As companies around the world struggle to mitigate the damage caused by the coronavirus pandemic, executive leadership is being put to the test. CEOs are facing intense scrutiny for how and when they are reopening their companies. While 2020 might see a freeze in CEO salary, 2019 was a good year for executive pay, as many chief executives were rewarded with huge compensation packages, often worth more than $20 million per year.

24/7 Wall St. reviewed information provided by public business information company MyLogIQ to determine the 50 highest paid CEOs of 2019. CEOs were ranked based on their total compensation, which typically includes salary, bonuses, stock options, and more. Median employee pay by company was also provided by MyLogIQ.

Many corporate leaders have to make difficult choices to help their companies through the pandemic — particularly those in vulnerable industries like oil and gas or entertainment. Many executives in these sectors have furloughed workers, scaled back operations, and reduced their own pay — like GE CEO Lawrence Culp who said he will forgo his salary for the rest of the year. These are the U.S. industries being devastated by the coronavirus.

The CEOs on this list tend to be concentrated in certain industries such as technology, energy, and health care. Even though employees in these fields tend to be relatively well compensated, all CEOs on this list make at least 100 times as much as the median pay of their employees. In some cases, they make more than 1,000 times as much. These are the CEOs that make 1,000 times more than their employees.

Click here to see the 50 highest paid CEOs in 2019

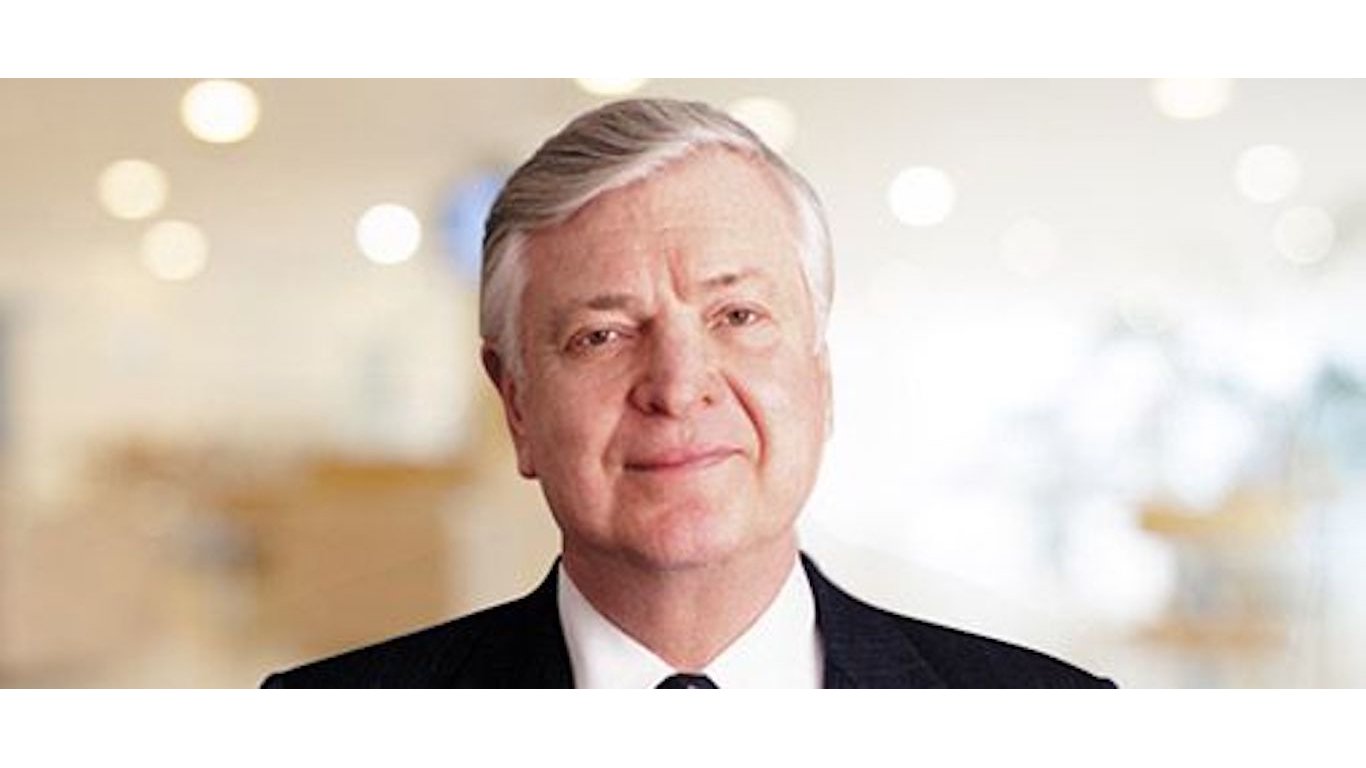

50. Gary R. Heminger (stepped down in March 2020)

> Company: Marathon Petroleum Corp

> Industry: Energy

> Total 2019 CEO compensation: $24.1 million

> Annual company revenue: $123.9 billion

> Median employee salary: $27,507

> CEO pay vs. median employee salary: 877 times higher

[in-text-ad]

49. Michael W. Lamach

> Company: Trane Technologies Plc

> Industry: Manufacturing

> Total 2019 CEO compensation: $24.2 million

> Annual company revenue: $16.6 billion

> Median employee salary: $54,757

> CEO pay vs. median employee salary: 442 times higher

48. Alfred F. Kelly Jr

> Company: Visa Inc.

