Nike Inc. (NYSE: NKE) reported its fiscal third-quarter financial results on Thursday after the close of trading. The sports apparel giant had very strong earnings, but this would have been far better had its currency issues not been such a drag. Nike reported $0.89 in earnings per share (EPS) on $7.46 billion in revenue, compared to Thomson Reuters consensus estimates of $0.84 in EPS on $7.62 billion in revenue. The same quarter from the previous year had $0.76 in EPS on $6.97 billion in revenue. Source: Wikimedia Commons

Source: Wikimedia Commons

Gross margin for the third quarter expanded by 140 basis points to 45.9%. This benefit came from a continued shift in mix to higher margin products, but it was partially offset by higher product input and warehousing costs.

During the third quarter, Nike repurchased a total of 6.5 million shares for approximately $612 million as part of the four-year, $8 billion program approved by the board of directors in September 2012. As of the end of the third quarter, a total of 74.1 million shares had been repurchased under this program for approximately $5.3 billion, an average cost of $71.13 per share.

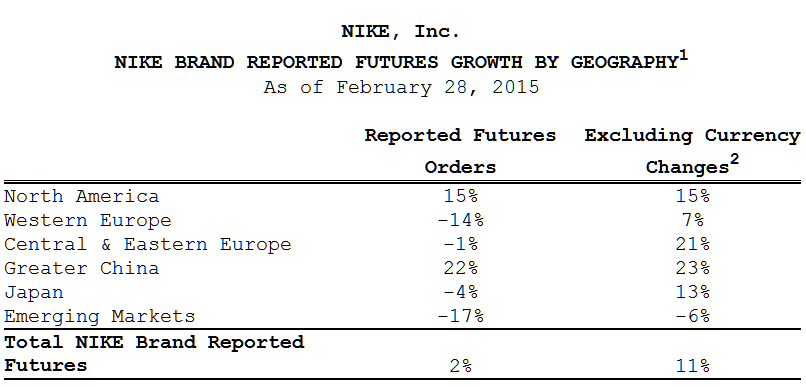

Worldwide futures orders that were scheduled for delivery between March 2015 and July 2015 were up 2%. As you can see in the table below, it would be much higher at 11% excluding currency changes. In terms of its growth, Nike is on point, but the company just needs to get through this currency storm before it can truly realize all the revenue it is currently missing out on.

ALSO READ: Tag Heuer, Google and Intel to Challenge Apple Watch

Mark Parker, president and CEO of Nike, said:

Our strong third quarter results show that our growth strategies are working, even under challenging macroeconomic conditions. Nike has the ability to deliver consistent shareholder value due to the strength of our brand, our relentless commitment to innovation and our powerful portfolio that allows us to invest in the opportunities with the highest potential for growth as well as manage risk.

Shares of Nike closed Thursday up 0.8% at $98.32. Following the release of the earnings report, shares were up another 0.5% or so in the after-hours trading session. The stock has a consensus analyst price target of $102.24 and a 52-week trading range of $70.60 to $99.76.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.