

Before markets opened Tuesday morning, BP reported better-than-expected earnings but a miss on revenue. The oil giant also said it would buy back $2.5 billion in stock before it announced second-quarter results. Shares traded up 6.3% early Tuesday.

Marathon Petroleum beat top-line and bottom-line estimates, and shares traded up about 2.4%. The refiner did not raise its buyback spending or its dividend.

Paramount Global beat the consensus earnings estimate but missed on revenue. Shares traded down about 8.5% in early trading.

Pfizer beat estimates on the top and bottom lines but issued downside guidance for earnings and revenue for the full 2022 fiscal year. Shares traded down about 0.6%.

After markets close Tuesday, Airbnb, AMD and Livent will report quarterly results.

Here is a look at four companies set to report results on Wednesday or Thursday.

Albemarle

Lithium producer Albemarle Corp. (NYSE: ALB) has added about 15% to its share price in the past 12 months, but that is more than 32% below the stock’s 52-week high posted in mid-November. As is the case with lithium miners generally, high demand is keeping prices high and is expected to continue doing so for a while yet. Albemarle will release results after markets close Wednesday.

Albemarle has begun weighing the possibility of reopening an idled lithium mine in North Carolina. The Kings Mountain mine is located on an 800-acre parcel on which Albemarle already operates a lithium refining plant and a battery materials operation. A decision is about two years away according to company officials.

Analysts are bullish on Albemarle. Of 22 brokerages covering the stock, 13 have a Buy or Strong Buy rating and seven have Hold ratings. At a recent price of around $191.40 a share, the implied gain based on a median price target of $256 is 33.8%. Based on the high price target of $307, the upside potential is 60.4%.

First-quarter revenue is forecast at $1.03 billion, which would be up about 15.4% sequentially and 24.2% higher year over year. Adjusted earnings per share (EPS) are forecast at $1.63, up 61.7% sequentially and 48.2% year over year. For the full 2022 fiscal year, analysts expect Albemarle to report EPS of $6.18, up 53%, on sales of $4.41 billion, up 32.6%.

Albemarle stock trades at 31.0 times expected 2022 EPS, 22.3 times estimated 2023 earnings of $8.57 and 19.1 times estimated 2024 earnings of $10.04 per share. The stock’s 52-week trading range is $150.00 to $291.48. Albemarle pays an annual dividend of $1.56 (yield of 0.83%). Total shareholder return over the past year was nearly 14.7%.

APA

Independent oil and gas producer APA Corp. (NYSE: APA) is also scheduled to release quarterly results after markets close on Wednesday. Over the past 12 months, the company’s stock price has increased by 105%, with all the growth coming since late September, when crude oil prices began their steady climb higher.

Last month the company released an interim report estimating that daily international production would decline by about 4 million barrels a day in the first quarter and U.S. production would be about 211 million barrels a day, just a million barrels short of company guidance.

Analysts remain bullish on the stock, with 14 of 27 having a rating of Buy or Strong Buy and 12 more rating the stock at Hold. At a share price of around $40.60, the upside potential based on a median price target of $52 is about 28.1%. At the high price target of $75, the upside potential is about 84.7%.

For the company’s first quarter of fiscal 2022, analysts expect APA to report revenue of $2.44 billion, up 1.3% sequentially and 16.7% year over year. Adjusted EPS are expected to come in at $2.09, up 62.1% sequentially and up 129.7% year over year. For full fiscal 2022, EPS are forecast at $9.44, up 142.1%, on sales of $9.93 billion, up 25.2%.

The stock trades at 4.3 times expected 2022 EPS, 4.6 times estimated 2023 earnings of $8.91 and 4.9 times estimated 2024 earnings of $8.23 per share. APA’s 52-week range is $15.54 to $45.22. The company pays an annual dividend of $0.24 (yield of 1.23%). Total shareholder return for the past year was 105.2%.

