Between 150,000 and 198,000 more U.S. businesses failed in the first 12 months of the COVID-19 pandemic than the roughly 600,000 companies that close in a given year, according to the Federal Reserve. About 100,000 of those excess failures were small services-oriented enterprises engaged in close contact with customers, like hair salons and sit-down restaurants.

Even without a devastating worldwide viral outbreak, starting a business comes with a sizable risk of failure. The chance of any for-profit enterprise in the United States lasting longer than five years is about 50-50, according to official government data. (Here are counties that lost the most businesses during the pandemic.)

To determine the likelihood a new business will fail in every state, 24/7 Wall St. reviewed data on establishment openings and closings from the Bureau of Labor Statistics’ Business Employment Dynamics program. States were ranked based on the percentage of businesses started in March 2016 that were still in business in March 2021. In Washington state, 60% of businesses fail within five years, the highest failure rate. In neighboring Oregon, only about 42% of businesses fail in that time frame, the lowest rate.

The share of U.S. economic activity generated by small businesses has been shrinking over the decades, but these enterprises remain a steadfast part of national prosperity. A 2019 report from the U.S. Small Business Administration estimated that small businesses accounted for nearly 44% of the country’s economic activity in 2014, down from 48% in 1998 but still considerable.

With some exceptions based on specific industries, the SBA defines a small business as an independently owned for-profit enterprise employing 500 or fewer people. These can include anything from a small auto parts supplier to a family run restaurant. Businesses that fit into the small category account from 76% of all establishments in Tennessee to 89% in Montana. (Here are states where the most people applied to start a business in 2021.)

The average age of American enterprises range from nearly 17 years in Iowa and Vermont to just under 11 years in California and Nevada. Nebraska and Utah enjoy the lowest unemployment rate while also having an above-average share of small businesses.

Here is the state with the highest likelihood of business failure

Click here to read our detailed methodology

50. Oregon

> Business that fail within 5 years: 41.8%

> Average establishment age: 13.6 years (18th lowest)

> Unemployment rate, March 2022: 3.8% (21st highest)

> Small business count: 86.0% of all establishments (9th highest)

[in-text-ad]

49. West Virginia

> Business that fail within 5 years: 42.8%

> Average establishment age: 15.9 years (6th highest)

> Unemployment rate, March 2022: 3.7% (22nd highest)

> Small business count: 77.3% of all establishments (2nd lowest)

48. Montana

> Business that fail within 5 years: 43.6%

> Average establishment age: 14.3 years (24th lowest)

> Unemployment rate, March 2022: 2.3% (4th lowest)

> Small business count: 89.1% of all establishments (the highest)

47. Minnesota

> Business that fail within 5 years: 45.0%

> Average establishment age: 15.3 years (15th highest)

> Unemployment rate, March 2022: 2.5% (8th lowest)

> Small business count: 83.3% of all establishments (21st highest)

[in-text-ad-2]

46. Massachusetts

> Business that fail within 5 years: 45.1%

> Average establishment age: 13.4 years (17th lowest)

> Unemployment rate, March 2022: 4.3% (13th highest)

> Small business count: 83.3% of all establishments (20th highest)

45. South Dakota

> Business that fail within 5 years: 45.3%

> Average establishment age: 15.9 years (7th highest)

> Unemployment rate, March 2022: 2.5% (8th lowest)

> Small business count: 87.4% of all establishments (5th highest)

[in-text-ad]

44. Idaho

> Business that fail within 5 years: 45.7%

> Average establishment age: 11.7 years (7th lowest)

> Unemployment rate, March 2022: 2.7% (11th lowest)

> Small business count: 86.7% of all establishments (6th highest)

43. Indiana

> Business that fail within 5 years: 46.3%

> Average establishment age: 15.9 years (10th highest)

> Unemployment rate, March 2022: 2.2% (3rd lowest)

> Small business count: 78.3% of all establishments (5th lowest)

42. Maine

> Business that fail within 5 years: 46.6%

> Average establishment age: 15.2 years (17th highest)

> Unemployment rate, March 2022: 3.6% (24th highest)

> Small business count: 86.6% of all establishments (7th highest)

[in-text-ad-2]

41. Louisiana

> Business that fail within 5 years: 47.3%

> Average establishment age: 15.3 years (16th highest)

> Unemployment rate, March 2022: 4.2% (14th highest)

> Small business count: 81.5% of all establishments (20th lowest)

40. California

> Business that fail within 5 years: 47.3%

> Average establishment age: 10.8 years (2nd lowest)

> Unemployment rate, March 2022: 4.9% (4th highest)

> Small business count: 86.1% of all establishments (8th highest)

[in-text-ad]