> Industry: Financial services

> Total 2019 CEO compensation: $24.3 million

> Annual company revenue: $23.0 billion

> Median employee salary: $142,494

> CEO pay vs. median employee salary: 170 times higher

47. Laurence D. Fink

> Company: Blackrock Inc.

> Industry: Investment management

> Total 2019 CEO compensation: $24.3 million

> Annual company revenue: $14.5 billion

> Median employee salary: $133,644

> CEO pay vs. median employee salary: 182 times higher

[in-text-ad-2]

46. Alan B. Miller

> Company: Universal Health Services Inc

> Industry: Health care

> Total 2019 CEO compensation: $24.5 million

> Annual company revenue: $11.4 billion

> Median employee salary: $38,931

> CEO pay vs. median employee salary: 629 times higher

45. James M. Cracchiolo

> Company: Ameriprise Financial Inc

> Industry: Financial services

> Total 2019 CEO compensation: $24.5 million

> Annual company revenue: $13.0 billion

> Median employee salary: $106,428

> CEO pay vs. median employee salary: 230 times higher

[in-text-ad]

44. H. Lawrence Culp, Jr.

> Company: General Electric Co

> Industry: Industrial machinery manufacturing

> Total 2019 CEO compensation: $24.6 million

> Annual company revenue: $95.2 billion

> Median employee salary: $50,471

> CEO pay vs. median employee salary: 486 times higher

43. David M. Solomon

> Company: Goldman Sachs Group Inc

> Industry: Financial services

> Total 2019 CEO compensation: $24.7 million

> Annual company revenue: $36.5 billion

> Median employee salary: $138,854

> CEO pay vs. median employee salary: 178 times higher

42. Sheldon G. Adelson

> Company: Las Vegas Sands Corp

> Industry: Resorts and casinos

> Total 2019 CEO compensation: $24.7 million

> Annual company revenue: $13.7 billion

> Median employee salary: $42,228

> CEO pay vs. median employee salary: 584 times higher

[in-text-ad-2]

41. Norman Thomas Linebarger

> Company: Cummins Inc

> Industry: Industrial machinery manufacturing

> Total 2019 CEO compensation: $25.1 million

> Annual company revenue: $23.6 billion

> Median employee salary: $73,480

> CEO pay vs. median employee salary: 342 times higher

40. Alex Gorsky

> Company: Johnson & Johnson

> Industry: Health care products

> Total 2019 CEO compensation: $25.4 million

> Annual company revenue: $82.1 billion

> Median employee salary: $76,000

> CEO pay vs. median employee salary: 334 times higher

[in-text-ad]

39. Michael Corbat

> Company: Citigroup Inc

> Industry: Financial services

> Total 2019 CEO compensation: $25.5 million

> Annual company revenue: $74.3 billion

> Median employee salary: $52,988

> CEO pay vs. median employee salary: 481 times higher

38. Daniel H. Schulman

> Company: Paypal Holdings, Inc.

> Industry: Financial services

> Total 2019 CEO compensation: $25.8 million

> Annual company revenue: $17.8 billion

> Median employee salary: $70,405

> CEO pay vs. median employee salary: 367 times higher

37. Charles H. Robbins

> Company: Cisco Systems, Inc.

> Industry: Technology

> Total 2019 CEO compensation: $25.8 million

> Annual company revenue: $51.9 billion

> Median employee salary: $142,593

> CEO pay vs. median employee salary: 181 times higher

[in-text-ad-2]

36. Marc Benioff

> Company: Salesforce.com Inc

> Industry: Technology

> Total 2019 CEO compensation: $26.0 million

> Annual company revenue: $17.1 billion

> Median employee salary: $167,750

> CEO pay vs. median employee salary: 155 times higher

35. Brian T. Moynihan

> Company: Bank of America Corp

> Industry: Financial services

> Total 2019 CEO compensation: $26.0 million

> Annual company revenue: $91.2 billion

> Median employee salary: $94,256

> CEO pay vs. median employee salary: 276 times higher

[in-text-ad]

34. Michael F. Neidorff

> Company: Centene Corp

> Industry: Health care

> Total 2019 CEO compensation: $26.4 million

> Annual company revenue: $74.6 billion

> Median employee salary: $68,987

> CEO pay vs. median employee salary: 383 times higher

33. Samuel N. Hazen

> Company: HCA Healthcare, Inc.

