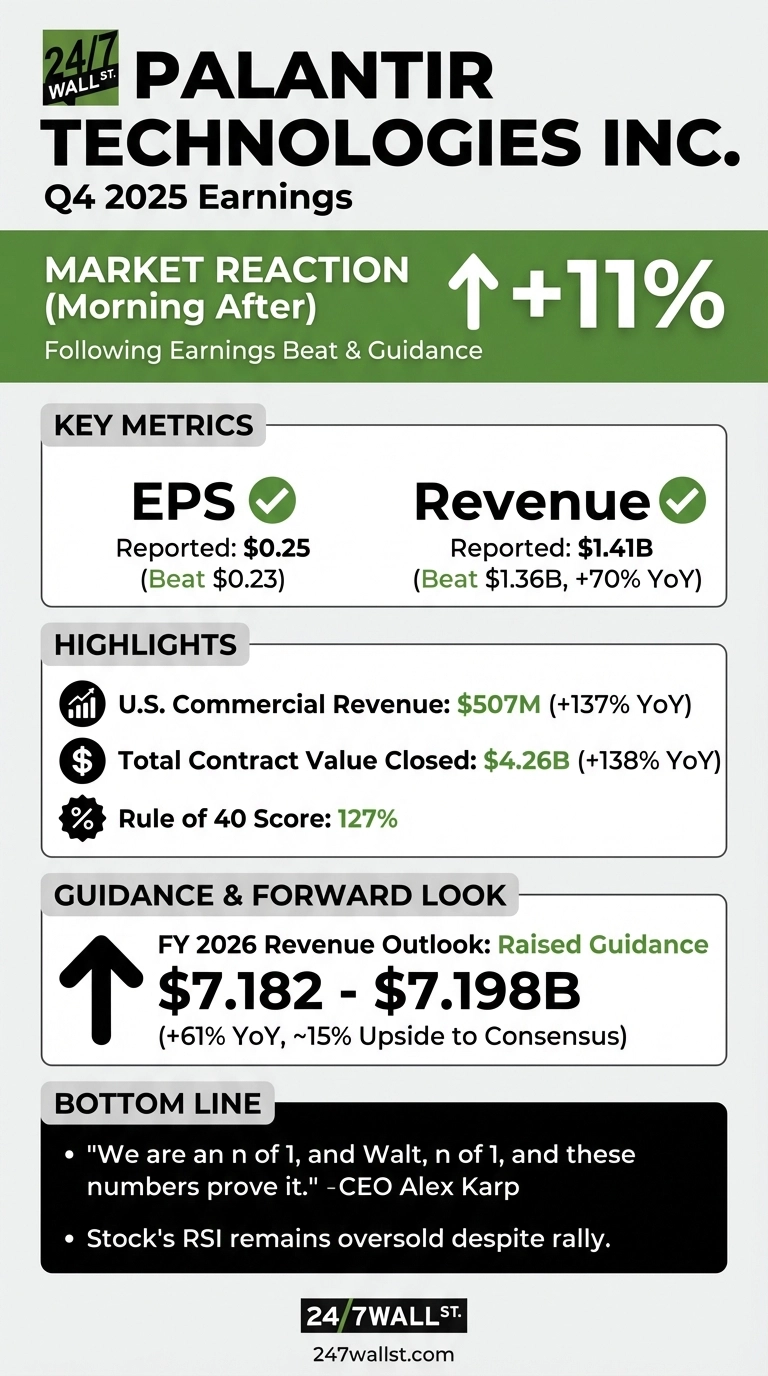

Palantir (NASDAQ: PLTR | PLTR Price Prediction) reported Q4 results that beat across the board, and investors are carrying that momentum into Tuesday’s open. As we noted in our live earnings coverage yesterday, the key question was whether management could sustain the commercial growth trajectory that defined 2025. They delivered an emphatic answer.

Guidance Drives the Reaction

Revenue hit $1.41 billion, up 70% year-over-year and ahead of the $1.36 billion consensus. EPS of $0.25 topped estimates of $0.23. But the number that matters most is the full-year 2026 revenue guide: $7.182 to $7.198 billion, implying 61% growth. That compares to a Street estimate of $6.22 billion, representing 15% upside to consensus.

U.S. commercial revenue grew 137% year-over-year to $507 million, accelerating from the prior quarter’s already-strong pace. U.S. government revenue rose 66% to $570 million. The company closed $4.26 billion in total contract value, up 138% year-over-year, signaling demand isn’t slowing.

Operating leverage remains intact. Net income reached $609 million, a 43% margin. Operating cash flow came in at $777 million. The company’s Rule of 40 score, a measure of growth plus profitability, hit 127%. CEO Alex Karp framed it bluntly: “Palantir’s Rule of 40 score is now an incredible 127%. Last quarter, our U.S. revenue grew 93% year-over-year and U.S. commercial revenue grew 137% year-over-year. We are also announcing a 2026 revenue growth guide of 61% year-over-year. We are an n of 1, and these numbers prove it.”

Market Sentiment Turns Bullish

Reddit sentiment shifted sharply positive overnight. A post titled “Palantir Reports Revenue Growth of 70% Y/Y; Issues FY 2026 Revenue Guidance of 61% Y/Y” accumulated 296 upvotes and 218 comments by early Tuesday morning. Sentiment scores moved from unclassified at the announcement to 88 (very bullish) by 3 a.m. ET, then normalized to 78 (bullish) by morning.

Prediction markets on Polymarket show conviction building around higher price targets. The $174 monthly high target commands the highest volume with 68% probability priced in. Markets assign 97.65% probability the stock closes above $140 by month-end, declining to 88% for a close above $150.

What to Watch This Week

Analyst calls are already moving. Wall Street coverage highlighted Palantir in top analyst research calls Tuesday morning, with upgrades featured alongside the earnings beat. The stock’s RSI of 27.09 remains in oversold territory despite the rally, suggesting room to run from a technical perspective.

The broader AI infrastructure narrative is gaining traction. Multiple companies including Teradyne and Woodward reported strong results tied to data center buildout, validating the demand environment Palantir is capturing. We’ll track whether this momentum holds as the week progresses and analysts digest the guidance implications.