Running a company is never easy, and 2020 was even more challenging, presenting business owners with an unprecedented set of circumstances. The COVID-19 pandemic caused major disruptions to the American economy, with the unemployment rate peaking at 14.7% in April. While unemployment dropped to 6.7% in November, it is still more than 3 percentage points higher than it was prior to the escalation of the pandemic.

With this economic crunch, many struggling companies were forced to seek bankruptcy protection or cease operations altogether. These businesses will join a list of once-prominent brands that, for one reason or another (long before the pandemic), lost profitability and shut down in the past 10 years.

To determine the brands that disappeared between 2011 and 2020, 24/7 Wall St. reviewed press releases, financial filings, and other news sources to find the major corporations that either went completely out of business or ceased the bulk of their operations.

Many of the companies on this list failed to adapt to changing market forces and lost profits because of it. Retailers that were once successful saw online shopping cut into their sales, even before the pandemic required social distancing.

Though virtually every business faced pandemic-related struggles, few sectors had a harder time getting through 2020 than restaurants. With restrictions on indoor dining and supply chain issues, as well as having to temporarily close due to local health measures, more than 100,000 eateries have closed their doors for good. According to the National Restaurant Association, these closures will affect around one out of every six restaurants in the country. Among these casualties are world famous restaurants all across the country. These are the saddest restaurant closings of 2020.

Click here to see the brands that disappeared in the last decade.

1. Vine

> Founded in: 2012

> Type of business: Media

Vine was a short-lived but beloved video making app that took the internet by storm in the early 2010s. The app let users make six second videos that looped over and over, often to hilarious effect. Vine was purchased by Twitter in 2012 for $30 million as an easy way for users to shoot and share videos on the social media platform. Many other social media platforms began to offer video services similar to Vine’s — specifically Instagram, which also gave creators a longer time limit on videos. Perhaps as a result, Vine usership plummeted, and Twitter discontinued the app in 2016.

[in-text-ad]

2. Pier 1 Imports

> Founded in: 1962

> Type of business: Home goods

Unlike many of the other companies that folded in 2020, Pier 1 Imports was already on its way out long before the COVID-19 pandemic. The home goods retailer filed for bankruptcy in February, following nine straight quarters of declining sales. A few months later, Pier 1 decided to cease all operations and liquidate its assets.

3. Borders

> Founded in: 1971

> Type of business: Retail, books

As Amazon expanded far beyond its initial aim of selling books through the internet, brick-and-mortar book sellers like Borders struggled to keep up. While Borders competitor Barnes and Noble launched its own eBook reader, Borders failed to adapt to shifts in customer preferences and went bankrupt in 2011. The company had nearly $1.3 billion in debt, exceeding the total value of its assets.

4. The Weinstein Company

> Founded in: 2005

> Type of business: Entertainment

After becoming successful in founding Miramax Films, Harvey Weinstein and his brother Bob founded film studio The Weinstein Company in 2005. In 2017, the New York Times and The New Yorker magazine published accounts from numerous women accusing Weinstein of rape, sexual harrassment, and unprofessional conduct. Following these revelations, the company bearing Weinstein’s name was in a public relations crisis. After an attempted sale fell through, The Weinstein Company declared bankruptcy in early 2018. Lantern Capital eventually won a bidding war for the assets of the company.

[in-text-ad-2]

5. Ringling Bros. and Barnum & Bailey Circus

> Founded in: 1884

> Type of business: Entertainment

For nearly 150 years, Ringling Bros. and Barnum & Bailey Circus traveled around the country to entertain the masses. Acquired by Feld Entertainment in 1967, the circus began losing its popularity over the past few decades — attendance has reportedly dropped by as much as 50% since the 1990s.

Animal rights activists continuously targeted the circus for its use of creatures like elephants in the show. Feld Entertainment’s CEO also noted that audiences seemed to be abandoning the circus due to their shortening attention spans and expanding entertainment options. The high cost of moving the show from city to city eventually made the business model untenable. The circus act performed for the final time in 2017.