> Industry: Health care

> Total 2019 CEO compensation: $26.8 million

> Annual company revenue: $51.3 billion

> Median employee salary: $56,012

> CEO pay vs. median employee salary: 478 times higher

32. Jeffery W. Yabuki

> Company: Fiserv Inc

> Industry: Technology

> Total 2019 CEO compensation: $27.6 million

> Annual company revenue: $10.2 billion

> Median employee salary: $65,254

> CEO pay vs. median employee salary: 423 times higher

[in-text-ad-2]

31. Kenneth C. Frazier

> Company: Merck & Co. Inc.

> Industry: Pharmaceuticals

> Total 2019 CEO compensation: $27.6 million

> Annual company revenue: $46.8 billion

> Median employee salary: $95,621

> CEO pay vs. median employee salary: 289 times higher

30. Gary A. Norcross

> Company: Fidelity National Information Services, Inc.

> Industry: Technology

> Total 2019 CEO compensation: $27.7 million

> Annual company revenue: $10.3 billion

> Median employee salary: $59,235

> CEO pay vs. median employee salary: 467 times higher

[in-text-ad]

29. Miles D. White (stepped down in March 2020)

> Company: Abbott Laboratories

> Industry: Health care

> Total 2019 CEO compensation: $27.8 million

> Annual company revenue: $31.9 billion

> Median employee salary: $84,434

> CEO pay vs. median employee salary: 329 times higher

28. Thomas A. Fanning

> Company: Southern Co

> Industry: Utilities

> Total 2019 CEO compensation: $27.9 million

> Annual company revenue: $21.4 billion

> Median employee salary: $167,872

> CEO pay vs. median employee salary: 166 times higher

27. Joseph W. Gorder

> Company: Valero Energy Corp

> Industry: Energy

> Total 2019 CEO compensation: $28.2 million

> Annual company revenue: $108.3 billion

> Median employee salary: $272,417

> CEO pay vs. median employee salary: 104 times higher

[in-text-ad-2]

26. Daniel O’Day

> Company: Gilead Sciences Inc

> Industry: Pharmaceuticals

> Total 2019 CEO compensation: $29.1 million

> Annual company revenue: $22.4 billion

> Median employee salary: $173,264

> CEO pay vs. median employee salary: 168 times higher

25. Robert A. Kotick

> Company: Activision Blizzard, Inc.

> Industry: Electronic gaming

> Total 2019 CEO compensation: $30.1 million

> Annual company revenue: $6.5 billion

> Median employee salary: $94,308

> CEO pay vs. median employee salary: 319 times higher

[in-text-ad]

24. Ryan Lance

> Company: ConocoPhillips

> Industry: Energy

> Total 2019 CEO compensation: $30.4 million

> Annual company revenue: $36.7 billion

> Median employee salary: $186,334

> CEO pay vs. median employee salary: 163 times higher

23. Hamid R. Moghadam

> Company: Prologis, Inc.

> Industry: Real estate investment

> Total 2019 CEO compensation: $30.4 million

> Annual company revenue: $3.3 billion

> Median employee salary: $117,751

> CEO pay vs. median employee salary: 258 times higher

22. Marillyn A. Hewson

> Company: Lockheed Martin Corp

> Industry: Defense

> Total 2019 CEO compensation: $30.9 million

> Annual company revenue: $59.8 billion

> Median employee salary: $154,883

> CEO pay vs. median employee salary: 200 times higher

[in-text-ad-2]