Barrick Gold

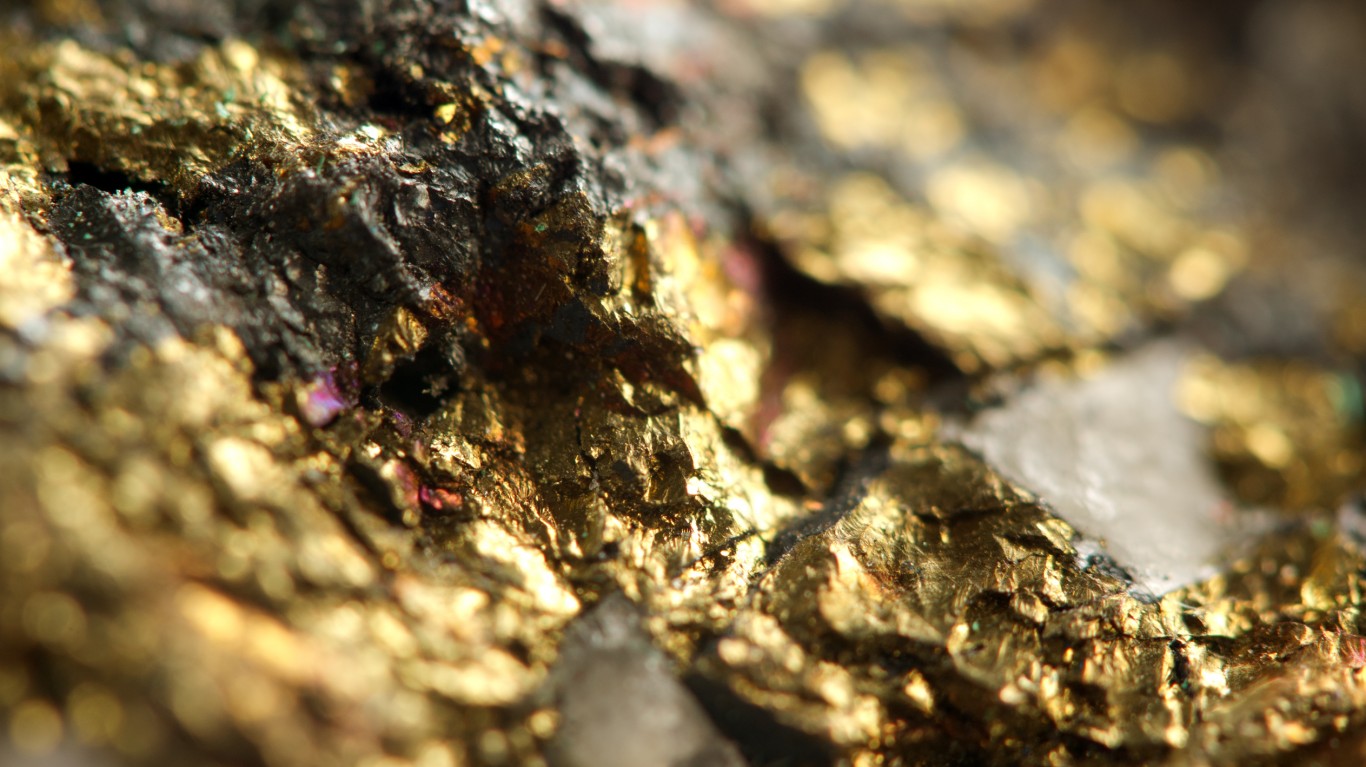

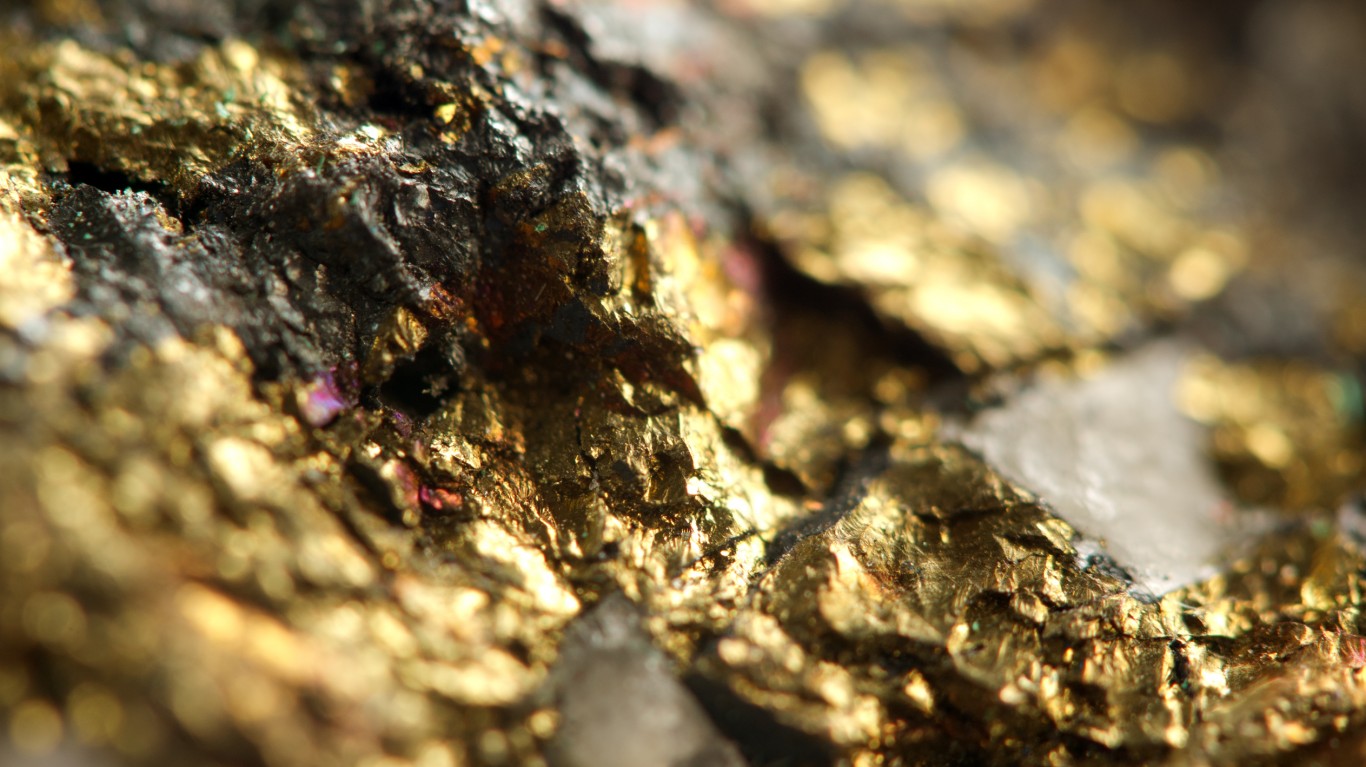

Over the past 12 months, the price of gold has increased by about 3.8%. Barrick Gold Corp. (NYSE: GOLD) has seen its share price rise by about 8.2% over the same period. Barrick reports quarterly results before Wednesday’s opening bell.

The current geopolitical tensions pushed gold futures to a high in early March of around $2,000 and Barrick stock to a 52-week high at the same time. A strong dollar, a 10-year Treasury note carrying a 3% interest rate and an expected federal interest rate hike on Wednesday have combined to weigh on the price of gold in the past few weeks. Unlike the dollar and U.S. Treasuries, gold is a non-yielding asset that raises the opportunity cost of holding the yellow metal instead of dollars or Treasury notes.

Analysts remain bullish on Barrick stock, with 19 of 25 brokerages having a Buy or Strong Buy rating while the rest have a Hold rating. At a share price of around $22.20, the upside potential based on a median price target of $28 is about 26.1%. At the high price target of $31.75, the upside potential is 43%.

First-quarter revenue is forecast at $2.78 billion, down 15.9% sequentially and about 6.1% lower year over year. Adjusted EPS are forecast at $0.24, down 31.8% sequentially and down 17.2% year over year. For full fiscal 2022, estimates call for EPS of $1.15, down 0.6%, on sales of $12.05 billion, down 0.5%.

Barrick stock trades at 19.2 times expected 2022 earnings, 17.8 times estimated 2023 earnings of $1.24 and 18.2 times estimated 2024 earnings of $1.22 per share. The stock’s 52-week range is $17.27 to $26.07. Barrick pays an annual dividend of $0.37 (yield of 3.57%). Total shareholder return for the past year was 8.2%.

Cameco

