Income inequality is a growing problem in the United States. In cities across the country, the rich are getting richer while the poor are getting poorer. Perhaps nowhere is the problem more apparent than in the corporate world. In some of the largest and most recognizable global companies, chief executives earn in less than an hour as much as their typical employee earns in an entire year.

MyLogIQ, a data aggregator of public companies, recently released a report comparing total CEO compensation to median employee compensation for companies on the S&P 500 index. 24/7 Wall St. reviewed the report to identify the 13 companies where the CEO makes at least 1,000 times the salary of their typical employee.

These immense differences in compensation between CEOs and their typical employees in some cases are the product of extremely high CEO compensation — over $100 million in one case. More often, however, it is a combination of large CEO pay (the lowest is $8.8 million) and very low median employee annual pay, as many of these companies employ part-time or seasonal workers. Indeed, some of these companies rank among those that owe their employees a raise.

Unlike most American workers who are primarily paid through wages and salaries, CEOs of major public companies are often compensated largely through stock options and other incentives. This is largely due to a Clinton-era policy that limited the amount companies can deduct for CEO salary come tax time to $1 million. Stock options — which are often indicative of CEO performance — are not taxable, however, and as such, are often a preferred form of CEO compensation.

Click here to see the CEOs that make 1,000 times more than their employees

To identify the companies where CEOs make at least 1,000 more than the typical employee, 24/7 Wall St. reviewed data compiled by MyLogIQ. MyLogIQ reviewed the 325 proxy statements filed by S&P 500 companies as of April 10, 2019 to obtain CEO and median employee compensation. Other corporate information, including annual profit for the most recent year, came from 10-K statements filed with the Securities and Exchange commission.

13. James Quincey

> Company: The Coca-Cola Company

> CEO annual pay: $16.7 million (1,016 times the typical employee)

> Median annual employee pay: $16,440

> Annual corporate profit: $6.5 billion

James Quincey took the top job at Coca-Cola, the world’s largest non-alcoholic beverage company, on May 1, 2017, after serving as the company’s president and chief operating officer for two years. Quincey’s annual compensation of $16.7 million is more than 1,000 times the compensation the typical Coca-Cola employee earns a year.

Though Quincey sits at the top of the company, he is still accountable to shareholders. Since Quincey took over the reins, Coca-Cola’s share price has fluctuated considerably and is up by only about 3%.

[in-text-ad]

12. Kevin R. Johnson

> Company: Starbucks Corp

> CEO annual pay: $13.4 million (1,049 times the typical employee)

> Median annual employee pay: $12,754

> Annual corporate profit: $4.5 billion

Starbucks CEO Kevin Johnson earns $13.4 million a year, while the median annual income among all of the coffee chain’s employees is just $12,754. In just 2 hours, Johnson earns as much as the typical Starbucks employee does in an entire year. With a 79% employee approval rating on review site Glassdoor, Johnson is generally well liked among those working under him.

Johnson took the top job at Starbucks in April 2017, and under his watch, corporate profits climbed 56.6% year-over-year.

11. Michelle Gass

> Company: Kohl’s Corporation

> CEO annual pay: $12.3 million (1,115 times the typical employee)

> Median annual employee pay: $11,070

> Annual corporate profit: $801 million

Michelle Gass is one of two female CEOs on this list. Gass’s total compensation in fiscal 2018 of $12.3 million included $1.4 million in salary, with stocks and incentives making up the remainder. Relatively new to the job, Gass was named CEO in March 2018 after working as the company’s chief marketing officer for about three years.

Brick and mortar retailers like Kohl’s are facing increasing competition from online retailers. To adapt to the changing consumer landscape, Gass is converting some of Kohl’s retail space into gyms in a new partnership with Planet Fitness.

10. Greg Creed

> Company: Yum! Brands, Inc.

> CEO annual pay: $14.0 million (1,181 times the typical employee)

> Median annual employee pay: $11,865

> Annual corporate profit: $1.5 billion

Fast food restaurants offer some of the lowest-paying jobs in the country. The typical employee at Yum! Brands — the parent company of such fast food chains as KFC, Pizza Hut, and Taco Bell — earns just $11,865 a year. Yum! CEO Greg Creed earns as much in less than 2 hours.

