In the early months of the Covid-19 pandemic, the hedge fund industry was struggling to eke out gains, but by the end of 2020, they had managed on average to pull themselves out of the red for the year.

A fund-weighted composite index by research firm HFR, which measures the performance in the hedge fund industry, showed an 11.6% return for 2020, led by funds focused on energy and basic materials, which gained 33%, followed by technology- and health care-focused funds, which grew almost 28% and 26%, respectively. By comparison, stocks in the Standard & Poor’s 500 index gained about 18% with dividends reinvested, according to Institutional Investor.

To learn how much the richest hedge fund managers made in 2020, 24/7 Wall St. reviewed the “The Richest Hedge Fund Managers On The 2020 Forbes 400 List,” released by Forbes in September 2020. Hedge fund manager wealth is for the first half of 2020. To determine the net worths of hedge fund managers and traders, Forbes examined hedge fund returns as well as the fee and ownership structure of a wide array of money management firms to estimate earnings and cash growth, and also counted other assets owned by hedge fund managers, such as private jets, yachts, and art collections.

The top 25 billionaires of the hedge fund industry — a list that includes familiar names like Ray Dalio, Steve Cohen, and George Soros — managed to grow their wealth by an estimated $3.8 billion, to nearly $186 billion, by the first half of 2020, compared to the same period in 2019. Individually, however, it was a mixed bag. Here are the 30 richest Americans of all time.

A dozen of these hedge fund titans experienced increases in their net worths by an average of nearly a billion dollars by the first half of 2020, led by Ken Griffin of Chicago-based hedge fund Citadel, who became $2.3 billion richer. Seven of these billionaires lost a total of nearly $14 billion in wealth in the same period of time, with combative activist shareholder Carl Icahn losing $3.6 billion in wealth. Here’s a list of the richest person in every state.

Click here to see what the richest 25 hedge fund managers made in 2020.

Six billionaires on this list, including Soros, saw no change in their net worth. There can be different reasons for this, often involving moving wealth into private family foundations to build philanthropic legacies. Some of these men are older and retired, or they’ve stopped managing other people’s money. Here’s the latest list of the 25 richest hedge fund managers.

25. William Ackman

> Chg. in net worth: Gained $1 billion

> Net worth in 2020: $2.1 billion

> Net worth in 2019: $1.1 billion

The founder and CEO of New York City-based Pershing Square Capital Management recently bought 10% of Universal Music Group through Pershing Square Tontine Holdings, Ackman’s special acquisition company. The SPAC raised a record-setting $4 billion to purchase the stake in the world’s largest record label that will allow UMG’s French owner Vivendi to take the business public without an IPO.

[in-text-ad]