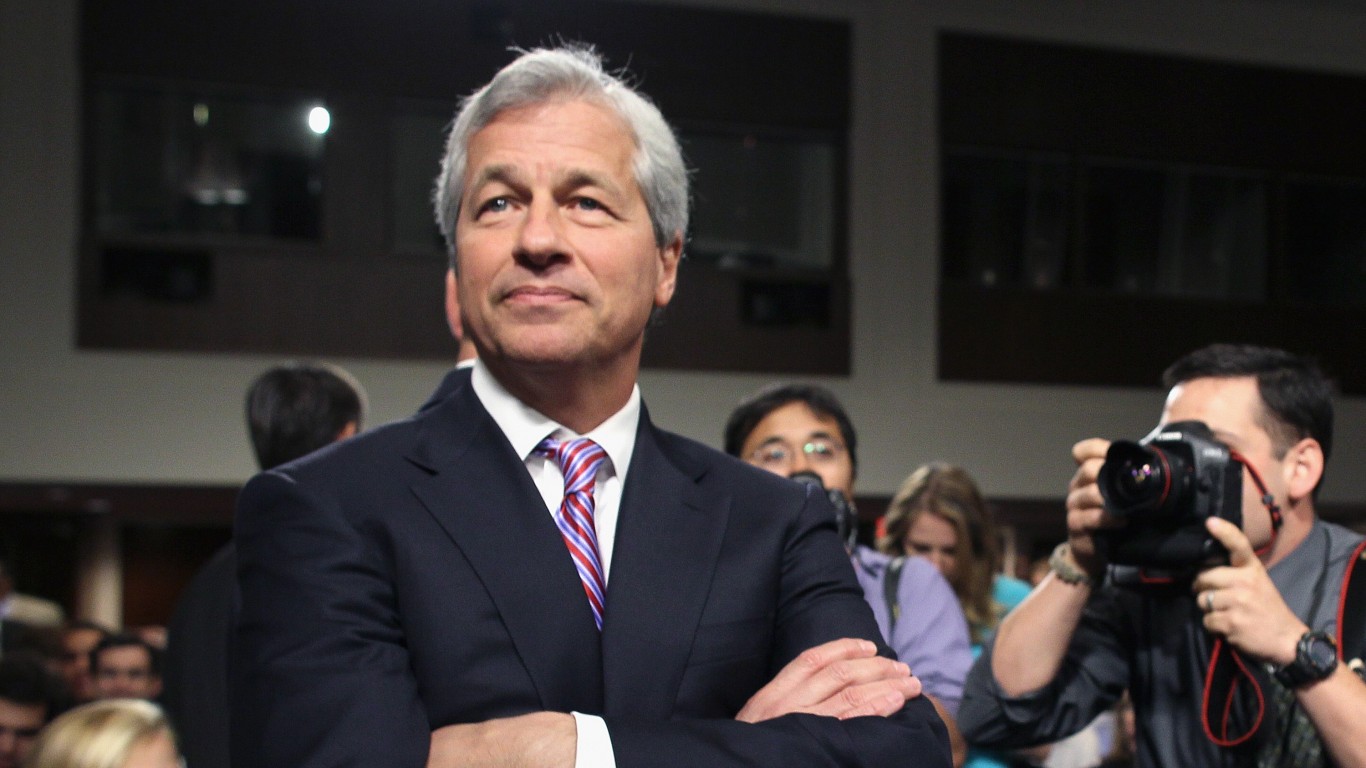

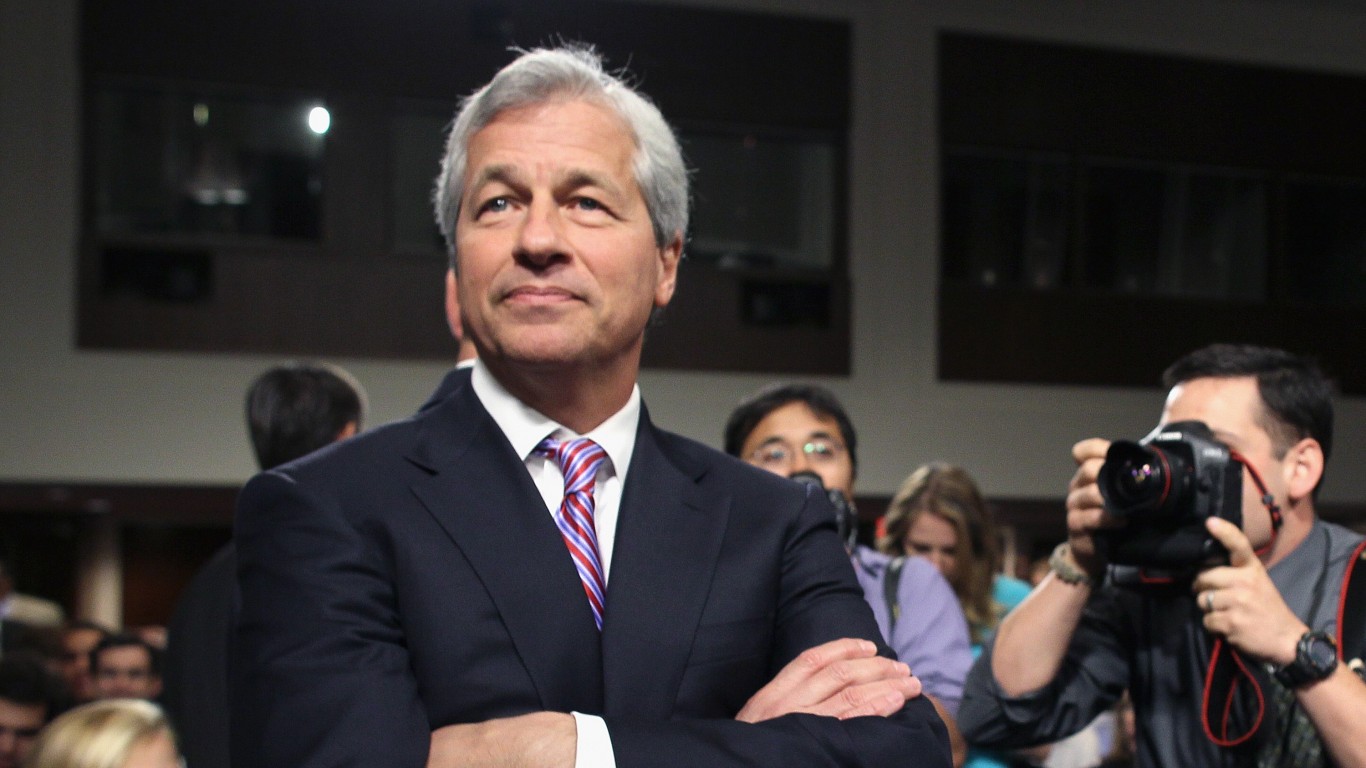

21. Jamie Dimon

> Company: JPMorgan Chase & Co

> Industry: Financial services

> Total 2019 CEO compensation: $31.6 million

> Annual company revenue: $115.6 billion

> Median employee salary: $80,431

> CEO pay vs. median employee salary: 393 times higher

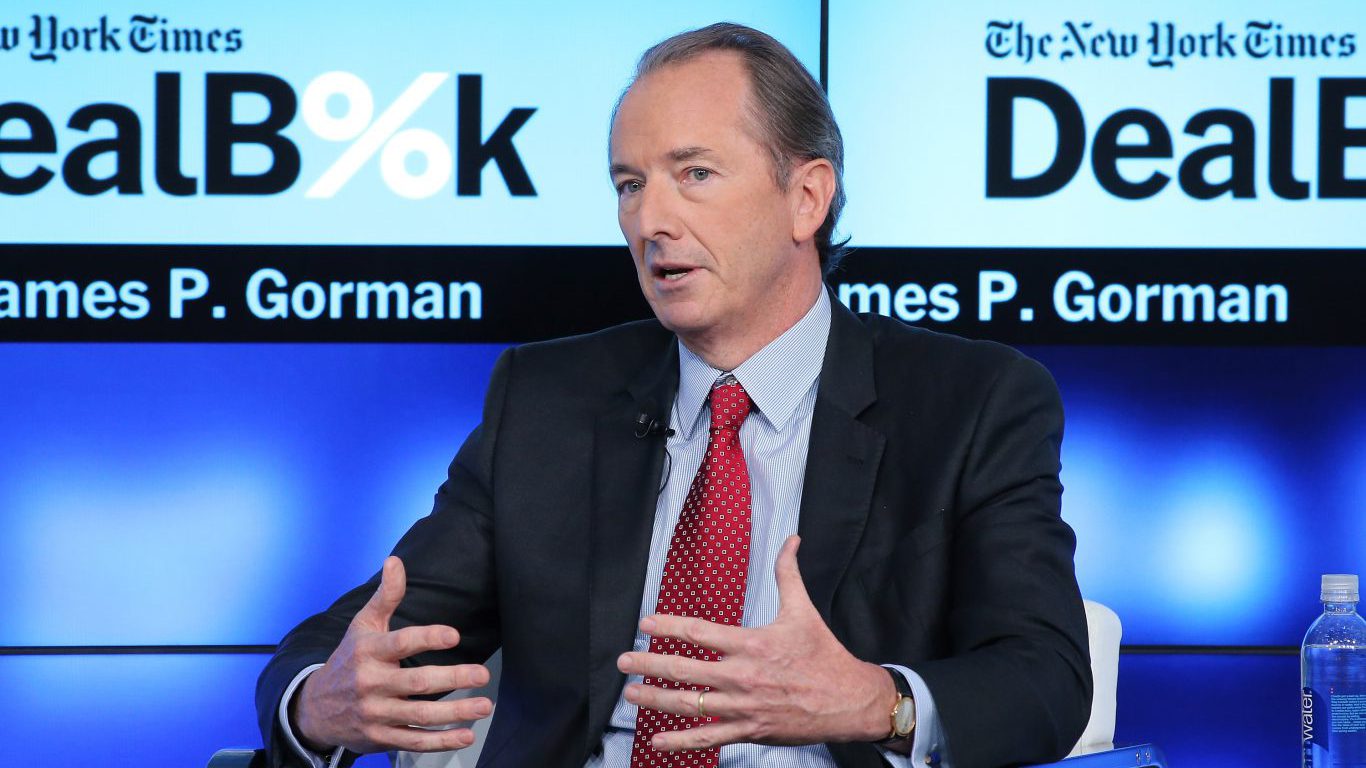

20. James P. Gorman

> Company: Morgan Stanley

> Industry: Financial services

> Total 2019 CEO compensation: $31.6 million

> Annual company revenue: $38.9 billion

> Median employee salary: $127,414

> CEO pay vs. median employee salary: 248 times higher

[in-text-ad]

19. Greg C. Garland

> Company: Phillips 66

> Industry: Energy

> Total 2019 CEO compensation: $31.9 million

> Annual company revenue: $104.6 billion

> Median employee salary: $188,738

> CEO pay vs. median employee salary: 169 times higher

18. Randall L. Stephenson

> Company: AT&T Inc.