In January 2019, Creed was named Restaurant Leader of the Year, a prestigious industry honor bestowed by the editors of Restaurant Business magazine. Over the course of Creed’s more than four-year tenure, the brands Yum! manages have managed to expand their retail footprint considerably, bucking the broader industry trend.

[in-text-ad-2]

9. Barbara Rentler

> Company: Ross Stores, Inc.

> CEO annual pay: $12.3 million (1,222 times the typical employee)

> Median annual employee pay: $10,027

> Annual corporate profit: $1.6 billion

Barbara Rentler’s compensation in 2018 included $1.3 million in salary and much more in stocks and incentives for a total of $12.3 million — 1,222 times as much as the annual pay of a typical employee at the department store chain. Rentler began working at Ross Stores, Inc. in 1986 as a merchandiser. She worked her way up and was appointed CEO in June 2014. Her net worth is an estimated $69.9 million.

8. Gerald W Evans Jr.

> Company: Hanesbrands Inc.

> CEO annual pay: $8.8 million (1,391 times the typical employee)

> Median annual employee pay: $6,348

> Annual corporate profit: $868.0 million

Hanesbrands is the company behind popular the athletic wear brand Champion, as well as the top selling apparel brand in the United States, Hanes. Gerald W Evans Jr. was appointed CEO of the company in October 2016, and profits have climbed steadily under his watch. Evans was paid a salary of $1.1 million in 2018 in addition to millions more in stocks and incentives. His total annual compensation of $8.8 million is nearly 1,400 times the amount the typical Hanesbrands employee earns in a year.

[in-text-ad]

