Source: courtesy J.C. Penney Co. Inc.

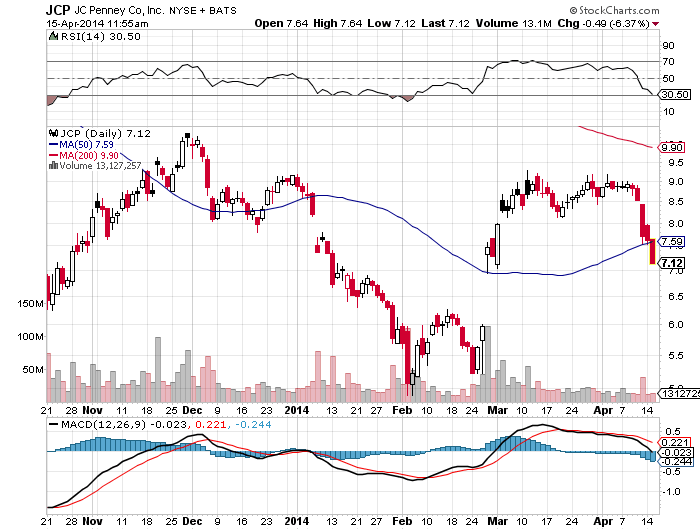

There was no news on the company Tuesday, but options traders were bailing out on call options at the $9 strike price at next Friday’s options expiration date. When is the last time J.C. Penney’s stock saw $9? Just a week ago, on April 7, shares touched $9.01 before closing at $8.88. On April 8, shares closed at $8.92, and the stock’s been on a slide ever since.

The options guys do not appear to be worried at all that J.C. Penney will hit the $9 level any time soon. The only way to lose by selling a call option now is to have the stock close above $9 a share next Friday. It could happen, but there is absolutely no reason to expect that it will.

So investors are following options trader and getting out. Shares have sunk more than 7% at the noon hour on Tuesday to trade at $7.05, and the pace of the decline has been picking up. The stock’s 52-week range is $4.90 to $19.63.

Here is what the chart looks like:

Source: StockCharts.com

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.