> Industry: Telecommunications

> Total 2019 CEO compensation: $32.0 million

> Annual company revenue: $181.2 billion

> Median employee salary: $98,630

> CEO pay vs. median employee salary: 325 times higher

17. Michael K. Wirth

> Company: Chevron Corp

> Industry: Energy

> Total 2019 CEO compensation: $33.1 million

> Annual company revenue: $146.5 billion

> Median employee salary: $140,063

> CEO pay vs. median employee salary: 236 times higher

[in-text-ad-2]

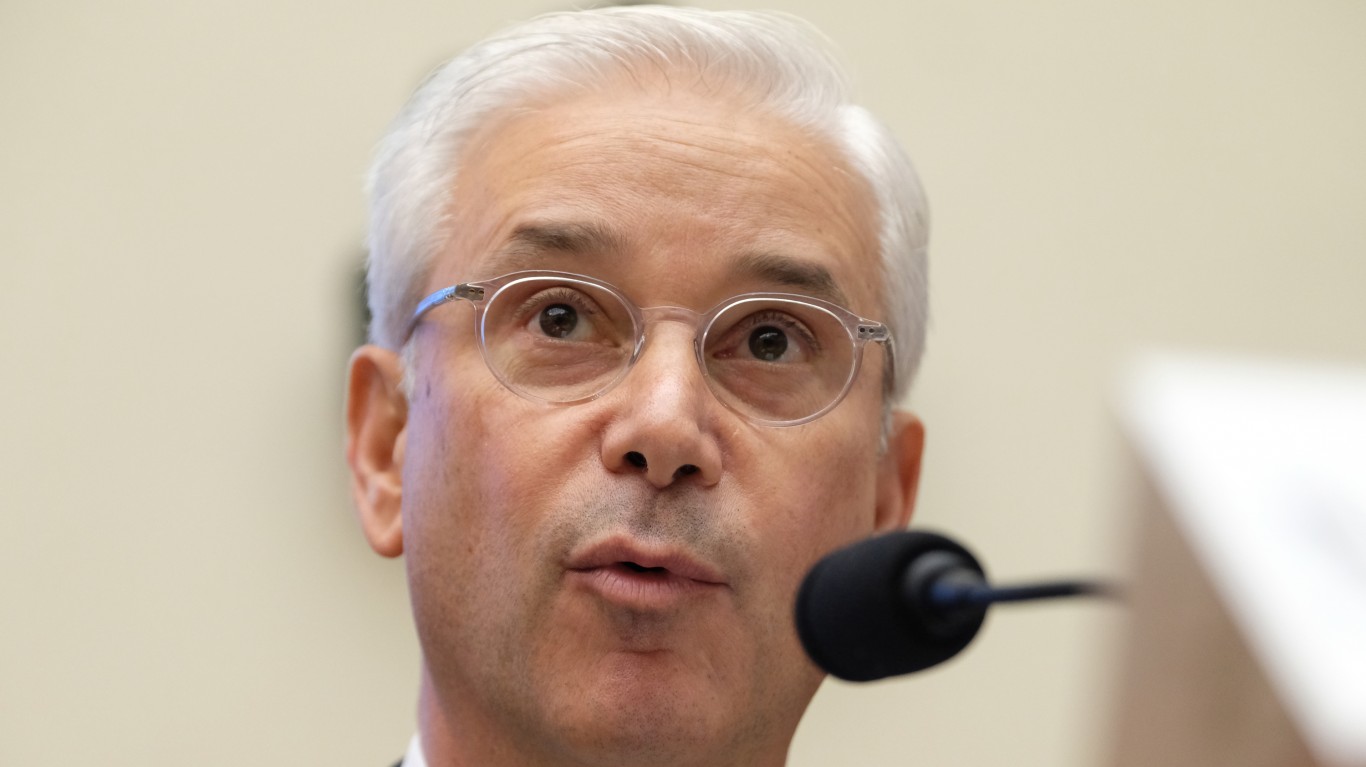

16. Charles W. Scharf

> Company: Wells Fargo & Company

> Industry: Financial services

> Total 2019 CEO compensation: $34.3 million

> Annual company revenue: $85.1 billion

> Median employee salary: $65,931

> CEO pay vs. median employee salary: 520 times higher

15. James Umpleby

> Company: Caterpillar Inc

> Industry: Industrial machinery manufacturing

> Total 2019 CEO compensation: $34.5 million

> Annual company revenue: $53.8 billion

> Median employee salary: $65,132

> CEO pay vs. median employee salary: 530 times higher

[in-text-ad]

