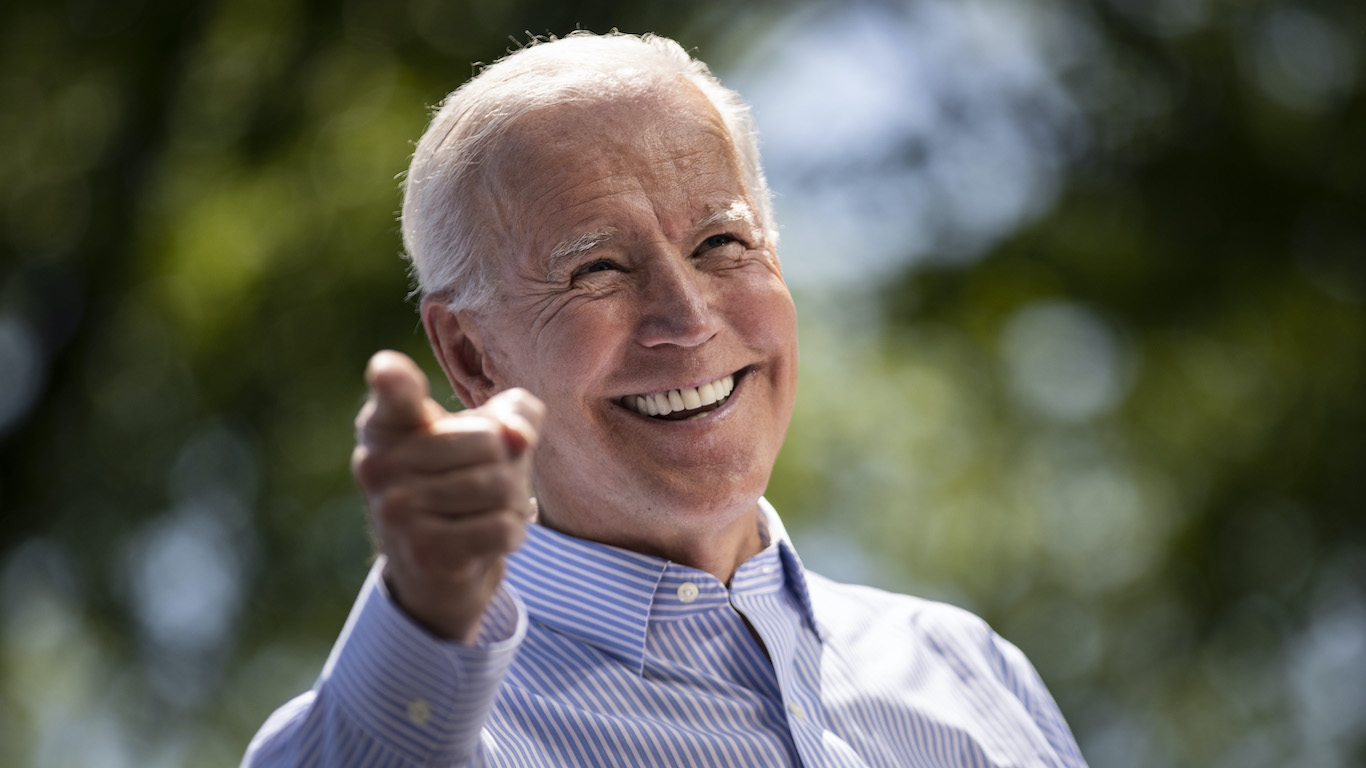

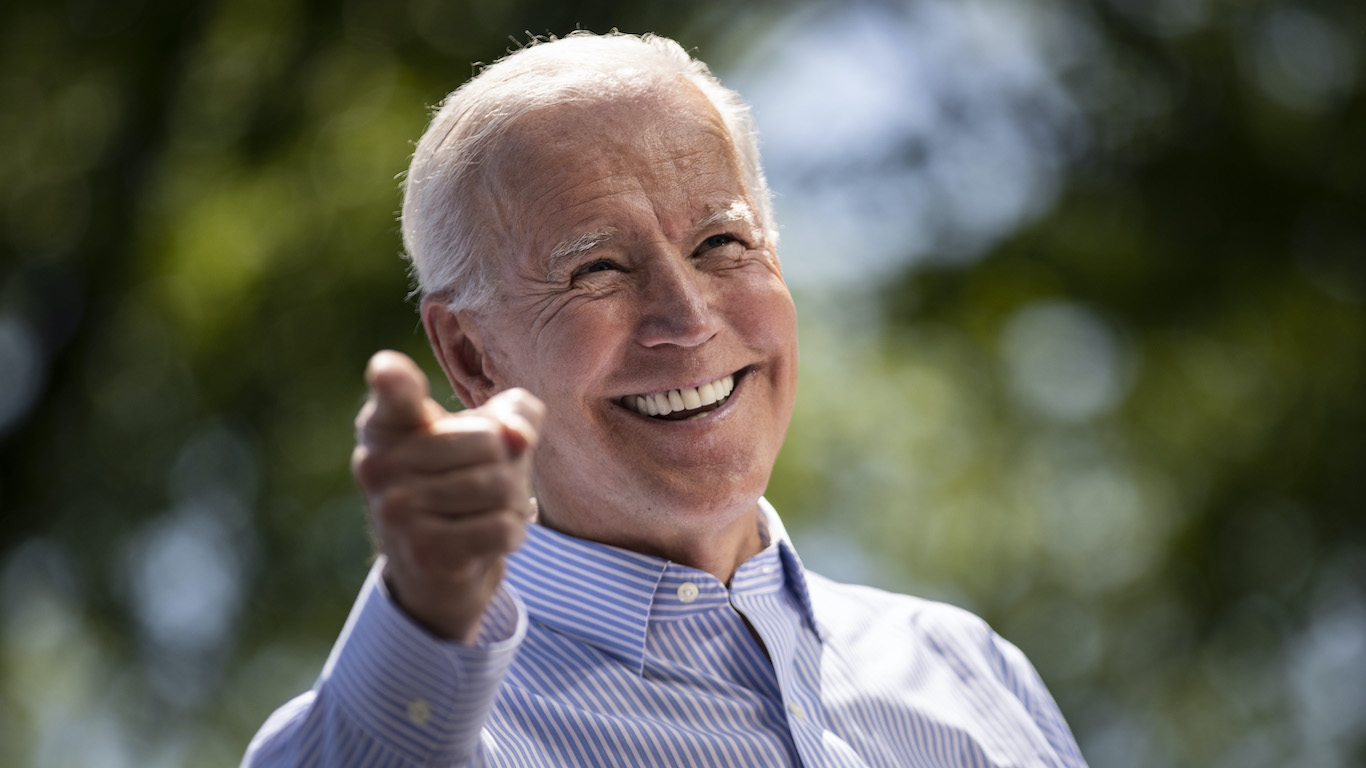

Emboldened by a better-than-expected performance by Democrats in Tuesday’s midterms, as well as Thursday’s bullish inflation numbers, President Joe Biden plans to arrive at COP27 in Egypt Friday with a plan to require almost all federal contractors to slash emissions to within limits tagged by Paris Agreements of 2015.

It’s a significant expansion of Biden’s climate agenda, though the plan calls for the contractors themselves to simply cut their direct greenhouse, so-called Scope 1 and Scope 2 emissions. Investors reading the tea leaves of what this could mean for the Securities and Exchange Commission’s upcoming climate disclosure rules might infer the government is setting the stage for the SEC to also leave out requirements for indirect emissions, or Scope 3, which have become controversial on Wall Street.

Renewable stocks, which on Election Day rose amid speculation the Democrats would do better than most polls predicted, soared this morning as signs that inflation is moderating and more voting returns indicating the Democrats might be able to hold the Senate attracted funds to solar companies in particular. The Invesco Solar ETF $TAN leaped almost 7%. The ETF is up more than 19% in the past month.

Whether Biden and climate czar John Kerry might use this week’s momentum to commit to some form of funding mechanism for compensation for small countries fighting global warming will be the key question in Sharm El-Sheikh as Biden arrives. Most delegates at the summit aren’t holding their breath, but this has been a week of surprises and Biden seems keen to push his luck.

More insights below . . . .