6. Sports Authority

> Founded in: 1987

> Type of business: Retail, sports

In 2005, Sports Authority had $2.5 billion in sales across nearly 400 stores. The following year, the Colorado-based sporting goods retailer became a private company after a buyout by a private equity firm. Over the course of the next decade, Sports Authority faced stiff competition not just from online retailers, but also similar businesses like Dicks Sporting Goods. In March 2016, the company filed for Chapter 11 bankruptcy protection. It initially planned to keep most of its stores open, but eventually decided to shutter all locations. Later that year, Sports Authority’s intellectual property was auctioned off for $15 million to its former competitor Dick’s Sporting Goods.

[in-text-ad]

7. Theranos

> Founded in: 2003

> Type of business: Health care

Theranos once appeared to be on the verge of revolutionizing the health care industry, but the entire operation turned out to be a sham. CEO Elizabeth Holmes claimed her company was creating a machine that could diagnose a wide range of diseases by analyzing a few drops of blood from a pricked finger. This promising idea earned Theranos a $9 billion valuation. It was later revealed that Theranos was simply testing customers’ blood using standard testing devices from other companies. Holmes now faces up to 20 years in prison on nine counts of wire fraud and two conspiracy counts related to defrauding investors, doctors, and patients. The company was dissolved in 2018.