39. Kentucky

> Business that fail within 5 years: 47.9%

> Average establishment age: 15.0 years (19th highest)

> Unemployment rate, March 2022: 4.0% (20th highest)

> Small business count: 77.8% of all establishments (3rd lowest)

38. Iowa

> Business that fail within 5 years: 47.9%

> Average establishment age: 16.7 years (the highest)

> Unemployment rate, March 2022: 3.3% (21st lowest)

> Small business count: 82.9% of all establishments (23rd highest)

37. North Dakota

> Business that fail within 5 years: 48.1%

> Average establishment age: 15.8 years (11th highest)

> Unemployment rate, March 2022: 2.9% (14th lowest)

> Small business count: 84.7% of all establishments (15th highest)

[in-text-ad-2]

36. Michigan

> Business that fail within 5 years: 48.3%

> Average establishment age: 15.1 years (18th highest)

> Unemployment rate, March 2022: 4.4% (11th highest)

> Small business count: 83.1% of all establishments (22nd highest)

35. North Carolina

> Business that fail within 5 years: 48.4%

> Average establishment age: 13.0 years (14th lowest)

> Unemployment rate, March 2022: 3.5% (25th lowest)

> Small business count: 80.5% of all establishments (15th lowest)

[in-text-ad]

34. Wisconsin

> Business that fail within 5 years: 48.5%

> Average establishment age: 15.9 years (8th highest)

> Unemployment rate, March 2022: 2.8% (12th lowest)

> Small business count: 82.1% of all establishments (24th lowest)

33. Illinois

> Business that fail within 5 years: 48.5%

> Average establishment age: 14.9 years (22nd highest)

> Unemployment rate, March 2022: 4.7% (6th highest)

> Small business count: 83.4% of all establishments (19th highest)

32. Colorado

> Business that fail within 5 years: 48.5%

> Average establishment age: 11.7 years (6th lowest)

> Unemployment rate, March 2022: 3.7% (22nd highest)

> Small business count: 84.5% of all establishments (16th highest)

[in-text-ad-2]

31. Tennessee

> Business that fail within 5 years: 48.7%

> Average establishment age: 13.6 years (19th lowest)

> Unemployment rate, March 2022: 3.2% (19th lowest)

> Small business count: 76.1% of all establishments (the lowest)

30. Texas

> Business that fail within 5 years: 48.8%

> Average establishment age: 12.9 years (12th lowest)

> Unemployment rate, March 2022: 4.4% (11th highest)

> Small business count: 79.8% of all establishments (11th lowest)

[in-text-ad]

29. Pennsylvania

> Business that fail within 5 years: 48.8%

> Average establishment age: 15.9 years (9th highest)

> Unemployment rate, March 2022: 4.9% (4th highest)

> Small business count: 80.8% of all establishments (17th lowest)

28. Utah

> Business that fail within 5 years: 49.2%

> Average establishment age: 11.1 years (4th lowest)

> Unemployment rate, March 2022: 2.0% (2nd lowest)

> Small business count: 85.7% of all establishments (10th highest)

27. Mississippi

> Business that fail within 5 years: 49.2%

> Average establishment age: 16.0 years (5th highest)

> Unemployment rate, March 2022: 4.2% (14th highest)

> Small business count: 78.6% of all establishments (7th lowest)

[in-text-ad-2]

26. Alabama

> Business that fail within 5 years: 49.2%

> Average establishment age: 14.7 years (23rd highest)

> Unemployment rate, March 2022: 2.9% (14th lowest)

> Small business count: 78.1% of all establishments (4th lowest)

25. Ohio

> Business that fail within 5 years: 49.7%

> Average establishment age: 16.5 years (3rd highest)

> Unemployment rate, March 2022: 4.1% (18th highest)

> Small business count: 78.5% of all establishments (6th lowest)

[in-text-ad]

24. South Carolina

> Business that fail within 5 years: 50.0%

> Average establishment age: 13.0 years (13th lowest)

> Unemployment rate, March 2022: 3.4% (24th lowest)

> Small business count: 79.3% of all establishments (8th lowest)

23. Oklahoma

> Business that fail within 5 years: 50.0%

> Average establishment age: 14.0 years (21st lowest)

> Unemployment rate, March 2022: 2.7% (11th lowest)

> Small business count: 82.3% of all establishments (25th lowest)

22. Arizona

> Business that fail within 5 years: 50.2%

> Average establishment age: 12.2 years (9th lowest)

> Unemployment rate, March 2022: 3.3% (21st lowest)

> Small business count: 79.9% of all establishments (12th lowest)

[in-text-ad-2]