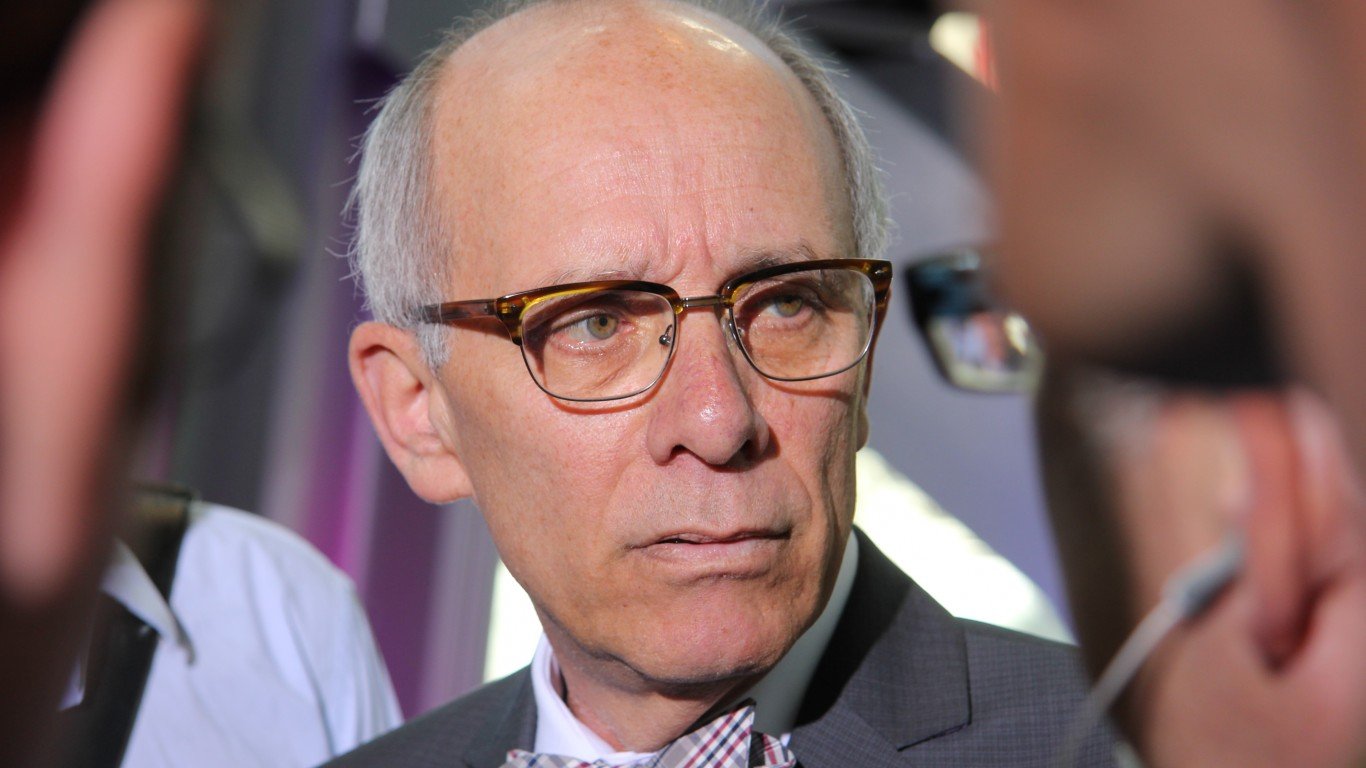

24. Noam Gottesman

> Chg. in net worth: Lost $800 million

> Net worth in 2020: $2.3 billion

> Net worth in 2019: $3.1 billion

The co-founder of London-based GLG Partners (now Man GLG) stepped down as CEO in 2010 after the firm was sold to Man Group in 2010. Four years later Gottesman co-founded Nomad Foods, Europe’s largest frozen foods company, and is the co-CEO of Go Acquisition Corp, a Delaware special acquisitions company (SPAC).

23. Leon G. Cooperman

> Chg. in net worth: Lost $700 million

> Net worth in 2020: $2.5 billion

> Net worth in 2019: $3.2 billion

Considered a legend of Wall Street, Cooperman built up Goldman Sachs’ asset management division before founding New York City-based Omega Advisors. The son of a Bronx plumber, he settled insider trading charges in 2017 and has since spent more time shifting his assets into his charitable foundation.

22. Stephen Mandel

> Chg. in net worth: No net change

> Net worth in 2020: $2.8 billion

> Net worth in 2019: $2.8 billion

The founder and managing director of Connecticut-based Lone Pine Capital is one of the so-called Tiger Cubs, a group of highly successful former employees of Tiger Management, run by Julian Robertson (No. 16 on this list).

[in-text-ad-2]

21. Daniel Loeb

> Chg. in net worth: Gained $100 million

> Net worth in 2020: $2.9 billion

> Net worth in 2019: $2.8 billion

The founder, chief investment officer, and CEO of New York City-based Third Point is also a well-known activist shareholder. Third Point backs cybersecurity firm SentinelOne, which recently went public and raised $1.23 billion in its IPO.

20. Daniel Och

> Chg. in net worth: No net change

> Net worth in 2020: $3.2 billion

> Net worth in 2019: $3.2 billion

Och was the founder of New York City-based Och-Ziff Capital Management, which became Sculptor Capital Management in 2019 in the wake of a bribery scandal involving the firm’s African subsidiary. Och stepped down in the restructuring aftermath and in late 2020 announced he was raising $750 million to create a special acquisitions company.

