The COVID-19 pandemic has ushered in an unprecedented surge in demand for homeownership in the United States. Inventory is at a record low, as is the average time it takes to sell a home. Meanwhile, both home prices and the share of homes selling above asking price are at record highs.

Of course, in some parts of the country, high home prices are nothing new. Even before the pandemic, the median home value in nearly a dozen states was over $300,000. In stark contrast, there are some states where the typical home is worth over $100,000 less than the national median home value of $240,500.

Using data from the U.S. Census Bureau, 24/7 Wall St. identified the most and least expensive states to buy a home.

Home values in a given area are often a reflection of what residents can afford. And, not surprisingly, in states with low median home values, incomes also tend to be relatively low and vise-versa. In each of the five states with the lowest median home values, the median household income is over $10,000 below the $65,700 that the typical American household earns. Similarly, the five states with the highest median home values have median household incomes that exceed the national median by over $10,000.

Even though home values tend to track closely with incomes, homes still appear to be more affordable in states with less expensive housing. The homeownership rate exceeds the national rate of 64.1% in each of the 10 states with the least expensive homes. Meanwhile, homeownership is more common than average in only three of the 10 states with the most expensive homes.

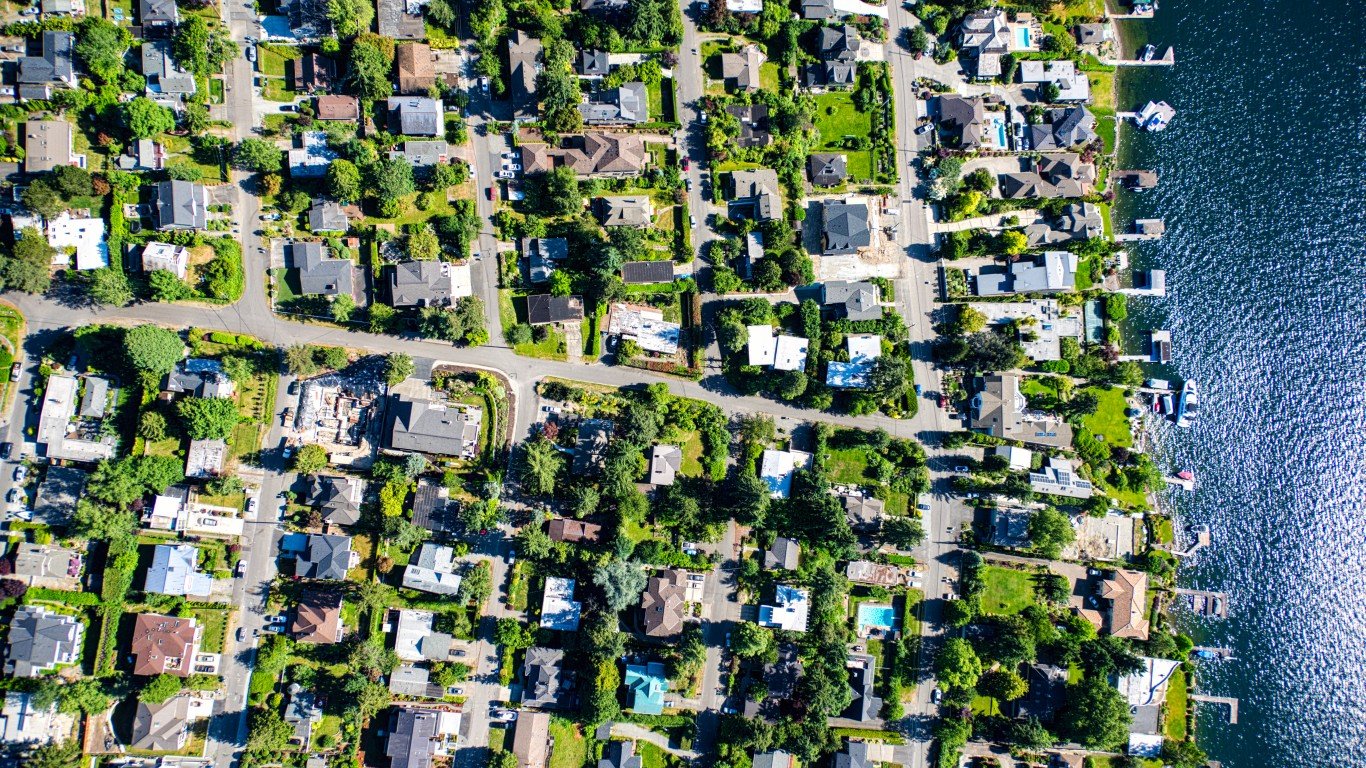

Click here to see the most (and least) expensive states to buy a home.

Click here to see our detailed methodology.

50. West Virginia

> Median home value: $124,600

> Median monthly housing costs with a mortgage: $1,052 (the lowest)

> Share of housing units with a mortgage: 46.4% (the lowest)

> Homeownership rate: 73.4% (the highest)

> Median household income: $48,850 (2nd lowest)

[in-text-ad]

49. Mississippi

> Median home value: $128,200

> Median monthly housing costs with a mortgage: $1,149 (4th lowest)

> Share of housing units with a mortgage: 49.1% (2nd lowest)

> Homeownership rate: 67.3% (19th highest)

> Median household income: $45,792 (the lowest)

48. Arkansas

> Median home value: $136,200

> Median monthly housing costs with a mortgage: $1,094 (2nd lowest)