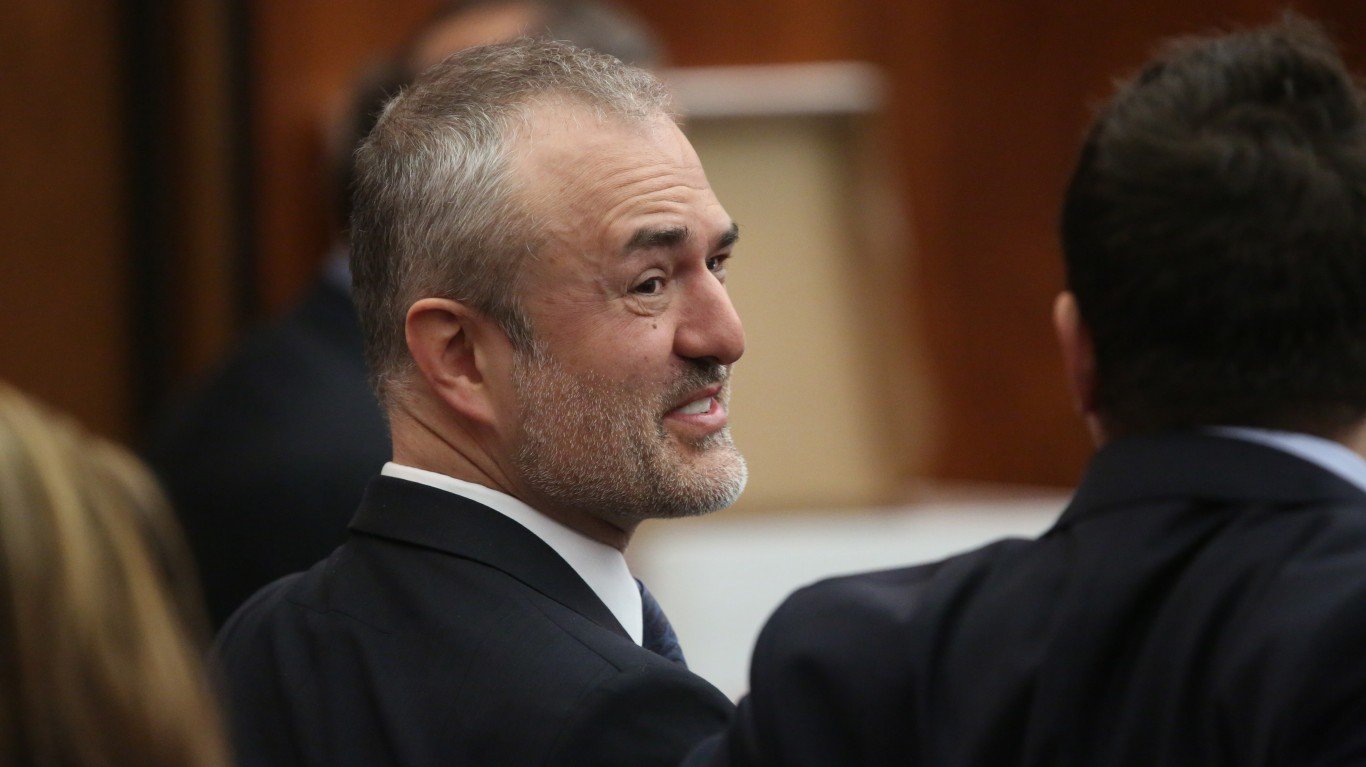

8. Gawker

> Founded in: 2003

> Type of business: Media

Gawker was an incredibly popular gossip blog that spawned a media empire, including specialty sites like Jezebel, io9, Deadspin and Kotaku. It was also one of the most divisive sites on the internet, publishing revealing pieces, frequently outing public figures as gay — including tech billionaire Peter Thiel. Thiel eventually funded a violation of privacy lawsuit filed by pro wrestler Hulk Hogan after Gawker published a sex tape of Hogan without his or his partner’s permission. Hogan, real name Terry Bollea, won a $140 million judgement in 2016, which was settled for $31 million. Gawker declared bankruptcy, and the company was put up for auction.

Univision acquired all the brands under the Gawker Media umbrella but shut down Gawker.com itself as the brand could have been a target of further lawsuits. Gawker.com was purchased by Bustle and planned to relaunch in 2019, but after a series of disagreements among staff and management, the relaunch was postponed and the staff laid off.

9. Solyndra

> Founded in: 2005

> Type of business: Tech, solar panels

Solar panel manufacturing company Solyndra was a Silicon Valley darling, raising about $1 billion in venture capital funds and getting a $535 million loan thanks to a U.S. Department of Energy green power initiative. When the company went out of business in 2011, it became the most well-financed flop in U.S. venture capital history. Even though it had $140 million in revenue, the influx of cheaper solar panels put Solyndra out of business in 2011.

[in-text-ad-2]

10. Dressbarn

> Founded in: 1962

> Type of business: Retail, clothing

Dressbarn was one of many companies that have suffered with the decline of the American mall. A staple at many large malls and shopping centers, Dressbarn offered professional women’s clothing at hundreds of locations across the country. In 2019, the company announced it would close down all of its approximately 650 nationwide stores. Dressbarn’s CFO said the company was not “operating at an acceptable level of profitability in today’s retail environment.”

11. A&P Supermarket

> Founded in: 1859

> Type of business: Grocery store

A&P Supermarket disappeared in 2015 after more than 100 years in business as it could not compete with cheaper grocers like Walmart or higher-end chains like Whole Foods. A&P first went bankrupt in 2010, declaring $2.5 billion in assets and $3.2 billion in debt, before re-establishing itself as a private company two years later. The company again declared bankruptcy in 2015, this time shuttering or selling all of its locations.

[in-text-ad]

12. MoviePass

> Founded in: 2011

> Type of business: Entertainment

MoviePass allowed users to pay a flat monthly fee to see as many movies as they wanted in theaters. According to MoviePass co-founder Stacy Spikes, its $9.95 price point was simply too low for the business model, which aimed to gain more revenue from the data it could glean from its customers. Spikes said parent company Helios and Matheson Analytics gained so many users after lowering the price, they refused to raise it.

With users seeing millions of dollars worth of movies each month on the company’s dime, the model became unsustainable and Helios and Matheson was bleeding cash. The company began imposing restrictions, blacking out certain films, and gained a reputation for poor customer service, driving away users. Finally, in September 2019, MoviePass ceased operations. At one point in 2018, Helios and Matheson stock was worth over $2,000 per share. Now it is worth less than a penny.

