Massachusetts-based drug developer Acrivon Therapeutics aims to raise $100M through its initial public offering in what is shaping up to be one of the largest biotech IPOs for the year.

The cancer biotech firm first filed with the U.S. Securities and Exchange Commission (SEC) in October but held back from revealing price details on the launch. Acrivon announced last Thursday that it would be offering 5.9 million shares at a range between $16.00 to $18.00. The IPO is due to price on Wednesday night, November 9, before floating on the Nasdaq under the ticker “ACRV” on Thursday, November 10.

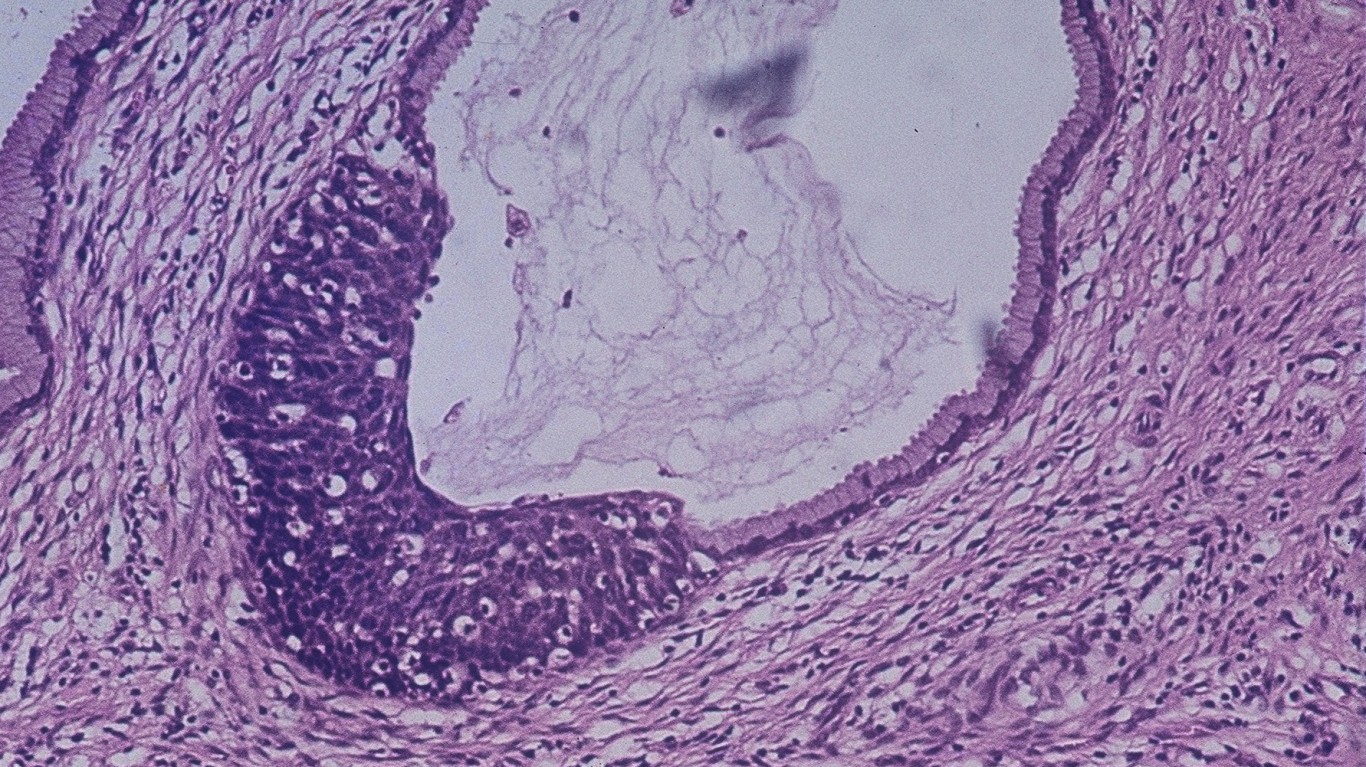

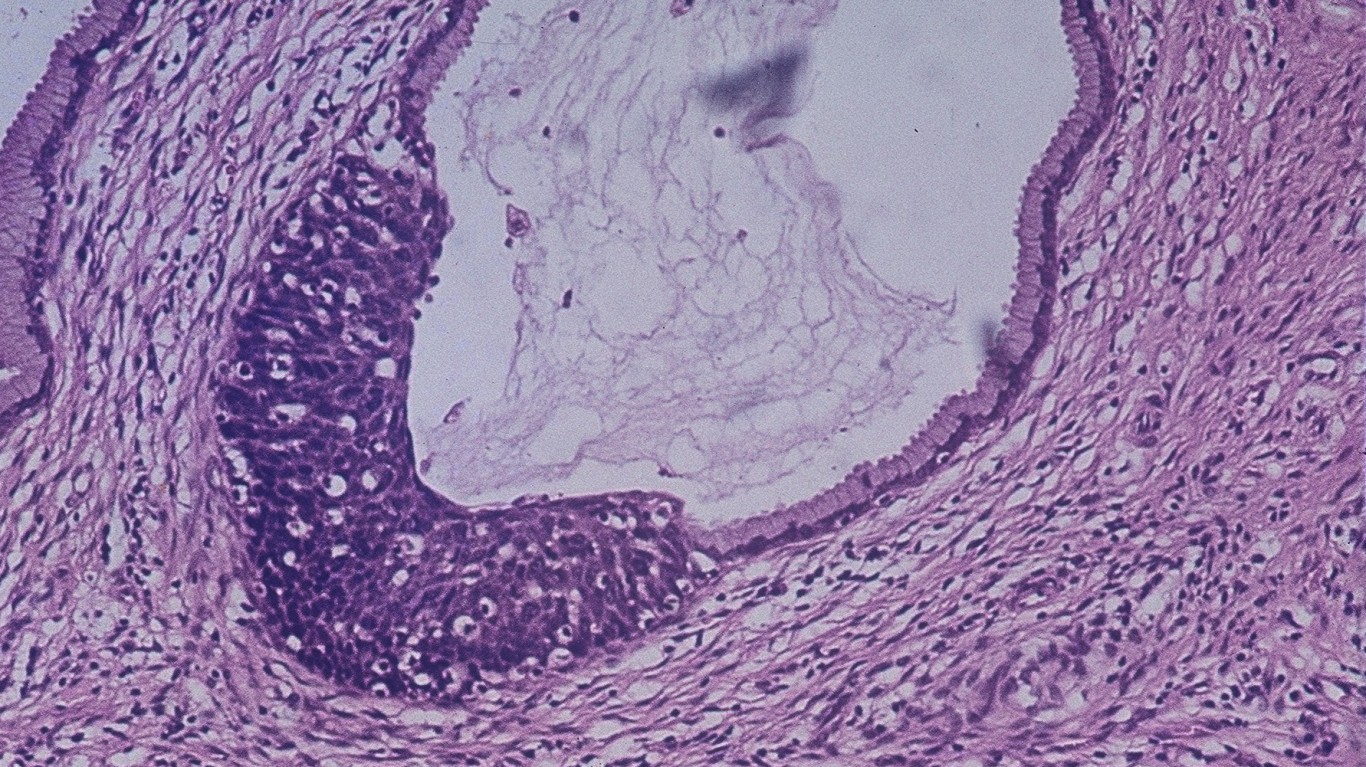

The firm specializes in developing precision oncology medicines. Its proprietary “Acrivon Predictive Precision Proteomics” (or AP3) platform leverages diagnostics to predict the likely response of a given tumor to a drug, enabling highly specific administration to patients.

In June, the firm’s leading drug candidate, the ACR-368, obtained clearance from the U.S. Food and Drug Administration (FDA) to progress with Phase 2 clinical trials. As a kinase inhibitor, the ACR-368 treats cancer by inhibiting specific enzymes that trigger a tumor’s growth.

The ACR-368 will be tested on multiple tumor types, including ovarian, endometrial, and bladder cancers.

By last year’s end, the firm had raised over $120 million in private markets. Its biggest backers include Chione Limited, RA Capital Management, Perceptive Life Sciences, Citadel, Wellington Biomedical, and Sands Capital Life Sciences.

Investors will note Acrivon is currently running at a loss. Last year the company ran through $16 million and generated no revenue.