> Share of housing units with a mortgage: 53.0% (6th lowest)

> Homeownership rate: 65.5% (17th lowest — tied)

> Median household income: $48,952 (3rd lowest)

47. Oklahoma

> Median home value: $147,000

> Median monthly housing costs with a mortgage: $1,231 (7th lowest)

> Share of housing units with a mortgage: 54.4% (7th lowest)

> Homeownership rate: 65.5% (17th lowest — tied)

> Median household income: $54,449 (8th lowest)

[in-text-ad-2]

46. Kentucky

> Median home value: $151,700

> Median monthly housing costs with a mortgage: $1,179 (6th lowest)

> Share of housing units with a mortgage: 56.9% (13th lowest)

> Homeownership rate: 67.0% (22nd highest)

> Median household income: $52,295 (7th lowest)

45. Alabama

> Median home value: $154,000

> Median monthly housing costs with a mortgage: $1,172 (5th lowest)

> Share of housing units with a mortgage: 55.3% (8th lowest)

> Homeownership rate: 68.8% (15th highest)

> Median household income: $51,734 (5th lowest)

[in-text-ad]

44. Indiana

> Median home value: $156,000

> Median monthly housing costs with a mortgage: $1,146 (3rd lowest)

> Share of housing units with a mortgage: 65.2% (14th highest)

> Homeownership rate: 69.3% (13th highest)

> Median household income: $57,603 (14th lowest)

43. Ohio

> Median home value: $157,200

> Median monthly housing costs with a mortgage: $1,250 (8th lowest — tied)

> Share of housing units with a mortgage: 62.1% (24th highest)

> Homeownership rate: 66.0% (20th lowest — tied)

> Median household income: $58,642 (15th lowest)

42. Iowa

> Median home value: $158,900

> Median monthly housing costs with a mortgage: $1,266 (11th lowest)

> Share of housing units with a mortgage: 59.9% (22nd lowest)

> Homeownership rate: 70.5% (10th highest)

> Median household income: $61,691 (21st lowest)

[in-text-ad-2]

41. Kansas

> Median home value: $163,200

> Median monthly housing costs with a mortgage: $1,387 (19th lowest — tied)

> Share of housing units with a mortgage: 57.9% (14th lowest)

> Homeownership rate: 66.5% (24th highest — tied)

> Median household income: $62,087 (24th lowest)

40. Missouri

> Median home value: $168,000

> Median monthly housing costs with a mortgage: $1,271 (13th lowest)

> Share of housing units with a mortgage: 60.2% (23rd lowest)

> Homeownership rate: 67.1% (21st highest)

> Median household income: $57,409 (13th lowest)

[in-text-ad]