[in-text-ad]

19. John Arnold

> Chg. in net worth: No net change

> Net worth in 2020: $3.3 billion

> Net worth in 2019: $3.3 billion

In the wake of the massive Enron scandal in 2001, Arnold took his bonus from working at the energy firm to establish Houston-based Centaurus Advisors in 2002. A decade later, Arnold announced he would no longer manage other people’s money and closed the firm at just 38 years old. In recent years Arnold has invested in solar energy and deepwater oil exploration.

18. Paul Singer

> Chg. in net worth: Gained $100 million

> Net worth in 2020: $3.6 billion

> Net worth in 2019: $3.5 billion

The combative hedge fund magnate founded Elliott Management in 1977 and grew its assets under management from $1.7 billion to roughly $45 billion. Unlike Paul Tudor Jones (No. 13 on this list), Singer is not a fan of cryptocurrency, calling it “the greatest financial scam in history.”

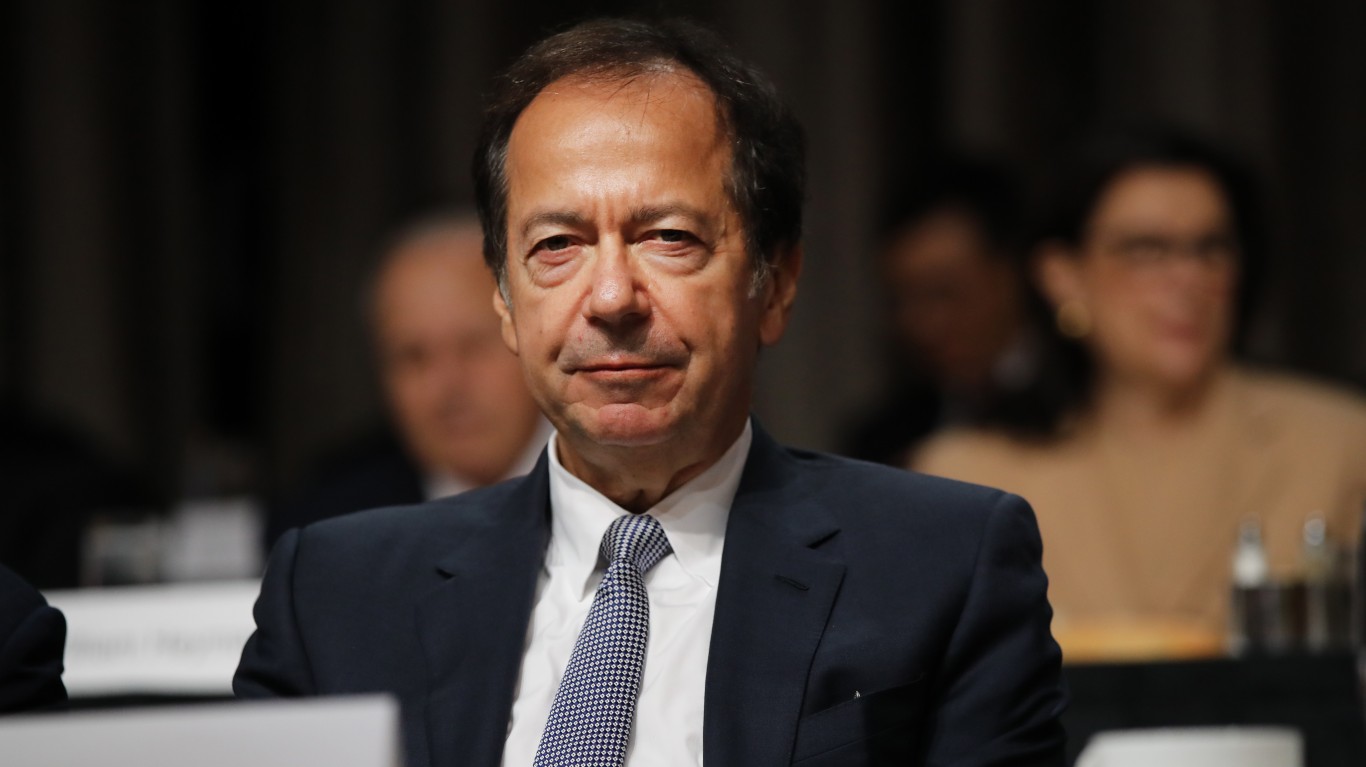

17. John Paulson

> Chg. in net worth: No net change

> Net worth in 2020: $4.2 billion

> Net worth in 2019: $4.2 billion

The man who famously made billions of dollars betting against the subprime mortgage market months before the 2008 financial collapse, recently announced that he’s converting his hedge fund, Paulson & Co., into a family office. The fund had been scaling down investments for years, dropping to $9 billion in assets under management, most of it his own money, from $38 billion in 2011, according to the Wall Street Journal.