13. Modell’s

> Founded in:1889

> Type of business: Sporting goods

Modell’s was a large sporting goods chain that operated in the northeastern part of the country. After initially planning to shut down just 24 of its stores, the company filed for bankruptcy in February, before the pandemic, and announced plans to close all stores. Modell’s executives blamed competition from big box stores and Amazon as well as warmer winters that cut into jacket sales for hurting sales and ultimately causing the stores to close.

14. Teavana

> Founded in: 1997

> Type of business: Retail, tea

Starbucks is the nation’s leading coffee seller, and in 2012, the company decided to venture into tea, acquiring Teavana for about $620 million. Many Teavana stores were located in shopping malls, which have experienced a significant decline in foot traffic in recent years. Starbucks decided in 2017 to close all of Teavana’s nearly 400 locations.

[in-text-ad-2]

15. Toys R Us

> Founded in: 1957

> Type of business: Retail, toys

Toys R Us was once a corporate juggernaut, controlling a quarter of the world’s toy market with nearly 1,500 stores in the 1990s. The company’s fortunes changed in the 21st century. Several private equity firms combined to take Toys R Us private in a $6.6 billion leveraged buyout deal in 2005. The company registered for an IPO in 2010 but withdrew the application in 2013 as sales have been declining. In 2017, Toys R Us filed for bankruptcy, with $5 billion worth of debt. The next year, the company announced plans to close all of its 800 or so remaining stores.

16. Alta Motors

> Founded in: 2010

> Type of business: Vehicles, electric motorbikes

Even as electric cars like Tesla have been taking off, one of the major players in electric motorbikes shut down operations in 2018. Alta Motors had expanded to more than 70 dealerships by 2018, but it failed to maintain a firm financial footing, even though sales had increased 50% in 2018 and reviewers and journalists seemed to be impressed with the product. A potential partnership with Harley-Davidson reportedly fell through, and the company ceased operations in 2018.

[in-text-ad]

17. Vertu

> Founded in: 1998

> Type of business: Tech, phones

Vertu was founded in 1998 by Nokia as a high-end luxury phone maker. Vertu phones were often covered in jewels and other precious metals, costing over $10,000 for even the most basic of models. Nokia spun it off in 2012 to a Swedish private equity group that paid over $200 million for Vertu in 2012. The phones were difficult to sell, in part because of the high price point, but also because the technology itself was inferior to other phones on the market. The company was struggling over the next few years, posting losses of more than $60 million in 2014. Vertu was sold to a Hong Kong-based fund in 2015, then to an exiled Turkish businessman in 2017. That year, it was revealed the company had over $130 million in debt, and it was liquidated.

18. American Apparel

> Founded in: 1989

> Type of business: Retail, clothing

Once a shopping mall staple, there are no more physical American Apparel locations in any of America’s malls. At its peak, the company was valued at over $1 billion, and once had over $600 million in sales. But the company filed for bankruptcy in 2015 after failing to turn a profit for six years. The clothing retailer would file for bankruptcy again just over a year later. American Apparel laid off employees and auctioned off its brand and equipment for just $88 million. It now operates as an online-only retailer.

19. Compaq

> Founded in: 1982

> Type of business: Tech, computers

Compaq was once one of the leading computer companies in America and the world overall. After its 1982 founding, the company had experienced tremendous growth, and by 1994, it controlled over 10% of the global computer marketplace. At its peak in 2000, Compaq was worth $40 billion. Yet competitors like Dell were able to eat up much of Compaq’s market share by selling directly to customers and allowing customization, while Compaq had distribution deals with retailers like Best Buy and Circuit City. In 2002, Compaq was acquired by HP for $24 billion in a controversial and contentious merger. HP retired the Compaq name in 2013.