39. Michigan

> Median home value: $169,600

> Median monthly housing costs with a mortgage: $1,285 (15th lowest)

> Share of housing units with a mortgage: 59.3% (19th lowest)

> Homeownership rate: 71.6% (5th highest — tied)

> Median household income: $59,584 (19th lowest)

38. Louisiana

> Median home value: $172,100

> Median monthly housing costs with a mortgage: $1,279 (14th lowest)

> Share of housing units with a mortgage: 51.7% (3rd lowest)

> Homeownership rate: 66.5% (24th highest — tied)

> Median household income: $51,073 (4th lowest)

37. Nebraska

> Median home value: $172,700

> Median monthly housing costs with a mortgage: $1,427 (23rd lowest)

> Share of housing units with a mortgage: 59.5% (20th lowest)

> Homeownership rate: 66.3% (24th lowest)

> Median household income: $63,229 (25th highest)

[in-text-ad-2]

36. South Carolina

> Median home value: $179,800

> Median monthly housing costs with a mortgage: $1,250 (8th lowest — tied)

> Share of housing units with a mortgage: 58.0% (15th lowest)

> Homeownership rate: 70.3% (11th highest — tied)

> Median household income: $56,227 (10th lowest)

35. New Mexico

> Median home value: $180,900

> Median monthly housing costs with a mortgage: $1,269 (12th lowest)

> Share of housing units with a mortgage: 52.9% (5th lowest)

> Homeownership rate: 68.1% (17th highest)

> Median household income: $51,945 (6th lowest)

[in-text-ad]

34. South Dakota

> Median home value: $185,000

> Median monthly housing costs with a mortgage: $1,371 (18th lowest)

> Share of housing units with a mortgage: 55.6% (10th lowest)

> Homeownership rate: 67.8% (18th highest)

> Median household income: $59,533 (18th lowest)

33. Tennessee

> Median home value: $191,900

> Median monthly housing costs with a mortgage: $1,264 (10th lowest)

> Share of housing units with a mortgage: 58.2% (16th lowest)

> Homeownership rate: 66.5% (24th highest — tied)

> Median household income: $56,071 (9th lowest)

32. Pennsylvania

> Median home value: $192,600

> Median monthly housing costs with a mortgage: $1,477 (23rd highest)

> Share of housing units with a mortgage: 59.1% (17th lowest)

> Homeownership rate: 68.4% (16th highest)

> Median household income: $63,463 (23rd highest)

[in-text-ad-2]

31. North Carolina

> Median home value: $193,200

> Median monthly housing costs with a mortgage: $1,318 (17th lowest)

> Share of housing units with a mortgage: 63.2% (20th highest)

> Homeownership rate: 65.3% (15th lowest — tied)

> Median household income: $57,341 (12th lowest)

30. Wisconsin

> Median home value: $197,200

> Median monthly housing costs with a mortgage: $1,412 (21st lowest)

> Share of housing units with a mortgage: 62.7% (21st highest)

> Homeownership rate: 67.2% (20th highest)

> Median household income: $64,168 (21st highest)

[in-text-ad]

29. Texas

> Median home value: $200,400

> Median monthly housing costs with a mortgage: $1,675 (16th highest)

> Share of housing units with a mortgage: 56.1% (11th lowest)

> Homeownership rate: 61.9% (7th lowest)

> Median household income: $64,034 (22nd highest)

28. Maine

> Median home value: $200,500

> Median monthly housing costs with a mortgage: $1,387 (19th lowest — tied)

> Share of housing units with a mortgage: 60.5% (24th lowest)

> Homeownership rate: 72.2% (2nd highest)

> Median household income: $58,924 (16th lowest)

27. Georgia

> Median home value: $202,500

> Median monthly housing costs with a mortgage: $1,450 (25th lowest)

> Share of housing units with a mortgage: 64.2% (19th highest)

> Homeownership rate: 64.1% (12th lowest)

> Median household income: $61,980 (22nd lowest)

[in-text-ad-2]

26. North Dakota

> Median home value: $205,400

> Median monthly housing costs with a mortgage: $1,430 (24th lowest)