[in-text-ad-2]

16. Julian Robertson

> Chg. in net worth: Lost $100 million

> Net worth in 2020: $4.3 billion

> Net worth in 2019: $4.4 billion

The retired hedge fund billionaire founded Tiger Management, the renowned hedge fund that he managed for 20 years, and now invests mainly in firms founded by former employees, known as Tiger Cubs, including Chase Coleman’s Tiger Global Management.

15. Stanley Druckenmiller

> Chg. in net worth: Lost $300 million

> Net worth in 2020: $4.4 billion

> Net worth in 2019: $4.7 billion

Druckenmiller earned his fortune from running hedge funds for more than three decades. His wealth is managed mainly through the New York City-based Duquesne family office, which he started in 2010 with $3 billion, according to Bloomberg.

[in-text-ad]

14. Bruce Kovner

> Chg. in net worth: No net change

> Net worth in 2020: $5.3 billion

> Net worth in 2019: $5.3 billion

The founder and former chairman of London-based Caxton Associates and manager of CAM Capital, a New York City-based family office, is also chairman of the board of The Juilliard School and contributes extensively to politically conservative causes.

13. Paul Tudor Jones

> Chg. in net worth: Gained $800 million

> Net worth in 2020: $5.8 billion

> Net worth in 2019: $5 billion

The founder of Connecticut-based Tudor Investment Corporation saw his fortune grow last year. The billionaire reportedly put 2% of his portfolio in bitcoin in 2020 and said in June he wants 5% each in gold, bitcoin, cash and commodities as hedges against inflation, which he says the Fed isn’t moving quickly enough to address.

10. David Shaw

> Chg. in net worth: Lost $800 million

> Net worth in 2020: $6.5 billion

> Net worth in 2019: $7.3 billion

The founder of D.E. Shaw, famous for hiring Jeff Bezos when the Amazon founder was in his 20s, lost net worth last year despite his firm reportedly gaining 19.4% after fees, almost doubling its return from 2019.

[in-text-ad-2]

10. John Overdeck

> Chg. in net worth: Gained $400 million

> Net worth in 2020: $6.5 billion

> Net worth in 2019: $6.1 billion

The mathematician co-founder of Two Sigma Investments is tied with his partner, David Siegel (No. 9 on this list), in net worth. Two Sigma is a quantitative trading firm that utilizes artificial intelligence and machine learning to develop successful trading strategies.

10. David Siegel

> Chg. in net worth: Gained $400 million

> Net worth in 2020: $6.5 billion

> Net worth in 2019: $6.1 billion

Siegel is the computer scientist partner of John Overdeck (No. 10 on this list). The two are tied for 10th place on this list. In addition to quantitative trading, Two Sigma Investments operates a venture capital division.

[in-text-ad]

9. Chase Coleman

> Chg. in net worth: Gained $2.4 billion

> Net worth in 2020: $6.9 billion

> Net worth in 2019: $4.5 billion

The founder and head of New York City-based Tiger Global Management had a good 2020 along with his firm, which trades heavily in technology stocks. At 45, Coleman is the youngest hedge fund manager on this list. Coleman is a Tiger Cub, a group of highly successful former employees of Julian Robertson’s Tiger Management.

8. Israel Englander

> Chg. in net worth: Gained $600 million

> Net worth in 2020: $7.2 billion

> Net worth in 2019: $6.6 billion

The co-founder of Millennium Management, a New York City-based global investment management firm, saw his net worth climb last year as raked in more money than any other hedge fund manager, according to Institutional Investor.

7. George Soros

> Chg. in net worth: No net change

> Net worth in 2020: $8.6 billion

> Net worth in 2019: $8.6 billion

The renowned hedge fund magnate hasn’t managed other people’s money for years, but he continues to invest broadly through his New York City-based family office while focusing on philanthropy through his progressive-leaning Open Society Foundations.

