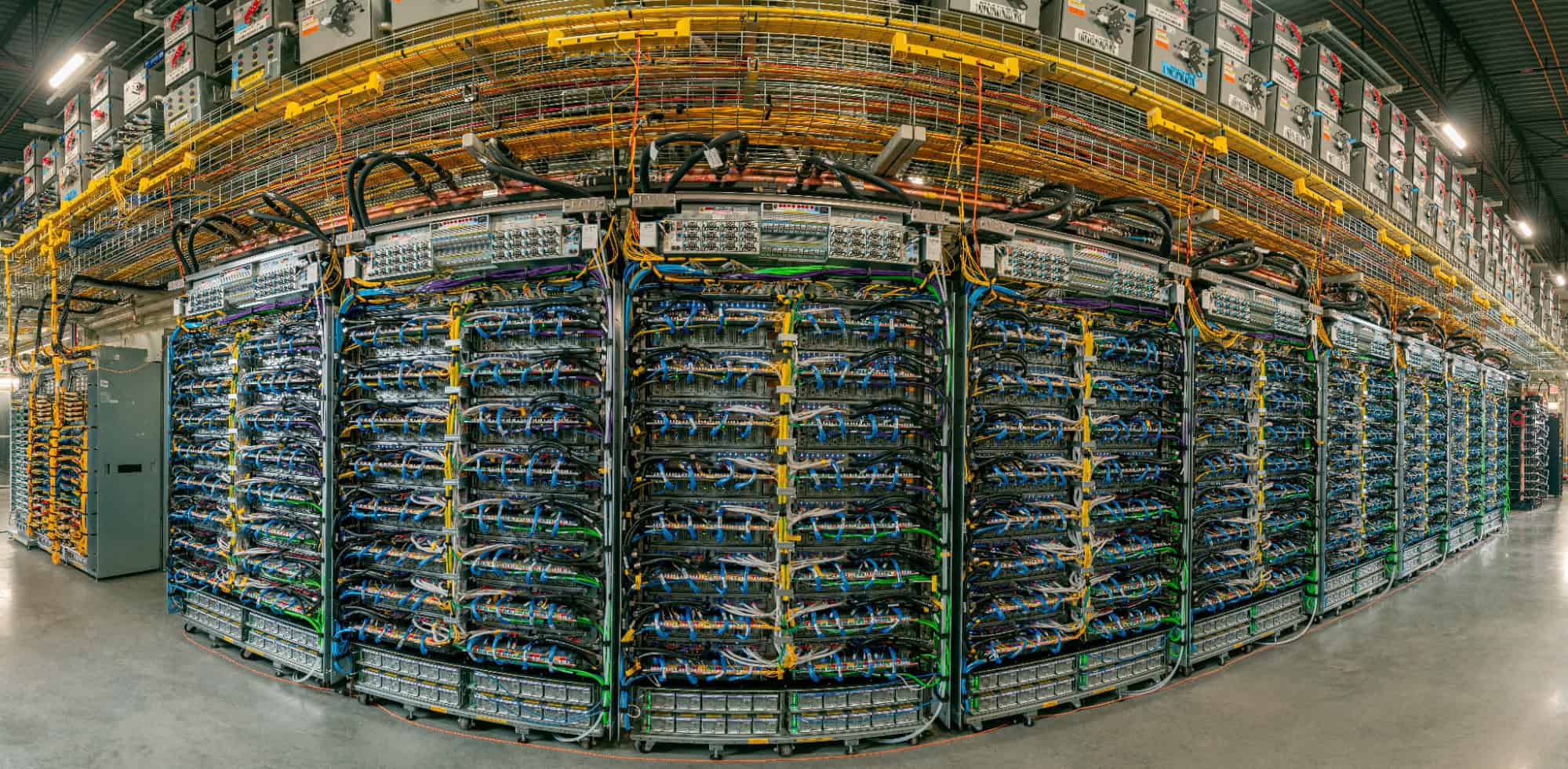

The AI infrastructure arms race has reached a staggering scale. Hyperscalers are collectively pouring approximately $700 billion into AI CapEx in 2026. Amazon (Nasdaq: AMZN) | AMZN Price Prediction just announced $200 billion in planned spend, Alphabet (Nasdaq: GOOGL) is projected $185, Meta Platforms (Nasdaq: META) up to $135 billion, and Microsoft will reveal an updated capex target closer to summer.