> Share of housing units with a mortgage: 52.1% (4th lowest)

> Homeownership rate: 61.3% (5th lowest)

> Median household income: $64,577 (20th highest)

25. Illinois

> Median home value: $209,100

> Median monthly housing costs with a mortgage: $1,688 (15th highest)

> Share of housing units with a mortgage: 62.4% (22nd highest — tied)

> Homeownership rate: 66.0% (20th lowest — tied)

> Median household income: $69,187 (17th highest)

[in-text-ad]

24. Vermont

> Median home value: $233,200

> Median monthly housing costs with a mortgage: $1,606 (17th highest)

> Share of housing units with a mortgage: 61.7% (25th highest)

> Homeownership rate: 70.9% (8th highest)

> Median household income: $63,001 (25th lowest)

23. Wyoming

> Median home value: $235,200

> Median monthly housing costs with a mortgage: $1,417 (22nd lowest)

> Share of housing units with a mortgage: 59.2% (18th lowest)

> Homeownership rate: 71.9% (3rd highest — tied)

> Median household income: $65,003 (19th highest)

22. Florida

> Median home value: $245,100

> Median monthly housing costs with a mortgage: $1,530 (22nd highest)

> Share of housing units with a mortgage: 56.3% (12th lowest)

> Homeownership rate: 66.2% (23rd lowest)

> Median household income: $59,227 (17th lowest)

[in-text-ad-2]

21. Minnesota

> Median home value: $246,700

> Median monthly housing costs with a mortgage: $1,595 (19th highest)

> Share of housing units with a mortgage: 65.1% (15th highest)

> Homeownership rate: 71.9% (3rd highest — tied)

> Median household income: $74,593 (13th highest)

20. Montana

> Median home value: $253,600

> Median monthly housing costs with a mortgage: $1,466 (24th highest)

> Share of housing units with a mortgage: 55.4% (9th lowest)

> Homeownership rate: 68.9% (14th highest)

> Median household income: $57,153 (11th lowest)

[in-text-ad]

19. Idaho

> Median home value: $255,200

> Median monthly housing costs with a mortgage: $1,306 (16th lowest)

> Share of housing units with a mortgage: 64.3% (18th highest)

> Homeownership rate: 71.6% (5th highest — tied)

> Median household income: $60,999 (20th lowest)

18. Arizona

> Median home value: $255,900

> Median monthly housing costs with a mortgage: $1,457 (25th highest)

> Share of housing units with a mortgage: 62.4% (22nd highest — tied)

> Homeownership rate: 65.3% (15th lowest — tied)

> Median household income: $62,055 (23rd lowest)

17. Delaware

> Median home value: $261,700

> Median monthly housing costs with a mortgage: $1,557 (21st highest)

> Share of housing units with a mortgage: 65.5% (13th highest)

> Homeownership rate: 70.3% (11th highest — tied)

> Median household income: $70,176 (16th highest)

[in-text-ad-2]

16. Connecticut

> Median home value: $280,700

> Median monthly housing costs with a mortgage: $2,087 (6th highest)

> Share of housing units with a mortgage: 66.2% (10th highest)

> Homeownership rate: 65.0% (14th lowest)

> Median household income: $78,833 (6th highest)

15. Alaska

> Median home value: $281,200

> Median monthly housing costs with a mortgage: $1,882 (10th highest)

> Share of housing units with a mortgage: 60.8% (25th lowest)

> Homeownership rate: 64.7% (13th lowest)

> Median household income: $75,463 (12th highest)

[in-text-ad]

14. New Hampshire

> Median home value: $281,400

> Median monthly housing costs with a mortgage: $1,963 (8th highest)

> Share of housing units with a mortgage: 64.9% (16th highest)

> Homeownership rate: 71.0% (7th highest)

> Median household income: $77,933 (8th highest)

13. Rhode Island

> Median home value: $283,000

> Median monthly housing costs with a mortgage: $1,837 (12th highest)

> Share of housing units with a mortgage: 66.3% (9th highest)