Over the past year, Canada-based uranium producer Cameco Corp. (NYSE: CCJ) has seen its share price rise by nearly 52%. At its peak in mid-April, the stock was up about 88% at a level it had not seen in nearly 11 years. Since the April peak, uranium prices have dropped by almost $11 a pound (about 16%). Cameco reports results first thing Thursday morning.

The U.S. Securities and Exchange Commission on Friday rejected an application from Sprott Asset Management to list the firm’s Physical Uranium Trust ETF on a U.S. exchange. The Sprott ETF has been driving uranium prices higher since mid-August, while trading on the Toronto Stock Exchange and over-the-counter (SRUUF) in the United States. Uranium prices ticked up a bit following the SEC announcement.

Analysts are solidly bullish on Cameco stock. Of 12 brokerages covering the shares, all have a Buy or Strong Buy rating. At a share price of around $25.50, the upside potential based on a median price target of $36.43 is 42.9%. At the high price target of $36.95, the upside potential is about 44.9%.

First-quarter revenue is forecast at $312.45 million, down 15% sequentially but up 35.4% year over year. Analysts expect Cameco to post an adjusted loss per share of $0.01, down from EPS of $0.05 in the prior quarter but better than the year-ago loss of $0.06 per share. For the full fiscal 2022 year, EPS currently are forecast at $0.20, better than the $0.20 per share loss last year, on sales of $1.38 billion, up 18.1%.

Cameco stock trades at 129.1 times expected 2022 earnings, 38.1 times estimated 2023 earnings of $0.67 per share and 34.1 times estimated 2024 earnings of $0.75 per share. The stock’s 52-week range is $15.31 to $32.49. Cameco pays an annual dividend of $0.06 (yield of 0.25%). Total shareholder return for the past year was 51.8%.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.