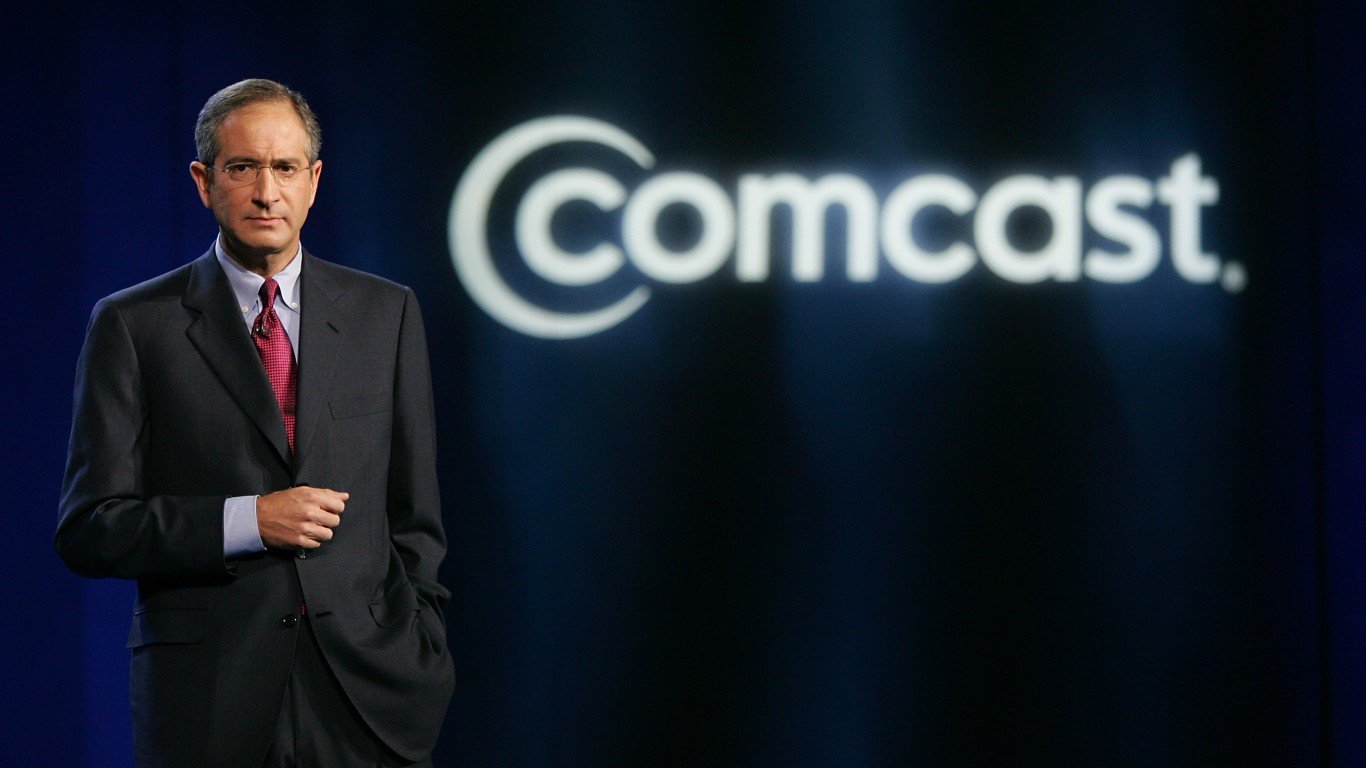

14. Brian L. Roberts

> Company: Comcast Corp

> Industry: Entertainment

> Total 2019 CEO compensation: $36.4 million

> Annual company revenue: $108.9 billion

> Median employee salary: $78,869

> CEO pay vs. median employee salary: 461 times higher

13. Larry J. Merlo

> Company: CVS Health Corp

> Industry: Health care

> Total 2019 CEO compensation: $36.5 million

> Annual company revenue: $256.8 billion

> Median employee salary: $46,140

> CEO pay vs. median employee salary: 790 times higher

12. Reed Hastings

> Company: Netflix Inc

> Industry: Entertainment

> Total 2019 CEO compensation: $38.6 million

> Annual company revenue: $20.2 billion

> Median employee salary: $202,931

> CEO pay vs. median employee salary: 190 times higher

[in-text-ad-2]

11. Shantanu Narayen

> Company: Adobe Inc.

> Industry: Technology

> Total 2019 CEO compensation: $39.1 million

> Annual company revenue: $11.2 billion

> Median employee salary: $147,115

> CEO pay vs. median employee salary: 266 times higher

10. William R. Mcdermott

> Company: ServiceNow, Inc.

> Industry: Technology

> Total 2019 CEO compensation: $41.7 million

> Annual company revenue: $3.5 billion

> Median employee salary: $223,554

> CEO pay vs. median employee salary: 186 times higher

[in-text-ad]

9. Lachlan K. Murdoch

> Company: Fox Corp

> Industry: Broadcasting

> Total 2019 CEO compensation: $42.1 million

> Annual company revenue: $11.4 billion

> Median employee salary: N/A

> CEO pay vs. median employee salary: N/A

8. Satya Nadella

> Company: Microsoft Corp

> Industry: Technology

> Total 2019 CEO compensation: $42.9 million

> Annual company revenue: $125.8 billion

> Median employee salary: $172,512

> CEO pay vs. median employee salary: 249 times higher

7. Miguel Patricio

> Company: Kraft Heinz Co

> Industry: Food

> Total 2019 CEO compensation: $43.3 million

> Annual company revenue: $25.0 billion

> Median employee salary: $42,689

> CEO pay vs. median employee salary: 1,014 times higher

[in-text-ad-2]

6. David M. Zaslav

> Company: Discovery, Inc.