21. New Jersey

> Business that fail within 5 years: 50.3%

> Average establishment age: 12.4 years (10th lowest)

> Unemployment rate, March 2022: 4.2% (14th highest)

> Small business count: 85.2% of all establishments (13th highest)

20. Alaska

> Business that fail within 5 years: 50.3%

> Average establishment age: 15.8 years (12th highest)

> Unemployment rate, March 2022: 5.0% (2nd highest)

> Small business count: 85.7% of all establishments (11th highest)

[in-text-ad]

19. Vermont

> Business that fail within 5 years: 50.5%

> Average establishment age: 16.6 years (2nd highest)

> Unemployment rate, March 2022: 2.7% (11th lowest)

> Small business count: 87.7% of all establishments (3rd highest)

18. Florida

> Business that fail within 5 years: 50.6%

> Average establishment age: 11.0 years (3rd lowest)

> Unemployment rate, March 2022: 3.2% (19th lowest)

> Small business count: 84.5% of all establishments (17th highest)

17. Virginia

> Business that fail within 5 years: 50.8%

> Average establishment age: 13.2 years (15th lowest)

> Unemployment rate, March 2022: 3.0% (15th lowest)

> Small business count: 79.6% of all establishments (9th lowest)

[in-text-ad-2]

16. Maryland

> Business that fail within 5 years: 51.4%

> Average establishment age: 14.5 years (25th lowest)

> Unemployment rate, March 2022: 4.6% (7th highest)

> Small business count: 81.7% of all establishments (23rd lowest)

15. Nebraska

> Business that fail within 5 years: 51.8%

> Average establishment age: 15.4 years (13th highest)

> Unemployment rate, March 2022: 2.0% (2nd lowest)

> Small business count: 84.1% of all establishments (18th highest)

[in-text-ad]

14. Rhode Island

> Business that fail within 5 years: 52.3%

> Average establishment age: 14.5 years (25th highest)

> Unemployment rate, March 2022: 3.4% (24th lowest)

> Small business count: 84.8% of all establishments (14th highest)

13. Wyoming

> Business that fail within 5 years: 52.5%

> Average establishment age: 14.9 years (21st highest)

> Unemployment rate, March 2022: 3.4% (24th lowest)

> Small business count: 87.6% of all establishments (4th highest)

12. Nevada

> Business that fail within 5 years: 52.5%

> Average establishment age: 10.8 years (the lowest)

> Unemployment rate, March 2022: 5.0% (2nd highest)

> Small business count: 81.2% of all establishments (19th lowest)

[in-text-ad-2]

11. New York

> Business that fail within 5 years: 52.8%

> Average establishment age: 14.2 years (22nd lowest)

> Unemployment rate, March 2022: 4.6% (7th highest)

> Small business count: 87.9% of all establishments (2nd highest)

10. Hawaii

> Business that fail within 5 years: 52.8%

> Average establishment age: 16.2 years (4th highest)

> Unemployment rate, March 2022: 4.1% (18th highest)

> Small business count: 82.7% of all establishments (24th highest)

[in-text-ad]

9. Arkansas

> Business that fail within 5 years: 52.8%

> Average establishment age: 14.7 years (24th highest)

> Unemployment rate, March 2022: 3.1% (17th lowest)

> Small business count: 80.4% of all establishments (14th lowest)