[in-text-ad-2]

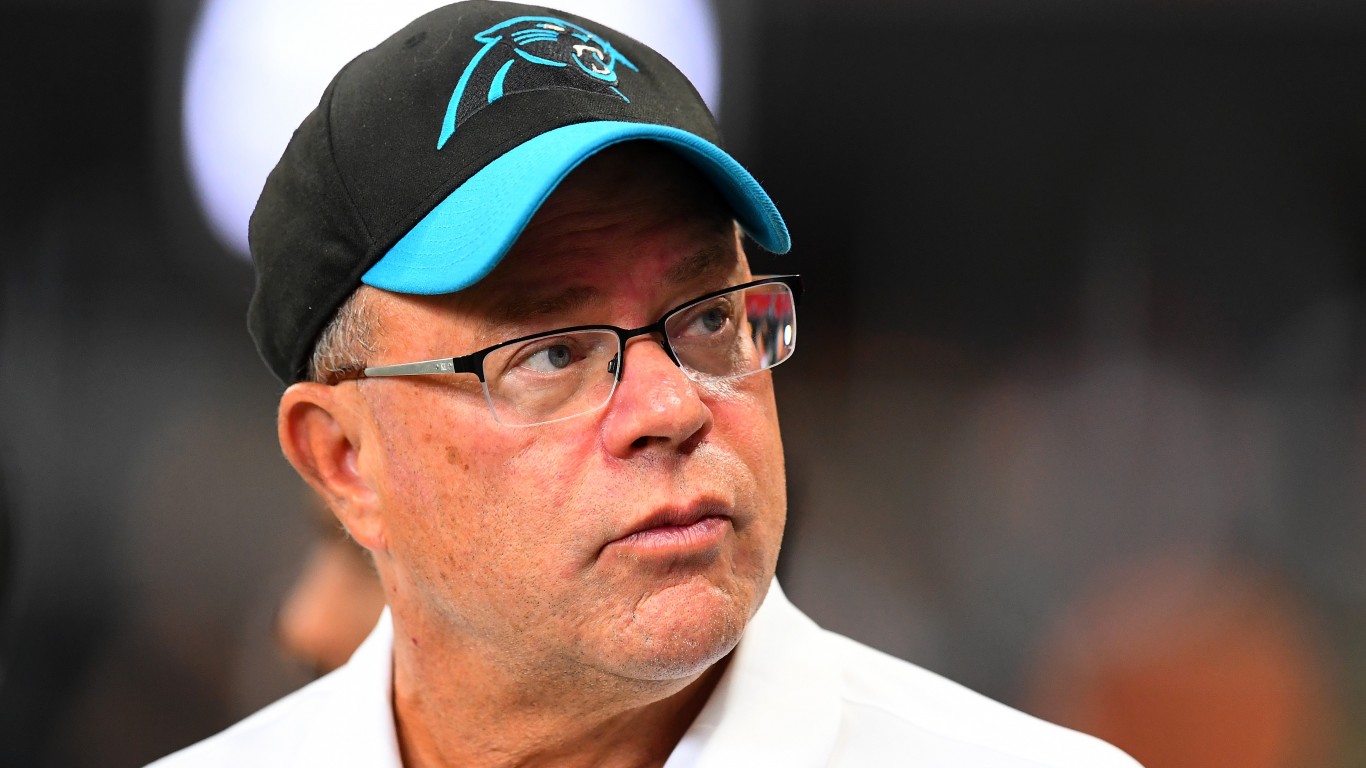

6. David Tepper

> Chg. in net worth: Gained $1 billion

> Net worth in 2020: $13 billion

> Net worth in 2019: $12 billion

The co-founder and manager of Miami-based Appaloosa Management, which focuses on public equity and fixed-income markets globally, reportedly hit his personal record net worth last year.

5. Carl Icahn

> Chg. in net worth: Lost $3.6 billion

> Net worth in 2020: $14 billion

> Net worth in 2019: $17.6 billion

New York City-based Icahn Enterprises, in which its famous corporate-raiding founder derives most of his net worth, was hit in 2020 by overinvestment in energy stocks and its short positions on growth stocks.