Demand is increasing for the kind of drugs Acrivon develops. According to Straits Research, last year, the global Ovarian Cancer Market was worth US$1.54 billion but is expected to grow at an average compounding rate of 23.8% for the rest of the decade to reach around US$20 billion by 2030.

Some of the more established players in the space include Sierra Oncology, AstraZeneca, Janssen Pharmaceuticals, Johnson & Johnson, ImmunoGen, and Eli Lilly and Company, which partnered with Acrivon on ACR-368 trials. Investors will be sizing up how much of this growing market Acrivon may be able to seize upon once it goes public.

Yet Acrivon isn’t the only biotech company jumping into the markets this election week. Intensity Therapeutics (which also develops drugs for cancer), machine learning pharmaceutical research platform Bullfrog AI, and nuclear medicine firm ASP Isotopes, are all due to go public, albeit at much smaller caps.

Investors will be keeping an eye on politics this week as the nation heads to the ballot box for the midterm elections on Tuesday. Historically, mid-term elections have often triggered a shift to bullish sentiment in the markets.

One study from Morgan Stanley that collated data from 1930 to 2018 showed the Dow Jones Industrial Average (DJIA) typically slumps in the lead-up to mid-terms before making up for lost ground in the period afterwards. The DJIA underperformed by around 4% up to the mid-terms (from January through to October) but then outperformed historical averages by 6% in the following year (from October to October the following year), per the study.

Predicting the outcome of this week’s election is hard enough – how equities go is anyone’s guess at this stage. Yet, Acrivon and other newly-listed companies could benefit from a boost to their initial floating if markets follow that historical trend.

This post was produced and syndicated by Wealth of Geeks.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.