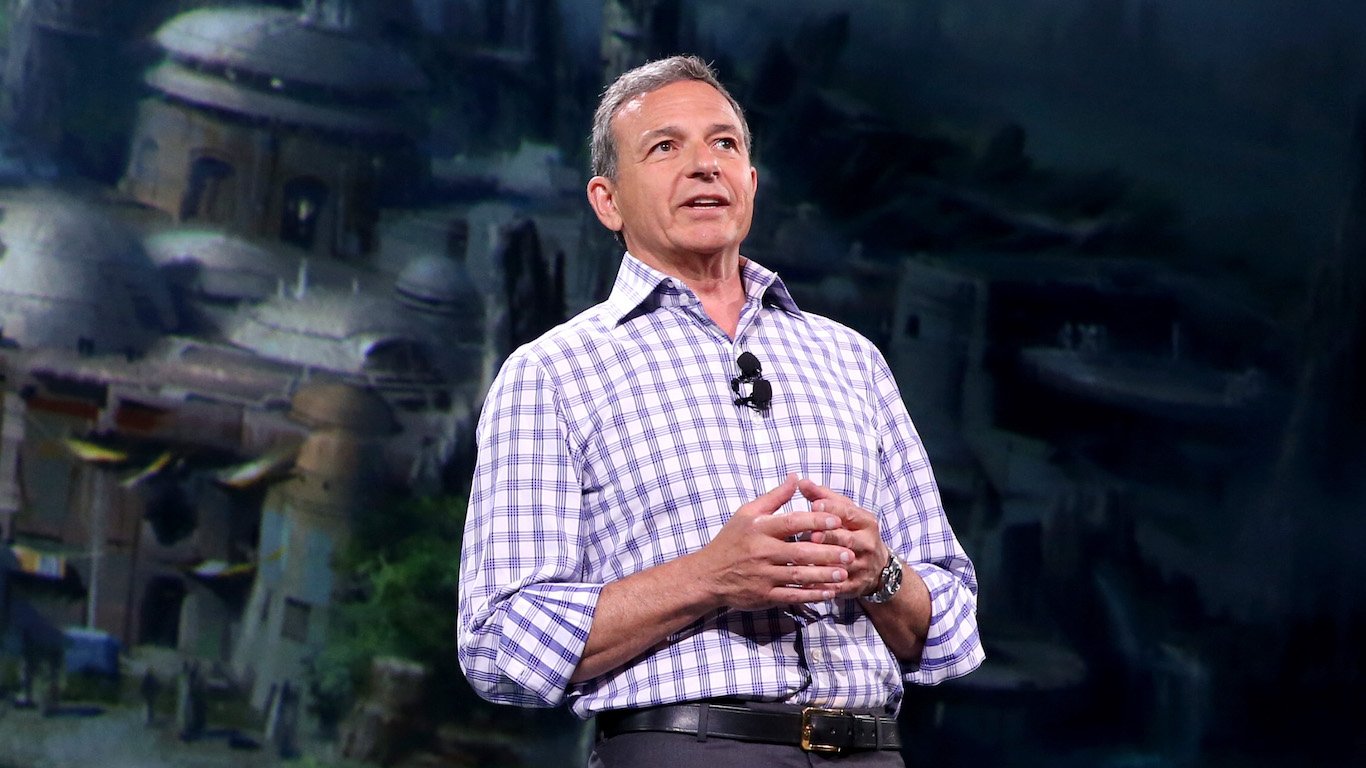

7. Robert A. Iger

> Company: The Walt Disney Company

> CEO annual pay: $65.7 million (1,424 times the typical employee)

> Median annual employee pay: $46,127

> Annual corporate profit: $13.1 billion

Disney CEO Robert Iger earns $46,127 — the median salary of a Disney employee — in an hour and a half. Iger’s $65.7 million compensation package is the second highest of any corporate leader on this list. Under Iger, Disney acquired 21st Century Fox in a $67 billion deal and became one of the largest media conglomerates in the world.

Iger is generally well regarded by those who work at Disney. He has an 84% employee approval rating on Glassdoor.

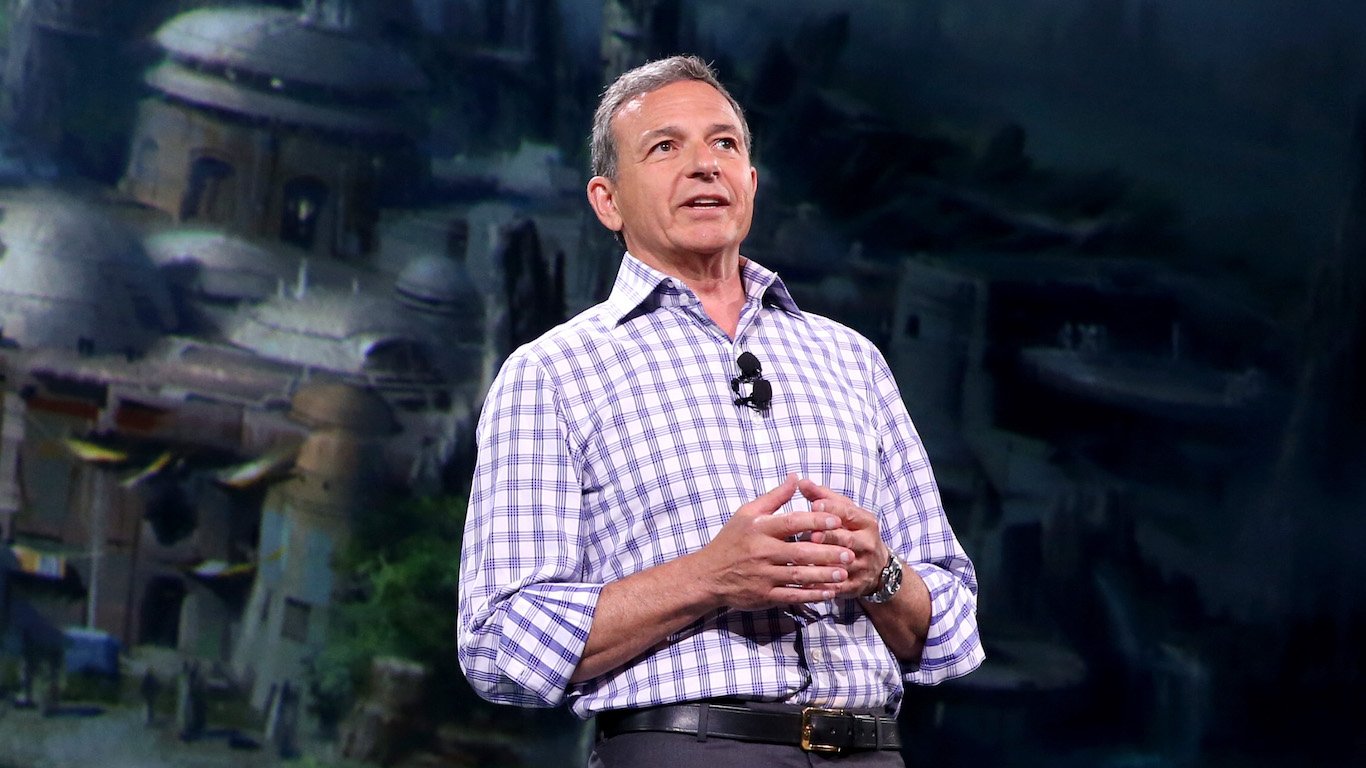

6. David M. Zaslav

> Company: Discovery, Inc.