[in-text-ad]

4. Steve Cohen

> Chg. in net worth: Gained $900 million

> Net worth in 2020: $14.5 billion

> Net worth in 2019: $13.6 billion

The founder of Connecticut-based Point72 Asset Management did well in his first year after a two-year ban in the wake of insider-trading charges against his previous investment firm. Cohen completed a $2.4 billion purchase of the New York Mets in November.

3. Ken Griffin

> Chg. in net worth: Gained $2.3 billion

> Net worth in 2020: $15 billion

> Net worth in 2019: $12.7 billion

The founder of Chicago-based Citadel saw a second year of robust returns after already becoming the most profitable hedge fund behind Ray Dalio’s Bridgewater Associates, and George Soros’ family office.

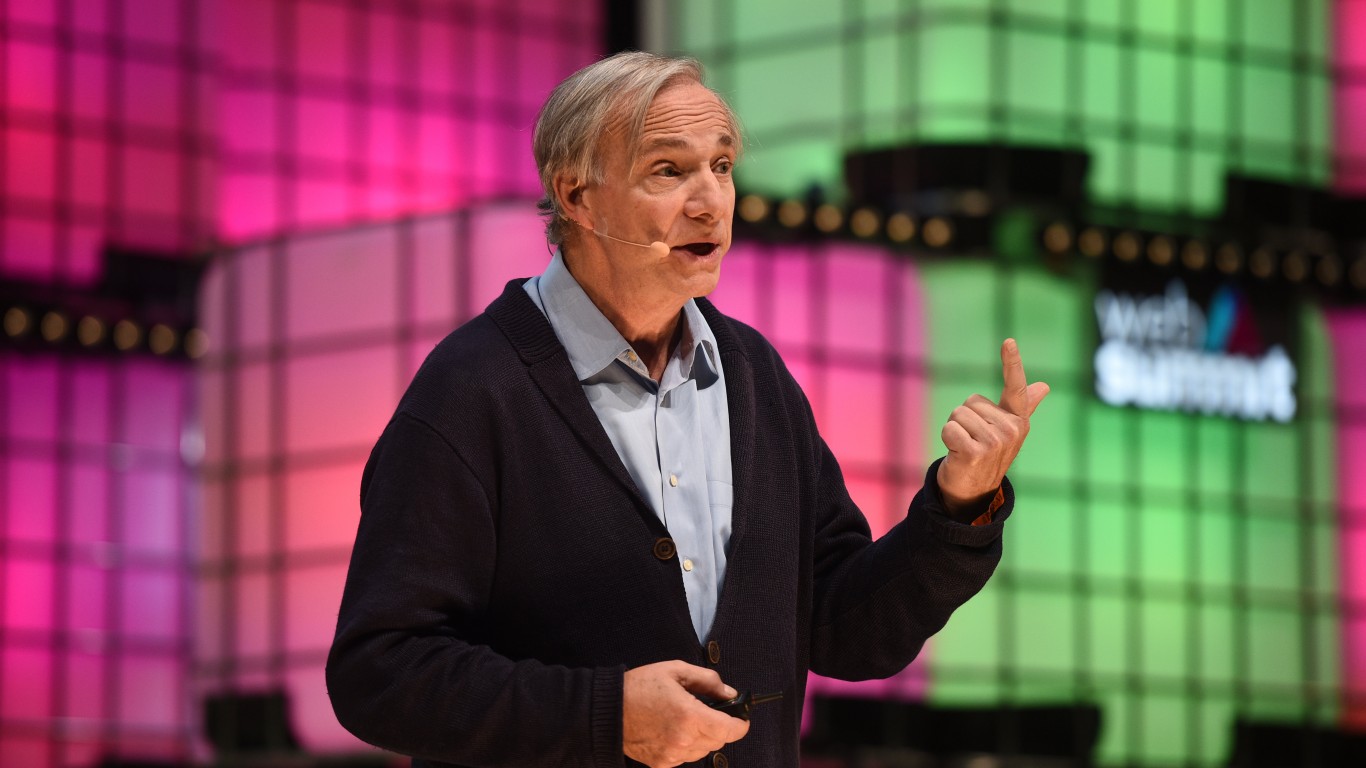

2. Ray Dalio

> Chg. in net worth: Lost $1.8 billion

> Net worth in 2020: $16.9 billion

> Net worth in 2019: $18.7 billion

The founder of Connecticut-based Bridgewater Associates saw his fortune shrink last year as the world’s largest hedge fund he founded struggled with its worst losses in years that caused a loss of confidence from investors.