That kind of spending makes it “hard to bet against Nvidia,” as one analyst put it. But here’s the paradox: Nvidia (NASDAQ:NVDA) stock has struggled despite this thesis, up just 0.24% year-to-date while the broader AI infrastructure buildout accelerates. Let’s explore what’s going on and why stocks like Broadcom (Nasdaq: AVGO), Micron (Nasdaq: MU), and Bloom Energy (Nasdaq: BE) have seen stronger recent gains.

The $700 Billion Breakdown

Hyperscaler spending is concentrated among the mega-cap tech giants. Alphabet, Meta Platforms, Microsoft (NASDAQ:MSFT), and Amazon are deploying massive capital into AI infrastructure and cloud computing, with Microsoft’s Azure and Amazon’s AWS competing for AI workload dominance. Together, these hyperscalers are funding the largest technology infrastructure expansion in history.

Secondary spending comes from ‘neoclouds’ like CoreWeave and Nebius, while other projects like sovereign AI data centers add even more fuel to the rapidly growing spending pie.

The Nvidia Paradox

Nvidia should be the obvious winner. The company has seen explosive Data Center growth, with AI revenue exponentially growing across training and inference. Yet the stock trades at $186.94, essentially flat for the year. The market seems to be pricing in execution risk or questioning whether $700 billion in CapEx translates to sustained GPU demand beyond the initial buildout phase.

Personally, I’m betting this is a mistake on Wall Street’s part. NVIDIA is my largest personal position, and I own it in the $500,000 portfolio I manage as part of 24/7 Wall Street’s AI Investor Podcast. Since we first recommended a buy of NVIDIA on 9/12/2024, shares are up 55%. That’s a healthy return in a year and a half for stock that was considered ‘overbought’ at the time by most of the media.

Still, you might be wondering what other stocks benefit from this $700 billion buildout beyond NVIDIA. Here are some stocks to consider.

Who Else Wins Beyond Nvidia?

The $700 billion wave creates opportunities across the entire supply chain. These picks-and-shovels plays are seeing explosive growth as AI infrastructure spending accelerates.

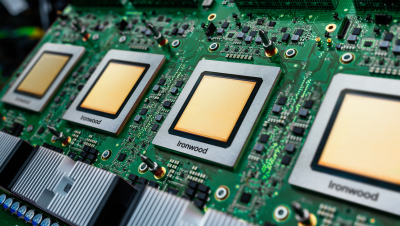

Broadcom: Custom Chip Winner

Broadcom (NASDAQ:AVGO) is capturing custom chip demand, with strong AI semiconductor revenue growth driven by custom AI accelerators and Ethernet AI switches. The stock is up 41% over the past year. We first recommended it in the $500,000 Portfolio on October 11, 2024 and later re-recommended it. Both recommendations are up more than 80%.

Broadcom shares are down 4% year-to-date despite its primary customer Google announcing $185 billion in capex, a number that was more than 50% above analyst expectations.

Lumentum: Optical Component Surge

Optical components are seeing explosive growth. Lumentum (NASDAQ:LITE) has seen strong data center and long-haul momentum, with optical circuit switches and co-packaged optics as next growth engines. The stock has surged 637% over the past year.

We first recommended it in the AI Portfolio on 11/8/2024 and shares are up 590% since. We’ve pounded the table since, such as when we brought on an optics expert on our March 28th episode last year titled ‘These Optical Stocks Could Be Set to Ride an Optical Supercycle.‘

Micron Technology: Memory Demand

Memory is another winner. Micron Technology (NASDAQ:MU) has seen AI memory demand driving record results as the only US-based memory manufacturer. The stock is up 353% over the past year. Once again, we recommended Micron before its most significant gains. Our January 17th recommendation last year is now up 292%.

Bloom Energy: Power Infrastructure

Power infrastructure plays are emerging. Bloom Energy (NYSE:BE) has seen strong momentum addressing AI data center power demands, with product backlog growing significantly. The stock has jumped 492% over the past year. Bloom Energy isn’t a stock we’ve recommended in our $500,000 AI Portfolio, but it could make the cut when we record our next episode.

The Next Wave of Buys

If you’re looking for other stocks that could benefit from the $700 billion buildout, make sure to subscribe to the AI Investor Podcast. On our next episode, we’re issuing a series of new buy recommendations. It’s absolutely free to subscribe and get each new idea. So far, our average recommendation is up 87%!