> CEO annual pay: $129.5 million (1,511 times the typical employee)

> Median annual employee pay: $85,704

> Annual corporate profit: $681 million

David M. Zaslav, CEO of Discovery, Inc., is the highest paid chief executive on this list. Zaslav has a base salary of $3 million and in 2018 he received well over $100 million in stocks, awards, and incentives. His 2018 compensation totalled $129.5 million, over 1,500 times the $85,704 median annual salary at Discovery.

Zaslav has headed the television company — now the second largest in the world by reach — since 2007. Under his watch, Discovery went public in 2008, became a Fortune 500 company in 2014, and acquired Scripps Networks Interactive in 2018.

5. Brian R. Niccol

> Company: Chipotle Mexican Grill, Inc.

> CEO annual pay: $33.6 million (2,438 times the typical employee)

> Median annual employee pay: $13,779

> Annual corporate profit: $176.6 million

Chipotle CEO Brian R. Niccol made $33.6 million in 2018, 2,438 times as much as the typical Chipotle employee. Niccol took the top job in March 2018 after serving as CEO of Taco Bell since January 2015. Niccols was selected for the job for his expertise in digital technologies and branding — talents that board members hope will drive sales growth at Chipotle. Despite a series of high profile E. Coli and Norovirus contamination incidents at Chipotle restaurants, the company has reported steadily climbing sales revenue year over year.

[in-text-ad-2]

4. Kevin P. Clark

> Company: Aptiv PLC

> CEO annual pay: $14.1 million (2,609 times the typical employee)

> Median annual employee pay: $5,414

> Annual corporate profit: $1.1 billion

Aptiv PLC, an auto parts company headquartered in Dublin, has one of the highest CEO-to-median employee pay ratios of any S&P 500 company. Kevin P. Clark, who has headed the company since March 2015, earned $14.1 million in 2018 — over 2,600 times as much as the company’s median employee pay. As is the case with most chief executives on this list, only a small share of Clark’s compensation — $1.4 million — was salary. The bulk of his $14.1 million in compensation came from stock awards and incentives.

3. Joseph M. Hogan

> Company: Align, Technology Inc.

> CEO annual pay: $41.8 million (3,168 times the typical employee)

> Median annual employee pay: $13,180

> Annual corporate profit: $400.2 million

Align Technology Inc, a California-based orthodontics company, is one of only three companies on the S&P 500 where the CEO earns over 3,000 times the typical employee pay. CEO Joseph Hogan took the top job in mid-2015. Under his watch, the company’s share price surged by about 366%, and corporate profits have climbed steadily since the end of 2016.

[in-text-ad]

2. Ynon Kreiz

> Company: Mattel, Inc.

> CEO annual pay: $18.7 million (3,408 times the typical employee)

> Median annual employee pay: $5,489

> Annual corporate profit: -$531.0 million

The CEO of Mattel, a California-based toy manufacturing company, makes over 3,400 times the amount the typical company employee earns. Ynon Kreiz took the top job at the company in June 2017 — and Mattel’s financial performance has been lackluster since. The company’s revenue has declined each year since at least 2016, which was the last time the company’s had a profitable year. Over the course of Kreiz’s tenure, the company’s share price has dipped by over a third.

1. Arthur L. Peck

> Company: The Gap, Inc.

> CEO annual pay: $20.8 million (3,566 times the typical employee)

> Median annual employee pay: $5,831

> Annual corporate profit: $1.0 billion

The typical employee of The Gap, Inc., the company behind Old Navy, Banana Republic, and Gap clothing brands, earns just under $6,000 a year. Arthur Peck, the company’s CEO, earns as much in about a half hour. While most Gap employees are compensated primarily through wages and salaries, Peck is an exception. Only $1.5 million of his $20.8 million 2018 compensation was salary, and the remainder was in company stocks and options.

Peck is not especially popular among those who work under him. According to Glassdoor reviews, just 68% of current and former employees approve of Peck as CEO.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.