[in-text-ad-2]

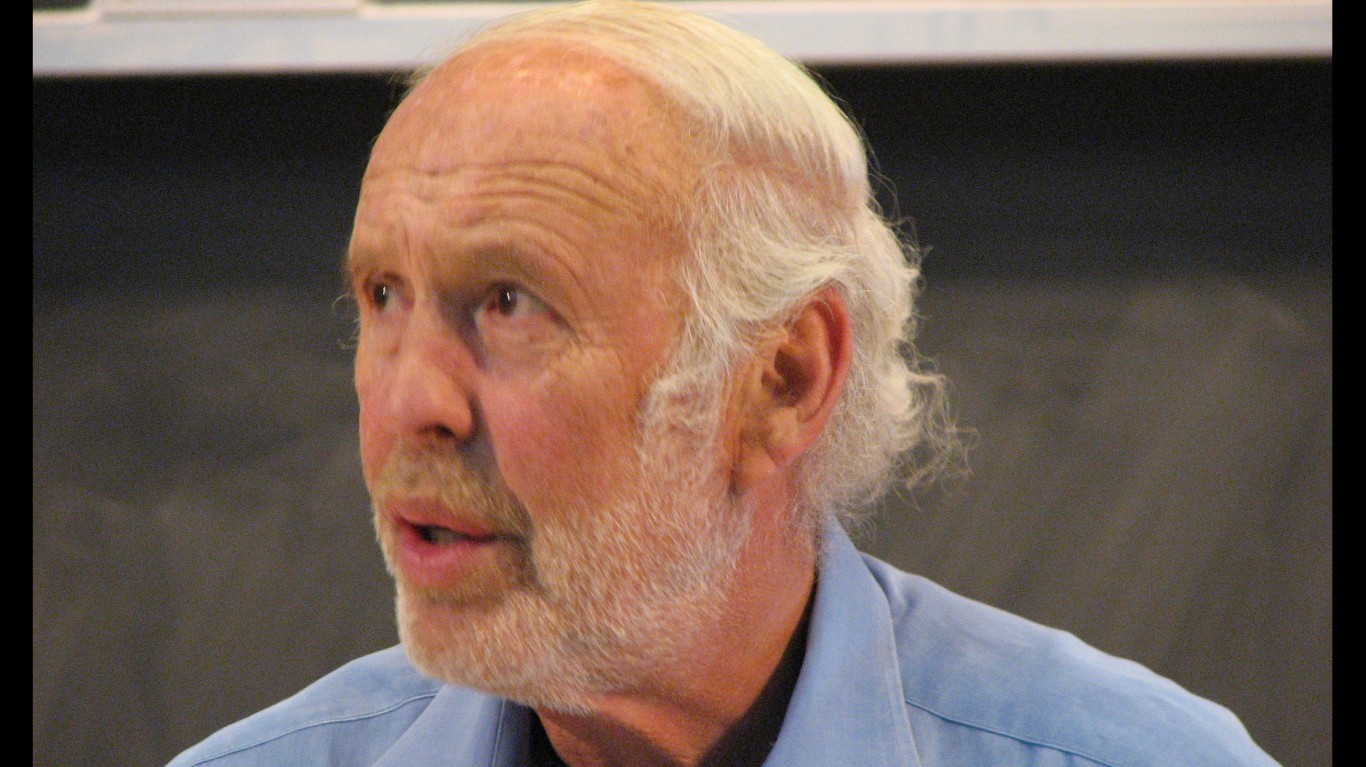

1. Jim Simons

> Chg. in net worth: Gained $1.9 billion

> Net worth in 2020: $23.5 billion

> Net worth in 2019: $21.6 billion

Known as the “Quant King” for his dominance in the business of using numerical data and software to make investment decisions, the founder of Long Island-based Renaissance Technologies retired from his role as CEO but remains invested in RenTech funds.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.