> Industry: Entertainment

> Total 2019 CEO compensation: $45.8 million

> Annual company revenue: $11.1 billion

> Median employee salary: $79,343

> CEO pay vs. median employee salary: 578 times higher

5. Robert A. Iger (stepped down in Feb. 2020)

> Company: Walt Disney Co

> Industry: Media

> Total 2019 CEO compensation: $47.5 million

> Annual company revenue: $69.6 billion

> Median employee salary: $52,184

> CEO pay vs. median employee salary: 911 times higher

[in-text-ad]

4. John C. Plant

> Company: Howmet Aerospace Inc.

> Industry: Industrial machinery

> Total 2019 CEO compensation: $51.7 million

> Annual company revenue: $14.2 billion

> Median employee salary: $55,497

> CEO pay vs. median employee salary: 932 times higher

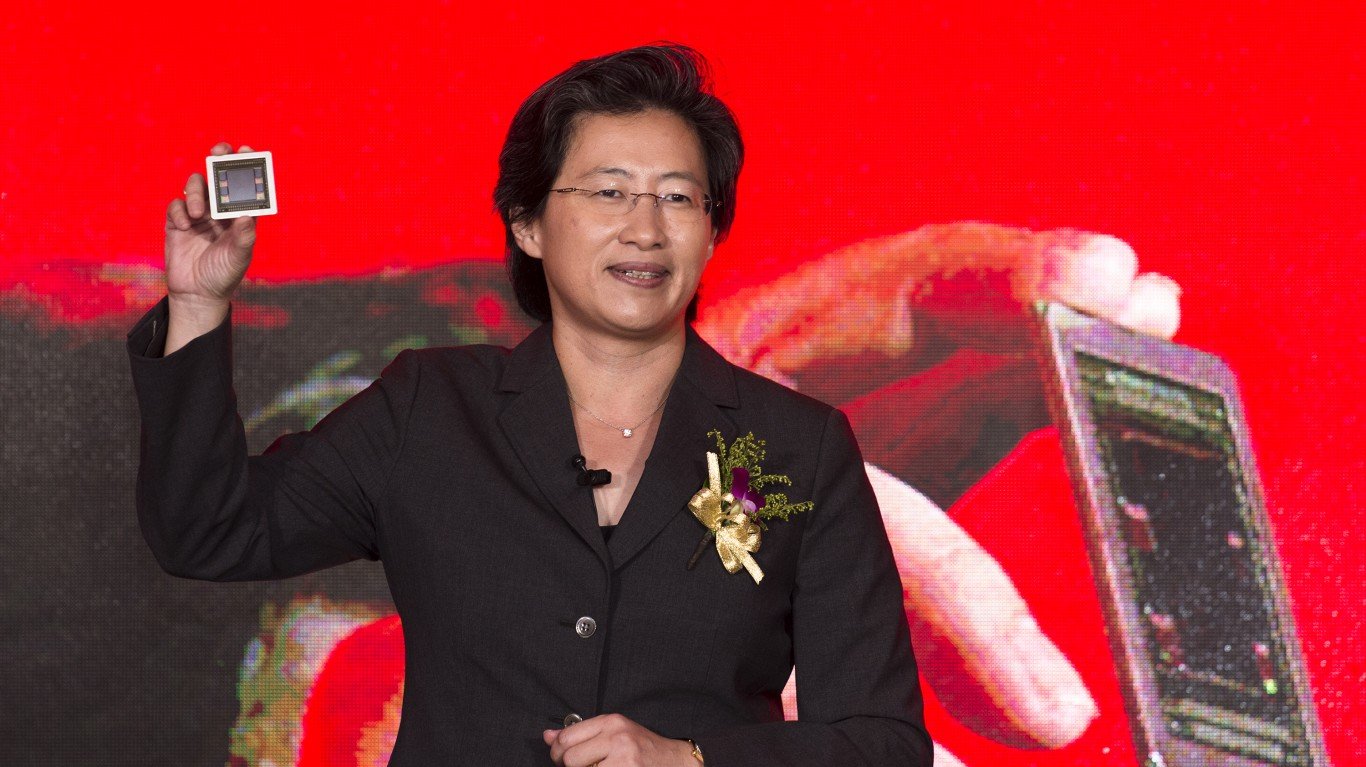

3. Lisa T. Su

> Company: Advanced Micro Devices Inc

> Industry: Technology

> Total 2019 CEO compensation: $58.5 million

> Annual company revenue: $6.7 billion

> Median employee salary: $96,874

> CEO pay vs. median employee salary: 604 times higher

2. Robert H. Swan

> Company: Intel Corp

> Industry: Technology

> Total 2019 CEO compensation: $66.9 million

> Annual company revenue: $72.0 billion

> Median employee salary: $96,300

> CEO pay vs. median employee salary: 695 times higher

[in-text-ad-2]

1. Sundar Pichai

> Company: Alphabet Inc.

> Industry: Technology

> Total 2019 CEO compensation: $280.6 million

> Annual company revenue: $161.9 billion

> Median employee salary: $258,708

> CEO pay vs. median employee salary: 1,085 times higher

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.