> Homeownership rate: 61.7% (6th lowest)

> Median household income: $71,169 (15th highest)

12. Virginia

> Median home value: $288,800

> Median monthly housing costs with a mortgage: $1,792 (13th highest)

> Share of housing units with a mortgage: 67.7% (6th highest — tied)

> Homeownership rate: 66.1% (22nd lowest)

> Median household income: $76,456 (10th highest)

[in-text-ad-2]

11. Nevada

> Median home value: $317,800

> Median monthly housing costs with a mortgage: $1,589 (20th highest)

> Share of housing units with a mortgage: 67.4% (8th highest)

> Homeownership rate: 56.6% (3rd lowest)

> Median household income: $63,276 (24th highest)

10. Utah

> Median home value: $330,300

> Median monthly housing costs with a mortgage: $1,605 (18th highest)

> Share of housing units with a mortgage: 70.1% (3rd highest)

> Homeownership rate: 70.6% (9th highest)

> Median household income: $75,780 (11th highest)

[in-text-ad]

9. Maryland

> Median home value: $332,500

> Median monthly housing costs with a mortgage: $2,015 (7th highest)

> Share of housing units with a mortgage: 71.9% (the highest)

> Homeownership rate: 66.8% (23rd highest)

> Median household income: $86,738 (the highest)

8. New York

> Median home value: $338,700

> Median monthly housing costs with a mortgage: $2,156 (5th highest)

> Share of housing units with a mortgage: 59.6% (21st lowest)

> Homeownership rate: 53.5% (the lowest)

> Median household income: $72,108 (14th highest)

7. New Jersey

> Median home value: $348,800

> Median monthly housing costs with a mortgage: $2,413 (3rd highest)

> Share of housing units with a mortgage: 65.6% (12th highest)

> Homeownership rate: 63.3% (11th lowest)

> Median household income: $85,751 (3rd highest)

[in-text-ad-2]

6. Oregon

> Median home value: $354,600

> Median monthly housing costs with a mortgage: $1,750 (14th highest)

> Share of housing units with a mortgage: 66.1% (11th highest)

> Homeownership rate: 62.9% (9th lowest)

> Median household income: $67,058 (18th highest)

5. Washington

> Median home value: $387,600

> Median monthly housing costs with a mortgage: $1,951 (9th highest)

> Share of housing units with a mortgage: 67.7% (6th highest — tied)

> Homeownership rate: 63.1% (10th lowest)

> Median household income: $78,687 (7th highest)

[in-text-ad]

4. Colorado

> Median home value: $394,600

> Median monthly housing costs with a mortgage: $1,845 (11th highest)

> Share of housing units with a mortgage: 70.8% (2nd highest)

> Homeownership rate: 65.9% (19th lowest)

> Median household income: $77,127 (9th highest)

3. Massachusetts

> Median home value: $418,600

> Median monthly housing costs with a mortgage: $2,276 (4th highest)

> Share of housing units with a mortgage: 68.3% (5th highest)

> Homeownership rate: 62.2% (8th lowest)

> Median household income: $85,843 (2nd highest)

2. California

> Median home value: $568,500

> Median monthly housing costs with a mortgage: $2,421 (2nd highest)

> Share of housing units with a mortgage: 69.0% (4th highest)

> Homeownership rate: 54.9% (2nd lowest)

> Median household income: $80,440 (5th highest)

[in-text-ad-2]

1. Hawaii

> Median home value: $669,200

> Median monthly housing costs with a mortgage: $2,472 (the highest)

> Share of housing units with a mortgage: 64.4% (17th highest)

> Homeownership rate: 60.2% (4th lowest)

> Median household income: $83,102 (4th highest)

Methodology

To determine the most and least expensive states to buy a home, 24/7 Wall St. reviewed one-year estimates of median owner-occupied home values from the U.S. Census Bureau’s 2019 American Community Survey.

States were ranked based on their owner-occupied median home values. Additional information on median monthly housing costs with a mortgage, the share of owner-occupied housing units that have a mortgage, rates of homeownership, and median household income are also one-year estimates from the 2019 ACS.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.