[in-text-ad-2]

20. Luby’s

> Founded in: 1947

> Type of business: Restaurant

Like many other restaurants, Luby’s Cafeteria struggled with the COVID-19 pandemic. The eatery was particularly ill-suited to survive — its cafeteria-style serving made social distancing harder, and the restaurant chain had already been struggling financially for years. The company announced in September 2020 that all of its Luby’s Cafeteria locations would close. Its parent company, Luby’s Inc., said in December it would sell off all Fuddruckers locations to a franchisee before dissolving the company altogether.

21. Pebble

> Founded in: 2012

> Type of business: Tech, wearables

Tech startup Pebble appeared poised for success after raising over $10 million on Kickstarter — then the most successful campaign of all time — to fund its early venture into smartwatches. While Apple was still focused on iPhones and iPods, Pebble’s campaign proved people would be interested in wearable tech. Once Pebble watches hit the market, sales were solid and reviews were mostly positive.

By 2015, Pebble was valued at $740 million — but it would be out of business the following year as Apple released its own smartwatch. Pebble struggled with supply chain issues, while Apple Watches took up more and more of the smartwatch market share. Pebble was unable to compete and was sold to FitBit for less than $40 million.

[in-text-ad]

22. Jawbone

> Founded in: 1999

> Type of business: Tech, wearables

Jawbone is a classic case of a unique Silicon Valley phenomenon: “death by overfunding.” The wearable tech company, known for making Bluetooth headsets and speakers, was once worth billions of dollars, but only because of all the capital it raised and not necessarily because of its earning potential. The company raised about $900 million in funding, which boosted its peak valuation to $3.2 billion in 2014.

By 2017, Jawbone was facing lawsuits from vendors, who said the company owed them money, and the company entered liquidation. According to Reuters, only one other venture capital-supported startup, solar panel maker Solyndra, raised more capital than Jawbone, and it also went out of business.

23. Palm

> Founded in: 1992

> Type of business: Tech, phones

Well before smartphones, PDAs — personal digital assistants — were a must-have device. The company that manufactured them, Palm, rose in value quickly. In 1998, Palm had more than two-thirds of the world’s PDA market. It had a massively successful IPO in 2000 when it was spun off from parent company 3Com, and like many tech companies of that era, Palm was riding the dotcom bubble that was about to burst. At its peak in 2000, Palm’s valuation was more than $53 billion, making it one of the most valuable companies in the world. Competitors like Sony began to eat into the PDA market, and once the tech bubble burst, Palm’s stock price came crashing down. By 2009, Palm was bleeding cash, and it was acquired by HP for $1.2 billion in 2010. HP announced in 2011 it would no longer make Palm hardware and retired the brand.

24. Henri Bendel

> Founded in: 1895

> Type of business: Retail, luxury

Once an iconic department store, Henri Bendel shuttered all of its remaining locations in 2019. In 2018, the brand operated at a $45 million loss. The luxury retailer, which was owned by L Brands, suffered the same fate as many other high-end stores. Many brick-and-mortar operations struggled to compete with online shopping, while industry analysts believe consumers have been spending less on luxury goods in favor of other purchases like phones and other tech.

[in-text-ad-2]

25. Blockbuster

> Founded in: 1985

> Type of business: Retail, entertainment

Even before the advent and surging popularity of streaming services like Netflix, Hulu, and Amazon Prime, Blockbuster was struggling. The once-ubiquitous video rental store has been in decline since 2004, when it had 9,000 stores worldwide. Blockbuster now has just one location — in Bend, Oregon. The decision to abandon online service helped doom the company, which filed for bankruptcy in 2010.

26. Lord & Taylor

> Founded in: 1826

> Type of business: Department store

Lord & Taylor, which opened in 1826, was considered the oldest department store in the country. It shut down largely due to COVID-19, but the store suffered from the same issues many department stores and retailers were facing even before the pandemic, including lower foot traffic and declining revenue as online shopping became more common. Lord & Taylor was sold to an investment firm in 2006 for $1.2 billion. In 2019, fashion rental company Le Tote bought it for around $71 million. The company began liquidating its stores in August.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.