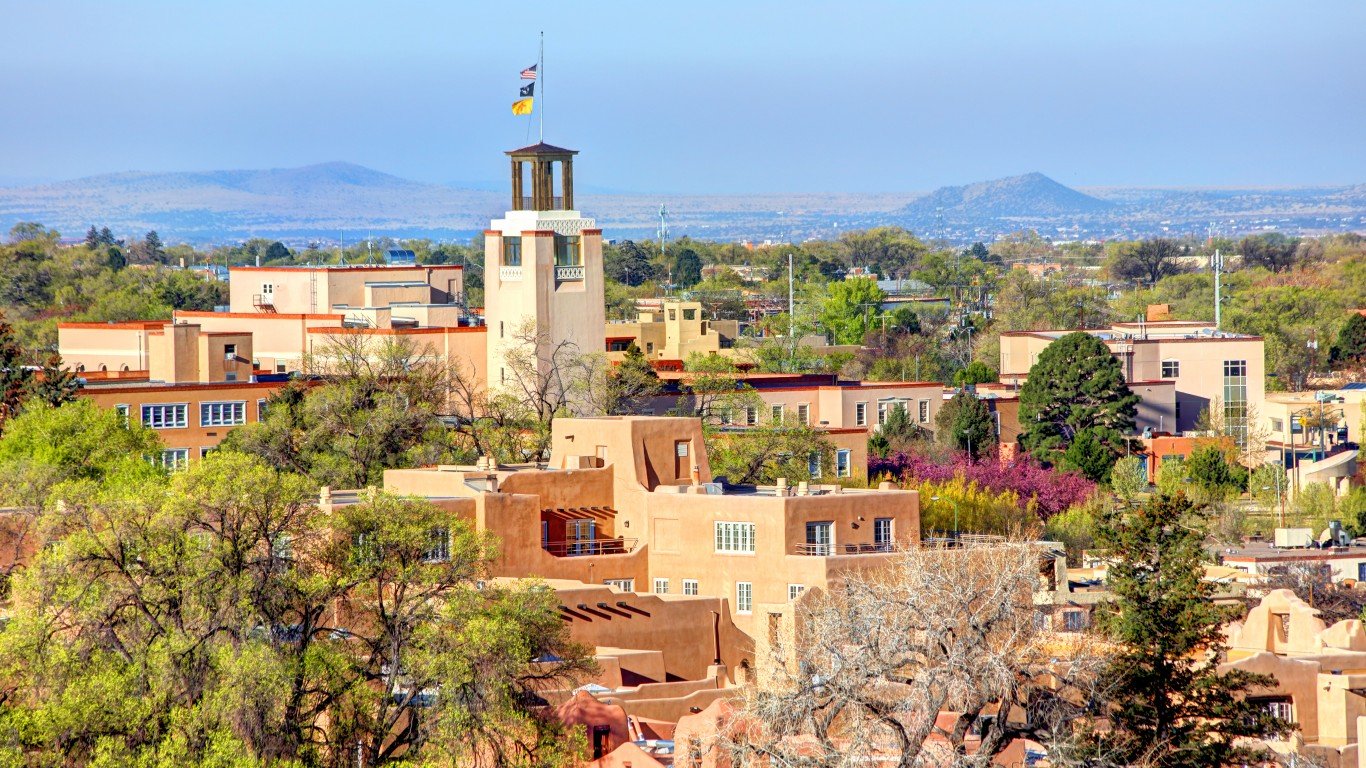

8. New Mexico

> Business that fail within 5 years: 53.2%

> Average establishment age: 13.9 years (20th lowest)

> Unemployment rate, March 2022: 5.3% (the highest)

> Small business count: 80.8% of all establishments (16th lowest)

7. Delaware

> Business that fail within 5 years: 53.4%

> Average establishment age: 12.4 years (11th lowest)

> Unemployment rate, March 2022: 4.5% (10th highest)

> Small business count: 79.8% of all establishments (10th lowest)

[in-text-ad-2]

6. New Hampshire

> Business that fail within 5 years: 53.5%

> Average establishment age: 14.3 years (23rd lowest)

> Unemployment rate, March 2022: 2.5% (8th lowest)

> Small business count: 82.4% of all establishments (25th highest)

5. Connecticut

> Business that fail within 5 years: 54.8%

> Average establishment age: 15.4 years (14th highest)

> Unemployment rate, March 2022: 4.6% (7th highest)

> Small business count: 81.7% of all establishments (22nd lowest)

[in-text-ad]

4. Missouri

> Business that fail within 5 years: 55.2%

> Average establishment age: 13.3 years (16th lowest)

> Unemployment rate, March 2022: 3.6% (24th highest)

> Small business count: 80.8% of all establishments (18th lowest)

3. Georgia

> Business that fail within 5 years: 55.4%

> Average establishment age: 12.2 years (8th lowest)

> Unemployment rate, March 2022: 3.1% (17th lowest)

> Small business count: 80.4% of all establishments (13th lowest)

2. Kansas

> Business that fail within 5 years: 58.0%

> Average establishment age: 14.9 years (20th highest)

> Unemployment rate, March 2022: 2.5% (8th lowest)

> Small business count: 81.6% of all establishments (21st lowest)

[in-text-ad-2]

1. Washington

> Business that fail within 5 years: 59.6%

> Average establishment age: 11.6 years (5th lowest)

> Unemployment rate, March 2022: 4.2% (14th highest)

> Small business count: 85.4% of all establishments (12th highest)

Methodology

To determine the likelihood a new business will fail in every state, 24/7 Wall St. reviewed data on establishment openings and closings from the Bureau of Labor Statistics’ Business Employment Dynamics program. States were ranked based on the percentage of businesses started in March 2016 that were still in business in March 2021.

Data used to calculate average business age also came from the BLS and is as of March 2021. Data on the percentage of establishments with fewer than 500 employees came from the BLS Statistics of U.S. Businesses program. Data on unemployment rate for March 2022 came from the BLS Local Area Unemployment Statistics program and are not seasonally adjusted.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.