As fund managers boost shareholder voting power, climate pressure suffers

. . . . A drive by large fund managers such as BlackRock $BLK to allow shareholders of their funds to vote individually on climate resolutions at big companies will end up diluting the power of shareholders to force change on global warming at their holdings, not increase power as the fund managers are hoping, writes Mark Hulbert. The interesting take comes as the big managers increasingly are trying to distance themselves from looking overly pro-environmental in the face of political backlash against their businesses from red states. In this case, the plan to grant shareholders more freedom to vote how they want looks set to backfire. . . .

A selection of this week’s subscriber-only insights

. . . . African financial institutions aren’t counting on a lot more than talk from wealthy nations at COP27 in Egypt this week to discuss “loss and damage” funding for smaller countries fighting global warming. Eighty-five African insurers banded together this week to announce their own, $14 billion funding facility to protect small communities from the ravages of flood and fire. In addition to being necessary, it’s a crafty move by the hosts of COP27 to apply pressure to countries like the U.S. and China to cough up financial reparations for the damage their own emissions cause. . . .

. . . . Is the renewables cat out of the bag? Regardless of any remaining uncertainties around the U.S. midterm elections, Al Gore says at COP27 that whatever politicians in different countries want to opine on, “we’re seeing business and investors and markets move toward solutions for the climate crisis.” Read more. . . .

. . . . Earlier this week, news of a standoff between wind developer Avangrid and the state of Massachusetts came to a head after the company said it wanted to renegotiate its terms to build and offshore facility. Part of the problem, Avangrid said, was rising interest rates. They are not the only one. Read more here. . . .

Editor’s picks: New global emissions data; Nicole heads north

Today’s release covers more than ever before:

–#Emissionsdata for 70K+ individual sources worldwide

-Updated country/sector level data for 2021

-New capability to examine data by different #GHGs

-New capability to examine data by 20yr vs. 100yr GWPhttps://t.co/NmqqEf8qPZ pic.twitter.com/9Nmp370AFR— Climate TRACE (@ClimateTRACE) November 9, 2022

Hurricane Nicole: late in the season but still unwelcome

Nicole became a Category 1 hurricane just before landfall along Florida’s Atlantic coast Thursday morning, but has weakened to a tropical storm as it moves north. Parts of the state are still trying to recover from Hurricane Ian a little over a month ago. Forecasters say coastal flooding, strong winds, flooding rain and tornadoes are expected along the Southeast coast. Heavy rain, strong winds and even tornadoes are possible in the rest of the East on Friday and Saturday. It’s the latest in the season that such a storm has hit Florida and could rank among the strongest storms to hit the U.S. so late in the season. The Weather Channel reports Nicole was just the fourth November hurricane to landfall in the mainland U.S. in records dating to the mid-19th century, and the first to do so in 37 years.

World Cup emissions reviewed

Qatar and FIFA say the largest source of emissions for the 2022 men’s World Cup soccer tournament will be travel — mostly the miles flown from overseas, making up 52% of the total emissions for the event. According to a report for The Associated Press, construction of the stadiums and training sites and their operations will account for 25%, while operating hotels and other accommodations for the five weeks, including the cruise ships Qatar hired as floating hotels, will contribute 20%. “For years, Qatar promised something else to distinguish this World Cup from the rest: It would be ‘carbon-neutral,’ or have a negligible overall impact on the climate,” the AP says, but experts are skeptical of the processes being used to account for emissions. In an official report estimating the event’s emissions, Qatari organizers and FIFA projected that the World Cup will produce some 3.6 million metric tons of CO₂ from activities related to the tournament between 2011 and 2023.

Global costs of extreme weather attributable to climate change

Extreme weather events have significant adverse costs for individuals, firms, communities, regional, and national economies, according to a Center for Economic Studies working paper titled The Global Costs of Extreme Weather that are Attributable to Climate Change. The authors use Extreme Event Attribution methodology to aggregate the global economic damage from extreme weather events that is attributable to anthropogenic climate change. According to the abstract, integrated assessment models are substantially under-estimating the current economic costs of climate change. Authors: Rebecca Newman, Reserve Bank of New Zealand; and Ilan Noy, Victoria University of Wellington.

Words to live by . . . .

“We are on a highway to climate hell with our foot on the accelerator. Our planet is fast approaching tipping points that will make climate chaos irreversible.” — António Guterres, secretary-general of the UN, speaking at COP27.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.